Crypto Traders Wrecked As Trump’s Tariffs Spark $2 Billion Liquidation

03 Febbraio 2025 - 1:30PM

NEWSBTC

As February began, crypto investors found themselves inside a

turbulent market after the digital asset space went crashing down,

leading to more than $2 billion in crypto liquidations and Bitcoin

price plunged near the $90,000 mark. Related Reading: Bitcoin

Bull Market At Risk If Key $97,000 Support Level Fails To Hold,

Analyst Warns Analysts attributed the current turmoil in the

cryptocurrency sector to the new tariffs imposed by President

Donald Trump on Canada, Mexico, and China, raising questions on

what would be the long-term impact of the tariffs on digital

currencies. $2 Billion In Crypto Liquidations Trump said in a

statement that the US is eyeing to implement heftier tariffs on its

three largest trading partners, Canada, Mexico, and China, a

measure that sent shockwaves in the cryptocurrency community.

Market observers believe that Trump’s announcement fueled the crash

across the cryptocurrency sector, which saw massive leverage

liquidations among virtual currencies. Source: Coinglass According

to Coinglass, more than $2 billion in crypto liquidations were

recorded in the 24 hours after the planned new tariff was announced

by the US President. Data also showed that the prices of the

top-tier cryptocurrencies plunged after traders found themselves in

a turbulent market after the tariff announcement. Bitcoin plummeted

to $95,200, according to CoinGecko, the lowest price the firstborn

crypto has been in three weeks. Meanwhile, Ethereum went down to

about $2,800, wiping out all the gains it made since early

November. “In the short term, we’ve bottomed. Market makers have

used this tariff news cycle to sweep the leveraged longs and there

is now very little liquidity worthy of pushing price lower,” crypto

fund manager Merkle Tree Capital chief investment officer Ryan

McMillin said in an interview. Tariffs Might Trigger An Inflation

Analysts said that many investors are worried that the new tariff

would contribute to inflation which could impact sentiments on

digital assets. “Crypto is really the only way to express risk over

the weekend, and on news like this, crypto resorts to a risk

proxy,” Pepperstone head of research Chris Weston said. Nick

Forster, founder of Derive, a DeFi derivatives protocol, believes

that Trump’s new tariff would more likely push inflation up,

dampening investor sentiment in cryptocurrencies. “We’re already

seeing signs of heightened market volatility, as BTC’s 30-day

implied volatility has risen by 4% to 54% in the wake of these

tariffs and the broader economic uncertainty,” Forster said. The

DeFi derivatives protocol founder added that he expects that this

volatility would persist as “more negative catalysts likely unfold

in the coming weeks.” A Bitcoin Boom? Bitwise Asset Management’s

head of alpha strategies Jeff Park suggested that a Bitcoin boom

might be a potential positive effect of Trump’s tariff policies.

Related Reading: Bitcoin Price Nosedives Nearly 10%: Panic or

Buying Opportunity? Park explained that the new tariffs might

weaken the US dollar, creating a favorable condition that could

drive growth for Bitcoin, saying that as tariffs increase

inflation, it would affect both domestic consumers and

international trade partners, which might drive the residents of

foreign nations toward BTC to counter currency debasement. Featured

image from Getty Images, chart from TradingView

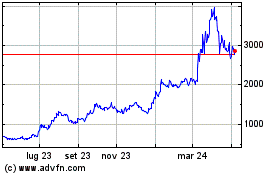

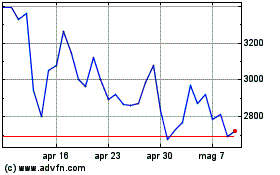

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Feb 2025 a Mar 2025

Grafico Azioni Maker (COIN:MKRUSD)

Storico

Da Mar 2024 a Mar 2025