Liquidation Quandary: Litecoin Wallets Draining Fast – What’s Next For LTC Prices?

08 Dicembre 2023 - 12:00PM

NEWSBTC

Litecoin (LTC) suffered a major fall after a week of consistent

growth, posing possible difficulties going forward. According to

recent data, a significant proportion of wallets have sold their

Bitcoin holdings. As of this writing, LTC is trading at $74.60,

down 1.1% from its peak price over the previous day. This decline

has also had an effect on LTC’s market capitalization. With

Litecoin’s market value falling by 55% compared to Bitcoin in just

five months, the price chart for LTC presents a bleak image. This

sharp decline in value is indicative of investors’ diminishing

trust as they choose to sell off more and more of their holdings.

Related Reading: This BRC-20 Token Just Breached $1 Billion Market

Cap With 180% Rally Today – Details Litecoin Downturn: Small

Investors Flee, Raising Long-Term Viability Concerns Santiment

claims that 199,000 wallets that contained Litecoin around 10 days

ago are no longer in possession of the cryptocurrency. This pattern

could explain why, in comparison to other prominent

cryptocurrencies previously discussed, the coin has performed

comparatively poorly over the last week and year. ⚡️ Approximately

199K wallets that held $LTC 10 days ago, no longer hold any coins.

This is the biggest drop in wallets since October 2022. $LTC‘s

market value vs. $BTC has dropped -55% in 5 months, but #FUD &

small wallets dropping could turn this around.

https://t.co/tIAj6ULd95 pic.twitter.com/SuhqULLfFm — Santiment

(@santimentfeed) December 7, 2023 Interestingly, small-scale

holders account for the majority of the wallets that collapse,

which contrasts with the tenacity exhibited by Sharks and Whales in

the cryptocurrency space, according to Santiment. It seems that

small investors—who are frequently the most susceptible to market

swings—are the main group selling their holdings, presumably

because they are worried about the investments’ long-term

sustainability and liquidity. The significant departure of almost

199,000 wallets that previously contained LTC is a noteworthy

phenomena that should not be disregarded. The significant decline

in selling activity reflects a more widespread feeling of

apprehension, uncertainty, and skepticism that has negatively

impacted the asset. LTC market cap currently at $5.499 billion on

the daily chart: TradingView.com Up to 2.13% of all Litecoin

wallets have sold off their LTC since late November, according

to the most recent data. On the Litecoin network, at least 9.11

million addresses now hold zero coins. As some of the top

cryptocurrencies have experienced incredible price

increases—gaining over 100% in the year thus far—Litecoin has

remained relatively stable, showing a growth of less than 4% year

to date. For about two weeks, the price of LTC has been

consistently fluctuating between $70 and $75. In the second half of

the month, there was a narrow trading range between $68 and $72.

LTC’s Resilience: Navigating Liquidation In Leveraged Trading In

order to forcefully end a trader’s leveraged position once a trader

loses all or a portion of their initial margin, the exchange uses a

process known as liquidation. It occurs when a trader doesn’t have

enough money to maintain an open position in a leveraged position,

or can’t meet the margin requirements for the position. Source:

Bitpay LTC maintained a high trading volume even as its price went

sideways. Additionally, its MVRV ratio was higher, which is often

an indication of good health. However, even with a decline, its

Relative Strength Index (RSI) stayed over the neutral threshold of

50. By doing this, the coin may be able to satisfy investors and

continue its bull run. Related Reading: XRP Greed Index Soars,

Backed By Robust $1.3 Billion Volume – Good For Price? Meanwhile,

the biggest crypto payment processor in the world, BitPay, now

accepts LTC as its preferred coin. Beyond Bitcoin [BTC] and

Ethereum [ETH], it has demonstrated its supremacy in practical

applications, accounting for 34% of BitPay’s payment count in

cryptocurrency. (This site’s content should not be construed as

investment advice. Investing involves risk. When you invest, your

capital is subject to risk). Featured image from Shutterstock

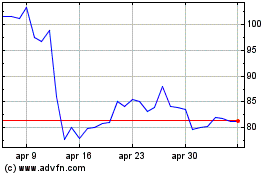

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni Litecoin (COIN:LTCUSD)

Storico

Da Lug 2023 a Lug 2024