Baytex Announces Pricing of Upsized US$800 Million Private Placement Offering of Senior Notes

29 Maggio 2014 - 10:17PM

Marketwired

Baytex Announces Pricing of Upsized US$800 Million Private

Placement Offering of Senior Notes

CALGARY, ALBERTA--(Marketwired - May 29, 2014) - Baytex Energy

Corp. ("Baytex") (TSX:BTE) (NYSE:BTE) announced today the pricing

of its previously announced offering of senior notes due 2021 (the

"2021 Notes") and 2024 (the "2024 Notes" and, together with the

2021 Notes, the "Notes") in a private placement offering (the

"offering") in an aggregate principal amount of US$800 million

(upsized from US$780 million). The 2021 Notes will be issued at par

in an aggregate principal amount of US$400 million, bear interest

at a rate of 5.125% per annum and mature on June 1, 2021. The 2024

Notes will be issued at par in an aggregate principal amount of

US$400 million, bear interest at a rate of 5.625% per annum and

mature on June 1, 2024. Each series of Notes will pay interest

semi-annually in arrears. The offering is subject to customary

closing conditions and is expected to close on June 6, 2014.

Concurrently with the closing of the offering, the gross

proceeds of the offering (plus an amount related to interest that

would accrue on the Notes through a specified date) will be

deposited into an escrow account until the date on which certain

escrow conditions are satisfied, including the closing of the

acquisition of all of the outstanding ordinary shares of Aurora Oil

& Gas Limited (the "Arrangement"). Prior to or concurrently

with the escrow release, the existing credit facilities of Baytex

will be replaced with a $1.0 billion revolving unsecured credit

facility with a four-year term, a $200 million unsecured two-year

term loan facility and a US$200 million revolving unsecured credit

facility with a four-year term for a U.S. subsidiary of Aurora Oil

& Gas Limited.

Baytex intends to use a substantial portion of the net proceeds

from the offering of the Notes to purchase the notes tendered and

accepted for purchase in its previously announced cash tender

offers (collectively, the "Tender Offers") and consent

solicitations for the 9.875% Senior Notes due 2017 and the 7.50%

Senior Notes due 2020 of Aurora USA Oil & Gas, Inc. The

remaining net proceeds will initially be used to reduce Baytex's

outstanding indebtedness under its revolving credit facilities

which will subsequently be re-drawn for general corporate purposes.

The purpose of the offering, in conjunction with the Tender Offers,

is to simplify Baytex's debt capital structure following the

completion of the Arrangement. Closing of the Arrangement is

expected to occur on June 11, 2014 (in Perth).

If the escrow conditions are not satisfied on or prior to June

16, 2014, Baytex delivers a notification that such conditions will

not be satisfied or the Scheme Implementation Deed governing the

Arrangement is terminated, Baytex will be required to redeem each

series of Notes in full at a price equal to 100% of the applicable

initial issue price of such Notes, plus accrued and unpaid interest

from the date of issuance of such Notes up to, but excluding, the

payment date of such mandatory redemption.

This press release does not constitute an offer to sell or the

solicitation of an offer to buy any Notes, nor shall there be any

sale of Notes in any state or jurisdiction in which such offer,

solicitation or sale would be unlawful prior to the registration or

qualification of the Notes under the securities laws of any such

jurisdiction. The Notes will be issued in reliance on the exemption

from the registration requirements provided by Rule 144A under the

Securities Act of 1933, as amended (the "Securities Act") and,

outside of the United States, only to non-U.S. investors pursuant

to Regulation S under the Securities Act. None of the Notes have

been registered under the Securities Act or any state securities

laws, and may not be offered or sold in the United States absent

registration or an applicable exemption from the registration

requirements of the Securities Act and applicable state securities

laws.

Advisory Regarding

Forward-Looking Statements

Certain statements in this press release are

"forward-looking statements" within the meaning of the United

States Private Securities Litigation Reform Act of 1995 and

"forward-looking information" within the meaning of applicable

Canadian securities legislation (collectively "forward-looking

statements"). Specifically, this press release contains

forward-looking statements relating to but not limited to: the

terms of the Notes, including escrow arrangements; the timing of

completion of the offering; the timing of the implementation of new

unsecured credit facilities and the terms of such facilities; the

use of proceeds of the offering; and the timing of completion of

the Arrangement. The forward-looking statements contained in this

press release speak only as of its date and are expressly qualified

by this cautionary statement.

These forward-looking statements are based on certain key

assumptions regarding, among other things, the satisfaction or

waiver of the other conditions to the Arrangement and the Tender

Offers; and completion of the offering. Readers are cautioned that

such assumptions, although considered reasonable by Baytex at the

time of preparation, may prove to be incorrect.

Actual results achieved will vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors. Such factors include, but are not

limited to: the Arrangement may not be completed on the terms

contemplated or at all; closing of the Arrangement could be delayed

or not completed if we are not able to obtain the necessary

approvals required for completion or, unless waived, some other

condition to closing is not satisfied; the Tender Offers and

consent solicitations may not be completed on the terms

contemplated or at all; the offering may not be completed on the

terms contemplated or at all; and other factors, many of which are

beyond the control of Baytex. Additional risk factors are discussed

in our Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2013, as filed with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission.

There is no representation by Baytex that actual results

achieved will be the same in whole or in part as those referenced

in such forward-looking statements and Baytex does not undertake

any obligation to update publicly or to revise any of the included

forward- looking statements, whether as a result of new

information, future events or otherwise, except as may be required

by applicable securities laws.

All amounts are in Canadian dollars unless otherwise

noted.

Baytex Energy Corp.

Baytex is a dividend-paying oil and gas corporation based in

Calgary, Alberta. The company is engaged in the acquisition,

development and production of crude oil and natural gas in the

Western Canadian Sedimentary Basin and in the Williston Basin in

the United States. Approximately 89% of Baytex's production is

weighted toward crude oil. Baytex pays a monthly dividend on its

common shares which are traded on the Toronto Stock Exchange and

the New York Stock Exchange under the symbol BTE. The subscription

receipts issued by Baytex to fund a portion of the purchase price

for Aurora trade on the Toronto Stock Exchange under the symbol

BTE.R.

Baytex Energy Corp.Brian EctorSenior Vice President, Capital

Markets and Public AffairsToll Free Number:

1-800-524-5521investor@baytexenergy.com

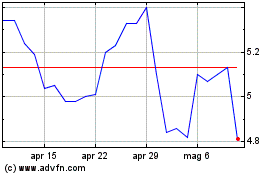

Grafico Azioni Baytex Energy (TSX:BTE)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Baytex Energy (TSX:BTE)

Storico

Da Feb 2024 a Feb 2025