After Tumultuous Year, What's Next for Qualcomm? -- Earnings Preview

07 Novembre 2018 - 11:59AM

Dow Jones News

By Micah Maidenberg

Qualcomm Inc. (QCOM) is scheduled to report earnings for its

fiscal fourth quarter after the market closes Wednesday. Here's

what you need to know:

EARNINGS FORECAST: Analysts expect Qualcomm to report adjusted

profits of 83 cents a share, according to FactSet. In its

fourth-quarter period for 2017, the company reported 92 cents a

share in profits on an adjusted basis, which excludes share-based

compensation and other costs.

REVENUE FORECAST: Analysts predict $5.53 billion in sales in the

fourth quarter. That would represent a 6% decline from the year-ago

period.

WHAT TO WATCH:

THE OUTLOOK: In February, as Qualcomm was fighting Broadcom

Inc.'s (AVGO) takeover bid, the company's board released a

shareholder letter saying it was "highly confident" Qualcomm could

deliver $6.75 a share to $7.50 a share in adjusted profit during

the 2019 fiscal year. Investors will look for indications Qualcomm

can live up to the forecast. Some observers are skeptical such a

profit range is within reach, given weak demand for smartphones, a

critical market for Qualcomm's modems. Global smartphone shipments

fell 6% in the third quarter from a year earlier to 355.2 million

units, according to International Data Corp. IDC also guided flat

growth in global smartphone shipments next year. Meanwhile, Michael

Walkley, an analyst at Canaccord Genuity, wrote in a September note

Qualcomm's plan to buy $16 billion worth of shares from three

financial-services firms will take at least a year and "limit

Qualcomm's ability to repurchase meaningful additional shares." "We

think they're going to have to lower their estimates," Mr. Walkley

said in an interview.

SETTLE DOWN: Qualcomm is locked in legal battles with Apple Inc.

(AAPL), which it accused of intellectual-property theft in an

amended lawsuit filed in California in September. A federal judge

Tuesday ruled the company must license some of its key industry

patents to rival chipmakers. The companies are also fighting over

patent royalties, which Apple has withheld, damaging Qualcomm's

financial performance. A settlement represents the largest single

catalyst that could drive Qualcomm's per-share earnings, adding

more than $1 a share on an ongoing basis, according to Nomura

Instinet analyst Romit Shah. Meanwhile, Qualcomm appears close to a

deal in its dispute over royalty payments Huawei Technologies Co.,

according to UBS analyst Timothy Arcuri. He notes the Chinese

company has already made payments to Qualcomm, leaving $1.5 billion

outstanding.

5G ROLLOUT: The forecast for 5G phones and devices will also be

on investors' minds. Next year, the first mobile phones built to

operate on next-generation 5G wireless networks will start shipping

to consumers, creating a significant new opportunity for Qualcomm.

As consumers start to switch over to those devices, Qualcomm could

counteract some of its struggles with Apple, which is using chips

from Intel Corp. (INTC) in its newest iPhones, and potentially

offset some of the softness in demand in the smartphone market,

analysts say. Most, if not all, of the 5G roads lead through

Qualcomm, says Mr. Arcuri of UBS. "It's difficult to envision 5G

with Qualcomm not playing a big role in it," he says.

Write to Micah Maidenberg at micah.maidenberg@wsj.com

(END) Dow Jones Newswires

November 07, 2018 05:44 ET (10:44 GMT)

Copyright (c) 2018 Dow Jones & Company, Inc.

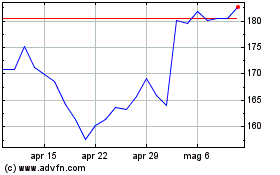

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Apr 2024 a Mag 2024

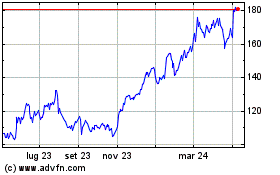

Grafico Azioni QUALCOMM (NASDAQ:QCOM)

Storico

Da Mag 2023 a Mag 2024