Metrics Signal Bitcoin Price Increase – But When Is Anyone’s Guess

17 Giugno 2024 - 3:30PM

NEWSBTC

Bitcoin has been on a bumpy ride in recent days. The world’s most

popular cryptocurrency has seen its price steadily decline, raising

concerns about a prolonged bear market. However, beneath the

surface, some analysts are detecting faint bullish whispers that

could signal a potential reversal. Related Reading: XRP Whale Goes

On Shopping Spree: 27 Million Coins Snapped Up As Price Dips Buying

Pressure Emerges, But Can It Overcome The Downtrend? One glimmer of

hope comes from the Bitcoin Taker Buy Sell Ratio, a metric that

tracks the balance between buy and sell orders on exchanges.

According to NewBTC’s analysis, this ratio has recently dipped

below one, indicating a bearish sentiment. On several exchanges,

the ratio is rising back above one, suggesting that the trend is

recovering. This indicates a change in the psychology of the

market, as more buyers than sellers are making orders. This is a

positive development, the data shows. It indicates that some

investors are seeing the recent price drop as an opportunity to

accumulate Bitcoin at a discount. However, it’s crucial to remember

that this is just one metric, and the overall trend remains

bearish. Exchange Inflows: The Other Narrative Another interesting

wrinkle in the story comes from Bitcoin’s exchange netflow. This

metric measures the difference between Bitcoins entering and

leaving exchanges. A positive netflow indicates more Bitcoins

flowing into exchanges, which is typically seen as a bearish signal

because it could signify investors preparing to sell. However, the

current inflow seems relatively low compared to past outflows,

suggesting that the overall trend of accumulation might still be

intact. This is the other part of the narrative, analysts said. On

the one hand, increased exchange inflows could lead to selling

pressure. On the other hand, the relatively low volume compared to

past outflows suggests that some investors might be transferring

their holdings to private wallets for safekeeping, which could be a

bullish indicator in the long run. A Cautious Outlook Despite the

emergence of these bullish whispers, the overall sentiment

surrounding Bitcoin remains cautious. The price continues its

downward trajectory, with the current support level of $65,000

under immense pressure. If this level breaks, it could trigger a

further sell-off and exacerbate the bearish trend. Related Reading:

Polkadot (DOT) Struggles Near $6.30 – Is Now The Time To

Accumulate? Bitcoin is at a critical juncture, and the recent signs

of buying pressure and exchange inflows are encouraging, but they

need to be backed by a sustained price recovery. Until then,

investors should adopt a cautious approach and be prepared for

continued volatility. The coming days will be crucial in

determining the fate of Bitcoin’s current price movement. Whether

the bullish whispers can transform into a resounding roar or get

drowned out by the bearish undercurrent remains to be seen.

Featured image from Getty Images, chart from TradingView

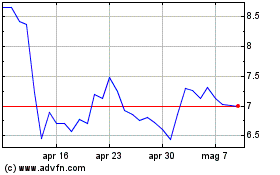

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Dic 2023 a Dic 2024