UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER PURSUANT

TO RULE 13a-16 OR

15d-16 UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of August 2020

Commission File Number: 001-34077

SAFE BULKERS,

INC.

(Translation of registrant’s name into English)

Apt. D11,

Les Acanthes

6, Avenue des Citronniers

MC98000 Monaco

Telephone : +30 2 111 888 400

(Address of principal executive office)

Indicate by check mark whether the registrant files or will

file annual reports under cover of Form 20-F or Form 40-F.

Form 20-F x Form

40-F o

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(1) ____:

Indicate by check mark if the registrant is submitting the Form

6-K in paper as permitted by Regulation S-T Rule 101(b)(7) ____:

Indicate by check mark whether the registrant by furnishing

the information contained in the Form is also thereby furnishing the information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes o No x

If “Yes” is marked, indicate below the file number

assigned to the registrant in connection with Rule 12g3-2(b): ____.

INFORMATION CONTAINED IN THIS FORM 6-K

REPORT

This report on Form 6-K is furnished by

Safe Bulkers, Inc., a Marshall Islands corporation (the “Company”), in connection with the entry by the Company into

a Shareholders Rights Agreement dated as of August 5, 2020 (the “Rights Agreement”), by and between the Company and

American Stock Transfer & Trust Company, as rights agent.

On August 5, 2020, the Board of Directors

(the “Board”) of the Company declared a dividend of one preferred share purchase right (a “Right”) for

each outstanding share of common stock, par value $0.001 per share (the “Common Stock”), and adopted a shareholder rights

plan, as set forth in the Rights Agreement. The dividend is payable on August 20, 2020 to the shareholders of record on August

17, 2020.

The Rights Agreement is intended to

enable all shareholders to realize the long-term value of their investment in the Company and to protect against any person

or group from gaining control of the Company through coercive or otherwise unfair takeover tactics. The Board unanimously

adopted the Rights Agreement, as the previously existing rights plan has expired, following careful consideration of the

uncertainties related to the long term impact on global trade and dry-bulk shipping of the 2019 Novel Coronavirus pandemic,

the cyclicality of the dry-bulk shipping market, the need to promote the fair and equal treatment of all shareholders of the

Company and to provide the Board and shareholders with adequate time to make informed decisions and ensure that the Board

remains in the best position to discharge its fiduciary duties to the Company and its shareholders. The Rights Agreement is

not intended to deter offers that are fair and otherwise in the best interests of the Company’s shareholders.

In general terms and subject to certain

exceptions, the Rights Agreement works by imposing a significant penalty upon any person or group which acquires 10% or more of

the outstanding shares of Common Stock without the approval of the Board. A summary of the terms of the Rights Agreement follows.

This description is only a summary, and is not complete, and should be read together with the entire Rights Agreement, which has

been filed as an exhibit to this Form 6-K. A copy of the Rights Agreement is available free of charge from the Company.

The Rights. The Rights will initially

trade with, and will be inseparable from, the Common Stock. The Rights are evidenced only by the certificates that represent shares

of Common Stock. New Rights will accompany any new shares of Common Stock the Company issues after August 17, 2020 until the Distribution

Date described below.

Exercise Price. Each Right will

allow its holder to purchase from the Company one one-thousandth of a share of Series A Participating Preferred Stock (a “Preferred

Share”) for $5.20 (the “Exercise Price”), once the Rights become exercisable. This portion of a Preferred Share

will give the shareholder approximately the same dividend, voting, and liquidation rights as would one share of Common Stock. Prior

to exercise, the Right itself does not give its holder any dividend, voting, liquidation or other rights as a shareholder of the

Company.

Exercisability. The Rights will

not be exercisable until 10 days after the earlier of (i) the first date of public announcement that a person or group has become

an “Acquiring Person” (as defined in the Rights Agreement) by obtaining beneficial ownership of 10% or more of the

outstanding Common Stock or (ii) the date that a tender or exchange offer is first published or sent if, assuming the successful

completion of such tender or exchange offer, such person or group would become an Acquiring Person.

Certain synthetic interests in securities

created by derivative positions – whether or not such interests are considered to be ownership of the underlying Common Stock

or are reportable for purposes of Regulation 13D of the Securities Exchange Act – are treated as beneficial ownership of

the number of shares of the Common Stock equivalent to the economic exposure created by the derivative position, to the extent

shares of Common Stock are the subject of or the reference securities for, underlie, or are beneficially owned, directly or indirectly,

by a counterparty under, any derivatives contract. Swaps dealers unassociated with any control intent or intent to evade the purposes

of the Rights Agreement are excepted from such imputed beneficial ownership.

Shares owned by Polys Hajioannou, the Company’s Chairman and Chief Executive Officer, or Nicolaos Hadjioannou and entities controlled by and/or affiliated or associated with Mr. Hajioannou or Mr. Hadjioannou or members or their respective families are not subject to the restrictions of the Rights Plan and shareholders who beneficially owned 10% or more of Safe Bulkers’ outstanding common stock prior to the first public announcement by Safe Bulkers of the adoption of the Rights Plan will not trigger any penalties under the Rights Plan so long as they do not acquire beneficial ownership of any additional shares of common stock at a time when they still beneficially own 10% or more of such common stock.

The date when the Rights become exercisable

is the “Distribution Date.” Until that date, the Common Stock certificates will also evidence the Rights, and any transfer

of shares of Common Stock will constitute a transfer of Rights. After that date, the Rights will separate from the Common Stock

and be evidenced by book-entry credits or by Rights certificates that the Company will mail to all eligible holders of Common Stock.

Any Rights held by an Acquiring Person are void and may not be exercised.

Consequences of a Person or Group Becoming an Acquiring Person.

|

|

·

|

Flip In. If a person or group becomes an Acquiring Person, all holders of Rights except the Acquiring Person shall thereafter

have the right to receive, upon exercise, that number of shares of Common Stock (or, in certain circumstances, cash, property or

other securities of the Company) which equals the Exercise Price divided by 50% of the current market price per share of Common

Stock at the date of the occurrence of such event.

|

|

|

·

|

Flip Over. If the Company is later acquired in a merger or similar transaction after a person or group becomes an Acquiring

Person, all holders of Rights except the Acquiring Person shall thereafter have the right to receive, upon exercise, that number

of shares of common stock of the acquiring company which equals the Exercise Price divided by 50% of the current market price of

such common stock at the date of the occurrence of the event.

|

|

|

·

|

Notional Shares. Shares held by affiliates and associates of an Acquiring Person, and notional shares that are the subject

of or the reference securities for, underlie, or are beneficially owned, directly or indirectly, by a counterparty under, a derivatives

contract with an Acquiring Person, will be deemed to be beneficially owned by the Acquiring Person.

|

Preferred Share Provisions. Each one one-thousandth of

a Preferred Share, if issued:

|

|

·

|

will not be redeemable;

|

|

|

·

|

will entitle its holder to quarterly dividend payments equal to the aggregate per share amount of all cash dividends, and the

aggregate per share amount (payable in kind) of all non cash dividends or other distributions other than a dividend payable in

shares of Common Stock or a subdivision of the outstanding shares of Common Stock (by reclassification or otherwise), declared

on the Common Stock since the preceding quarterly dividend payment;

|

|

|

·

|

will entitle its holder upon liquidation to receive an amount equal to the aggregate amount to be distributed per share to

holders of shares of Common Stock plus an amount equal to any accrued and unpaid dividends on such shares of Series A Participating

Preferred Stock;

|

|

|

·

|

will have the same voting power as one share of Common Stock; and

|

|

|

·

|

if shares of the Common Stock are exchanged via merger, consolidation, or a similar transaction, will entitle holders to a

per share payment equal to the payment made on one share of Common Stock.

|

The value of one one-thousandth interest in a Preferred Share

should approximate the value of one share of Common Stock.

Expiration. The Rights will expire

on August 5, 2030.

Redemption. The Board may redeem

the Rights for $0.01 per Right at any time before the tenth day after any person or group becomes an Acquiring Person. If the Board

redeems any Rights, it must redeem all of the Rights. Once the Rights are redeemed, the only right of the holders of Rights will

be to receive the redemption price of $0.01 per Right. The redemption price will be adjusted if the Company has a stock split or

stock dividends of its Common Stock.

Exchange. After a person or group

becomes an Acquiring Person, but before an Acquiring Person owns 50% or more of the outstanding Common Stock, the Board may extinguish

the Rights by exchanging one share of Common Stock or an equivalent security for each Right, other than Rights held by the Acquiring

Person.

Anti-Dilution Provisions. The Board

may adjust the purchase price of the Preferred Shares, the number of Preferred Shares issuable and the number of outstanding Rights

to prevent dilution that may occur from a stock dividend, a stock split, a combination or a reclassification of the Preferred Shares

or Common Stock. No adjustments to the Exercise Price shall be required unless such adjustment would require an increase or decrease

of at least 1% in the Exercise Price.

Amendments. The terms of the Rights

and the Rights Agreement may be amended by the Board without the consent of the holders of the Rights. After a person or group

becomes an Acquiring Person, the Board may not amend the Rights or the Rights Agreement in a way that adversely affects holders

of the Rights (other than an Acquiring Person or an affiliate or associate of an Acquiring Person).

Miscellaneous. Until a Right is

exercised, the holder thereof, as such, will have no separate rights as a shareholder of the Company, including, without limitation,

the right to vote or to receive dividends in respect of the Rights. Although the distribution of the Rights will not be taxable

to shareholders or to the Company, shareholders may, depending upon the circumstances, recognize taxable income in the event that

the Rights become exercisable for Common Stock (or other consideration) or for common stock of the acquiring company or in the

event of the redemption of the Rights as set forth above.

Anti-Takeover Effects. The Rights may have certain anti-takeover

effects. The Rights may cause substantial dilution to any person or group that attempts to acquire the Company without the approval

of the Board. As a result, the overall effect of the Rights may be to render more difficult or discourage a merger, tender offer

or other business combination involving the Company that is not supported by the Board.

In connection with the adoption of the Rights Agreement, the

Board approved the Statement of Designation of Rights, Preferences and Privileges of Series A Participating Preferred Stock (the

“Statement of Designation”). The Statement of Designation was filed with the Registrar of Corporations of the Republic

of the Marshall Islands on August 6, 2020.

The Statement of Designation and Rights Agreement are attached

hereto as Exhibits 3.1 and 4.1, respectively and are incorporated herein by reference. The foregoing descriptions of the Rights

and Statement of Designation are qualified in their entirety by reference to such exhibits.

On

August 6, 2020, the Company issued a press release announcing the adoption of the Rights Agreement and the declaration of the dividend

of the Rights. A copy of the press release is attached as Exhibit 99.1 and incorporated herein by reference.

INCORPORATION BY REFERENCE

This Report on Form 6-K shall be incorporated

by reference into our registration statement on Form F-3, as filed with the Securities and Exchange Commission on July 1, 2020

and as may be further amended, to the extent not superseded by documents or reports subsequently filed by us under the Securities

Act of 1933 or the Securities Exchange Act of 1934, in each case as amended.

EXHIBIT INDEX

3.1 Statement of Designation of Rights, Preferences and Privileges of Series A Participating Preferred Stock

4.1 Shareholders Rights Agreement dated as of August 5, 2020, by and between Safe Bulkers, Inc. and American Stock Transfer & Trust Company

99.1 Press Release dated August 6, 2020: Safe Bulkers Adopts Rights Plan

SIGNATURES

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: August 6, 2020

|

|

SAFE BULKERS, INC.,

|

|

|

|

|

|

|

|

By: /s/ KONSTANTINOS ADAMOPOULOS

|

|

|

|

Name:

|

Konstantinos Adamopoulos

|

|

|

|

Title:

|

Chief Financial Officer

|

|

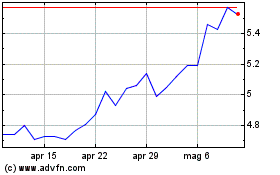

Grafico Azioni Safe Bulkers (NYSE:SB)

Storico

Da Mar 2024 a Apr 2024

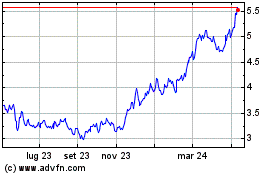

Grafico Azioni Safe Bulkers (NYSE:SB)

Storico

Da Apr 2023 a Apr 2024