This Bitcoin Mining Giant Just Spent $100 Million To Buy BTC

27 Luglio 2024 - 7:00PM

NEWSBTC

Bitcoin mining behemoth, Marathon Digital has made headlines by

investing a staggering $100 million in BTC. This substantial

investment comes despite BTC’s previous price drops, underscoring

the mining giant’s confidence in the long term potential of the

pioneer cryptocurrency. MARA Buys $100 Million Worth Of BTC

In a press release published on Thursday, July 25, MARA, (recently

rebranded from Marathon Digital) announced that it has purchased an

additional $100 million worth of BTC. This substantial Bitcoin

investment marks a significant increase in MARA’s already

impressive Bitcoin holdings. Related Reading: Can Dogecoin

Replicate Its 2021 18,000% Run? Here’s What The Chart Says MARA’s

latest BTC acquisition has brought its balance sheet holdings to

about 20,000 BTC, valued at approximately $1.3 billion. The Bitcoin

mining company’s total holdings now represent nearly 0.1% of BTC’s

maximum supply of 21 million BTC. Notably, MARA’s substantial

BTC purchase comes at a time when the crypto market is steadily

recovering from previous bearish declines. Despite the constant

fluctuations in BTC’s price, MARA has taken advantage of recent

declines to heavily invest in Bitcoin in order to facilitate its

long term view of the crypto assets potential. At the time of

writing, the price of BTC is trading at $68,031, marking a 1.4%

increase in the last 24 hours and another 2.24% surge over the past

seven days, according to CoinMarketCap. Based on current exchange

rates and MARA’s balance sheet holdings, it could be estimated that

its recent acquisition totaled about 1,500 BTC. While MARA

has not disclosed the specific average price at which it acquired

the $100 million worth of BTC, the Bitcoin mining giant announced

that it will be adopting a full Hold On For Dear Life (HODL)

approach towards its Bitcoin treasury policy. Furthermore,

Michael Saylor, co-founder and former Chief Executive Officer (CEO)

of MicroStrategy, has commemorated MARA’s latest Bitcoin purchase

and its 20,000 BTC milestone. The popular Bitcoin billionaire has

urged Marathon Digital to increase their holdings to 26,200 BTC,

cleverly referencing the standard marathon distance of 26.2

miles. Bitcoin Mining Giant Unveils Full HODL Strategy

MARA also announced its decision to adopt a full HODL strategy for

its Bitcoin treasury, aiming to retain all the BTC mined during

operations instead of selling it. Additionally, the company

revealed that it will be periodically making strategic open market

purchases to further increase its considerable holdings.

Related Reading: Analyst Says XRP Remains Strongest Compared To

Bitcoin And Ethereum, Here’s Why Fred Thiel, MARA’s chairman and

CEO, emphasized the company’s strong belief in BTC’s long-term

value, encouraging governments and corporations to consider BTC as

a reserve asset. He elaborated that MARA sees Bitcoin as the best

treasury reserve asset globally and supports the idea of sovereign

wealth funds holding the pioneer cryptocurrency.

Additionally, Salman Khan, MARA’s Chief Financial Officer (CFO),

revealed that the Bitcoin mining firm once held all of its Bitcoin.

However due to recent market conditions, increased institutional

interest and improving macro environment, MARA has decided to

return a full HODL strategy. Featured image created with

Dall.E, chart from Tradingview.com

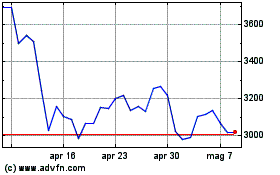

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Ethereum (COIN:ETHUSD)

Storico

Da Lug 2023 a Lug 2024