Tesla Price Cuts Send European, Chinese Auto Stocks Lower

17 Gennaio 2024 - 1:51PM

Dow Jones News

By Sherry Qin and David Sachs

Shares of European and Chinese automakers fell after Tesla

continued to cut prices, amid heightened global competition and

uncertain demand in the electric-vehicle market.

In Germany, the U.S. electric-car company slashed prices by

5,000 euros ($5,439) for two versions of its Model Y, according to

its website. The Performance model now costs German consumers

EUR55,990 while the Long Range model costs EUR49,990. Tesla also

cut the base Model Y price by EUR1,900 to EUR42,990.

At 1219 GMT, shares in Volkswagen were down 2.1%, Stellantis

dropped 1.1%, Renault was down 2%, Mercedes-Benz fell 1.7% and BMW

was down 2.4%.

Meanwhile in China, Tesla cut the price of its entry-level Model

3 by 5.9% to 245,900 yuan ($34,291) and lowered the Model Y's

starting price to CNY258,900 from CNY266,400 on Friday.

NIO shares fell 9.6% to 49.05 Hong Kong dollars ($6.27) on

Wednesday in Asia after ADRs shed 8.65% overnight. Its Hong

Kong-listed shares have lost 33% so far this year. XPeng dropped

9.9% and Zhejiang Leapmotor Technology declined 5.1%.

Tesla's recent price reductions have hurt overall sentiment in

the auto industry, Daiwa Capital Markets analyst Kelvin Lau said in

a research note. The pricing pressure, together with Chinese EV

makers' lackluster January sales so far, triggered the selloff, Lau

said.

Fiercer competition and flagging demand are expected to put

pressure on electric-vehicle pricing in Europe this year, HSBC

analysts said in a note last week.

Tesla sales rose 2.2% in Germany last year but fell 77% in

December, according to Kraftfahrt-Bundesamt, the federal motor

transport authority.

NIO's month-to-date insurance registrations, a gauge of retail

sales, have fallen 27% from the previous month, according to data

compiled by Citi. XPeng's insurance sales have dropped 62% so far,

while Leapmotor's has declined 30%. China's EV sales could fall 30%

in January from December, Citi analysts led by Jeff Chung said in a

note.

Tesla's price cut on models in the CNY200,000-CNY300,000 range,

where most of XPeng's products are positioned, could pose a threat

to the Chinese EV maker, the Citi analysts said in a separate note

recently.

Several investment banks, including Citi and HSBC Qianhai,

recently lowered their target prices on NIO's and XPeng's ADRs and

H shares, citing intense competition and pricing pressures.

Write to Sherry Qin at sherry.qin@wsj.com. Write to David Sachs

at david.sachs@wsj.com.

(END) Dow Jones Newswires

January 17, 2024 07:36 ET (12:36 GMT)

Copyright (c) 2024 Dow Jones & Company, Inc.

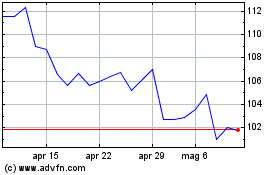

Grafico Azioni Bayerische Motoren Werke (TG:BMW)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Bayerische Motoren Werke (TG:BMW)

Storico

Da Dic 2023 a Dic 2024