Polkadot (DOT) Bulls Push Toward $4.8 Resistance, Breakout Ahead?

08 Agosto 2024 - 8:00PM

NEWSBTC

Polkadot (DOT) has been gaining significant bullish momentum, with

its price steadily approaching the critical resistance level of

$4.8. This upward movement suggests a strong presence of positive

sentiment in the market. As DOT nears this key resistance,

speculations are about whether the bulls can maintain their

dominance and drive the price higher. A successful breakout above

$4.8 could signal the beginning of a new bullish phase, potentially

leading to further gains. However, failure to break this level

might result in a pullback. This article analyzes DOT’s recent

price action and its approach to the critical $4.8 resistance

level. With the help of technical indicators, it will evaluate the

significance of this resistance, assess market sentiment, and

predict potential future movements, including the likelihood of a

breakout. DOT was trading at around $4.73 and has increased by over

3.58% with a market capitalization of over $6.9 billion and a

trading volume of over $200 Million as of the time of writing. In

the last 24 hours, the asset’s market cap has increased by more

than 3.61%, while its trading volume has increased by more than

7.46% Market Sentiment: Are Bulls In Control? Currently, the price

of DOT on the 4-hour chart has been on a bullish move following a

rejection at the $3.5 support mark. It is now advancing toward the

$4.8 resistance mark and the 100-day Simple Moving Average (SMA).

Since breaching this key resistance level, the digital asset has

shown a consistent upward trend, indicating that the bulls are

gaining control and could drive the price even higher.

Additionally, an analysis of the 4-hour Relative Strength Index

(RSI) shows that the signal line of the indicator has successfully

risen above 50% and is currently heading to 60%, suggesting that

buying pressure is increasing and the asset might experience

further upward movement. On the 1-day chart, although DOT is still

trading below the 100-day SMA, it has successfully printed three

bullish momentum candlesticks approaching the $4.8 resistance

level. This indicates that the bulls remain in control, which could

help trigger a rally for DOT. Finally, on the 1-day chart, the RSI

signal line is ascending from the oversold zone toward 50%, further

supporting the potential for a continued rally and indicating that

the bulls are gaining control over the bears. Conclusion: Will DOT

Break Through Or Face Rejection? In conclusion, as DOT’s price

approaches the $4.8 resistance level, it could either break through

or encounter a rejection. A breakthrough above the $4.8 resistance

level, DOT might continue its bullish move to challenge the $6.2

resistance level. Once it breaks below this range, the digital

asset may move further to test the $7.7 level and probably other

key levels afterwards. Meanwhile, if DOT encounters rejection at

the $4.8 resistance level, it may start to decline toward the $3.5

support level. Should the price fall below this support, it could

drop more to test the $1.9 support point, potentially creating a

new low if this level is breached. Featured image from Adobe Stock,

chart from Tradingview.com

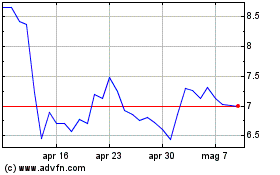

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Polkadot (COIN:DOTUSD)

Storico

Da Gen 2024 a Gen 2025