News Release – TC Energy Corporation (TSX, NYSE: TRP) (TC Energy or

the Company) and its partner Northern New England Investment

Company, Inc., a subsidiary of Énergir L.P. (Énergir), have entered

into a purchase and sale agreement to sell Portland Natural Gas

Transmission System (PNGTS) to BlackRock, through a fund managed by

its Diversified Infrastructure business, and investment funds

managed by Morgan Stanley Infrastructure Partners (the Buyer), for

a gross purchase price of US$1.14 billion, which includes the

assumption of US$250 million of outstanding Senior Notes held at

PNGTS. This transaction implies a valuation of approximately 11.0

times reported 2023 comparable EBITDA.

"Today’s announcement represents continued progress toward

achieving our 2024 strategic priority of enhancing our balance

sheet strength by delivering approximately $3 billion in asset

divestitures. We are committed to reaching our 4.75 times

debt-to-EBITDA upper limit by year-end and expect to have further

asset divestiture announcements through the year,” said François

Poirier, TC Energy’s President and Chief Executive Officer. “This

sale of a non-core asset at a strong valuation is a unique

opportunity to support our capital rotation and deleveraging

priorities while continuing to meet the needs of the communities

PNGTS serves.”

The cash proceeds will be split pro-rata according to the

current PNGTS ownership interests (TC Energy 61.7 per cent, Énergir

38.3 per cent) and will be paid at closing, subject to certain

customary adjustments. As part of the transaction, the Buyer will

assume the outstanding Senior Notes held at PNGTS and currently

consolidated on TC Energy’s balance sheet. The transaction is

expected to close in mid-2024, subject to the receipt of regulatory

approvals and customary closing conditions.

PNGTS is a 475-kilometer (295-mile) FERC-regulated transporter

of natural gas serving the upper New England and Atlantic Canada

markets. The pipeline receives natural gas from the Trans Quebec

and Maritimes (TQM) Pipeline via the Canadian Mainline. TC Energy

will provide customary transition services and will work jointly

with the Buyer to ensure the safe and orderly transition of this

critical natural gas system.

TC Energy’s focus for 2024 remains clear. The company will

continue maximizing the value of its assets through safety and

operational excellence, delivering its secured capital program on

time and on budget, and enhancing its balance sheet strength and

financial flexibility through asset divestitures and streamlining

its business through efficiency efforts. TC Energy's 2024 financial

guidance and growth outlook through 2026 remain unchanged as a

result of this announcement.

Barclays acted as exclusive financial advisor to TC Energy and

Énergir on the transaction. Bracewell LLP acted as legal advisor to

TC Energy.

________________________1 Comparable EBITDA is a non-GAAP

measure. This measure does not have any standardized meaning under

GAAP and therefore are unlikely to be comparable to similar

measures presented by other companies. The most directly comparable

GAAP measure is Segmented earnings (losses). For more information

on non-GAAP measures, refer to the “Non-GAAP Measures” section of

this news release. 2 Debt-to-EBITDA is a non-GAAP ratio. Adjusted

debt and adjusted comparable EBITDA are non-GAAP measures used to

calculated debt-to-EBITDA. These measures do not have any

standardized meaning under GAAP and therefore are unlikely to be

comparable to similar measures presented by other companies. See

the “Forward-looking information”, “Non-GAAP measures” and

“Reconciliation” sections of this news release for more

information.

About TC EnergyWe’re a team of 7,000+ energy

problem solvers working to safely move, generate and store the

energy North America relies on. Today, we’re delivering solutions

to the world’s toughest energy challenges – from innovating to

deliver the natural gas that feeds LNG to global markets, to

working to reduce emissions from our assets, to partnering with our

neighbours, customers and governments to build the energy system of

the future. It’s all part of how we continue to deliver sustainable

returns for our investors and create value for communities.

TC Energy’s common shares trade on the Toronto (TSX) and New

York (NYSE) stock exchanges under the symbol TRP. To learn more,

visit us at TCEnergy.com.

FORWARD-LOOKING INFORMATIONThis release

contains certain information that is forward-looking and is subject

to important risks and uncertainties (such statements are usually

accompanied by words such as "anticipate", "expect", "believe",

"may", "will", "should", "estimate", "intend" or other similar

words). Forward-looking statements in this document are intended to

provide TC Energy security holders and potential investors with

information regarding TC Energy and its subsidiaries, including

management's assessment of TC Energy's and its subsidiaries' future

plans and financial outlook. All forward-looking statements reflect

TC Energy's beliefs and assumptions based on information available

at the time the statements were made and as such are not guarantees

of future performance. As actual results could vary significantly

from the forward-looking information, you should not put undue

reliance on forward-looking information and should not use

future-oriented information or financial outlooks for anything

other than their intended purpose. We do not update our

forward-looking information due to new information or future

events, unless we are required to by law. For additional

information on the assumptions made, and the risks and

uncertainties which could cause actual results to differ from the

anticipated results, refer to the most recent Quarterly Report to

Shareholders and Annual Report filed under TC Energy’s profile on

SEDAR+ at www.sedarplus.ca and with the U.S. Securities and

Exchange Commission at www.sec.gov.

Non-GAAP Measures This release contains

references to comparable EBITDA, which is a non-GAAP measure. It

also contains references to debt-to-EBITDA, a non-GAAP ratio, which

is calculated using adjusted debt and adjusted comparable EBITDA,

each of which is a non-GAAP measure. We believe debt-to-EBITDA

ratios provide investors with a useful credit measure as they

reflect our ability to service our debt and other long-term

commitments. These non-GAAP measures do not have any standardized

meaning as prescribed by GAAP and therefore may not be comparable

to similar measures presented by other entities. These non-GAAP

measures are calculated by adjusting certain GAAP measures for

specific items we believe are significant but not reflective of our

underlying operations in the period. These comparable measures are

calculated on a consistent basis from period to period and are

adjusted for specific items in each period, as applicable except as

otherwise described in the Condensed consolidated financial

statements and MD&A.

Comparable EBITDA for Portland Natural Gas Transmission System

for the years ended December 31, 2023 and 2022 was US$104 million

and US$101 million, respectively. Comparable EBITDA for our U.S.

Natural Gas Pipelines segment for the years ended December 31, 2023

and 2022 was US$3.248 billion and US$3.142 billion, respectively.

Segmented earnings for our U.S. Natural Gas Pipelines segment for

the years ended December 31, 2023 and 2022 were $3.531 billion and

$2.617 billion, respectively. For reconciliations of comparable

EBITDA to segmented earnings for our U.S. Natural Gas Pipelines

segment for the years ended December 31, 2023 and 2022, refer to

pages 21, 50 and the Non-GAAP measures section of our management’s

discussion and analysis for the year ended December 31, 2023 (the

MD&A), which sections of the MD&A are incorporated by

reference herein. The MD&A can be found on SEDAR+

(www.sedarplus.ca) under TC Energy's profile.

Adjusted debt is defined as the sum of Reported total debt,

including Notes payable, Long-Term Debt, Current portion of

long-term debt and Junior Subordinated Notes, as reported on our

Consolidated balance sheet as well as Operating lease liabilities

recognized on our Consolidated balance sheet and 50 per cent of

Preferred Shares as reported on our Consolidated balance sheet due

to the debt-like nature of their contractual and financial

obligations, less Cash and cash equivalents as reported on our

Consolidated balance sheet and 50 per cent of Junior Subordinated

Notes as reported on our Consolidated balance sheet due to the

equity-like nature of their contractual and financial

obligations.

Adjusted comparable EBITDA is calculated as comparable EBITDA

excluding Operating lease costs recorded in Plant operating costs

and other in our Consolidated statement of income and adjusted for

Distributions received in excess of income from equity investments

as reported in our Consolidated statement of cash flows which is

more reflective of the cash flows available to TC Energy to service

our debt and other long-term commitments.

See the “Reconciliation” section for reconciliation of adjusted

debt and adjusted comparable EBITDA for the years ended 2023 and

2022.

ReconciliationThe following is a reconciliation

of adjusted debt and adjusted comparable EBITDAi.

|

|

Year endedDecember 31 |

|

(millions of Canadian $) |

2023 |

|

2022 |

|

|

Reported total debt |

63,201 |

|

58,300 |

|

|

Management adjustments: |

|

|

|

Debt treatment of preferred sharesii |

1,250 |

|

1,250 |

|

|

Equity treatment of junior subordinated notesiii |

(5,144 |

) |

(5,248 |

) |

|

Cash and cash equivalents |

(3,678 |

) |

(620 |

) |

|

Operating lease liabilities |

459 |

|

433 |

|

|

Adjusted debt |

56,088 |

|

54,115 |

|

|

|

|

|

|

Comparable EBITDAiv |

10,988 |

|

9,901 |

|

|

Operating lease cost |

118 |

|

106 |

|

|

Distributions received in excess of (income) loss from equity

investments |

(123 |

) |

(29 |

) |

|

Adjusted Comparable EBITDA |

10,983 |

|

9,978 |

|

|

|

|

|

|

Adjusted Debt-to-Adjusted Comparable

EBITDAi |

5.1 |

|

5.4 |

|

i Adjusted debt and adjusted comparable EBITDA are non-GAAP

financial measures. Management methodology. Individual rating

agency calculations will differ. ii 50 per cent debt treatment on

$2.5 billion of preferred shares as of December 31, 2023. iii 50

per cent equity treatment on $10.3 billion of junior subordinated

notes as of December 31, 2023. U.S. dollar-denominated notes

translated at December 31, 2023, U.S./Canada foreign exchange rate

of 1.32. iv Comparable EBITDA is a non-GAAP financial measure. See

the Forward-looking information and Non-GAAP measures sections for

more information.

-30-

Media Inquiries:Media

Relationsmedia@tcenergy.com 403-920-7859 or 800-608-7859

Investor & Analyst Inquiries:Gavin Wylie /

Hunter Mauinvestor_relations@tcenergy.com403-920-7911 or

800-361-6522

PDF

available: http://ml.globenewswire.com/Resource/Download/1cc2c58d-e9c9-465a-8972-0091fadbb835

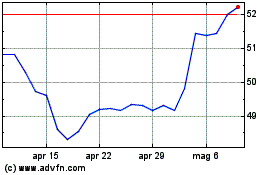

Grafico Azioni TC Energy (TSX:TRP)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni TC Energy (TSX:TRP)

Storico

Da Gen 2024 a Gen 2025