CNO Financial Raised to Outperform - Analyst Blog

18 Gennaio 2013 - 3:10PM

Zacks

On Jan 16, 2013, we upgraded insurance company CNO

Financial Group, Inc. (CNO) to Outperform. The improved

recommendation was based on strong fundamentals and prospects of

significant capital deployment in 2013.

Why the Upgrade?

We remain upbeat about the fourth-quarter 2012 earnings of CNO

Financial, with an Earnings Surprise Prediction (ESP) of 4.35%. The

company has consistently outperformed estimates in the last four

quarters, leading to an Average Surprise of 16.72%. ESP is a

leading indicator of an expected positive earnings surprise for

shares. As a result, the company carries a Zacks Rank #2 (Buy).

CNO Financial reported third-quarter 2012 adjusted operating

earnings of 26 cents per share, surpassing the Zacks Consensus

Estimate of 19 cents and year-ago earnings of 16 cents. Revenues

increased 10.1% to $1.1 billion from $0.9 billion in the prior-year

quarter. Total revenue also surpassed the Zacks Consensus Estimate

of $1.03 billion.

The Zacks Consensus Estimate for CNO Financial’s fourth-quarter

earnings is 23 cents per share, up 15.7% over the prior-year

quarter. The company’s fourth-quarter and full year 2012 financial

results are scheduled to release after the closing bell on Feb 11,

2013.

Apart from a history of outperforming estimates and strong

financial results, CNO Financial has other positives such as stable

credit ratings, strong investment portfolio and declining expenses.

Moreover, the recapitalization in September 2012 has improved the

capital structure and debt maturity profile.

Further, the value of CNO Financial’s investment portfolio is

steadily increasing since 2008 and its operating cash flow has also

been strong over the years. Moreover, the company’s strong organic

growth and excess capital generation allowed it to announce a $300

million hike in its share repurchase authorization in December

2012, after a $100 million hike in February 2012. CNO Financial is

expected to spend $250–$300 million each on share buybacks and

dividend payouts in 2013.

Other Stocks to Consider

Some of the other companies, which are performing well in the

insurance sector are Ageas SA/NV (AGESY) – Zacks

Rank #1 (Strong Buy), Prudential plc (PUK) – Zacks

Rank #2 (Buy) and FBL Financial Group Inc. (FFG) –

Zacks Rank #2 (Buy).

(AGESY): ETF Research Reports

CNO FINL GRP (CNO): Free Stock Analysis Report

FBL FINL GRP-A (FFG): Free Stock Analysis Report

PRUDENTIAL PLC (PUK): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

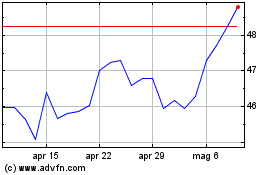

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Apr 2024 a Mag 2024

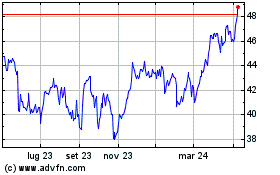

Grafico Azioni Ageas (PK) (USOTC:AGESY)

Storico

Da Mag 2023 a Mag 2024