Net Sales Increased 13%

EPS Increased 50%; Adjusted EPS Increased

89%

Maintains Full Year 2024 Sales Outlook and

Raises Full Year 2024 EPS Outlook

YETI Holdings, Inc. (“YETI”) (NYSE: YETI) today announced its

financial results for the first quarter ended March 30, 2024. YETI

reports its financial performance in accordance with accounting

principles generally accepted in the United States of America

(“GAAP”) and as adjusted on a non-GAAP basis. Please see “Non-GAAP

Financial Measures,” and “Reconciliation of GAAP to Non-GAAP

Financial Information” below for additional information and

reconciliations of the non-GAAP financial measures to the most

comparable GAAP financial measures.

First Quarter 2024

Highlights

- Net sales increased 13%

- Coolers & Equipment net sales increased 15%; Drinkware net

sales increased 13%

- Wholesale net sales increased 13%; Direct-to-consumer net sales

increased 12%

- International net sales increased 32%; U.S. net sales increased

9%

- Gross margin expansion of 360 basis points to 57.1%; Adjusted

gross margin expansion of 450 basis points to 57.5%

- Operating margin expansion of 260 basis points to 7.6%;

Adjusted operating margin expansion of 440 basis points to

11.6%

- EPS increased 50% to $0.18; Adjusted EPS increased 89% to

$0.34

- Entered into a $100 million accelerated share repurchase

agreement

Matt Reintjes, President and Chief Executive Officer, commented,

“First quarter results were highlighted by balanced, double-digit

growth across both our wholesale and direct-to-consumer channels,

as well as our Drinkware and Coolers & Equipment categories.

This performance was punctuated by our international sales mix

reaching a record 19% coupled with re-acceleration in domestic

growth. Profitability continued to show strength with both adjusted

gross margin and adjusted operating margin expanding nearly 450

basis points during the period. Additionally, we completed our

previously announced acquisitions, and entered into a $100 million

accelerated share repurchase agreement.”

Mr. Reintjes continued, “We remain confident as we move into the

second quarter and second half of the year. We are well positioned

in Coolers & Equipment to leverage new innovation, expanded

color options, and impactful product marketing. On top of that, we

continue to see strong demand for our diverse range of Drinkware,

as our brand continues to grow both domestically and

internationally.”

First Quarter 2024

Results

Sales and adjusted sales both increased 13% to $341.4

million, compared to $302.8 million during the same period last

year.

- Direct-to-consumer (“DTC”) channel sales increased 12% to

$187.8 million, compared to $167.0 million in the prior year

quarter, due to growth in both Drinkware and Coolers &

Equipment.

- Wholesale channel sales increased 13% to $153.6 million,

compared to $135.8 million in the same period last year, due to

growth in both Coolers & Equipment and Drinkware.

- Drinkware sales increased 13% to $214.6 million, compared to

$190.3 million in the prior year quarter, driven by the continued

expansion and innovation of our Drinkware product offerings and new

seasonal colorways.

- Coolers & Equipment sales increased 15% to $119.9 million,

compared to $104.4 million in the same period last year, driven by

strong performance in bags, soft coolers, and hard coolers.

Gross profit increased 20% to $194.8 million, or 57.1% of

sales, compared to $161.9 million, or 53.5% of sales, in the first

quarter of 2023. The 360 basis point increase in gross margin was

primarily due to lower inbound freight costs and lower product

costs.

Adjusted gross profit increased $35.7 million to $196.4

million, or 57.5% of adjusted sales, compared to $160.6 million, or

53.0% of adjusted sales, in the first quarter of 2023. The 450

basis point increase in gross margin was primarily due to lower

inbound freight costs and lower product costs.

Selling, general, and administrative (“SG&A”)

expenses increased 15% to $169.0 million, compared to $146.8

million in the first quarter of 2023. As a percentage of sales,

SG&A expenses increased 100 basis points to 49.5% from 48.5% in

the prior year period. This increase was primarily due to higher

employee costs and marketing expenses, partially offset by lower

warehousing costs.

Adjusted SG&A expenses increased 13% to $156.8

million, compared to $139.0 million in the first quarter of 2023.

As a percentage of adjusted sales, adjusted SG&A expenses were

flat at 45.9% compared to the prior year period, as higher employee

costs and marketing expenses were offset by lower warehousing

costs.

Operating income increased 71.0% to $25.8 million, or

7.6% of sales, compared to $15.1 million, or 5.0% of sales during

the prior year quarter.

Adjusted operating income increased 82% to $39.6 million,

or 11.6% of adjusted sales, compared to $21.7 million, or 7.2% of

adjusted sales during the same period last year.

Net income increased 50% to $15.9 million, or 4.6% of

sales, compared to $10.6 million, or 3.5% of sales in the prior

year quarter; Net income per diluted share was $0.18,

compared to $0.12 in the prior year quarter.

Adjusted net income increased 89% to $29.3 million, or

8.6% of adjusted sales, compared to $15.5 million, or 5.1% of

adjusted sales in the prior year quarter; Adjusted net income

per diluted share increased 89% to $0.34, compared to $0.18 per

diluted share in the prior year quarter.

Balance Sheet and Other

Highlights

Cash increased $6.1 million to $173.9 million, compared

to $167.8 million at the end of the first quarter of 2023.

Inventory increased 5% to $363.9 million, compared to

$347.0 million at the end of the prior year quarter.

Total debt, excluding finance leases and unamortized

deferred financing fees, was $81.2 million, compared to $84.4

million at the end of the first quarter of 2023. During the first

quarter of 2024, we made mandatory debt payments of $1.1

million.

Updated 2024 Outlook

Mr. Reintjes concluded, “With the bulk of the year ahead of us,

we are maintaining our topline outlook as we weigh our strong first

quarter execution with the ongoing uncertainties that persist in

the market. However, with the continued momentum in our gross

margin improvement and the execution of our accelerated share

repurchase, we have raised our full year bottom line range. We

remain focused on strategic investments to drive the YETI brand,

product innovation, channel growth and global expansion.”

For Fiscal 2024, YETI expects:

- Adjusted sales to increase between 7% and 9% (consistent

with previous outlook);

- Adjusted operating income as a percentage of adjusted

sales between 16.0% and 16.5% (versus previous outlook of

approximately 16.0%);

- An effective tax rate of approximately 25.3% (compared

to 24.8% in the prior year period);

- Adjusted net income per diluted share between $2.49 and

$2.62 (versus previous outlook of between $2.45 and $2.50),

reflecting an 11% to 16% increase;

- Diluted weighted average shares outstanding of

approximately 86.1 million (versus previous outlook of 87.4

million); and

- Capital expenditures of approximately $60 million

primarily to support investments in technology and new product

innovation.

2024 Accelerated Share

Repurchase

As previously announced, during the first quarter of 2024, our

Board of Directors approved a share repurchase program of up to

$300 million of YETI’s common stock (the “Share Repurchase

Program”). On February 27, 2024, we entered into an accelerated

share repurchase agreement (the “ASR Agreement”) with Goldman Sachs

& Co. LLC (“Goldman Sachs”) to repurchase $100 million of

YETI’s common stock. Pursuant to the ASR Agreement, we made a

payment of $100 million to Goldman Sachs and received an initial

delivery of approximately 2.0 million shares of YETI’s common

stock. In the second quarter of 2024, the ASR Agreement was

completed, and we received approximately 0.6 million additional

shares of YETI’s common stock. The ASR Agreement resulted in the

total repurchase of approximately 2.6 million shares. As of March

30, 2024, $200 million remained available under the Share

Repurchase Program.

Conference Call Details

A conference call to discuss the first quarter of 2024 financial

results is scheduled for today, May 9, 2024, at 8:00 a.m. Eastern

Time. Investors and analysts interested in participating in the

call are invited to dial 833-816-1399 (international callers,

please dial 412-317-0492) approximately 10 minutes prior to the

start of the call. A live audio webcast of the conference call will

be available online at http://investors.yeti.com. A replay will be

available through May 23, 2024 by dialing 844-512-2921

(international callers, 412-317-6671). The accompanying access code

for this call is 10187799.

About YETI Holdings, Inc.

Headquartered in Austin, Texas, YETI is a global designer,

retailer, and distributor of innovative outdoor products. From

coolers and drinkware to bags and apparel, YETI products are built

to meet the unique and varying needs of diverse outdoor pursuits,

whether in the remote wilderness, at the beach, or anywhere life

takes you. By consistently delivering high-performing, exceptional

products, we have built a strong following of brand loyalists

throughout the world, ranging from serious outdoor enthusiasts to

individuals who simply value products of uncompromising quality and

design. We have an unwavering commitment to outdoor and recreation

communities, and we are relentless in our pursuit of building

superior products for people to confidently enjoy life outdoors and

beyond. For more information, please visit www.YETI.com.

Non-GAAP Financial Measures

In addition to our results determined in accordance with GAAP,

we supplement our results with non-GAAP financial measures,

including adjusted net sales, adjusted gross profit, adjusted

SG&A expenses, adjusted operating income, adjusted net income,

adjusted net income per diluted share as well as adjusted gross

profit and adjusted SG&A expenses, adjusted operating income

and adjusted net income as a percentage of adjusted net sales. Our

management uses these non-GAAP financial measures in conjunction

with GAAP financial measures to measure our profitability and to

evaluate our financial performance. We believe that these non-GAAP

financial measures provide meaningful supplemental information

regarding the underlying operating performance of our business and

are appropriate to enhance an overall understanding of our

financial performance. These non-GAAP financial measures have

limitations as analytical tools in that they do not reflect all of

the amounts associated with our results of operations as determined

in accordance with GAAP. Because of these limitations, these

non-GAAP financial measures should be considered along with GAAP

financial performance measures. The presentation of these non-GAAP

financial measures is not intended to be considered in isolation or

as a substitute for, or superior to, financial information prepared

and presented in accordance with GAAP. Investors are encouraged to

review the reconciliation of these non-GAAP financial measures to

their most directly comparable GAAP financial measures. A

reconciliation of the non-GAAP financial measures to such GAAP

measures can be found below.

YETI does not provide a reconciliation of forward-looking

non-GAAP to GAAP financial measures because such reconciliations

are not available without unreasonable efforts. This is due to the

inherent difficulty in forecasting with reasonable certainty

certain amounts that are necessary for such reconciliation,

including in particular the impact of the voluntary recalls and

realized and unrealized foreign currency gains and losses reported

within other expense. For the same reasons, we are unable to

forecast with reasonable certainty all deductions and additions

needed in order to provide a forward-looking GAAP financial

measures at this time. The amount of these deductions and additions

may be material and, therefore, could result in forward-looking

GAAP financial measures being materially different or less than

forward-looking non-GAAP financial measures. See “Forward-looking

statements” below.

Forward-looking statements

This press release contains ‘‘forward-looking statements’’

within the meaning of the Private Securities Litigation Reform Act

of 1995. All statements other than statements of historical or

current fact included in this press release are forward-looking

statements. Forward-looking statements include statements

containing words such as “anticipate,” “assume,” “believe,” “can

have,” “contemplate,” “continue,” “could,” “design,” “due,”

“estimate,” “expect,” “forecast,” “goal,” “intend,” “likely,”

“may,” “might,” “objective,” “plan,” “predict,” “project,”

“potential,” “seek,” “should,” “target,” “will,” “would,” and other

words and terms of similar meaning in connection with any

discussion of the timing or nature of future operational

performance or other events. For example, all statements made

relating to our future expectations relating to our share

repurchase program, demand and market conditions, pricing

conditions, expected sales, gross margin, operating expense and

cash flow levels, and our expectations for opportunity, growth,

investments, and new products, including those set forth in the

quotes from YETI’s President and CEO, and the 2024 financial

outlook provided herein, constitute forward-looking statements. All

forward-looking statements are subject to risks and uncertainties

that may cause actual results to differ materially from those that

are expected and, therefore, you should not unduly rely on such

statements. The risks and uncertainties that could cause actual

results to differ materially from those expressed or implied by

these forward-looking statements include but are not limited to:

(i) economic conditions or consumer confidence in future economic

conditions; (ii) our ability to maintain and strengthen our brand

and generate and maintain ongoing demand for our products; (iii)

our ability to successfully design, develop and market new

products; (iv) our ability to effectively manage our growth; (v)

our ability to expand into additional consumer markets, and our

success in doing so; (vi) the success of our international

expansion plans; (vii) our ability to compete effectively in the

outdoor and recreation market and protect our brand; (viii) the

level of customer spending for our products, which is sensitive to

general economic conditions and other factors; (ix) problems with,

or loss of, our third-party contract manufacturers and suppliers,

or an inability to obtain raw materials; (x) fluctuations in the

cost and availability of raw materials, equipment, labor, and

transportation and subsequent manufacturing delays or increased

costs; (xi) our ability to accurately forecast demand for our

products and our results of operations; (xii) our relationships

with our national, regional, and independent retail partners, who

account for a significant portion of our sales; (xiii) the impact

of natural disasters and failures of our information technology on

our operations and the operations of our manufacturing partners;

(xiv) our ability to attract and retain skilled personnel and

senior management, and to maintain the continued efforts of our

management and key employees; (xv) the impact of our indebtedness

on our ability to invest in the ongoing needs of our business, and

(xvi) our ability to successfully execute our share repurchase

program and its impact on stockholder value and the volatility of

the price of our common stock. For a more extensive list of factors

that could materially affect our results, you should read our

filings with the United States Securities and Exchange Commission

(the “SEC”), including our Annual Report on Form 10-K for the year

ended December 30, 2023, as such filings may be amended,

supplemented or superseded from time to time by other reports YETI

files with the SEC.

These forward-looking statements are made based upon detailed

assumptions and reflect management’s current expectations and

beliefs. While YETI believes that these assumptions underlying the

forward-looking statements are reasonable, YETI cautions that it is

very difficult to predict the impact of known factors, and it is

impossible for YETI to anticipate all factors that could affect

actual results.

The forward-looking statements included here are made only as of

the date hereof. YETI undertakes no obligation to publicly update

or revise any forward-looking statement as a result of new

information, future events, or otherwise, except as required by

law. Many of the foregoing risks and uncertainties may be

exacerbated by the global business and economic environment,

including ongoing geopolitical conflicts. Solely for convenience,

certain trademark and service marks referred to in this press

release appear without the ® or ™ symbols, but those references are

not intended to indicate, in any way, that we will not assert, to

the fullest extent under applicable law, our rights to these

trademarks and service marks.

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF OPERATIONS

(Unaudited)

(In thousands, except per

share amounts)

Three Months Ended

March 30, 2024

April 1, 2023

Net sales

$

341,394

$

302,796

Cost of goods sold

146,581

140,926

Gross profit

194,813

161,870

Selling, general, and administrative

expenses

168,996

146,772

Operating income

25,817

15,098

Interest income (expense), net

659

(594

)

Other (expense) income, net

(4,101

)

6

Income before income taxes

22,375

14,510

Income tax expense

(6,520

)

(3,946

)

Net income

$

15,855

$

10,564

Net income per share

Basic

$

0.18

$

0.12

Diluted

$

0.18

$

0.12

Weighted-average shares

outstanding

Basic

86,355

86,529

Diluted

87,157

87,086

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED BALANCE

SHEETS

(Unaudited)

(In thousands, except per

share amounts)

March 30, 2024

December 30,

2023

April 1, 2023

ASSETS

Current assets

Cash

$

173,911

$

438,960

$

167,841

Accounts receivable, net

108,350

95,774

95,582

Inventory

363,919

337,208

347,002

Prepaid expenses and other current

assets

57,005

42,463

44,461

Total current assets

703,185

914,405

654,886

Property and equipment, net

129,941

130,714

124,843

Operating lease right-of-use assets

77,171

77,556

54,421

Goodwill

72,894

54,293

54,293

Intangible assets, net

133,927

117,629

100,813

Other assets

2,686

2,595

17,259

Total assets

$

1,119,804

$

1,297,192

$

1,006,515

LIABILITIES AND STOCKHOLDERS’

EQUITY

Current liabilities

Accounts payable

$

139,133

$

190,392

$

101,703

Accrued expenses and other current

liabilities

97,359

130,026

177,058

Taxes payable

29,151

33,489

6,778

Accrued payroll and related costs

11,057

23,141

8,531

Operating lease liabilities

15,703

14,726

11,293

Current maturities of long-term debt

6,367

6,579

24,436

Total current liabilities

298,770

398,353

329,799

Long-term debt, net of current portion

77,379

78,645

65,719

Operating lease liabilities,

non-current

75,398

76,163

54,219

Other liabilities

21,358

20,421

14,217

Total liabilities

472,905

573,582

463,954

Stockholders’ Equity

Common stock

889

886

883

Treasury stock, at cost

(180,702

)

(100,025

)

(100,025

)

Additional paid-in capital

373,697

386,377

363,205

Retained earnings

454,291

438,436

279,115

Accumulated other comprehensive loss

(1,276

)

(2,064

)

(617

)

Total stockholders’ equity

646,899

723,610

542,561

Total liabilities and stockholders’

equity

$

1,119,804

$

1,297,192

$

1,006,515

YETI HOLDINGS, INC.

CONDENSED CONSOLIDATED

STATEMENTS OF CASH FLOWS

(Unaudited)

(In thousands, except per

share amounts)

Three Months Ended

March 30, 2024

April 1, 2023

Cash Flows from Operating

Activities:

Net income

$

15,855

$

10,564

Adjustments to reconcile net income to

cash provided by (used in) operating activities:

Depreciation and amortization

11,474

11,402

Amortization of deferred financing

fees

163

138

Stock-based compensation

8,497

6,775

Deferred income taxes

(7

)

6,832

Impairment of long-lived assets

2,025

—

Other

3,117

(303

)

Changes in operating assets and

liabilities:

Accounts receivable

(9,480

)

(16,114

)

Inventory

(11,090

)

23,988

Other current assets

(10,425

)

(10,930

)

Accounts payable and accrued expenses

(106,536

)

(69,655

)

Taxes payable

(8,032

)

(8,512

)

Other

765

(873

)

Net cash used in operating activities

(103,674

)

(46,688

)

Cash Flows from Investing

Activities:

Purchases of property and equipment

(10,644

)

(10,082

)

Business acquisition, net of cash

acquired

(36,164

)

—

Additions of intangibles, net

(11,197

)

(3,165

)

Net cash used in investing activities

(58,005

)

(13,247

)

Cash Flows from Financing

Activities:

Repayments of long-term debt

(1,055

)

(5,625

)

Taxes paid in connection with employee

stock transactions

(1,174

)

(1,737

)

Proceeds from employee stock

transactions

—

679

Finance lease principal payment

(586

)

(710

)

Repurchase of common stock

(100,000

)

—

Net cash used in financing activities

(102,815

)

(7,393

)

Effect of exchange rate changes on

cash

(555

)

428

Net decrease in cash

(265,049

)

(66,900

)

Cash, beginning of period

438,960

234,741

Cash, end of period

$

173,911

$

167,841

YETI HOLDINGS, INC.

Supplemental Financial

Information

Reconciliation of GAAP to

Non-GAAP Financial Information

(Unaudited) (In thousands

except per share amounts)

Three Months Ended

March 30, 2024

April 1, 2023

Net sales

$

341,394

$

302,796

Product recall(1)

—

16

Adjusted net sales

$

341,394

$

302,812

Gross profit

$

194,813

$

161,870

Transition costs(2)

1,547

—

Product recall(1)

—

(1,237

)

Adjusted gross profit

$

196,360

$

160,633

Selling, general, and administrative

expenses

$

168,996

$

146,772

Non-cash stock-based compensation

expense

(8,497

)

(6,775

)

Long-lived asset impairment

(2,025

)

—

Product recall(1)

—

(167

)

Organizational realignment costs(3)

(1,122

)

(880

)

Transition costs(4)

(542

)

—

Adjusted selling, general, and

administrative expenses

$

156,810

$

138,950

Gross margin

57.1

%

53.5

%

Adjusted gross margin

57.5

%

53.0

%

SG&A expenses as a % of net sales

49.5

%

48.5

%

Adjusted SG&A expenses as a % of

adjusted net sales

45.9

%

45.9

%

_________________________

(1)

Represents adjustments and charges

associated with recalls.

(2)

Represents inventory disposal costs and

inventory step-up costs in connection with the acquisition of

Mystery Ranch, LLC. Inventory step-up costs are expensed as the

acquired inventory is sold.

(3)

Represents employee severance costs in

connection with strategic organizational realignments.

(4)

Represents transition costs in connection

with the acquisition of Mystery Ranch, LLC, including third-party

business integration costs.

YETI HOLDINGS, INC.

Supplemental Financial

Information

Reconciliation of GAAP to

Non-GAAP Financial Information

(Unaudited) (In thousands

except per share amounts)

Three Months Ended

March 30, 2024

April 1, 2023

Operating income

$

25,817

$

15,098

Adjustments:

Non-cash stock-based compensation

expense(1)

8,497

6,775

Long-lived asset impairment(1)

2,025

—

Product recalls(2)

—

(1,070

)

Organizational realignment costs(1)(3)

1,122

880

Transition costs(4)

2,089

—

Adjusted operating income

$

39,550

$

21,683

Net income

$

15,855

$

10,564

Adjustments:

Non-cash stock-based compensation

expense(1)

8,497

6,775

Long-lived asset impairment(1)

2,025

—

Product recalls(2)

—

(1,070

)

Organizational realignment costs(1)(3)

1,122

880

Transition costs(4)

2,089

—

Other income (expense), net(5)

4,101

(6

)

Tax impact of adjusting items(6)

(4,369

)

(1,612

)

Adjusted net income

$

29,320

$

15,531

Net sales

$

341,394

$

302,796

Adjusted net sales

$

341,394

$

302,812

Operating income as a % of net sales

7.6

%

5.0

%

Adjusted operating income as a % of

adjusted net sales

11.6

%

7.2

%

Net income as a % of net sales

4.6

%

3.5

%

Adjusted net income as a % of adjusted net

sales

8.6

%

5.1

%

Net income per diluted share

$

0.18

$

0.12

Adjusted net income per diluted share

$

0.34

$

0.18

Weighted average shares outstanding used

to compute adjusted net income per diluted share

87,157

87,086

_________________________

(1)

These costs are reported in SG&A

expenses.

(2)

Represents adjustments and charges

associated with recalls.

(3)

Represents employee severance costs in

connection with strategic organizational realignments.

(4)

Represents transition costs in connection

with the acquisition of Mystery Ranch, LLC, including inventory

disposal costs, inventory step-up costs and third-party business

integration costs.

(5)

Other income (expense), net substantially

consists of realized and unrealized foreign currency gains and

losses on intercompany balances that arise in the ordinary course

of business.

(6)

Represents the tax impact of adjustments

calculated at an expected statutory tax rate of 24.5% for both the

three months ended March 30, 2024 and April 1, 2023.

YETI HOLDINGS, INC.

Supplemental Financial

Information

Reconciliation of GAAP to

Non-GAAP Financial Measures

(Unaudited) (In

thousands)

Three Months Ended March 30,

2024

Three Months Ended April 1,

2023

Net Sales

Product Recalls(1)

Adjusted Net Sales

Net Sales

Product Recalls(1)

Adjusted Net Sales

Channel

Wholesale

$

153,568

$

—

$

153,568

$

135,829

$

16

$

135,845

Direct-to-consumer

187,826

—

187,826

166,967

—

166,967

Total

$

341,394

$

—

$

341,394

$

302,796

$

16

$

302,812

Category

Coolers & Equipment

$

119,906

$

—

$

119,906

$

104,354

$

16

$

104,370

Drinkware

214,580

—

214,580

190,287

—

190,287

Other

6,908

—

6,908

8,155

—

8,155

Total

$

341,394

$

—

$

341,394

$

302,796

$

16

$

302,812

Geographic Region

United States

$

275,796

$

—

$

275,796

$

252,986

$

9

$

252,995

International

$

65,598

$

—

$

65,598

$

49,810

$

7

$

49,817

Total

$

341,394

$

—

$

341,394

$

302,796

$

16

$

302,812

_________________________

(1)

Represents adjustments and charges

associated with recalls.

YETI HOLDINGS, INC.

Fiscal 2024 Outlook

(Unaudited) (In thousands

except per share amounts)

Fiscal 2023

Fiscal 2024 Outlook

Low

High

Adjusted net sales

$

1,680,413

$

1,798,042

$

1,831,650

Adjusted operating income

$

262,785

$

287,687

$

302,222

Adjusted operating income as a % of

adjusted net sales

15.6

%

16.0

%

16.5

%

Adjusted net income

$

196,987

$

214,512

$

225,366

Adjusted net income as a % of adjusted net

sales

11.7

%

11.9

%

12.3

%

Adjusted net income per diluted share

$

2.25

$

2.49

$

2.62

Weighted average shares outstanding -

diluted

87,403

86,105

86,105

YETI HOLDINGS, INC.

Supplemental Financial

Information

Reconciliation of GAAP to

Non-GAAP Financial Information

(Unaudited) (In

thousands)

Twelve Months Ended

December 30,

2023

Net sales

$

1,658,713

Product recall(1)

21,700

Adjusted net sales

$

1,680,413

Operating income

$

225,458

Adjustments:

Non-cash stock-based compensation

expense(2)

29,800

Long-lived asset impairment(2)

2,927

Product recalls(1)

1,895

Organizational realignment costs(2)(3)

1,582

Business optimization expense(2)(4)

582

Transaction costs(2)(5)

541

Adjusted operating income

$

262,785

Net income

$

169,885

Adjustments:

Non-cash stock-based compensation

expense(2)

29,800

Long-lived asset impairment(2)

2,927

Product recalls(1)

1,895

Organizational realignment costs(2)(3)

1,582

Business optimization expense(2)(4)

582

Transaction costs(2)(5)

541

Other expense(6)

(1,430

)

Tax impact of adjusting items(7)

(8,795

)

Adjusted net income

$

196,987

Operating income as a % of net sales

13.6

%

Adjusted operating income as a % of net

sales

15.6

%

Net income as a % of net sales

10.2

%

Adjusted net income as a % of net

sales

11.7

%

Net income per diluted share

$

1.94

Adjusted net income per diluted share

$

2.25

Weighted average common shares outstanding

used to compute adjusted net income per diluted share

87,403

_________________________

(1)

Represents adjustments and charges

associated with product recalls.

(2)

These costs are reported in SG&A

expenses.

(3)

Represents employee severance costs in

connection with strategic organizational realignments.

(4)

Represents start-up costs, transition and

integration charges associated with our new distribution facilities

in the Netherlands and Australia.

(5)

Represents third-party costs related to

the announced acquisition of Mystery Ranch, LLC, including

professional, legal, and other transaction costs.

(6)

Other expense substantially consists of

realized and unrealized foreign currency gains and losses on

intercompany balances that arise in the ordinary course of

business.

(7)

Represents the tax impact of adjustments

calculated at an expected statutory tax rate of 24.5%.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240509230705/en/

Investor Relations Contact: Tom Shaw, 512-271-6332

Investor.relations@yeti.com Media Contact: YETI Holdings,

Inc. Media Hotline Media@yeti.com

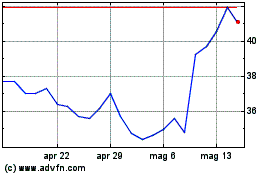

Grafico Azioni YETI (NYSE:YETI)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni YETI (NYSE:YETI)

Storico

Da Gen 2024 a Gen 2025