Baytex Announces Closing of Aurora Acquisition and Confirms 9%

Dividend Increase

CALGARY, ALBERTA--(Marketwired - Jun 11, 2014) - Baytex Energy

Corp. ("Baytex") (TSX:BTE)(NYSE:BTE) announces the closing of its

previously announced acquisition of all of the shares of Aurora Oil

& Gas Limited ("Aurora") pursuant to a scheme of arrangement

under Australian law (the "Arrangement").

Concurrent with closing of the Arrangement, the monthly dividend

on our common shares will increase by 9% to $0.24 from $0.22 per

share. This increased dividend level will be effective in respect

of June operations and will be paid on July 15, 2014 to

shareholders of record on June 30, 2014. The annualized dividend of

$2.88 per share represents a dividend yield of approximately 6.0%

based on the closing price of our common shares on the Toronto

Stock Exchange ("TSX") on June 10, 2014 of $47.68.

We expect to provide revised guidance for 2014 in early July.

The guidance will include a full update incorporating the

acquisition of Aurora and any modifications to our current capital

spending plans.

Based on cash consideration payable for Aurora of A$4.20

(Australian dollars) per share, the total purchase price is

estimated at $2.8 billion (including the assumption of

approximately $0.9 billion of indebtedness).

To partially finance the acquisition, Baytex completed the

issuance of 38,433,000 subscription receipts (the "Subscription

Receipts") at $38.90 each on February 24, 2014, raising gross

proceeds of approximately $1.5 billion. Upon completion of the

Arrangement, each holder of Subscription Receipts became entitled

to receive one common share for each Subscription Receipt held.

Holders of Subscription Receipts will also receive a payment of

$0.88 in cash per Subscription Receipt, less any applicable

withholding taxes (the "Dividend Equivalent Payment"), representing

the four dividends declared from the date the Subscription Receipts

were issued to the date of the closing of the Arrangement. Baytex

expects that holders of Subscription Receipts will receive their

common shares and the Dividend Equivalent Payment to which they are

entitled in their brokerage accounts within a few days. Holders of

Subscription Receipts are not required to take any action in order

to receive their common shares and Dividend Equivalent Payment.

We expect that trading in the Subscription Receipts on the TSX

will be halted prior to market open and will be de-listed after

market close today.

As a result of the closing of the Arrangement, the gross

proceeds of our US$800 million private placement offering of senior

notes (the "Notes") will be released from escrow today.

Approximately US$745.5 million of the net proceeds from the

offering of the Notes will be used to purchase the notes tendered

and accepted for purchase in our previously announced cash tender

offers and consent solicitations for the 9.875% Senior Notes due

2017 (the "9.875% Notes") and the 7.50% Senior Notes due 2020 (the

"7.50% Notes") of Aurora USA Oil & Gas, Inc., which expired at

5:00 p.m. EST on June 10, 2014. Baytex accepted valid tenders and

consents from holders of US$357,100,000 in aggregate principal

amount of 9.875% Notes, representing 97.84% of the outstanding

aggregate principal amount of 9.875% Notes, and US$293,600,000 in

aggregate principal amount of 7.50% Notes, representing 97.87% of

the outstanding aggregate principal amount of 7.50% Notes. The

remaining net proceeds will initially be used to reduce Baytex's

outstanding indebtedness under its revolving credit facilities

which will subsequently be re-drawn for general corporate

purposes.

As a result of the closing of the Arrangement and the completion

of the tender offers and consent solicitations for the 9.875% Notes

and the 7.50% Notes, the existing credit facilities of Baytex were

replaced with a $1.0 billion revolving unsecured credit facility

with a four-year term, a $200 million unsecured term loan facility

with a two-year term and a US$200 million revolving unsecured

credit facility with a four-year term for a U.S. subsidiary of

Aurora.

Advisory Regarding

Forward-Looking Statements

In the interest of providing Baytex's shareholders and

potential investors with information regarding Baytex, including

management's assessment of Baytex's future plans and operations,

certain statements in this press release are "forward-looking

statements" within the meaning of the United States Private

Securities Litigation Reform Act of 1995 and "forward-looking

information" within the meaning of applicable Canadian securities

legislation (collectively, "forward-looking statements"). In some

cases, forward-looking statements can be identified by terminology

such as "anticipate", "believe", "continue", "could", "estimate",

"expect", "forecast", "intend", "may", "objective", "ongoing",

"outlook", "potential", "project", "plan", "should", "target",

"would", "will" or similar words suggesting future outcomes, events

or performance. The forward-looking statements contained in this

press release speak only as of the date thereof and are expressly

qualified by this cautionary statement.

Specifically, this press release contains forward-looking

statements relating to but not limited to: our business strategies,

plans and objectives; the estimated total purchase price for the

acquisition of Aurora, including the estimated level of assumed

indebtedness; the timing of future guidance incorporating the

acquisition of Aurora and any modifications to our current capital

spending plans; our plans to increase the dividend on our common

shares upon completion of the acquisition of Aurora; the

anticipated timing of receipt by the former holders of Subscription

Receipts of the common shares and the Dividend Equivalent Payment

to which they are entitled; the release of the net proceeds from

the offering of the Notes from escrow; and the use of the net

proceeds from the offering of the Notes. Cash dividends on our

common shares are paid at the discretion of our Board of Directors

and can fluctuate. In establishing the level of cash dividends, the

Board of Directors considers all factors that it deems relevant,

including, without limitation, the outlook for commodity prices,

our operational execution, the amount of funds from operations and

capital expenditures and our prevailing financial circumstances at

the time.

These forward-looking statements are based on certain key

assumptions regarding, among other things: petroleum and natural

gas prices and pricing differentials between light, medium and

heavy gravity crude oil; well production rates and reserve volumes;

our ability to add production and reserves through our exploration

and development activities; capital expenditure levels; the

receipt, in a timely manner, of regulatory and other required

approvals for our operating activities; the availability and cost

of labour and other industry services; the amount of future cash

dividends that we intend to pay; interest and foreign exchange

rates; the continuance of existing and, in certain circumstances,

proposed tax and royalty regimes; our ability to develop our crude

oil and natural gas properties in the manner currently

contemplated; and current industry conditions, laws and regulations

continuing in effect (or, where changes are proposed, such changes

being adopted as anticipated). Readers are cautioned that such

assumptions, although considered reasonable by Baytex at the time

of preparation, may prove to be incorrect.

Actual results achieved will vary from the information

provided herein as a result of numerous known and unknown risks and

uncertainties and other factors. Such factors include, but are not

limited to: failure to realize the anticipated benefits of the

Arrangement; declines in oil and natural gas prices; risks related

to the accessibility, availability, proximity and capacity of

gathering, processing and pipeline systems; variations in interest

rates and foreign exchange rates; risks associated with our hedging

activities; uncertainties in the credit markets may restrict the

availability of credit or increase the cost of borrowing;

refinancing risk for existing debt and debt service costs; a

downgrade of our credit ratings; the cost of developing and

operating our assets; risks associated with the exploitation of our

properties and our ability to acquire reserves; changes in

government regulations that affect the oil and gas industry;

changes in income tax or other laws or government incentive

programs; uncertainties associated with estimating petroleum and

natural gas reserves; risks associated with acquiring, developing

and exploring for oil and natural gas and other aspects of our

operations; risks associated with large projects or expansion of

our activities; risks related to heavy oil projects; changes in

environmental, health and safety regulations; the implementation of

strategies for reducing greenhouse gases; depletion of our

reserves; risks associated with the ownership of our securities,

including the discretionary nature of dividend payments and changes

in market-based factors; risks for United States and other

non-resident shareholders, including the ability to enforce civil

remedies, differing practices for reporting reserves and

production, additional taxation applicable to non-residents and

foreign exchange risk; and other factors, many of which are beyond

our control. These and additional risk factors are discussed in our

Annual Information Form, Annual Report on Form 40-F and

Management's Discussion and Analysis for the year ended December

31, 2013, as filed with Canadian securities regulatory authorities

and the U.S. Securities and Exchange Commission.

The above summary of assumptions and risks related to

forward-looking statements in this press release has been provided

in order to provide shareholders and potential investors with a

more complete perspective on Baytex's current and future operations

and such information may not be appropriate for other purposes.

There is no representation by Baytex that actual results achieved

will be the same in whole or in part as those referenced in the

forward-looking statements and Baytex does not undertake any

obligation to update publicly or to revise any of the included

forward-looking statements, whether as a result of new information,

future events or otherwise, except as may be required by applicable

securities law.

All amounts are in Canadian dollars unless otherwise

noted.

Baytex Energy Corp.

Baytex Energy Corp. is a dividend-paying oil and gas corporation

based in Calgary, Alberta. The company is engaged in the

acquisition, development and production of crude oil and natural

gas in the Western Canadian Sedimentary Basin and in the Eagle Ford

and Williston Basin in the United States. Approximately 86% of

Baytex's production is weighted toward crude oil and natural gas

liquids. Baytex pays a monthly dividend on its common shares which

are traded on the Toronto Stock Exchange and the New York Stock

Exchange under the symbol BTE.

Baytex Energy Corp.Brian EctorSenior Vice President, Capital

Markets and Public AffairsToll Free:

1-800-524-5521investor@baytexenergy.comwww.baytexenergy.com

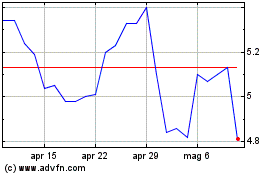

Grafico Azioni Baytex Energy (TSX:BTE)

Storico

Da Gen 2025 a Feb 2025

Grafico Azioni Baytex Energy (TSX:BTE)

Storico

Da Feb 2024 a Feb 2025