Doman Building Materials Group Ltd. (“Doman” or “the Company”)

(TSX:DBM) announced today its fourth quarter and full year 2023

financial results(1) for the period ended December 31, 2023.

For the year ended December 31, 2023(1),

consolidated revenues were $2.5 billion, compared to $3.0 billion

in 2022. The decrease was largely due to the impact of lower

construction materials pricing, which resulted in lower average

pricing for lumber, plywood and OSB during the current year. The

Company is pleased that while it experienced lower average pricing,

this was partially offset by increased unit volumes during 2023.

The Company’s sales by product group in the period were made up of

74% construction materials, compared to 76% last year, with the

remaining balance resulting from specialty and allied products of

22%, and forestry and other sources of 4%.

Gross margin dollars were $402.7 million in

2023, versus $408.8 million in 2022. Gross margin percentage was

16.2% during the year, an increase from the 13.5% achieved in 2022,

largely due to reduced volatility in construction materials

pricing.

EBITDA(2) was $196.1 million, compared to $203.2

million in 2022. The Company declared a total of $0.56 per share(3)

in dividends in 2023, which was unchanged compared to 2022.

For the three-month period ended December 31,

2023(1), revenues amounted to $527.4 million when compared to

$572.9 million in the same period in 2022. The Company’s sales by

product group in the quarter were made up of 72% construction

materials, with the remaining balance of sales resulting from

specialty and allied products of 24%, and forestry and other of

4%.

Gross margin dollars were $80.6 million in the

three-month period versus $82.0 million in the comparative quarter

of 2022. Gross margin percentage was 15.3% in the quarter, an

increase from 14.3% achieved in the same quarter of 2022.

EBITDA(2) for the three-month period ended

December 31, 2023(1), amounted to $33.2 million, compared to $32.9

million in 2022.

“Despite the impact of significantly lower

year-over-year construction materials pricing, our business units

continued to show reslilience in volumes while delivering very

strong gross margin performance," commented Amar S. Doman, Chairman

of the Board. "While there remain macroeconomic uncertainties, on

the back of ending 2023 on solid footing, we remain enthusiastic

and confident in seizing growth opportunities in our key

markets.”

Reconciliation of Net Earnings to

Earnings before Interest, Tax, Depreciation and Amortization

(EBITDA):

|

|

Three months ended December 31, |

Years ended December 31, |

|

|

2023 |

2022 |

2023 |

2022 |

|

(in thousands of dollars) |

$ |

$ |

$ |

$ |

|

Net earnings |

10,524 |

4,333 |

75,786 |

78,740 |

|

|

|

|

|

|

|

(Recovery of) Provision for income taxes |

(3,506) |

1,400 |

11,654 |

19,977 |

|

Finance costs |

9,353 |

9,771 |

40,543 |

37,574 |

|

Depreciation and amortization |

16,858 |

17,415 |

68,103 |

66,877 |

|

|

|

|

|

|

|

EBITDA |

33,229 |

32,919 |

196,086 |

203,168 |

Subsequent Event - Southeast Forest

Products Acquisition

On March 1, 2024, the Company announced that its

wholly owned subsidiary in the United States doing business as

Doman Lumber acquired two lumber pressure treating plants, related

equipment and business, formerly owned by Southeast Forest Products

Treated, LTD. in Richmond, Indiana and near Birmingham, Alabama

(the “Acquisition”).

The Acquisition was fully funded by Doman’s

cash-on-hand and no shares were issued.

About Doman Building Materials Group

Ltd.

Founded in 1989, Doman is headquartered in Vancouver,

British Columbia, and trades on the Toronto Stock

Exchange under the symbol DBM.

As Canada’s only fully integrated national distributor in the

building materials and related products sector, Doman operates

several distinct divisions with multiple treating plants,

planing and specialty facilities and distribution centres

coast-to-coast in all major cities across Canada and select

locations across the United States.

Strategically located across Canada, Doman Building

Materials Canada operates distribution centres

coast-to-coast, and Doman Treated Wood Canada

operates multiple treating plants near major

cities; headquartered in Dallas, Texas,

Doman Lumber

operates 21 treating plants, two specialty planing mills and five

specialty sawmills located in nine states, distributing, producing

and treating lumber, fencing and building material servicing the

central U.S.; Doman Building Materials

USA and Doman Treated Wood USA serve

the U.S. west coast with multiple locations in California and

Oregon; and in the state of Hawaii the Honsador Building

Products Group services 14 locations across all the

islands. The Company’s Canadian operations also include ownership

and management of private timberlands and forest licenses, and

agricultural post-peeling and pressure treating through

its Doman Timber operations.

For additional information on Doman Building Materials Group

Ltd., please refer to the Company’s filings on SEDAR+ and the

Company’s website www.domanbm.com

For further information regarding Doman please

contact:

Ali MahdaviInvestor Relations416-962-3300

ali.mahdavi@domanbm.com

Certain statements in this press release may

constitute “forward-looking” statements. When used in this press

release, forward-looking statements often but not always, can be

identified by the use of forward-looking words such as, including

but not limited to, “may”, “will”, “intend”, “should”, “expect”,

“believe”, “outlook”, “predict”, “remain”, “anticipate”,

“estimate”, “potential”, “continue”, “plan”, “could”, “might”,

“project”, “targeting” or the inverse or negative of these terms or

other similar terminology. Forward-looking information in the 2023

Reporting Documents includes, without limitation, statements

regarding funding requirements, dividends, commodity pricing, debt

repayment, interest rates, economic conditions data and housing

starts. Additionally, the ultimate impact of COVID-19 on the

Company’s results is difficult to quantify, as it will depend on,

inter alia, the ongoing duration and impact of the pandemic, the

impact of government policies, and the pace of economic recovery.

These statements are based on management’s current expectations

regarding future events and operating performance, and on

information currently available to management, speak only as of the

date of the 2023 Reporting Documents and are subject to risks which

are described in the Company’s current Annual Information Form

dated March 31, 2023 (“AIF”) and the Company’s public filings on

the Canadian Securities Administrators’ website at www.sedar.com

(“SEDAR”) and as updated from time to time, and would include, but

are not limited to, dependence on market economic conditions, risks

related to the impact of geopolitical conflicts, local, national,

and international health concerns, including but not limited to

COVID-19 or other viruses, epidemics or pandemics, sales and margin

risk, acquisition and integration risks and operational risks

related thereto, competition, information system risks, technology

risks, cybersecurity risks, availability of supply of products,

interest rate risks, inflation risks, risks associated with the

introduction of new product lines, product design risk, product

liability risk, environmental risks, climate change risks,

volatility of commodity prices, inventory risks, customer and

vendor risks, contract performance risk, availability of credit,

credit risks, performance bond risk, currency risks, insurance

risks, tax risks, risks of legislative or regulatory changes,

international trade and tariff risks, operational and safety risks,

resource industry risks, resource extraction risks, risks relating

to remote operations, forestry management and silviculture, fire

and natural disaster risks, key executive risk and litigation

risks. These risks and uncertainties may cause actual results to

differ materially from those contained in the statements. Such

statements reflect management’s current views and are based on

certain assumptions. Some of the key assumptions include, but are

not limited to, assumptions regarding the performance of the

Canadian and the United States (“US”) economies, the impact of

COVID-19, other viruses, epidemics, pandemics or health risks,

interest rates, exchange rates, inflation, capital and loan

availability, commodity pricing, the Canadian and the US housing

and building materials markets; international trade matters;

post-acquisition operation of a business; the amount of the

Company’s cash flow from operations; tax laws; laws and regulations

relating to the protection of the environment, including the

impacts of climate change, and natural resources; and the extent of

the Company’s future acquisitions and capital spending requirements

or planning in respect thereto, including but not limited to the

performance of any such business and its operation; availability or

more limited availability of access to equity and debt capital

markets to fund, at acceptable costs, the Company’s future growth

plans, the implementation and success of the integration of

acquisitions, the ability of the Company to refinance its debts as

they mature; the direct and indirect effect of the US housing

market and economy; exchange rate fluctuations between the Canadian

and US dollar; retention of key personnel; the Company’s ability to

sustain its level of sales and earnings margins; the Company’s

ability to grow its business long-term and to manage its growth;

the Company’s management information systems upon which it is

dependent are not impaired, ransomed or unavailable; the Company’s

insurance is sufficient to cover losses that may occur as a result

of its operations as well as the general level of economic

activity, in Canada and the US, and abroad, discretionary spending

and unemployment levels; the effect of general economic conditions;

market demand for the Company’s products, and prices for such

products; the effect of forestry, land use, environmental and other

governmental regulations; and the risk of losses from fires, floods

and other natural disasters and unemployment levels. They are, by

necessity, only estimates of future developments and actual

developments may differ materially from these statements due to a

number of known and unknown factors. Investors are cautioned not to

place undue reliance on these forward-looking statements. All

forward-looking information in the 2023 Reporting Documents is

qualified by these cautionary statements. Although the

forward-looking information contained in the 2023 Reporting

Documents is based on what management believes are reasonable

assumptions, there can be no assurance that actual results will be

consistent with these forward-looking statements. Certain

statements included in the 2023 Reporting Documents may be

considered “financial outlook” for purposes of applicable

securities laws, and such financial outlook may not be appropriate

for purposes other than the 2023 Reporting Documents. In addition,

there are numerous risks associated with an investment in the

Company’s common shares and senior unsecured notes, which are also

further described in the “Risks and Uncertainties” section in these

2023 Reporting Documents and in the “Risk Factors” section of the

Company’s AIF, and as updated from time to time, in the Company’s

other public filings on SEDAR.

The forward-looking statements contained in the

2023 Reporting Documents are made as of the date of this report and

should not be relied upon as representing the Company’s views as of

any date subsequent to the date of this report. Except as required

by applicable law, the Company undertakes no obligation to publicly

update or otherwise revise any forward-looking statement, whether

as a result of new information, future events, or otherwise.

The information in this report is as at March 7,

2024, unless otherwise indicated. All amounts are reported in

Canadian dollars, unless otherwise indicated.

(1) Please refer to our Q4 2023 MD&A and

Financial Statements for further information. Our Q4 2023 Financial

Statements filings are reported under International Financial

Reporting Standards (“IFRS”).

(2) In the discussion, reference is made to

EBITDA, which represents earnings from continuing operations before

interest, including amortization of deferred financing costs,

provision for income taxes, depreciation, and amortization. This is

not a generally accepted earnings measure under IFRS and does not

have a standardized meaning under IFRS, and therefore the measure

as calculated by Doman may not be comparable to similarly titled

measures reported by other companies. EBITDA is presented as we

believe it is a useful indicator of a company’s ability to meet

debt service and capital expenditure requirements and because we

interpret trends in EBITDA as an indicator of relative operating

performance. EBITDA should not be considered by an investor as an

alternative to net earnings or cash flows as determined in

accordance with IFRS. For a reconciliation of EBITDA to the most

directly comparable measures calculated in accordance with IFRS

refer to “Reconciliation of Net Earnings to Earnings before

Interest, Tax, Depreciation and Amortization (EBITDA) and Adjusted

EBITDA”.

(3) On December 15, 2023, Doman declared a

quarterly dividend of $0.14 per share, which was paid on January

12, 2024, to shareholders of record on December 29, 2023. Please

refer to our Q4 2023 MD&A and Financial Statements for more

information.

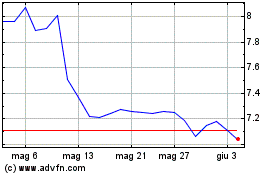

Grafico Azioni Doman Building Materials (TSX:DBM)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Doman Building Materials (TSX:DBM)

Storico

Da Gen 2024 a Gen 2025