These Events Will Be Key For Bitcoin And Crypto This Week

07 Novembre 2022 - 12:30PM

NEWSBTC

The Bitcoin and crypto market is kicking off what could be an

extremely important week. While the market is currently overwhelmed

by the news surrounding the battle between Binance CEO Changpeng

Zhao (“CZ”) and FTX CEO Sam Bankman-Fried (“SBF”), the midterm

elections and the release of the CPI data in the US are two major

events that could be of crucial importance for the market. As

Bitcoinist reports, CZ had announced on Sunday that Binance will

sell all of its FTT tokens after a report surfaced that FTX’s books

are in trouble. Even though FTX and Alameda have denied the rumors,

a lot of selling pressure is currently building on FTT. According

to some analysts, this “FUD” could have a significant impact on the

markets. As of press time, the Bitcoin price broke below the

important $21,000, a mark which was breached last Friday and has

been crossed for the first time since mid-September. Bitcoin Ahead

Of Midterm Elections Tomorrow, Tuesday, the midterm elections will

take place in the U.S., deciding how Congress will be composed

soon. As Bloomberg reports, the stakes are high for the Bitcoin and

crypto community. Related Reading: Bitcoin Price Surges As U.S.

October Jobs Data Comes To Light While the crypto industry waited

for clear regulation in 2022, several bills were introduced that

could have moved the industry forward. However, political disputes

between lawmakers and lobbyists, as well as time pressure,

prevented passage. Experts believe the debate will now drag into

2023, unless a crypto bill is attached to a government funding

package or another bill that absolutely must pass. “That makes the

midterm elections more important than ever,” Bloomberg reports.

Current predictions forecast that Republicans could take back both

the House and Senate, which could benefit the crypto industry. In

Cynthia Lummis and Tom Emmer, Republicans provide two of the crypto

industry’s biggest supporters. Bloomberg also estimates: A

Republican-controlled Congress would also likely put pressure on

agencies, like the SEC — which the industry has charged with

regulating through enforcement — to ease their aggressive posture

against crypto firms. CPI Data Release On Thursday Whether there

will be a positive impact on the market in the short term remains

to be seen, but it is rather unlikely. Instead, all eyes are likely

to be on Thursday, November 10. Related Reading: Bitcoin And Crypto

Ahead Of The Fed Hike Announcement – What to Expect On this day,

the new consumer price index (CPI) will be released. During the

last FOMC meeting of the U.S. central bank, Jerome Powell

emphasized conspicuously often that the data must be awaited in

order to determine the next steps in interest rate policy. In this

respect, Thursday could be a crucial day for financial markets. If

inflation comes in higher as expected, the markets could react with

a risk-sell-off. Conversely, if a significant drop in inflation is

reported, the start of a new recovery rally could be triggered in

anticipation of a slowing pace of rate hikes by the FED. Even more

important than CPI this time could be the core CPI, which measures

the change in the cost of goods and services excluding the food and

energy sectors. Provided the core CPI falls for the first time

after a three-month rise and producer prices (PPI) also fall on

November 15, this could be a powerful bullish sign for the markets.

In previous crises, such as in the 1970s and 1980s and also in

2008, the PPI was always a leading indicator of flattening

inflation, which ultimately led to the FED’s pivot on interest

rates. Thus, a falling CPI and core CPI could be the beginning of a

near shift for the Bitcoin and crypto market.

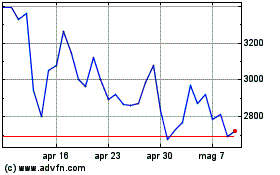

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Apr 2024 a Mag 2024

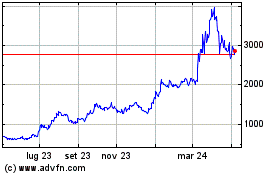

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mag 2023 a Mag 2024