Kinross Gold Corporation (TSX:K)(NYSE:KGC) today announced the

results of its pre-feasibility study (PFS) for its Tasiast

expansion project. Based on these results, the Company has decided

to proceed with a feasibility study on an expanded Tasiast

operation with a 38,000 tonne per day (tpd) mill.

The PFS was based on constructing a new 30,000 tonne tpd mill at

Tasiast utilizing heavy fuel oil as an energy source. It assumed a

$1,500 per ounce gold price for overall project economics and,

consistent with the Company's year-end mineral reserve estimates, a

$1,200 per ounce gold price for pit design purposes. The PFS

estimates are based on a pit design mineral resource estimate of

approximately 10 million recovered gold ounces, which does not

include additional known resources estimated using a gold price

assumption above $1,200 per ounce. In addition, the PFS estimates

do not include potential district exploration upside.

The study found that during the first five years of production,

a 30,000 tpd mill would be expected to have average gold production

of approximately 830,000 ounces per year, with average cash

costs(1) of approximately $500 per ounce, and average all-in

sustaining costs(2) of approximately $735 per ounce. The expected

initial capital cost would be approximately $2.7 billion(3). The

PFS indicated an estimated IRR for the project of approximately 11%

and an estimated NPV of approximately $1.1 billion.

In addition, the PFS incorporated trade-off studies which

considered utilizing the existing 8,000 tpd mill capacity at

Tasiast in addition to a new 30,000 tpd mill. These studies

concluded that a single new 38,000 tpd mill would be expected to

provide the optimum economics for an expanded project. Based on

these results, the Company is proceeding to a full feasibility

study (FS) on an expanded Tasiast operation with a 38,000 tpd mill.

The FS work process will begin immediately, and is now scheduled

for expected completion in the first quarter of 2014. Following

completion of the FS, the Company will make a decision on whether

to complete engineering and proceed with construction. The decision

will depend on a range of factors, including gold price assumptions

and projections, expected economic returns, and various technical

and other considerations.

"Although there is considerable work to be done at the

feasibility study level before we decide whether to proceed with

construction, the results of the PFS are encouraging," said CEO J.

Paul Rollinson. "As we continue to evaluate the project, we remain

firmly focused on preserving the strength of our balance

sheet."

The FS will assess construction of a standard carbon-in-leach

(CIL) circuit with a primary crusher and SAG mill, in addition to

the existing dump leach facilities. The FS will assume an open-pit

mining sequence based on developing a series of pushbacks that

would allow the mine to encounter expected higher grade ore early

in the mine life. A variable cut-off grade strategy is expected to

be applied to bring gold production forward and stockpile

lower-grade material for processing later in the mine life.

The FS will explore a number of opportunities to optimize the

project and improve overall economics, including the potential for

implementing lower-cost natural gas power. Kinross is currently

part of a joint venture which is working to advance the

commercialization of power generated by natural gas supply located

offshore of Mauritania.

----------------------------------------------------------------------------

Summary of PFS estimates for 30,000 tpd mill at Tasiast

----------------------------------------------------------------------------

Operational metric Estimate (weighted average)

----------------------------------------------------------------------------

Mill throughput 30,000 tonnes per day

----------------------------------------------------------------------------

Life of mine(4) (end of production) 2033

----------------------------------------------------------------------------

Ounces recovered - life of mine 10.0 million(5) -- based on pit

design using assumed gold price of

$1,200/ounce

----------------------------------------------------------------------------

Estimated ore processed - life of mine CIL: 196 million tonnes

Dump leach: 46 million tonnes

----------------------------------------------------------------------------

Average annual production (ounces) - 755,000-855,000 (830,000)

first five years

----------------------------------------------------------------------------

Average annual production (ounces) - 400,000-500,000 (475,000)

life of mine

----------------------------------------------------------------------------

Cash cost per ounce - first five years $475-575/ounce ($500)

----------------------------------------------------------------------------

Cash cost per ounce - life of mine $675-775 ($700)

----------------------------------------------------------------------------

All-in sustaining cost per ounce - first $710-810 ($735)

five years

----------------------------------------------------------------------------

All-in sustaining cost per ounce - life $890-990 ($910)

of mine

----------------------------------------------------------------------------

Average grade - first five years 2.08 g/t

----------------------------------------------------------------------------

Average grade - life of mine 1.41 g/t

----------------------------------------------------------------------------

Average CIL recovery - life of mine 93%

----------------------------------------------------------------------------

Strip ratio - first five years 4.5

----------------------------------------------------------------------------

Strip ratio - life of mine 4.6

----------------------------------------------------------------------------

Peak mining rate per year 120 million tonnes

----------------------------------------------------------------------------

Initial capital expenditure (April 1, $2.7 billion

2013 forward)

----------------------------------------------------------------------------

IRR(6) 11%

----------------------------------------------------------------------------

NPV(6) $1.1 billion

----------------------------------------------------------------------------

Key assumptions:

Energy source Heavy fuel oil

Gold price (pit design) $1,200/ounce

Gold price (economic evaluation) $1,500/ounce

Discount rate 5%

----------------------------------------------------------------------------

Kinross will hold a conference call and audio webcast on Monday,

April 29, at 8 a.m. ET to discuss the results of the Tasiast PFS,

followed by a question-and-answer session. To access the call,

please dial:

Canada & US toll-free - 1-800-319-4610

Outside of Canada & US - 1-604-638-5340

Replay (available up to 14 days after the call):

Canada & US toll-free - 1-800-319-6413; Passcode - 4137

followed by #.

Outside of Canada & US - 1-604-638-9010; Passcode - 4137

followed by #.

You may also access the conference call on a listen-only basis

via webcast at our website www.kinross.com. The audio webcast will

be archived on our website at www.kinross.com.

(1) Cash costs include operating costs and royalties.

(2) All-in sustaining cost includes operating costs, royalties, sustaining

capital, and capitalized stripping, and does not include any allocation

of regional or corporate overhead costs.

(3) Includes estimated capital expenditures from April 1, 2013 forward, and

a contingency of $290 million.

(4) Defined as April 1, 2013 forward

(5) The $1,200 pit design in the PFS for purposes of economic evaluation

does not include inferred mineral resources and certain measured and

indicated mineral resources. The PFS does not result in any change to

Kinross' existing mineral reserve and mineral resource estimates for the

Tasiast project. Please refer to our most recent Annual Information Form

for Tasiast annual mineral reserve and mineral resource estimates as at

December 31, 2012.

(6) Does not include potential for improved economics related to potential

district exploration upside, potential implementation of lower-cost

natural gas generated power, or additional known mineral resource

estimates using a gold price above $1,200.

About Kinross Gold Corporation

Kinross is a Canadian-based gold mining company with mines and

projects in Brazil, Canada, Chile, Ecuador, Ghana, Mauritania,

Russia and the United States, employing approximately 9,000 people

worldwide. Kinross maintains listings on the Toronto Stock Exchange

(symbol:K) and the New York Stock Exchange (symbol:KGC).

Cautionary statement on forward-looking information

All statements, other than statements of historical fact,

contained or incorporated by reference in this news release, but

not limited to, any information as to the future financial or

operating performance of Kinross, constitute "forward-looking

information" or "forward-looking statements" within the meaning of

certain securities laws, including the provisions of the Securities

Act (Ontario) and the provisions for "safe harbour" under the

United States Private Securities Litigation Reform Act of 1995 and

are based on expectations, estimates and projections as of the date

of this news release. Forward-looking statements include, without

limitation, statements with respect to: possible events, the future

price of gold and silver, the estimation of mineral reserves and

mineral resources, the realization of mineral reserve and mineral

resource estimates, the timing and amount of estimated future

production, costs of production, capital expenditures, costs and

timing of the development of projects and new deposits, success of

exploration, development and mining activities, permitting

timelines, currency fluctuations, requirements for additional

capital, government regulation of mining operations, environmental

risks, unanticipated reclamation expenses, title disputes or claims

and limitations on insurance coverage. The words "aim",

"anticipates", "plans", "expects", "indicative", "intend",

"scheduled", "timeline", "estimates", "forecasts", "guidance",

"opportunity", "outlook", "potential", "projected", "schedule",

"seek", "strategy", "study" (including, without limitation, as may

be qualified by "feasibility" and "pre-feasibility"), "targets",

"models", or "believes", or variations of or similar such words and

phrases or statements that certain actions, events or results

"may", "could", "would", or "should", "might", or "will be taken",

"occur" or "be achieved" and similar expressions identify

forward-looking statements. Forward-looking statements are

necessarily based upon a number of estimates and assumptions that,

while considered reasonable by Kinross as of the date of such

statements, are inherently subject to significant business,

economic and competitive uncertainties and contingencies.

The estimates, models and assumptions of Kinross referenced,

contained or incorporated by reference in this news release, which

may prove to be incorrect, include, but are not limited to, the

various assumptions set forth herein and in our most recently filed

Annual Information Form and our full-year 2012 Management's

Discussion and Analysis as well as: (1) there being no significant

disruptions affecting the operations of the Company or any entity

in which it now or hereafter directly or indirectly holds an

investment, whether due to labour disruptions, supply disruptions,

power disruptions, damage to equipment or otherwise; (2) political

and legal developments in Mauritania being consistent with the

Company's current expectations; (3) the exchange rate between the

Canadian dollar, Mauritanian ouguiya and the U.S. dollar being

approximately consistent with current levels; (4) certain price

assumptions for gold and silver; (5) prices for diesel, natural

gas, fuel oil, electricity and other key supplies being

approximately consistent with current levels; (6) production and

cost of sales forecasts for the Company, and entities in which it

now or hereafter directly or indirectly holds an investment,

meeting expectations; (7) the accuracy of the current mineral

reserve and mineral resource estimates of the Company (including

but not limited to ore tonnage and ore grade estimates) and any

entity in which it now or hereafter directly or indirectly holds an

investment; (8) labour and materials costs increasing on a basis

consistent with Kinross' current expectations; (9) the viability of

the Tasiast mine (including but not limited to the impact of ore

tonnage and grade variability reconciliation analysis) as well as

permitting, development and expansion (including but not limited

to, the results of the feasibility study) being consistent with

Kinross' current expectations; (10) the terms and conditions of the

Tasiast legal and fiscal stability agreement being interpreted and

applied in a manner consistent with their intent and Kinross'

expectations; and (11) access to capital markets, including but not

limited to maintaining an investment grade debt rating and securing

partial project financing the Tasiast expansion projects, being

consistent with the Company's current expectations.

Known and unknown factors could cause actual results to differ

materially from those projected in the forward-looking statements.

Such factors include, but are not limited to: fluctuations in the

currency markets; fluctuations in the spot and forward price of

gold or certain other commodities (such as diesel fuel and

electricity); increases in the discount rates applied to present

value net future cash flows based on country-specific real weighted

average cost of capital; declines in the market valuations of peer

group gold producers and the Company, and the resulting impact on

market price to net asset value multiples; changes in interest

rates or gold or silver lease rates that could impact the

mark-to-market value of outstanding derivative instruments and

ongoing payments/receipts under any interest rate swaps and

variable rate debt obligations; risks arising from holding

derivative instruments (such as credit risk, market liquidity risk

and mark-to-market risk); changes in national and local government

legislation, taxation (including but not limited to income tax,

advance income tax, stamp tax, withholding tax, capital tax,

tariffs, value-added or sales tax, capital outflow tax, capital

gains tax, windfall or windfall profits tax, royalty, excise tax,

customs/import or export taxes/duties, asset taxes, asset transfer

tax, property use or other real estate tax, together with any

related fine, penalty, surcharge, or interest imposed in connection

with such taxes), controls, policies and regulations; the security

of personnel and assets; political or economic developments in

Mauritania or other countries in which Kinross does business or may

carry on business; business opportunities that may be presented to,

or pursued by, us; operating or technical difficulties in

connection with mining or development activities; employee

relations; the speculative nature of gold exploration and

development including, but not limited to, the risks of obtaining

necessary licenses and permits; diminishing quantities or grades of

reserves; adverse changes in our credit rating; and contests over

title to properties, particularly title to undeveloped properties.

In addition, there are risks and hazards associated with the

business of gold exploration, development and mining, including

environmental hazards, industrial accidents, unusual or unexpected

formations, pressures, cave-ins, flooding and gold bullion losses

(and the risk of inadequate insurance, or the inability to obtain

insurance, to cover these risks).

Many of these uncertainties and contingencies can directly or

indirectly affect, and could cause, Kinross' actual results to

differ materially from those expressed or implied in any

forward-looking statements made by, or on behalf of, Kinross,

including but not limited to resulting in an impairment charge on

goodwill and/or assets. There can be no assurance that

forward-looking statements will prove to be accurate, as actual

results and future events could differ materially from those

anticipated in such statements. Forward-looking statements are

provided for the purpose of providing information about

management's expectations and plans relating to the future. All of

the forward-looking statements made in this news release are

qualified by these cautionary statements and those made in our

other filings with the securities regulators of Canada and the

United States including, but not limited to, the cautionary

statements made in the "Risk Factors" section of our most recently

filed Annual Information Form and full-year 2012 Management

Discussion and Analysis. These factors are not intended to

represent a complete list of the factors that could affect Kinross.

Kinross disclaims any intention or obligation to update or revise

any forward-looking statements or to explain any material

difference between subsequent actual events and such

forward-looking statements, except to the extent required by

applicable law.

Other information

Where we say "we", "us", "our", the "Company", or "Kinross" in

this news release, we mean Kinross Gold Corporation and/or one or

more or all of its subsidiaries, as may be applicable.

For impairment assessment purposes, the Company considers the

PFS results as well as other factors including, but not limited to,

estimated pit shell mineral resources using a gold price assumption

of $1,400 (vs. $1,200) per ounce, expected throughput of 38,000

tpd, consensus gold prices, additional exploration potential and

NAV multiples and project optimization. As a result, the values

determined under the Company's impairment analysis at December 31,

2012 may differ from the NPV values resulting from the 30,000 tpd

PFS.

The technical information about Tasiast contained in this news

release has been prepared under the supervision of, and verified

by, Mr. James K. Fowler, an officer with the Company who is a

"qualified person" within the meaning of National Instrument

43-101.

This news release contains forward-looking information subject

to the risks and assumptions set out in our Cautionary Statement on

Forward-Looking Information located on page three of this release.

All dollar amounts in this release are expressed in U.S. dollars,

unless otherwise noted.

Contacts: Media Contact Kinross Gold Corporation Steve Mitchell

Vice-President, Corporate Communications

416-365-2726steve.mitchell@kinross.com Investor Relations Contact

Kinross Gold Corporation Tom Elliott Vice-President, Investor

Relations 416-365-3390tom.elliott@kinross.com

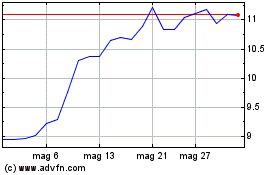

Grafico Azioni Kinross Gold (TSX:K)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Kinross Gold (TSX:K)

Storico

Da Mar 2024 a Mar 2025