Provides Funds to Materially Advance the

Kindersley Lithium Project

Conference call and webcast to be held at

10:00am (MST) on January 17, 2024 to describe the transaction

CALGARY,

AB, Jan. 16, 2024 /PRNewswire/ - (TSXV:

GRD) (OTCQB: GRDAF) – Grounded Lithium Corp. ("GLC" or

the "Company") is pleased to announce we entered into a

definitive agreement dated January 15,

2024 with Denison Mines Corp (TSX: DML NYSE American:

DNN) ("Denison") whereby Denison has the option to earn

up to a 75% working interest in the Kindersley Lithium Project

("KLP") by funding in aggregate up to $15,150,000 comprised of both cash payments to

GLC of up to $3,150,000 and funding

project expenditures of up to $12,000,000 through a structured earn-in option.

(the "Agreement").

The Agreement is expected to provide more than sufficient

funding for a field pilot (the "Pilot") for the KLP which

both the Company and Denison (collectively, the "Parties")

plan to advance on a priority basis. Beyond the Pilot, Denison

may also provide further capital during the earn-in period to fund

other activities as necessary to drive the overall KLP value such

as further technical evaluations and studies, drilling, sampling

and expenditures to maintain the KLP lands in good standing.

The Agreement highlights are as follows:

- Three distinct earn-in options (each, an "Earn-in

Option") which include a cash payment directly to the Company

along with dedicated expenditures to advance the KLP, as described

below. During the earn-in period, KLP expenditures will

generally be funded 100% by Denison, and Denison will be

entitled to an increased working interest in the KLP as it

completes each Earn-in Option phase. Key economic parameters of the

Agreement are summarized in the table below:

|

(all amounts in CAD$000's)

|

Earn-in Option

Phase

|

|

|

|

|

|

|

|

Phase 1

|

Phase 2

|

Phase 3

|

|

|

|

|

|

|

Royalty Financing

Payment

|

|

800

|

|

|

|

Cash Payments to

GLC

|

|

-

|

850

|

1,500

|

|

Cumulative Cash

Payments

|

|

800

|

1,650

|

3,150

|

|

|

|

|

|

|

Project

Expenditures

|

|

2,200

|

3,800

|

6,000

|

|

Cumulative Project

Expenditures

|

|

2,200

|

6,000

|

12,000

|

|

|

|

|

|

|

Total Contributions per

Option Phase

|

|

3,000

|

4,650

|

7,500

|

|

Cumulative Total

Contributions

|

|

3,000

|

7,650

|

15,150

|

|

|

|

|

|

|

Denison Working

Interest in the KLP

|

|

30 %

|

55 %

|

75 %

|

- Upon funding the total amounts of each Earn-in Option, Denison

has the right to either exercise the Earn-In Option and acquire the

working interest associated with that Earn-In Option phase or move

on to the ensuing option phase;

- Should Denison exercise the Earn-In Option and elect to acquire

a working interest in the KLP, a formal joint venture will be

created to govern the Parties. The joint venture agreement will

contain customary language and terms associated with an arrangement

of this nature, including but not limited to, governance

provisions, rights of first refusals, dilution provisions for

non-participation and technical and management committees;

- The Agreement terminates on the earlier of (i) Denison electing

to acquire its working interest and convert to a formal joint

venture, (ii) June 30, 2028, or (iii)

a date as otherwise agreed between the Parties;

- The ability exists for either Party to recommend drilling

expenditures, outside of the earn-in option terms detailed above,

for which the purpose is to preserve lithium rights associated with

the various KLP permits; and

- Denison will become the named operator of the KLP during the

Earn-In Period, however, to ensure continuity of site activities,

the Parties will enter into a two-year site management contract

whereby a fee will be paid to the Company to effectively manage the

day-to-day site activities of the KLP.

The Company also sold a 5% gross overriding royalty

("GORR") on the KLP to Denison in accordance with the terms

of a royalty agreement (the "Royalty Agreement") for a cash

payment of $800,000. Pursuant to the

terms of the Royalty Agreement, the GORR drops to 2% upon the

receipt of all approvals, inclusive of GLC shareholder approval of

the Agreement. The GORR is eliminated in its entirety on the

date that is fifteen (15) months after the closing of the Earn-In

Agreement unless Denison elects to forfeit its rights to exercise

an Earn-In Option.

GLC and Denison have established an area of mutual interest in

respect of any lands acquired within 10 kilometers of any existing

lands contained within the KLP that are prospective for lithium

("AMI Lands"). GLC is free to explore for, acquire and

develop lands outside of the AMI Lands for its own account and we

currently have developed several prospects which honour our

geological model for economic lithium resource plays, while we

benefit from intellectual knowledge gained from the technical work

on the KLP.

"Grounded remains steadfast in our vision to economically

produce battery grade lithium with a focus on low-cost operations

and this strategic investment from Denison is a major step in that

regard," stated Gregg Smith,

President & CEO. "Denison has a considerable operating

footprint in Saskatchewan as well

as an excellent reputation within the Province, and we continue to

be impressed with the diligence and professionalism of the Denison

team. We look forward to working together to unlock the full value

potential of the KLP for the benefit of our respective

shareholders. Further, the strategic investment from Denison

in both GLC and the KLP eliminates many perceived or distinct risks

in our anticipated path to commercial production."

David Cates, President and CEO of

Denison commented, "Denison is excited to acquire a royalty and

enter into an earn-in agreement with GLC that supports the further

assessment of the KLP in Saskatchewan. Denison has developed a unique

platform for the de-risking of mine development projects in the

Province with its innovative and highly skilled Saskatoon-based technical, regulatory, and

operations teams. Lithium is a complementary mineral

to Denison's core uranium business, with both identified as

critical minerals needed to support the clean energy transition.

Brine extraction also has many similarities to the In-Situ Recovery

mining method that the Company has successfully validated for use

at its flagship Wheeler River uranium project in northern

Saskatchewan. Combining our deep

local technical capabilities with the Grounded team's experience

on KLP has the potential to create an incredible environment

to incubate the KLP to emerge as a premier lithium project in a top

mining jurisdiction."

"The transaction with Denison is a great outcome for both

parties," commented Greg Phaneuf,

Senior Vice President Corporate Development & CFO. "Denison

gains exposure to a high-potential lithium brine project in

Saskatchewan with similarities to

its impressive uranium project development portfolio in the

Province while Grounded receives immediate funding and partners

with a strategic investor with a much lower cost of capital to

advance the KLP without incurring dilution at the corporate

level."

The Agreement is subject to the regulatory approval of the TSX

Venture Exchange and is subject to receipt of shareholder approval

by way of the written consent of shareholders holding over 50% of

the current issued and outstanding shares of the Company.

Conference Call Details

Those interested can listen to Company officials describe the

transaction with Denison by participating in the following

conference call details:

Participant Toll-Free Dial-In Number: 1 (888) 300-4030

Participant Toll Dial-In Number: 1 (646) 970-1443

Conference ID: 5553583

Webcast url: https://events.q4inc.com/attendee/658855672

The Company will post a playback of the conference call on the

Company's website.

About Denison Mines

Corp.

Denison is a uranium exploration and development company with

interests focused in the Athabasca

Basin region of northern Saskatchewan,

Canada. The Company has an effective 95% interest in its

flagship Wheeler River Uranium Project, which is the largest

undeveloped uranium project in the infrastructure rich eastern

portion of the Athabasca Basin

region of northern Saskatchewan.

In mid-2023, a Feasibility Study was completed for Wheeler River's

Phoenix deposit as an ISR mining

operation, and an update to the previously prepared PFS was

completed for Wheeler River's Gryphon deposit as a conventional

underground mining operation. Based on the respective studies, both

deposits have the potential to be competitive with the lowest cost

uranium mining operations in the world. Permitting efforts for the

planned Phoenix ISR operation commenced in 2019 and have advanced

significantly, with licensing in progress and a draft Environmental

Impact Statement submitted for regulatory and public review in

October 2022.

Denison's interests in Saskatchewan also include a 22.5% ownership

interest in the McClean Lake Joint Venture, which owns several

uranium deposits and the McClean Lake uranium mill, contracted to

process the ore from the Cigar Lake mine under a toll milling

agreement, plus a 25.17% interest in the Midwest Main and Midwest A

deposits and a 67.41% interest in the THT and Huskie deposits on

the Waterbury Lake property. The Midwest Main, Midwest A, THT and

Huskie deposits are located within 20 kilometres of the McClean

Lake mill.

Through its 50% ownership of JCU (Canada) Exploration Company, Ltd

("JCU"), Denison holds additional interests in various

uranium project joint ventures in Canada, including the Millennium project (JCU,

30.099%), the Kiggavik project (JCU, 33.8118%) and Christie Lake (JCU, 34.4508%).

Denison's exploration portfolio includes further interests in

properties covering approximately 285,000 hectares in the

Athabasca Basin region.

About Grounded Lithium

Corp.

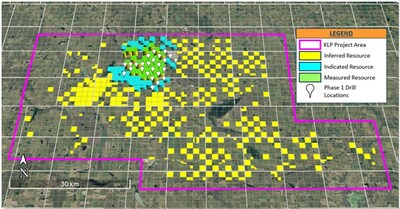

GLC is a publicly traded lithium brine exploration and

development company that controls approximately 1.0 million metric

tonnes of Measured & Indicated lithium carbonate equivalent

mineral resource and approximately 3.2 million metric tonnes of

Inferred lithium carbonate equivalent resource over our focused

land holdings in Southwest

Saskatchewan as per the Company's updated PEA. The updated

PEA, titled "NI 43-101 Technical Report: Preliminary Economic

Assessment Kindersley Lithium Project – Phase 1 Update" dated

November 7, 2023 and effective as of

June 30, 2023, reports a Phase 1

NPV8 after-tax of US$1.0

billion with an after-tax IRR of 48.5%. GLC's multi-faceted

business model involves the consolidation, delineation,

exploitation and ultimately development of our opportunity base to

fulfill our vision to build a best-in-class, environmentally

responsible, Canadian lithium producer supporting the global energy

transition shift. U.S. investors can find current financial

disclosure and Real-Time Level 2 quotes for the Company

on https://www.otcmarkets.com/.

Qualified Person

Scientific and technical information contained in this press

release has been prepared under the supervision of Doug Ashton, P.Eng., Alexey Romanov, P. Geo., Meghan Klein, P. Eng., Dean Quirk, P.Eng., Jeffrey Weiss, P.Eng., Chad Hitchings., P.L. Eng., and Michael Munteanu, P.Eng., each of whom is a

qualified person within the meaning of NI 43-101.

Forward-Looking

Statements

This press release may contain forward-looking statements and

forward-looking information within the meaning of applicable

Canadian securities laws. The opinions, forecasts, projections and

statements about future events of results, are forward looking

information, forward-looking statements or financial outlooks

(collectively, "forward-looking statements") under the

meaning of applicable Canadian securities laws. These statements

are made as of the date of this press release and the fact that

this press release remains available does not constitute a

representation by GLC that the Company believes these

forward-looking statements continue to be true as of any subsequent

date. Although GLC believes that the assumptions underlying, and

expectations reflected in, these forward-looking statements are

reasonable, it can give no assurance that these assumptions and

expectations will prove to be correct. Such statements include, but

are not limited to, statements pertaining to the advancement of the

Pilot and the timing thereof, GLC's expectation of the funding

required for the Pilot; Denison's funding to the Company, the

timing and amount thereof and the use of proceeds from such

funding; shareholder approval of the Agreement activities necessary

to drive the overall KLP value; the entering into of the joint

venture agreement if at all and the timing and terms thereof; the

impact of the Agreement on the shareholders of the Company;

prospective lands outside of the AOI Lands and the viability for

economic lithium resource plays; and GLC's vision of becoming a

best-in-class, environmentally responsible, Canadian lithium

producer supporting the global energy transition.

Among the important factors, risks, uncertainties and

assumptions that could cause actual results to differ materially

from those indicated by such forward-looking statements are: GLC's

expectation that our operations will be in Western Canada, unexpected problems can arise

due to technical difficulties and operational difficulties which

impact the production, transport or sale of our products;

geographic and weather conditions can impact the production; the

risk that current global economic and credit conditions may impact

commodity prices and consumption more than GLC currently predicts;

the failure to obtain financing on reasonable terms; the risk that

unexpected delays and difficulties in developing currently owned

properties may occur; the failure of drilling to result in

commercial projects; unexpected delays due to the limited

availability of drilling equipment and personnel; and the other

risk factors detailed from time to time in GLC's periodic reports.

GLC's forward-looking statements are expressly qualified in their

entirety by this cautionary statement.

This news release shall not constitute an offer to sell or

the solicitation of an offer to buy any securities in any

jurisdiction.

Neither the TSX Venture Exchange nor its Regulation Services

Provider (as that term is defined in the policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this news release.

View original content to download

multimedia:https://www.prnewswire.com/news-releases/grounded-lithium-executes-strategic-investment-with-denison-mines-302035876.html

View original content to download

multimedia:https://www.prnewswire.com/news-releases/grounded-lithium-executes-strategic-investment-with-denison-mines-302035876.html

SOURCE Grounded Lithium Corp