Barrick Clarifies Merger Discussions with Newmont

28 Aprile 2014 - 7:31PM

Marketwired

Barrick Clarifies Merger Discussions with Newmont

TORONTO, ONTARIO--(Marketwired - Apr 28, 2014) - In response to

a press release issued today by Newmont Mining, Barrick Gold

Corporation (NYSE:ABX)(TSX:ABX) (Barrick or the "company") confirms

that the company had negotiated a term sheet for a proposed merger

between Barrick and Newmont, which was agreed upon and signed by

both parties on April 8.

Since then, Newmont has sought

to renege on three foundational elements of the signed term sheet:

the location of the head office of the merged company in Toronto;

the identification of any specific assets that would be included in

a spin-off company; and the carefully constructed governance

arrangements, particularly with respect to the roles and authority

of the Chairman, the Lead Director and the CEO.

Both companies were in full

agreement that the merger would produce substantial added value for

shareholders, through unique synergies that can only be achieved by

combining Barrick and Newmont, and the spin-off and further

rationalization of certain of the companies' combined assets.

CAUTIONARY STATEMENT ON FORWARD-LOOKING INFORMATION

Certain information contained or incorporated by reference in

this press release, including any information as to our strategy,

projects, plans or future financial or operating performance,

constitutes "forward-looking statements". All statements, other

than statements of historical fact, are forward-looking statements.

The word "believe" and similar expressions identify forward-looking

statements. Forward-looking statements are necessarily based upon a

number of estimates and assumptions that, while considered

reasonable by Barrick, are inherently subject to significant

business, economic and competitive uncertainties and contingencies.

Known and unknown factors could cause actual results to differ

materially from those projected in the forward-looking statements.

Such factors include, but are not limited to: fluctuations in the

spot and forward price of gold, copper or certain other commodities

(such as silver, diesel fuel and electricity); changes in national

and local government legislation, taxation, controls or regulations

and/or changes in the administration of laws, policies and

practices, expropriation or nationalization of property and

political or economic developments in Canada, the United States and

other jurisdictions in which Barrick does or may carry on business

in the future; failure to comply with environmental and health and

safety laws and regulations; timing of receipt of, or failure to

comply with, necessary permits and approvals; diminishing

quantities or grades of reserves; increased costs, delays,

suspensions and technical challenges associated with the

construction of capital projects; the impact of global liquidity

and credit availability on the timing of cash flows and the values

of assets and liabilities based on projected future cash flows;

adverse changes in our credit rating; the impact of inflation;

operating or technical difficulties in connection with mining or

development activities; the speculative nature of mineral

exploration and development; risk of loss due to acts of war,

terrorism, sabotage and civil disturbances; fluctuations in the

currency markets; changes in U.S. dollar interest rates; risks

arising from holding derivative instruments; litigation; contests

over title to properties, particularly title to undeveloped

properties, or over access to water, power and other required

infrastructure; business opportunities that may be presented to, or

pursued by, us; our ability to successfully integrate acquisitions

or complete divestitures; employee relations; availability and

increased costs associated with mining inputs and labor; and the

organization of our previously held African gold operations and

properties under a separate listed company. In addition, there are

risks and hazards associated with the business of mineral

exploration, development and mining, including environmental

hazards, industrial accidents, unusual or unexpected formations,

pressures, cave-ins, flooding and gold bullion losses (and the risk

of inadequate insurance, or inability to obtain insurance, to cover

these risks). Many of these uncertainties and contingencies can

affect our actual results and could cause actual results to differ

materially from those expressed or implied in any forward-looking

statements made by, or on behalf of, us. Readers are cautioned that

forward-looking statements are not guarantees of future

performance. All of the forward-looking statements made in this

press release are qualified by these cautionary statements.

Specific reference is made to the most recent Form 40-F/Annual

Information Form on file with the U.S. Securities Exchange

Commission and Canadian provincial securities regulatory

authorities for a discussion of some of the factors underlying

forward-looking statements.

Barrick disclaims any intention or obligation to update or

revise any forward-looking statements whether as a result of new

information, future events or otherwise, except as required by

applicable law.

INVESTOR CONTACT: Amy SchwalmVice President, Investor

Relations(416) 307-7422aschwalm@barrick.comMEDIA CONTACT: Andy

LloydVice President, Communications(416)

307-7414alloyd@barrick.com

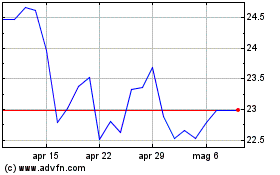

Grafico Azioni Barrick Gold (TSX:ABX)

Storico

Da Feb 2025 a Mar 2025

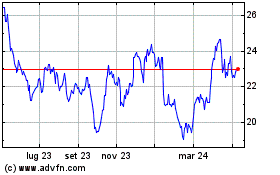

Grafico Azioni Barrick Gold (TSX:ABX)

Storico

Da Mar 2024 a Mar 2025