Hanger Stays at Neutral - Analyst Blog

09 Luglio 2013 - 9:00PM

Zacks

On Jul 8, we retained

Hanger Inc. (HGR) at Neutral, following its solid

first-quarter 2013 results. In spite of the upbeat performance, we

remain on the sidelines given the uncertain healthcare

environment.

Why the Retention?

Hanger’s adjusted earnings of 28 cents per share for the first

quarter surpassed the Zacks Consensus Estimate by 12%. Profit of

this orthotic and prosthetic (O&P) company grew 10.5% to $9.5

million (or 27 cents a share), primarily led by strong sales and

accretive acquisitions.

Revenues increased 7.1% year over year to $233.5 million in the

quarter, marginally beating the Zacks Consensus Estimate of $233

million. It led to record sales of above $1 billion for the

company, trailing 12 months. While, the core Patient Care segment

is growing on the back of increased same-center sales, the

Distribution business is facing headwinds in the form of

unfavorable weather and tough year-over-year comparisons.

The company’s earnings have also managed to beat the Zacks

Consensus Estimates in the last 4 quarters with an average surprise

of 5.87%. Following the earnings release, the Zacks Consensus

Estimate for 2013 has moved up by 1.5% to $2.09 per share. For 2014

too the Zacks Consensus Estimate increased significantly (up 3.9%

to $2.40 per share).

Hanger enjoys a sovereign position in the orthotic and prosthetic

(O&P) market and continues to gain market share. The company is

focusing on expanding its geographical footprint and revenues

through complementary acquisitions. In addition, to derive better

results from its market strategy from 2013, the company realigned

its reporting segments.

However, Hanger remains affected by a host of macro issues

including sequestration, and measures (including Medicare and

Medicaid reimbursement cuts) adopted by the state governments to

cover budget deficits. Moreover, the impact of the medical devices

tax is pressurizing the company’s margins. These factors are

apprehended to weigh on Hanger’s results going forward.

Other Stocks to Consider

Other large-cap medical products companies such as

Resmed (RMD), Essilor International

SA (ESLOY) and Edwards Lifesciences Corp.

(EW) are expected to do well in the medical industry. All these

stocks carry a Zacks Rank #2 (Buy).

ESSILOR INTL SA (ESLOY): Get Free Report

EDWARDS LIFESCI (EW): Free Stock Analysis Report

HANGER ORTHOPED (HGR): Free Stock Analysis Report

RESMED INC (RMD): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

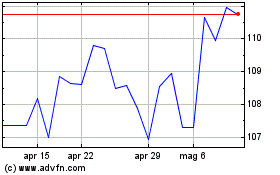

Grafico Azioni Essilor Luxottica (PK) (USOTC:ESLOY)

Storico

Da Giu 2024 a Lug 2024

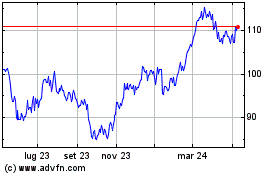

Grafico Azioni Essilor Luxottica (PK) (USOTC:ESLOY)

Storico

Da Lug 2023 a Lug 2024

Notizie in Tempo Reale relative a Essilor Luxottica (PK) (OTCMarkets): 0 articoli recenti

Più Essilor International (PC) Articoli Notizie