AEW UK REIT plc (AEWU)

AEW UK REIT plc: Half Yearly Results

28-Nov-2019 / 07:00 GMT/BST

Dissemination of a Regulatory Announcement, transmitted by EQS Group.

The issuer is solely responsible for the content of this announcement.

28 November 2019

AEW UK REIT PLC (the "Company")

Interim Report and Financial Statements

for the six months ended 30 September 2019

Financial Highlights

? Unaudited Net Asset Value ("NAV") of GBP147.55 million and of

97.36 pence per share ("pps") as at 30 September 2019 (31

March 2019: GBP149.46 million and 98.61 pps).

? Operating profit before fair value changes of GBP7.26 million

for the period (six months ended 30 September 2018: GBP6.86

million).

? Profit Before Tax ("PBT") of GBP4.16 million and 2.74 pps (six

months ended 30 September 2018: GBP11 .68 million and 7.71 pps).

PBT includes a GBP2.41 million loss arising from changes to fair

value of the investment properties in the period (six months

ended 30 September 2018: gain of GBP5.65 million). This change

explains the significant fall in PBT for the period.

? Unadjusted EPRA Earnings Per Share ("EPRA EPS") for the period

of 4.37 pps (six months ended 30 September 2018: 4.10 pps).

See below for the calculation of EPRA EPS.

? Total dividends of 4.00 pps have been declared for the period

(six months ended 30 September 2018: 4.00 pps).

? Shareholder Total Return for the period of 5.50% (six months

ended 30 September 2018: 3.56%).

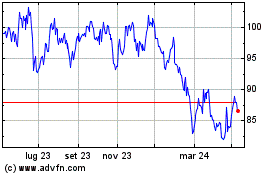

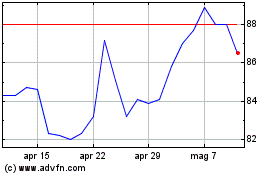

? The price of the Company's Ordinary Shares on the Main Market

of the London Stock Exchange was 93.90 pps as at 30 September

2019 (31 March 2019: 92.80 pps).

? As at 30 September 2019, the Company had drawn GBP50.00 million

(31 March 2019: GBP50.00 million) of a GBP60.00 million (31 March

2019: GBP60.00 million) term credit facility with the Royal Bank

of Scotland International Limited ('RBSi') and was geared to

25.50% of the portfolio valuation (31 March 2019: 25.30%).

? The Company held cash balances totalling GBP2.01 million as at

30 September 2019 (31 March 2019: GBP2.13 million). Under the

terms of its loan facility, the Company can draw a further

GBP1.64 million (31 March 2019: GBP2.31 million) up to the maximum

35% loan to NAV at drawdown.

Property Highlights

? As at 30 September 2019, the Company's property portfolio had

a fair value of GBP196.05 million across 35 properties (31 March

2019: GBP197.61 million across 35 properties) and a historical

cost of GBP197.02 million (31 March 2019: GBP196.86 million).

? As at 30 September 2019, the Company's property portfolio had

an EPRA vacancy rate of 3.96% (31 March 2019: 2.99%).

? Rental income generated during the period was GBP8.78 million

(six months ended 30 September 2018: GBP8.46 million). The

number of tenants as at 30 September 2019 was 92 (31 March

2019: 95).

? EPRA Net Initial Yield ("EPRA NIY") of 7.45% as at 30

September 2019 (31 March 2019: 7.62%).

? Weighted Average Unexpired Lease Term ("WAULT") of 4.33 years

to break and 5.82 years to expiry (31 March 2019: 4.87 years

to break and 6.10 years to expiry). See below for definition

and relevance to strategy.

Chairman's Statement

Overview

I am pleased to present the unaudited interim results of the Company for the

six month period from 1 April 2019 to 30 September 2019. As at 30 September

2019, the Company has established a diversified portfolio of 35 commercial

investment properties throughout the UK with a value of GBP196.05 million. On

a like-for-like basis, the portfolio valuation decreased by 0.79% over the

six months.

The Company achieved EPRA EPS of 4.37 pps for the period, which represents a

dividend cover of 109.3%, having paid dividends of 4.00 pps in relation to

the period. This is an improvement on the EPRA EPS reported for the year

ended 31 March 2019, which produced a dividend cover of 100.9% and reflects

the success of key asset management transactions which have boosted rental

income and maintained a vacancy rate below 4% by Estimated Rental Value

("ERV") over the six months to September 2019. The portfolio has a short

WAULT of 4.33 years to break and 5.82 years to expiry, which we anticipate

will provide the opportunity to add further value through an active approach

to asset management.

The Company's share price was 93.90 pps as at 30 September 2019,

representing a 3.55% discount to NAV. Over the six month period, the Company

generated a shareholder total return of 5.50% and a NAV total return of

2.79%.

Financial Results

6 month 6 month 12 month

period from period from period from

1 April 2019 1 April 2018 1 April 2018

to 30 to 30 to 31

September September 2018 March

2019 (unaudited) 2019

(unaudited) (audited)

Operating Profit before 7,264 6,859 13,524

fair value changes

(GBP'000)

Operating Profit 4,901 12,334 17,226

(GBP'000)

PBT (GBP'000)* 4,159 11,678 15,544

EPRA EPS (basic and 4.37 4.10 8.07

diluted) (pence)

Ongoing Charges (%) 1.34 1.26 1.40

NAV per share (pence) 97.36 100.06 98.61

EPRA NAV per share 97.32 100.06 98.51

(pence)

*PBT includes a GBP2.41 million loss arising from changes to fair value of the

investment properties in the period (six months ended 30 September 2018:

gain of GBP5.65 million). This change explains the significant fall in PBT for

the period.

Financing

The Company has a GBP60.00 million loan facility, of which it had drawn a

balance of GBP50.00 million as at 30 September 2019 (31 March 2019: GBP60.00

million facility; GBP50.00 million drawn), producing a gearing of 25.50% (31

March 2019: 25.30%) loan to property valuation.

The unexpired term of the facility was 4.1 years as at 30 September 2019 (31

March 2019: 4.6 years). The loan incurs interest at 3 month LIBOR +1.4%,

which equated to an all-in rate of 2.17% as at 30 September 2019 (31 March

2019: 2.32%). The Company is protected from a significant rise in interest

rates as it currently has effective interest rate caps with a combined

notional value of GBP36.51 million (31 March 2019: GBP36.51 million), with

GBP26.51 million capped at 2.50% and GBP10.00 million capped at 2.00%, resulting

in the loan being 73% hedged (31 March 2019: 73%). These interest rate caps

are effective until 19 October 2020. The Company has entered into additional

interest rate caps on a notional value of GBP46.51 million at 2.00% covering

the extension period of the loan from 20 October 2020 to 19 October 2023.

On 9 October 2019, the Company announced that it had completed an amendment

to its loan facility, increasing the loan to NAV covenant from 45% to 55%

(subject to certain conditions). There are no changes to the margin

currently charged under the facility.

The long term gearing target remains 25% or less, however the Company can

borrow up to 35% of Gross Asset Value ("GAV") in advance of an expected

capital raise or asset disposal. The Board and Investment Manager will

continue to monitor the level of gearing and may adjust the target gearing

according to the Company's circumstances and perceived risk levels.

Dividends

The Company has continued to deliver on its target of paying dividends of

8.00 pps per annum. During the period, the Company declared and paid two

quarterly dividends of 2.00 pps, in line with its target.

On 18 October 2019, the Board declared an interim dividend of 2.00 pps in

respect of the period from 1 July 2019 to 30 September 2019. This interim

dividend will be paid on 29 November 2019 to shareholders on the register as

at 1 November 2019.

The Directors will declare dividends taking into account the current level

of the Company's earnings and the Directors' view on the outlook for

sustainable recurring earnings. As such, the level of dividends paid may

increase or decrease from the current annual dividend of 8.00 pps. Based on

the current profile of the portfolio, the Company expects to pay an

annualised dividend of 8.00 pps in respect of the year ending 31 March 2020,

subject to market conditions.

The following shows the dividend paid (in pps) in relation to each quarter

from the Company's inception:

Quarter ended 2015 2016 2017

January 2.00 2.00

April 2.00 2.00

July 2.00 2.00

October 1.50 2.00 2.00

Quarter ended 2017 2018 2019

March 2.00 2.00

June 2.00 2.00

September 2.00 2.00

December *1.33 2.00

*Note that the Company changed its quarter end dates starting in December

2017 and the dividend payment of 1.33 pps relates to the two month period

from 1 November 2017 to 31 December 2017.

Outlook

The Board and the Investment Manager are pleased with the strong income

returns delivered to shareholders to date. Based on annualised dividend

payments of 8.00 pps, the Company delivered a dividend yield of 8.52% as at

30 September 2019.

The Company was fully invested at the start of the period and achieved

returns during the period which fully covered its dividend payments. The

Board expects this level of returns to continue, based on the projected

income from the portfolio which had a NIY of 7.45% and a Reversionary Yield

of 7.82% as at 30 September 2019.

In the wider political and economic environment, the country is preparing

for a general election on 12 December 2019. The outcome of this should

provide better clarity to the ongoing Brexit debate, for which the deadline

to reach an agreement with the EU has been pushed back to 31 January 2020.

It is hoped that the coming months will see an end to the continued

uncertainty which has hampered the investment markets.

Looking forward, our focus remains on continuing to grow the Company as part

of the 12 month share-issuance programme, closing on 28 February 2020, as

set out in the Company's Prospectus, subject to market conditions. Subject

to future fund raising, the Investment Manager will focus on finding further

acquisitions which will deliver an attractive return as part of a

well-diversified portfolio. There will be a continuation vote at the AGM of

the Company to be held in 2020, under the provisions of the Articles, at

which the Board will propose an ordinary resolution that the Company

continue its business as presently constituted.

Board Composition

James Hyslop retired from the Board at the AGM on 12 September 2019. The

Board expresses its appreciation for his valuable contribution to the

Company since its IPO in 2015. The Board will instigate a search for a

replacement independent non-executive Director at an appropriate time.

Mark Burton

Chairman

27 November 2019

Key Performance Indicators

KPI AND DEFINITION RELEVANCE TO PERFORMANCE

STRATEGY

1. EPRA NIY* The NIY is in line 7.45%

with the Company's

target dividend

yield meaning that,

Annualised rental after costs, the at 30 September 2019

income based on the Company should have (31 March 2019:

cash rents passing at the ability to meet 7.62%).

the balance sheet its target dividend

date, less through property

non-recoverable income.

property expense,

divided by the market

value of the

property, increased

with (estimated)

purchasers' costs.

2. True Equivalent A True Equivalent 7.93%

Yield Yield profile in

line with the

Company's target

dividend yield at 30 September 2019

The average weighted shows that, after (31 March 2019:

return a property costs, the Company 7.94%).

will produce should have the

according to the ability to meet its

present income and proposed dividend

estimated rental through property

value assumptions, income.

assuming the income

is received quarterly

in advance.

3. Reversionary Yield A Reversionary 7.82%

Yield profile that

is in line with an

Initial Yield

The expected return profile shows a at 30 September 2019

the property will potentially (31 March 2019:

provide once rack sustainable income 7.75%).

rented. stream that can be

used to meet

dividends past the

expiry of a

property's current

leasing

arrangements.

4. WAULT to expiry The Investment 5.82 years

Manager believes

that current market

conditions present

The average lease an opportunity at 30 September 2019

term remaining to whereby assets with (31 March 2019: 6.10

expiry across the a shorter unexpired years).

portfolio, weighted lease term are

by contracted rent. often mispriced. It

is also the

Investment

Manager's view that

a shorter WAULT is

useful for active

asset management as

it allows the

Investment Manager

to engage in direct

negotiation with

tenants rather than

via rent-review

mechanisms.

5. WAULT to break The Investment 4.33 years

Manager believes

that current market

conditions present

The average lease an opportunity at 30 September 2019

term remaining to whereby assets with (31 March 2019: 4.87

break, across the a shorter unexpired years).

portfolio weighted by lease term are

contracted rent. often mispriced. It

is also the

Investment

Manager's view that

a shorter WAULT is

useful for active

asset management as

it allows the

Investment Manager

to engage in direct

negotiation with

tenants rather than

via rent-review

mechanisms.

6. NAV The change in NAV GBP147.55 million

reflects the

Company's ability

to grow the

NAV is the value of portfolio and add at 30 September 2019

an entity's assets value to it (31 March 2019:

minus the value of throughout the life GBP149.46 million).

its liabilities. cycle of its

assets.

7. Leverage (Loan to The Company 25.50%

property valuation) utilises borrowings

to enhance returns

over the medium

term. Borrowings at 30 September 2019

The proportion of the will not exceed 35% (31 March 2019:

property portfolio of GAV (measured at 25.30%).

that is funded by drawdown) with a

borrowings. long term target of

25% or less of GAV.

8. Vacant ERV The Company's aim 3.96%

is to minimise

vacancy of the

properties. A low

The space in the level of structural at 30 September 2019

property portfolio vacancy provides an (31 March 2019:

which is currently opportunity for the 2.99%).

unlet, as a Company to capture

percentage of the rental uplifts and

total ERV of the manage the mix of

portfolio. tenants within a

property.

9. Dividend The dividend 4.00 pps

reflects the

Company's ability

to deliver a

Dividends declared in sustainable income for the six months to

relation to the year. stream from its 30 September 2019.

The Company targets a portfolio.

dividend of 8.00 pps

per annum.

This supports an

annualised target of

8.00 pps (six months

to 30 September 2018:

4.00 pps).

10. Ongoing Charges The Ongoing Charges 1.34%

ratio provides a

measure of total

costs associated

The ratio of total with managing and for the six months to

administration and operating the 30 September 2019

operating costs Company, which (six months to 30

expressed as a includes the September 2018:

percentage of average management fees due 1.26%).

NAV throughout the to the Investment

period. Manager. This

measure is to

provide investors

with a clear

picture of

operational costs

involved in running

the Company.

11. PBT The PBT is an GBP4.16 million

indication of the

Company's financial

performance for the

PBT is a period in which its for the six months to

profitability measure strategy is 30 September 2019

which considers the exercised. (six months to 30

Company's profit September 2018:

including fair value GBP11.68 million).

changes before the

payment of income

tax.

12. Shareholder Total This reflects the 5.50%

Return return seen by

shareholders on

their shareholdings

through share price for the six months to

The percentage change movements and 30 September 2019

in the share price dividends received. (six months to 30

assuming dividends September 2018:

are reinvested to 3.56%).

purchase additional

Ordinary Shares.

13. EPRA EPS This reflects the 4.37 pps

Company's ability

to generate

earnings from the

Earnings from core portfolio which for the six months to

operational underpins 30 September 2019

activities. A key dividends. (six months to 30

measure of a September 2018: 4.10

company's underlying pps).

operating results

from its property

rental business and

an indication of the

extent to which

current dividend

payments are

supported by

earnings. See note 7.

* For the current and comparative reporting dates, the calculation of NIY

has been revised to use EPRA methodology to bring consistency with

disclosures made elsewhere in the Interim Report and Financial Statements.

The difference in output is considered immaterial.

Investment Manager's Report

Market Outlook

The portfolio, now increasingly mature, is offering us numerous

opportunities to undertake asset management initiatives which provide

various potential routes to add value. Despite the backdrop of ongoing

political uncertainty, the Company remains confident in its ability to

deliver on its objectives. The value of our assets has remained robust,

particularly in the office and industrial sectors, where assets have either

been acquired at conservative levels or provide exciting value-add

opportunities. There has been some loss of value in retail assets, in line

with the structural changes that we are seeing across the retail sector.

However, this has been mitigated by the portfolio's light exposure to the

sector and also by valuation gains in other parts of the portfolio. Despite

our positive outlook for the portfolio, we are conscious of the opportunity

to limit downside risk in an uncertain macro environment and, with this in

mind, we have recently taken a number of steps to reduce risk associated

with the Company's debt facility, details of these are set out below.

Financial Results

The Company's NAV as at 30 September 2019 was GBP147.55 million or 97.36 pps

(31 March 2019: GBP149.46 million or 98.61 pps). This is a decrease of 1.25

pps or 1.27% over the six months. EPRA EPS for the six month period was 4.37

pps which, based on dividends paid of 4.00 pps, reflects a dividend cover of

109.3%.

Financing

As at 30 September 2019, the Company had a GBP60.0 million loan facility with

RBSi, in place until October 2023, the details of which are presented below:

30 September 2019 31 March 2019

Facility GBP60.00 million GBP60.00 million

Drawn GBP50.00 million GBP50.00 million

Gearing (Loan to 25.50% 25.30%

Property Value)

Gearing (Loan to NAV) 33.89% 33.45%

Interest rate 2.17% all-in (LIBOR 2.32% all-in (LIBOR

+ 1.4%) + 1.4%)

Notional Value of Loan 73.02% 73.02%

Balance Hedged

On 9 October 2019, the Company announced that it had completed an amendment

to its loan facility to increase the hard loan to NAV covenant from 45% to

55% (subject to certain conditions), although the target gearing remains as

set out in the Prospectus. There are no changes to the margin currently

charged under the facility.

The Company has not made any acquisitions or disposals during the period.

The following tables illustrate the composition of the portfolio in relation

to its properties, tenants and income streams:

Summary by Sector as at 30 September 2019

Knight Area Occupancy WAULT Gross ERV

Frank to

Number of by ERV Passing

Valuation break

Rental

Income

Sector Properties (GBPm) ('000 (%) (years) (GBPm) (GBPm)

sq

ft)

Industrial 20 93.93 2,335 99.4 4.1 7.55 8.37

Office 6 44.35 287 88.8 2.8 3.42 4.30

Other 3 30.02 165 100.0 5.6 2.82 2.33

Standard 5 21.65 169 92.1 3.8 1.94 2.00

Retail

Retail 1 6.10 51 100.0 4.5 0.61 0.51

Warehouse

Total 35 196.05 3,007 96.0 4.3 16.34 17.51

Summary by Geographical Area as at 30 September 2019

Number of Knight Area Occupancy WAULT Gross ERV

Frank to

by ERV Passing

Valuation break

Rental

Income

Geographical Properties (GBPm) ('000 (%) (years) (GBPm) (GBPm)

Area sq

ft)

Yorkshire 8 34.80 1,028 98.5 2.8 2.63 3.38

and

Humberside

South East 5 28.65 195 89.7 3.5 2.05 2.42

Eastern 5 23.20 345 100.00 3.5 1.90 2.11

South West 3 22.05 125 100.00 3.3 1.73 1.77

West 4 19.00 397 100.00 3.2 1.69 1.83

Midlands

East 2 17.62 81 100.00 2.5 1.85 1.47

Midlands

North West 4 15.40 302 100.00 3.7 1.45 1.33

Wales 2 14.73 376 100.00 9.6 1.25 1.29

Greater 1 12.00 72 100.00 12.1 0.96 0.75

London

Scotland 1 8.60 86 65.8 1.8 0.83 1.16

Total 35 196.05 3,007 96.0 4.3 16.34 17.51

Sector and Geographical Allocation by Market Value as at 30 September 2019

Sector Allocation

Sector %

Standard Retail 11

Retail Warehouse 3

Offices 23

Industrial 48

Other 15

Geographical Allocation

Geographical %

Greater London 6

South East 15

South West 11

Eastern 12

West Midlands 10

East Midlands 9

North West 8

Yorkshire & Humberside 18

Wales 7

Scotland 4

Properties by Market Value

Market Value

Property Sector Region Range (GBPm)

1 2 Geddington Other (Car East Midlands 10.0-15.0

Road, Corby parking)

2 40 Queen Square, Offices South West 10.0-15.0

Bristol

3 London East Other (Leisure) Greater London 10.0-15.0

Leisure Park,

Dagenham

4 Eastpoint Offices South East 10.0-15.0

Business Park,

Oxford

5 Gresford Industrial Wales 7.5-10.0

Industrial

Estate, Wrexham

6 225 Bath Street, Offices Scotland 7.5-10.0

Glasgow

7 Lockwood Court, Industrial Yorkshire and 5.0-7.5

Leeds Humberside

8 Langthwaite Industrial Yorkshire and 5.0-7.5

Grange Industrial Humberside

Estate, South

Kirkby

9 Above Bar Street, Standard Retail South East 5.0-7.5

Southampton

10 Storeys Bar Road, Industrial Eastern 5.0-7.5

Peterborough

The Company's top ten properties listed above comprise 48.0% of the total

value of the portfolio.

Market

Value

Property Sector Region Range (GBPm)

11 Sarus Court Industrial North West 5.0-7.5

Industrial

Estate, Runcorn

12 Barnstaple Retail South West 5.0-7.5

Retail Park Warehouse

13 Sandford House, Offices West Midlands 5.0-7.5

Solihull

14 Apollo Business Industrial Eastern 5.0-7.5

Park, Basildon

15 Euroway Trading Industrial Yorkshire and 5.0-7.5

Estate, Bradford Humberside

16 Brockhurst Industrial West Midlands 5.0-7.5

Crescent,

Walsall

17 Odeon Cinema, Other (Leisure) Eastern 5.0-7.5

Southend

18 Oak Park, Industrial West Midlands 5.0-7.5

Droitwich

Commercial Road, Standard Retail South East 5.0-7.5

Portsmouth

19

20 Diamond Business Industrial Yorkshire and <5.0

Park, Wakefield Humberside

21 Pearl Assurance Standard Retail East Midlands <5.0

House,

Nottingham

22 Excel 95, Industrial Wales <5.0

Deeside

23 Walkers Lane, St Industrial North West <5.0

Helens

24 Cedar House, Offices South West <5.0

Gloucester

25 Bank Hey Street, Standard Retail North West <5.0

Blackpool

26 Brightside Lane, Industrial Yorkshire and <5.0

Sheffield Humberside

Bessemer Road, Industrial South East <5.0

Basingstoke

27

Magham Road, Industrial Yorkshire and <5.0

Rotherham Humberside

28

29 Pipps Hill Industrial Eastern <5.0

Industrial

Estate, Basildon

30 Eagle Road, Industrial West Midlands <5.0

Redditch

31 Vantage Point, Offices Eastern <5.0

Hemel Hempstead

Clarke Road, Industrial South East <5.0

Milton Keynes

32

33 Knowles Lane, Industrial Yorkshire and <5.0

Bradford Humberside

34 Moorside Road, Industrial North West <5.0

Salford

35 Fargate and Standard Retail Yorkshire and <5.0

Chapel Walk, Humberside

Sheffield

Tenancy Profile

Top Ten Tenants by Passing Rent

% of

Portfolio

Passing Total

Rental Passing

Income Rental

Tenant Sector Property (GBP'000) Income

1 GEFCO UK Logistics 2 Geddington 1,320 8.1

Limited Road, Corby

2 Plastipak UK Manufacturing Gresford 883 5.4

Limited Industrial

Estate,

Wrexham

3 The Government Body Sandford 832 5.1

Secretary of House,

State Solihull and

Cedar House,

Gloucester

4 Ardagh Glass Manufacturing Langthwaite 676 4.1

Limited Industrial

Estate, South

Kirkby

5 Mecca Bingo Leisure London East 625 3.8

Limited Leisure Park,

Dagenham

6 Egbert H Manufacturing Oak Park, 620 3.8

Taylor & Droitwich

Company

Limited

7 Odeon Leisure Odeon Cinema, 535 3.3

Cinemas Southend

8 Sports Retail Barnstaple 525 3.2

Direct Retail Park

and Bank Hey

Street,

Blackpool

9 Wyndeham Manufacturing Storeys Bar 525 3.2

Peterborough Road,

Limited Peterborough

10 Advance Logistics Euroway 428 2.6

Supply Chain Trading

(BFD) Estate,

Limited Bradford

The Company's top ten tenants, listed above, represent 42.6% of the total

passing rental income of the portfolio.

Asset Management

Knowles Lane, Bradford - in September 2019, the Company settled a rent

review back-dated to September 2018 at this industrial property. The review

documents a new passing rent of GBP182,500, representing a 14% increase on the

previous rent and which was also ahead of the valuer's ERV at the date of

signing.

Bessemer Road, Basingstoke - in September 2019, a lease extension for a term

of six months was completed with HFC Prestige Manufacturing in Basingstoke.

Due to the short extension period, a rental level was agreed 46% ahead of

the previous passing rent.

Lease Expiry Profile

Approximately GBP3.36 million of the Company's current contracted income

stream is subject to an expiry or break within the 12 month period

commencing 1 October 2019. Of this GBP3.36 million, GBP940,000 (28%) is already

subject to an agreed renewal in principle, either at or above the current

level of passing rent. In respect of a further GBP1.52 million (45%), the

Investment Manager is currently engaged in active renewal discussions where

tenants are expected to remain in occupation subject to agreeing final lease

terms. The Investment Manager expects to engage further tenants in renewal

discussion throughout the period. To date, tenants that have served notice

to vacate within this period and have made clear that they intend to do so

amount to c.GBP71,000 (2%).

AEW UK Investment Management LLP

27 November 2019

Interim Management Report & Directors' Responsibility Statement

Interim Management Report

The important events that have occurred during the period under review, the

key factors influencing the financial statements and the principal risks and

uncertainties for the remaining six months of the financial year are set out

in the Chairman's Statement and the Investment Manager's Report above.

The principal risks facing the Company are unchanged since the date of the

Annual Report and Financial Statements for the year ended 31 March 2019 and

continue to be as set out in that report on pages 29 to 34 and Note 20 to

the Financial Statements on pages 92 to 95.

Risks faced by the Company include, but are not limited to: property market,

property valuation, tenant default, asset management initiatives, due

diligence, fall in rental rates, breach of borrowing covenants, interest

rate rises, availability and cost of debt, use of service providers,

dependence on the Investment Manager, ability to meet objectives, Company

REIT status, political/economic risks, market price risk, real estate risk,

credit risk and liquidity risk.

Responsibility Statement

We confirm that to the best of our knowledge:

· the condensed set of financial statements has been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by the EU;

· the interim management report includes a fair review of the information

required by:

a) DTR 4.2.7R, being an indication of important events that have occurred

during the first six months of the financial year and their impact on the

condensed set of financial statements; and a description of the principal

risks and uncertainties for the remaining six months of the year; and

b) DTR 4.2.8R, being related party transactions that have taken place in

the first six months of the current financial year and that have

materially affected the financial position or performance of the entity

during that period; and any changes in the related party transactions

described in the last annual report that could do so.

On behalf of the Board

Mark Burton

Chairman

27 November 2019

Independent Review Report to AEW UK REIT plc

Conclusion

We have been engaged by the Company to review the condensed set of financial

statements in the Interim Report & Financial Statements for the six months

ended 30 September 2019 which comprises the Condensed Statement of

Comprehensive Income, Condensed Statement of Changes in Equity, Condensed

Statement of Financial Position, Condensed Statement of Cash Flows and the

related explanatory notes.

Based on our review, nothing has come to our attention that causes us to

believe that the condensed set of financial statements in the half-yearly

financial report for the six months ended 30 September 2019 are not

prepared, in all material respects, in accordance with IAS 34 Interim

Financial Reporting as adopted by the EU and the DTR of the UK's Financial

Conduct Authority (the "FCA").

Scope of review

We conducted our review in accordance with International Standard on Review

Engagements (UK and Ireland) 2410 Review of Interim Financial Information

Performed by the Independent Auditor of the Entity issued by the Auditing

Practices Board for use in the UK. A review of interim financial information

consists of making enquiries, primarily of persons responsible for financial

and accounting

matters, and applying analytical and other review procedures. We read the

other information contained in the Interim Report & Financial Statements and

consider whether it contains any apparent misstatements or material

inconsistencies with the information in the condensed set of financial

statements.

A review is substantially less in scope than an audit conducted in

accordance with International Standards on Auditing (UK) and consequently

does not enable us to obtain assurance that we would become aware of all

significant matters that might be identified in an audit. Accordingly, we do

not express an audit opinion.

The impact of uncertainties due to the UK exiting the European Union on our

review

Uncertainties related to the effects of Brexit are relevant to understanding

our review of the condensed financial statements. Brexit is one of the most

significant economic events for the UK, and at the date of this report its

effects are subject to unprecedented levels of uncertainty of outcomes, with

the full range of possible effects unknown. An interim review cannot be

expected to predict the

unknowable factors or all possible future implications for a company and

this is particularly the case in relation to Brexit.

Directors' responsibilities

The Interim Report & Financial Statements is the responsibility of, and has

been approved by, the Directors. The Directors are responsible for preparing

the Interim Report & Financial Statements in accordance with the DTR of the

FCA.

The annual financial statements of the Company are prepared in accordance

with International Financial Reporting Standards as adopted by the EU. The

Directors are responsible for preparing the condensed set of financial

statements included in the Interim Report & Financial Statements in

accordance with IAS 34 as adopted by the EU.

Our responsibility

Our responsibility is to express to the Company a conclusion on the

condensed set of financial statements in the Interim Report & Financial

Statements based on our review.

The purpose of our review work and to whom we owe our responsibilities

This report is made solely to the Company in accordance with the terms of

our engagement to assist the Company in meeting the requirements of the DTR

of the FCA. Our review has been undertaken so that we might state to the

Company those matters we are required to state to it in this report and for

no other purpose. To the fullest extent permitted by law, we do not accept

or assume responsibility to anyone other than the Company for our review

work, for this report, or for the conclusions we have reached.

Henry Todd

for and on behalf of KPMG LLP

Chartered Accountants

15 Canada Square

London

E14 5GL

27 November 2019

Financial Statements

Condensed Statement of Comprehensive Income

for the six months ended 30 September 2019

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

(unaudited) (unaudited) (audited)

Notes GBP'000 GBP'000 GBP'000

Income

Rental and 3 8,777 8,459 17,183

other income

Property 4 (509) (630) (1,462)

operating

expenses

Net rental and 8,268 7,829 15,721

other income

Other operating 4 (1,004) (970) (2,197)

expenses

Operating 7,264 6,859 13,524

profit before

fair value

changes

Change in fair 9 (2,407) 5,653 4,184

value of

investment

properties

Gain/(loss) on 9 44 (178) (482)

disposal of

investment

properties

Operating 4,901 12,334 17,226

profit

Finance expense 5 (742) (656) (1,682)

Profit before 4,159 11,678 15,544

tax

Taxation 6 - - -

Profit after 4,159 11,678 15,544

tax

Other - - -

comprehensive

income

Total 4,159 11,678 15,544

comprehensive

income for the

period

Earnings per 7 2.74 7.71 10.26

share (pence

per share)

(basic and

diluted)

The notes below form an integral part of these condensed financial

statements.

Condensed Statement of Changes in Equity

for the six months ended 30 September 2019

For the period Share Share Capital Total capital

1 April 2019

to

capital premium reserve and and reserves

account retained attributable to

earnings owners of

the Company

30 September Notes GBP'000 GBP'000 GBP'000 GBP'000

2019

(unaudited)

Balance as at 1,515 49,770 98,171 149,456

1 April 2019

Total - - 4,159 4,159

comprehensive

income

Dividends paid 8 - - (6,062) (6,062)

Balance as at 1,515 49,770 96,268 147,553

30 September

2019

For the period Share Share Capital Total capital

1 April 2018

to

capital premium reserve and and reserves

account retained attributable to

earnings owners of

the Company

30 September Notes GBP'000 GBP'000 GBP'000 GBP'000

2018

(unaudited)

Balance at 1 1,515 49,768 94,751 146,034

April 2018

Total - - 11,678 11,678

comprehensive

income

Share issue - 3 - 3

costs

Dividends paid 8 - - (6,062) (6,062)

Balance as at 1,515 49,771 100,367 151,653

30 September

2018

Share Share Capital Total capital

capital premium reserve and and reserves

account retained attributable to

earnings owners of

the Company

For the year Notes GBP'000 GBP'000 GBP'000 GBP'000

ended 31 March

2019 (audited)

Balance at 1 1,515 49,768 94,751 146,034

April 2018

Total - - 15,544 15,544

comprehensive

income

Share issue - 2 - 2

costs

Dividends paid 8 - - (12,124) (12,124)

Balance as at 1,515 49,770 98,171 149,456

31 March 2019

The notes below form an integral part of these condensed financial

statements.

Condensed Statement of Financial Position

as at 30 September 2019

As at As at As at

30 September 30 September 31 March 2019

2019

(unaudited)

2018 (audited)

(unaudited)

Notes GBP'000 GBP'000 GBP'000

Assets

Non-Current Assets

Investment 9 193,979 192,519 196,129

property

193,979 192,519 196,129

Current Assets

Receivables and 10 7,621 3,394 4,469

prepayments

Other financial 11 58 9 162

assets held at

fair value

Cash and cash 2,012 8,145 2,131

equivalents

9,691 11,548 6,762

Total assets 203,670 204,067 202,891

Non-Current

Liabilities

Interest bearing 12 (49,528) (49,714) (49,476)

loans and

borrowings

Finance lease 14 (636) (573) (636)

obligations

(50,164) (50,287) (50,112)

Current

Liabilities

Payables and 13 (5,905) (2,080) (3,275)

accrued expenses

Finance lease 14 (48) (47) 48

obligations

(5,953) (2,127) (3,323)

Total Liabilities (56,117) (52,414) (53,435)

Net Assets 147,553 151,653 149,456

Equity

Share capital 1,515 1,515 1,515

Share premium 49,770 49,771 49,770

account

Capital reserve 96,268 100,367 98,171

and retained

earnings

Total capital and 147,553 151,653 149,456

reserves

attributable to

equity holders of

the Company

Net Asset Value 7 97.36 100.06 98.61

per share (pps)

The financial statements were approved by the Board of Directors on 27

November 2019 and were signed on its behalf by:

Mark Burton

Chairman

AEW UK REIT plc

Company number: 09522515

The notes below form an integral part of these condensed financial

statements.

Condensed Statement of Cash Flows

for the six months ended 30 September 2019

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Cash flows from

operating activities

Profit after tax 4,159 11,678 15,544

Adjustment for

non-cash items:

Finance expenses 742 656 1,682

Loss/(gain) from 2,407 (5,653) (4,184)

change in fair value

of investment

property

Realised (gain)/loss (44) 178 482

on disposal of

investment property

Increase in other (3,152) (455) (1,318)

receivables and

prepayments

Increase/(decrease) 2,640 (385) 587

in other payables and

accrued expenses

Net cash generated 6,752 6,019 12,793

from operating

activities

Cash flows from

investing activities

Additions to (257) (506) (7,945)

investment property

Proceeds from 44 4,508 6,629

disposal of

investment property

Net cash (used (213) 4,002 (1,316)

in)/generated from

investing activities

Cash flows from

financing activities

Share issue costs - (31) (32)

Loan arrangement fees - - (294)

Premiums on interest - - (531)

rate caps

Finance costs (596) (494) (1,076)

Dividends paid (6,062) (6,062) (12,124)

Net cash used in (6,658) (6,587) (14,057)

financing activities

Net (119) 3,434 (2,580)

(decrease)/increase

in cash and cash

equivalents

Cash and cash 2,131 4,711 4,711

equivalents at start

of the period/year

Cash and cash 2,012 8,145 2,131

equivalents at end of

the period/year

The notes below form an integral part of these condensed financial

statements.

Notes to the Condensed Financial Statements

for the six months ended 30 September 2019

1. Corporate information

AEW UK REIT plc (the 'Company') is a closed ended Real Estate Investment

Trust ('REIT') incorporated on 1 April 2015 and domiciled in the UK.

The comparative information for the year ended 31 March 2019 does not

constitute statutory accounts as defined in section 434 of the Companies Act

2006. The auditor reported on those accounts. Its report was unqualified and

did not contain a statement under section 498(2) or (3) of the Companies Act

2006.

2. Accounting policies

2.1 Basis of preparation

These interim condensed unaudited financial statements have been prepared in

accordance with IAS 34 Interim Financial Reporting as adopted by the EU, and

should be read in conjunction with the Company's last financial statements

for the year ended 31 March 2019. These condensed unaudited financial

statements do not include all information required for a complete set of

financial statements proposed in accordance with IFRS as adopted by the EU

('EU IFRS'). However, selected explanatory notes have been included to

explain events and transactions that are significant in understanding

changes in the Company's financial position and performance since the last

financial statements. A review of the interim financial information has been

performed by the Independent Auditor of the Company for issue on 27 November

2019.

The comparative figures disclosed in the condensed unaudited financial

statements and related notes have been presented for both the six month

period ended 30 September 2018 and year ended 31 March 2019 and as at 30

September 2018 and 31 March 2019.

These condensed unaudited financial statements have been prepared under the

historical-cost convention, except for investment property and interest rate

derivatives that have been measured at fair value. The condensed unaudited

financial statements are presented in Sterling and all values are rounded to

the nearest thousand pounds (GBP'000), except when otherwise indicated.

The Company is exempt by virtue of section 402 of the Companies Act 2006

from the requirement to prepare group financial statements. These financial

statements present information solely about the Company as an individual

undertaking.

New standards, amendments and interpretations

There were a number of new standards and amendments to existing standards

which are required for the Company's accounting periods beginning after 1

April 2019, which have been considered and applied. These being:

· IFRS 16, Leases. In January 2016, the IASB published the final version

of IFRS 16 Leases. IFRS specifies how an IFRS reporter will recognise,

measure, present and disclose leasing arrangements. The accounting for

lessors did not significantly change. For finance lease obligations, the

Company is already carrying a right of use asset at fair value so

treatment remains in line with prior years in that regard.

· Amendments to IFRS 9 - Prepayment Features with Negative Compensation.

This seeks to enable companies to measure at amortised cost some

prepayable financial assets with negative compensation.

· IFRIC 23, Uncertainty over Income Tax Treatments. This seeks to clarify

the application of recognition and measurement requirements in IAS 12,

Income Taxes, when there is uncertainty over income tax treatment.

· Amendments to IAS 28 Long Term interests in Associates and Joint

Ventures. This seeks to clarify the impact of expected credit loss model

in IFRS 9 on any long-term interests in an associate or joint venture to

which the equity method is not applied but that, in substance, form part

of the net investment in associate or joint venture.

· Amendments to IAS 19 Plan Amendment, Curtailment or Settlement. This

seeks to clarify when an entity is required to determine the current

service cost and net interest for the remainder of the period after a plan

amendment, curtailment or settlement.

The Company has applied the new standards and there has been no impact on

the financial statements.

There are a number of new standards and amendments to existing standards

which have been published and are mandatory for the Company's accounting

periods beginning on or after 1 April 2020 or later. The following are the

most relevant to the Company and their impact on the financial statements is

as follows:

· Definition of Material - amendments to IAS 1 and IAS 8.

· Annual improvements to IFRS 2015-2017 Cycle: amendments to IFRS 3

Business Combinations, IFRS 11 Joint Arrangements.

The impact of the adoption of new accounting standards issued and becoming

effective for accounting periods beginning on or after 1 April 2020 has been

considered and is not considered to be significant.

2.2 Significant accounting judgements and estimates

The preparation of financial statements in accordance with IAS 34 requires

the Directors of the Company to make judgements, estimates and assumptions

that affect the reported amounts recognised in the financial statements.

However, uncertainty about these assumptions and estimates could result in

outcomes that require a material adjustment to the carrying amount of the

asset or liability in the future.

i) Valuation of investment property

The Company's investment property is held at fair value as determined by the

independent valuer on the basis of fair value in accordance with the

internationally accepted Royal Institution of Chartered Surveyors ('RICS')

Appraisal and Valuation Standards.

2.3 Segmental information

In accordance with IFRS 8, the Company is organised into one main operating

segment being investment in property and property related-investments in the

UK.

2.4 Going concern

The Directors have made an assessment of the Company's ability to continue

as a going concern and are satisfied that the Company has the resources to

continue in business for at least 12 months. Furthermore, the Directors are

not aware of any material uncertainties that may cast significant doubt upon

the Company's ability to continue as a going concern. Therefore, the

financial statements have been prepared on the going concern basis.

2.5 Summary of significant accounting policies

The principal accounting policies applied in the preparation of these

financial statements are consistent with those applied within the Company's

Annual Report and Financial Statements for the year ended 31 March 2019

except for the changes as detailed in note 2.1.

3. Revenue

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Gross rental income 8,777 8,456 17,179

received

Other property income - 3 4

Total rental and 8,777 8,459 17,183

other income

Rent receivable under the terms of the leases is adjusted for the effect of

any incentives agreed.

4. Expenses

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Property operating 509 630 1,462

expenses

Other operating

expenses

Investment management 665 648 1,302

fee

Auditor remuneration 48 43 98

Operating costs 230 226 675

Directors' 61 53 122

remuneration

Total other operating 1,004 970 2,197

expenses

Total operating 1,513 1,600 3,659

expenses

5. Finance expense

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Interest payable on 556 540 1,103

loan borrowings

Amortisation of loan 53 71 127

arrangement fee

Agency fee payable on - 2 3

loan borrowings

Commitment fee 29 26 54

payable on loan

borrowings

638 639 1,287

Change in fair value 104 17 395

of interest rate

derivatives

Total 742 656 1,682

6. Taxation

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Analysis of charge in

the period

Profit before tax 4,159 11,678 15,544

Theoretical tax at UK 790 2,219 2,953

corporation tax

standard rate of 19%

(30 September 2018:

19%; 31 March 2019:

19%)

Adjusted for:

Exempt REIT income (1,239) (1,178) (2,249)

Non taxable 449 (1,041) (704)

investment

losses/(gains)

Total - - -

7. Earnings per share and NAV per share

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

EPS:

Total comprehensive 4,159 11,678 15,544

income (GBP'000)

Weighted average 151,558,251 151,558,251 151,558,251

number of shares

EPS (basic and 2.74 7.71 10.26

diluted) (pence)

EPRA EPS: 4,159 11,678 15,544

Total comprehensive

income (GBP'000)

Adjustment to total

comprehensive

income:

Change in fair 2,407 (5,653) (4,184)

value of investment

property (GBP'000)

(Gain)/loss on (44) 178 482

disposal of

investment property

(GBP'000)

Change in fair 104 17 395

value of interest

rate derivatives

(GBP'000)

Total EPRA Earnings 6,626 6,220 12,237

(GBP'000)

EPRA EPS (basic and 4.37 4.10 8.07

diluted) (pence)

NAV per share:

Net assets (GBP'000) 147,553 151,653 149,456

Ordinary Shares 151,558,251 151,558,251 151,558,251

NAV per share 97.36 100.06 98.61

(pence)

EPRA NAV per share:

Net assets (GBP'000) 147,553 151,653 149,456

Adjustments to net

assets:

Other financial (58) (9) (162)

assets held at fair

value (GBP'000)

EPRA NAV (GBP'000) 147,495 151,644 149,294

EPRA NAV per share 97.32 100.06 98.51

(pence)

EPS amounts are calculated by dividing profit for the period attributable to

ordinary equity holders of the Company by the weighted average number of

Ordinary Shares in issue during the period. As at 30 September 2019, EPRA

NNNAV was equal to IFRS NAV and as such a reconciliation between the two

measures has not been presented.

8. Dividends paid

Period from Period from Year ended

1 April 2019 to 1 April 2018 to 31 March

30 September 30 September 2019

2019 2018

Dividends paid GBP'000 GBP'000 GBP'000

during the period

Represents 6,062 6,062 12,124

two/two/four

interim dividends

of 2.00 pps each

Period from Period from

1 April 2019 to 1 April 2018 to Year ended

30 September 31 October 31 March

2019 2018 2019

Dividends relating GBP'000 GBP'000 GBP'000

to the period

Represents 6,062 6,062 12,124

two/two/four

interim dividends

of 2.00 pps each

Dividends paid during the period relate to Ordinary Shares only.

9. Investments

9.a) Investment property

Period from 1 April 2019 to

30 September 2019

(unaudited)

Period from Year

ended

1 April

2018 31 March

to 31

September

Investment Investment 2018 2019

properties properties (unaudited) (audited)

freehold leasehold Total Total Total

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

UK

Investment

property

As at 159,080 38,525 197,605 192,342 192,342

beginning

of period

Additions 262 (5) 257 151 7,590

in the

period

Disposals - - - (4,628) (7,053)

in the

period

Revaluation (2,617) 805 (1,812) 5,665 4,726

of

investment

property

Valuation 156,725 39,325 196,050 193,530 197,605

provided by

Knight

Frank

Adjustment (2,755) (1,631) (2,160)

for rent

free debtor

Adjustment 684 620 684

for finance

lease

obligations

*

Total 193,979 192,519 196,129

Investment

property

Change in

fair value

of

investment

property

Change in (1,812) 5,665 4,726

fair value

before

adjustments

for lease

incentives

Adjustment

for

movement in

the period:

in value (595) (12) (542)

for rent

free debtor

(2,407) 5,653 4,184

Gain/(loss)

on disposal

of the

investment

property

Net 44 4,508 6,629

proceeds

from

disposals

of

investment

property

during the

period

Cost of - (4,628) (7,053)

disposal

Lease - (58) (58)

incentives

amortised

in current

period/year

Gain/(loss) 44 (178) (482)

on disposal

of

investment

property

* Adjustment in respect of minimum payment under head leases separately

included as a liability within the Condensed Statement of Financial

Position.

Valuation of investment property

Valuation of investment property is performed by Knight Frank LLP, an

accredited external valuer with recognised and relevant professional

qualifications and recent experience of the location and category of the

investment property being valued.

The valuation of the Company's investment property at fair value is

determined by the external valuer on the basis of market value in accordance

with the internationally accepted RICS Valuation - Professional Standards

(incorporating the International Valuation Standards).

The determination of the fair value of investment property requires the use

of estimates such as future cash flows from assets (such as lettings,

tenants' profiles, future revenue streams, capital values of fixtures and

fittings, plant and machinery, any environmental matters and the overall

repair and condition of the property) and discount rates applicable to those

flows.

9.b) Fair value measurement hierarchy

The following table provides the fair value measurement hierarchy for

non-current assets:

Quoted prices Significant Significant

in active observable unobservable

markets inputs inputs

(Level 1) (Level 2) (Level 3) Total

GBP'000 GBP'000 GBP'000 GBP'000

Assets measured

at fair value

30 September 2019

Investment - - 193,979 193,979

property

30 September 2018

Investment - - 192,519 192,519

property

31 March 2019

Investment - - 196,129 196,129

property

Explanation of the fair value hierarchy:

Level 1 - Quoted prices for an identical instrument in active markets;

Level 2 - Prices of recent transactions for identical instruments and

valuation techniques using observable market data; and

Level 3 - Valuation techniques using non-observable data.

There have been no transfers between Level 1 and Level 2 during either

period, nor have there been any transfers in or out of Level 3.

Sensitivity analysis to significant changes in unobservable inputs within

Level 3 of the hierarchy

The significant unobservable inputs used in the fair value measurement

categorised within Level 3 of the fair value hierarchy of the entity's

portfolios of investment properties are:

1) ERV

2) Equivalent yield

Increases/(decreases) in the ERV (per sq ft per annum) in isolation would

result in a higher/(lower) fair value measurement. Increases/(decreases) in

the yield in isolation would result in a lower/(higher) fair value

measurement.

The significant unobservable inputs used in the fair value measurement

categorised within Level 3 of the fair value hierarchy of the portfolio of

investment property are:

Significant

Fair value Valuation unobservable

Class GBP'000 technique inputs Range

30 September

2019

Investment 196,050 Income ERV GBP0.50 -

Property capitalisati GBP127.00

on

Equivalent yield

5.95% -

9.69%

30 September

2018

Investment 193,530 Income ERV GBP1.00 -

Property capitalisati GBP127.00

on

Equivalent yield

4.23% -

12.09%

31 March 2019

Investment 197,605 Income ERV GBP1.00-

Property capitalisati GBP127.00

on

Equivalent yield

5.87% -

10.25%

Where possible, sensitivity of the fair values of Level 3 assets are tested

to changes in unobservable inputs to reasonable alternatives.

Gains and losses recorded in profit or loss for recurring fair value

measurements categorised within Level 3 of the fair value hierarchy are

attributable to changes in unrealised gains or losses relating to investment

property and investments held at the end of the reporting period.

With regards to both investment property and investments, gains and losses

for recurring fair value measurements categorised within Level 3 of the fair

value hierarchy, prior to adjustment for rent free debtor and rent guarantee

debtor, are recorded in profit and loss.

The carrying amount of the assets and liabilities, detailed within the

Condensed Statement of Financial Position, is considered to be the same as

their fair value.

The tables below sets out a sensitivity analysis for each of the key sources

of estimation uncertainty with the resulting increase/(decrease) in the fair

value of investment property.

Fair Change in ERV Change in equivalent

value yield

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Sensitivity +5% -5% +5% -5%

Analysis

30 September 196,05 204,427 187,935 185,802 207,198

2019 0

30 September 193,53 200,241 183,820 181,321 203,387

2018 0

31 March 197,60 205,803 189,720 187,352 208,707

2019 5

Fair Change in ERV Change in equivalent

value yield

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Sensitivity +10% -10% +10% -10%

Analysis

30 September 196,05 213,858 179,153 178,444 217,351

2019 0

30 September 193,53 208,704 175,911 173,762 213,834

2018 0

31 March 197,60 215,108 181,156 179,876 219,000

2019 5

10. Receivables and prepayments

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Receivables

Rent debtor 2,789 1,283 1,477

Allowance for expected (51) - (39)

credit losses

Rent agent float account 1,363 184 92

Other receivables 481 221 381

4,582 1,688 1,911

Rent free debtor 2,755 1,631 2,160

Prepayments 284 75 398

Total 7,621 3,394 4,469

The aged debtor analysis of receivables as follows:

30 30 September 31 March

September

2019 2018 2019

GBP'000 GBP'000 GBP'000

Less than three months due 4,257 1,688 1,911

Between three and six months 325 - -

due

Total 4,582 1,688 1,911

11. Interest rate derivatives

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

At the beginning of the 162 26 26

period

Interest rate cap premium - - 531

paid

Changes in fair value of (104) (17) (395)

interest rate derivatives

At the end of the period 58 9 162

The Company is protected from a significant rise in interest rates as it has

interest rate caps with a combined notional value of GBP36.51 million (31

March 2019: GBP36.51 million), resulting in the loan being 73% hedged (31

March 2019: 73%). These interest rate caps are effective until 19 October

2020. In October 2018, the Company entered into additional interest rate

caps on a notional value of GBP46.51 million at 2.00% covering the extension

period of the loan from October 2020 to October 2023.

Fair Value hierarchy

The following table provides the fair value measurement hierarchy for

interest rate derivatives:

Assets measured at fair value

Quoted prices Significant Significant

in active observable unobservable

markets input inputs

(Level 1) (Level 2) (Level 3) Total

Valuation date GBP'000 GBP'000 GBP'000 GBP'000

30 September - 58 - 58

2019

30 September - 9 - 9

2018

31 March 2019 - 162 - 162

The fair value of these contracts are recorded in the Condensed Statement of

Financial Position as at the period end.

There have been no transfers between Level 1 and Level 2 during the period,

nor have there been any transfers between Level 2 and Level 3 during the

period.

The carrying amount of the assets and liabilities, detailed within the

Condensed Statement of Financial Position, is considered to be the same as

their fair value.

12. Interest bearing loans and borrowings

Bank borrowings drawn

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

At the beginning of the 50,000 50,000 50,000

period

Bank borrowings drawn in the - - -

period

Interest bearing loans and 50,000 50,000 50,000

borrowings

Unamortised loan arrangement (472) (286) (524)

fees

At the end of the period 49,528 49,714 49,476

Repayable between two and 50,000 50,000 50,000

five years

Bank borrowings available 10,000 10,000 10,000

but undrawn in the period

Total facility available 60,000 60,000 60,000

The Company has a GBP60.00 million (31 March 2019: GBP60.00 million) credit

facility with RBSi of which GBP50.00 million (31 March 2019: GBP50.00 million)

has been utilised as at 30 September 2019.

Under the terms of the Prospectus, the Company has a target gearing of 25%

loan to GAV, but can borrow up to 35% loan to GAV in advance of a capital

raise or asset disposal. As at 30 September 2019, the Company's gearing was

25.50% loan to property valuation (31 March 2019: 25.30%).

Under the terms of the loan facility, the Company can draw up to 35% loan to

NAV at drawdown. On 9 October 2019, the Company announced that it had

completed an amendment to its loan facility, increasing the loan to NAV

covenant from 45% to 55% (subject to certain conditions). There are no

changes to the margin currently charged under the facility.

Borrowing costs associated with the credit facility are shown as finance

costs in note 5 to these financial statements.

13. Payables and accrued expenses

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Deferred income 3,312 929 1,137

Accruals 1,037 467 1,189

Other creditors 1,556 684 949

Total 5,905 2,080 3,275

14. Finance lease obligations

Finance leases are capitalised at the lease's commencement at the present

value of the minimum lease payments. The present value of the corresponding

rental obligations are included as liabilities.

The following table analyses the minimum lease payments under

non-cancellable finance leases:

30 September 30 September 31 March

2019 2018 2019

(unaudited) (unaudited) (audited)

GBP'000 GBP'000 GBP'000

Not later than one year 48 47 48

Later than one year but not 160 152 160

later than five years

Later than five years 476 421 476

636 573 636

Total 684 620 684

15. Issued share capital

There was no change to the issued share capital during the period. The

number of ordinary shares in issue and fully paid remains 151,558,251 of

GBP0.01 each.

16. Transactions with related parties

As defined by IAS 24 Related Party Disclosures, parties are considered to be

related if one party has the ability to control the other party or exercise

significant influence over the other party in making financial or

operational decisions.

For the six months ended 30 September 2019, the Directors of the Company are

considered to be the key management personnel. Directors' remuneration is

disclosed in note 4.

The Company is party to an Investment Management Agreement with the

Investment Manager, pursuant to which the Company has appointed the

Investment Manager to provide investment management services relating to the

respective assets on a day-to-day basis in accordance with their respective

investment objectives and policies, subject to the overall supervision and

direction of the Board of Directors.

Under the Investment Management Agreement, the Investment Manager receives a

quarterly management fee which is calculated and accrued monthly at a rate

equivalent to 0.9% per annum of NAV (excluding uninvested proceeds from

fundraising).

During the period from 1 April 2019 to 30 September 2019, the Company

incurred GBP665,344 (six months ended 30 September 2018: GBP648,247) in respect

of investment management fees and expenses of which GBP664,962 was outstanding

at 30 September 2019 (31 March 2019: GBP328,323).

17. Events after reporting date

Dividend

On 18 October 2019, the Board declared its second interim dividend of 2.00

pps in respect of the period from 1 July 2019 to 30 September 2019. The

dividend payment will be made on 29 November 2019 to shareholders on the

register as at 1 November 2019. The ex-dividend date was 31 October 2019.

The dividend of 2.00 pps was designated as an interim property income

distribution ("PID"). Unless shareholders have elected to receive the PID

gross, 20% tax will be deducted at source.

Financing

On 9 October 2019, the Company announced that it had completed an amendment

to its loan facility, increasing the loan to NAV covenant from 45% to 55%

(subject to certain conditions).

EPRA Performance Measures

Detailed below is a summary table showing the EPRA performance measures of

the Company. All EPRA performance measures have been calculated in line with

EPRA Best Practices Recommendations Guidelines which can be found at

www.epra.com [1].

MEASURE AND DEFINITION PURPOSE PERFORMANCE

1. EPRA Earnings

Earnings from A key measure of GBP6.63 million/4.37

operational activities. a company's pps

underlying

operating results

and an indication

of the extent to EPRA earnings for the

which current six month period

dividend payments ended 30 September

are supported by 2019 (six month

earnings. period ended 30

September 2018: GBP6.22

million/4.10 pps)

2. EPRA NAV

NAV adjusted to include Makes adjustments GBP147.50 million/97.32

properties and other to IFRS NAV to pps EPRA NAV as at 30

investment interests at provide September 2019 (At 31

fair value and to stakeholders with March 2019: GBP149.29

exclude certain items the most relevant million/ 98.51 pps)

not expected to information on

crystallise in a the fair value of

long-term investment the assets and

property business. liabilities

within a true

real estate

investment

company with a

long-term

investment

strategy.

3. EPRA NNNAV

EPRA NAV adjusted to Makes adjustments GBP147.55 million/97.36

include the fair values to EPRA NAV to pps EPRA NNNAV as at

of: provide 30 September 2019

stakeholders with

the most relevant

information on

(i) financial the current fair (At 31 March 2019:

instruments; value of all the GBP149.46 million/98.61

assets and pps)

liabilities

within a real

(ii) debt; and estate company.

(iii) deferred taxes.

4.1 EPRA NIY

Annualised rental income

based on the cash rents

passing at the balance

sheet date, less

non-recoverable property A comparable 7.45%

operating expenses, measure for

divided by the market portfolio

value of the property, valuations. This

increased with measure should EPRA NIY

(estimated) purchasers' make it easier

costs. for investors to

judge themselves,

how the valuation as at 30 September

of portfolio X 2019

compares with

portfolio Y.

(At 31 March 2019:

7.62%)

4.2 EPRA 'Topped-Up' NIY

This measure A comparable 8.27%

incorporates an measure for

adjustment to the EPRA portfolio

NIY in respect of the valuations. This

expiration of rent-free measure should EPRA 'Topped-Up' NIY

periods (or other make it easier

unexpired lease for investors to

incentives such as judge themselves,

discounted rent periods how the valuation as at 30 September

and step rents). of portfolio X 2019

compares with

portfolio Y.

(At 31 March 2019:

8.58%)

5. EPRA Vacancy

Estimated Market Rental A "pure" (%) 3.96%

Value ('ERV') of vacant measure of

space divided by ERV of investment

the whole portfolio. property space

that is vacant, EPRA vacancy

based on ERV.

as at 30 September

2019

(At 31 March 2019:

2.99%)

6. EPRA Cost Ratio

Administrative and A key measure to 16.93%

operating costs enable meaningful

(including and excluding measurement of

costs of direct vacancy) the changes in a

divided by gross rental company's EPRA Cost Ratio

income. operating costs. (including direct

vacancy cost) as at

30 September 2019

(At 30 September

2018: 18.68%)

13.76%

EPRA Cost ratio

excluding direct

vacancy costs as at

30 September 2019

(At 30 September

2018: 14.96%)

Calculation of EPRA NIY and 'topped-up' NIY

30 September

2019

GBP'000

Investment property - wholly-owned 196,050

Allowance for estimated purchasers' costs 13,331

Gross up completed property portfolio valuation 209,381

Annualised cash passing rental income 16,335

Property outgoings (738)

Annualised net rents 15,597

Rent expiration of rent-free periods and fixed 1,716

uplifts

'Topped-up' net annualised rent 17,313

EPRA NIY 7.45%

EPRA 'topped-up' NIY 8.27%

EPRA NIY basis of calculation

EPRA NIY is calculated as the annualised net rent, divided by the gross

value of the completed property portfolio.

The valuation of grossed up completed property portfolio is determined by

our external valuers as at 30 September 2019, plus an allowance for

estimated purchasers' costs. Estimated purchasers' costs are determined by

the relevant stamp duty liability, plus an estimate by our valuers of agent

and legal fees on notional acquisition. The net rent deduction allowed for

property outgoings is based on our valuers' assumptions on future recurring

non-recoverable revenue expenditure.

In calculating the EPRA 'topped-up' NIY, the annualised net rent is

increased by the total contracted rent from expiry of rent-free periods and

future contracted rental uplifts.

Calculation of EPRA Vacancy Rate

30 September

2019

GBP'000

Annualised potential rental value of vacant 694

premises

Annualised potential rental value for the 17,512

completed property portfolio

EPRA Vacancy Rate 3.96%

30 September

2019

GBP'000

Administrative/operating expense per IFRS income 1,513

statement

Less: Ground rent costs (33)

EPRA Costs (including direct vacancy costs) 1,480

Direct vacancy costs (277)

EPRA Costs (excluding direct vacancy costs) 1,203

Gross Rental Income less ground rent costs 8,744

EPRA Cost Ratio (including direct vacancy costs) 16.93%

EPRA Cost Ratio (excluding direct vacancy costs) 13.76%

Company Information

Share Register Enquiries

The register for the Ordinary Shares is maintained by Computershare Investor

Services PLC. In the event of queries regarding your holding, please contact

the Registrar on 0370 889 4069 or email: web.queries@computershare.co.uk.

Changes of name and/or address must be notified in writing to the Registrar,

at the address shown below. You can check your shareholding and find

practical help on transferring shares or updating your details at

www.investorcentre.co.uk [2]. Shareholders eligible to receive dividend

payments gross of tax may also download declaration forms from that website.

Share Information

Ordinary GBP0.01 Shares 151,558,251

SEDOL Number BWD2415

ISIN Number GB00BWD24154

Ticker/TIDM AEWU

The Company's Ordinary Shares are traded on the Main Market of the London

Stock Exchange.

Annual and Interim Reports

Copies of the Annual and Interim Reports are available from the Company's

website: www.aewukreit.com [3].

Provisional Financial Calendar

31 March 2020 Year end

June 2020 Announcement of annual results

September 2020 Annual General Meeting

30 September 2020 Half-year end

November 2020 Announcement of interim results

Dividends

The following table summarises the dividends declared in relation to the

period:

GBP

Interim dividend for the period 1 April 2019 to 30 3,031,165

June 2019 (payment made on 30 August 2019)

Interim dividend for the period 1 July 2019 to 30 3,031,165

September 2019 (payment to be made on 29 November

2019)

Total 6,062,330

Independent Directors

Mark Burton (Non-executive Chairman)

Bim Sandhu (Non-executive Director)

Katrina Hart (Non-executive Director)

Registered Office

6th Floor

65 Gresham Street

London

EC2V 7NQ

Investment Manager and AIFM

AEW UK Investment Management LLP

33 Jermyn Street

London

SW1Y 6DN

Tel: 020 7016 4880

Website: www.aewuk.co.uk

Property Manager

M J Mapp

180 Great Portland Street

London

W1W 5QZ

Corporate Broker

Liberum

Ropemaker Place

25 Ropemaker Street

London

EC2Y 9LY

Legal Adviser

Gowling WLG (UK) LLP

4 More London Riverside

London

SE1 2AU

Depositary

Langham Hall UK LLP

8th Floor

1 Fleet Place

London

EC4M 7RA

Administrator

Link Alternative Fund Administrators Limited

Beaufort House

51 New North Road

Exeter

EX4 4EP

Company Secretary

Link Company Matters Limited

6th Floor

65 Gresham Street

London

EC2V 7NQ

Registrar

Computershare Investor Services PLC

The Pavilions