Fall in Copper Prices Threatens to Drive Metal Shortages

09 Agosto 2019 - 10:47PM

Dow Jones News

By Amrith Ramkumar

The recent slide in copper prices threatens to limit investment

in new mines, a trend that industry analysts and executives say

could lead in coming years to sizable shortages of the material

critical to manufacturing and renewable-energy projects.

Prices fell to two-year lows recently on fears that trade

tensions will weaken the global economy and crimp demand. Because

copper is heavily used in construction and manufacturing, its price

movements are closely tied to momentum in the world economy, and

particularly in China, which accounts for about half of global

demand.

Some investors say the downturn in prices could actually lead to

an even bigger rally years from now because of the time needed to

extract metal from new projects. Many of those mines also require

capital commitments to finish and are located in risky operating

jurisdictions around the world.

Ore grades also decline over time, potentially leading to lower

usable supply than expected as demand from electric vehicles and

new technologies is likely to ramp up in the mid-2020s, analysts

say.

Copper is now about 14% below the $3-a-pound level that

investors say makes many long-term projects viable. It last closed

above that level in June 2018, when President Trump approved

tariffs on about $50 billion of Chinese imports.

"We have this great inventory of opportunities, but like other

projects in the industry, they require prices higher than today's

price to develop," Richard Adkerson, chief executive of copper

miner Freeport-McMoRan Inc., said in an interview. "If global

growth turns down, then we won't be in a position to invest in

these resources."

Copper fell to $2.54 a pound on Monday, its lowest level since

May 2017, before rebounding to $2.58 on Friday.

Jefferies projects a 1 million metric ton deficit in 2024

without more capital commitments from miners. Commodities

consultancy Wood Mackenzie recently forecast a roughly 4 million

metric ton supply gap by 2028, based on annual production of about

25 million metric tons at that time.

Driving those projections is a belief that copper will be

critical to long-term shifts toward electric vehicles and cleaner

technologies in transportation and energy storage. Electric and

hybrid cars use more copper than conventional vehicles, and

analysts project hefty demand increases from the implementation of

EV charging stations. Fast-growing countries such as India also are

expected to continue investing in copper-intensive infrastructure

projects.

Another reason some investors remain confident that prices will

eventually rebound: Operating mines in places such as Indonesia

continues to come with a high degree of risk.

Many expect Freeport-McMoRan's success in the coming years to be

defined by its ability to transition a giant copper and gold mine

in Indonesia into an underground operation. Late last year, the

Indonesian government took a 51% stake in the mine -- Grasberg --

by paying nearly $4 billion to Freeport and Australian miner Rio

Tinto PLC. While the transition underground continues, Freeport is

posting lower revenue and higher capital costs.

In another sign of the challenges facing miners, Rio Tinto last

month said it will take much longer than expected and cost more to

complete a mine in Mongolia's southern Gobi Desert.

The difficulties ahead for industry leaders Freeport and Rio

Tinto could portend delays in the years ahead for other companies

pursuing complicated projects, analysts say. While there are

plentiful opportunities in countries such as Chile and Australia,

extracting the metal could prove trickier than expected.

"These projects take a long period of time to bring on line,"

said Christopher LaFemina, a metals and mining analyst at

Jefferies. "The market should be very, very tight as long as we

don't have a recession."

Still, many investors say it is difficult to invest in the metal

and shares of companies that produce it as trade uncertainty

continues to hammer copper prices. They have fallen 13% from a peak

in April. Shares of Freeport are down 36% in the past year

following a nearly 4% drop on Friday. Other mining stocks such as

Southern Copper Corp. have also taken a beating.

Hedge funds and other speculative investors pushed net bearish

bets on copper to their highest level since November 2016 during

the week ended Tuesday, Commodity Futures Trading Commission data

show.

"Investors continue to be reticent about our sector," Mr.

Adkerson said. "That's likely to be the case until there's some

clarity on the direction of this trade issue."

To receive our Markets newsletter every morning in your inbox,

click here.

Write to Amrith Ramkumar at amrith.ramkumar@wsj.com

(END) Dow Jones Newswires

August 09, 2019 16:32 ET (20:32 GMT)

Copyright (c) 2019 Dow Jones & Company, Inc.

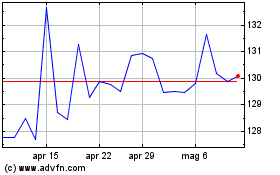

Grafico Azioni Rio Tinto (ASX:RIO)

Storico

Da Apr 2024 a Mag 2024

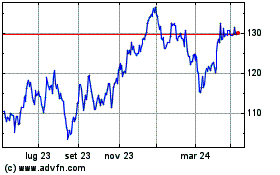

Grafico Azioni Rio Tinto (ASX:RIO)

Storico

Da Mag 2023 a Mag 2024