Israeli Markets Stabilize After Sunday Selloff, Global Oil Price Jumps

09 Ottobre 2023 - 10:31AM

Dow Jones News

By Dominic Chopping

Israeli stock and bond prices stabilized Monday following a

sharp selloff Sunday, while global oil prices surged after terror

group Hamas killed hundreds and took hostages over the weekend.

The weekend violence saw the largest indexes on Tel Aviv's stock

exchange fall by more than 6.5% on Sunday, but a slight rebound saw

them gain by around 0.5% on Monday morning in a choppy session.

The country's currency has weakened sharply against the U.S.

dollar Monday, falling 1.7% to a seven-year low and prompting

Israel's central bank to plan the sale of up to $30 billion in

foreign currencies to stabilize the shekel. The bank will also

provide an additional $15 billion in liquidity to the market

through swap mechanisms.

The mounting uncertainty in the region has seen oil prices jump,

with Brent crude up 2.8% to $86.94 a barrel while WTI is 3.3%

higher at $85.50 a barrel, having hit $87.24 a barrel earlier in

the session.

European defense stocks including Britain's BAE Systems,

Germany's Rheinmetall and Italy's Leonardo are strong gainers in

early European trade, while Saab, Dassault Aviation, QinetiQ Group

and Thales also higher.

At least 700 people have reportedly been killed in Israel and

more than 400 have been killed in Gaza. Palestinian militant groups

claimed to be holding more than 130 captives from the Israeli

side.

More than 48 hours after Hamas launched its unprecedented

incursion out of Gaza, Israeli forces were still battling with

militants holed up in several locations.

Write to Dominic Chopping at dominic.chopping@wsj.com

(END) Dow Jones Newswires

October 09, 2023 04:16 ET (08:16 GMT)

Copyright (c) 2023 Dow Jones & Company, Inc.

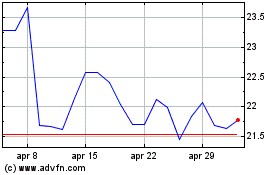

Grafico Azioni Leonardo (BIT:LDO)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Leonardo (BIT:LDO)

Storico

Da Dic 2023 a Dic 2024