Ahold Delhaize Raises 2020 Guidance, Plans EUR1 Billion Buyback Despite 3Q Profit Fall

04 Novembre 2020 - 8:40AM

Dow Jones News

By Ian Walker

Koninklijke Ahold Delhaize NV on Wednesday raised its full-year

guidance and said it plans to start a new 1 billion-euro ($1.17

billion) share buyback program, despite reporting a large fall in

third quarter net profit due to higher costs.

The Netherlands-based owner of grocery chains such as Stop &

Shop and Giant Food made a net profit for the quarter of EUR68

million compared with EUR453 million for the same period last

year.

Ahold said Covid-19 related costs in the quarter were EUR140

million.

Underlying earnings per share--one of the company's key metrics

that strips out exceptional and other one-off items--rose to 50

European cents a share compared with 44 cents for the third quarter

of 2019.

Ahold said it now expects to report high-20% growth in

underlying EPS. It raised guidance in August to low-to-mid 20%

underlying EPS growth, from mid-single-digit range earlier this

year.

Net sales for the quarter rose to EUR17.83 billion from EUR16.69

billion a year before, the company said. In the U.S. comparable

sales excluding fuel were up 12% in the quarter, while European

sales were up 7.5%, Ahold Delhaize said.

Write to Ian Walker at ian.walker@wsj.com

(END) Dow Jones Newswires

November 04, 2020 02:25 ET (07:25 GMT)

Copyright (c) 2020 Dow Jones & Company, Inc.

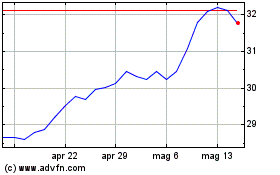

Grafico Azioni Koninklijke Ahold Delhai... (QX) (USOTC:ADRNY)

Storico

Da Mag 2024 a Mag 2024

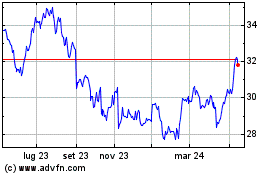

Grafico Azioni Koninklijke Ahold Delhai... (QX) (USOTC:ADRNY)

Storico

Da Mag 2023 a Mag 2024

Notizie in Tempo Reale relative a Koninklijke Ahold Delhaize NV (QX) (OTCMarkets): 0 articoli recenti

Più Koninklijke Ahold Delhaize NV (QX) Articoli Notizie