Sleeping Giant Awakens! Ethereum Whale With Over 12,000 ETH Creates Noise

07 Aprile 2024 - 8:30PM

NEWSBTC

The Ethereum market is buzzing after a long-dormant “whale” – a

major investor holding a vast amount of cryptocurrency – resurfaced

and transferred a significant amount of ETH to the Kraken exchange.

This move has sparked speculation about a potential price drop, but

wider market trends suggest a more complex picture. Related

Reading: Bitcoin Dips, But Don’t Panic: ETFs See Three Days Of

Bullish Inflow On-chain analytics firm Spot On Chain has disclosed

that the investor, who participated in Ethereum’s Initial Coin

Offering (ICO) in 2014, recently deposited 1,069 ETH, valued at

roughly $3.56 million, to Kraken. Traditionally, deposits to

exchanges are seen as a sign of intent to sell, potentially putting

downward pressure on the price of ETH. This whale’s activity is

particularly noteworthy because of their participation in the

Ethereum ICO. Back in 2014, they acquired 12,566 ETH at a meager

$0.30 per token. The recent transfer represents just a fraction of

their holdings, but the sale price – over $3,300 per ETH –

signifies a massive profit for the early investor. An #Ethereum

#ICO participant returned after 1.12 years to deposit 1,069 $ETH

($3.56M) to #Kraken at $3,329 3 hours ago. The whale received

12,566 $ETH at #Ethereum Genesis in Jul 2015, at an ICO price of

~$0.31, And then distributed the $ETH across 12 wallets in 2017, of

which… pic.twitter.com/Lid1hItGik — Spot On Chain (@spotonchain)

April 6, 2024 Ethereum Market Shows Signs Of Accumulation While the

whale’s move might suggest a potential sell-off, on-chain data

reveals a broader trend that could offset its impact. According to

IntoTheBlock, a blockchain analytics company, the past quarter

witnessed a significant outflow of ETH from cryptocurrency

exchanges, totaling a staggering $4 billion. This movement suggests

that many investors are accumulating ETH, potentially anticipating

future price increases. Ether market cap currently at $409 billion.

Chart: TradingView.com Dencun Upgrade Fuels Ethereum Network

Activity The news comes on the heels of Ethereum’s successful

Dencun upgrade, implemented in March 2024. The upgrade aimed to

address the network’s scalability issues, specifically targeting

high transaction fees and slow processing times. Early signs appear

positive, with IntoTheBlock reporting a surge in activity on the

main optimistic rollups (Layer 2 scaling solutions) following the

upgrade. Weekly transaction volume reached highs of 32 million,

indicating increased network usage. While gas prices have risen

recently, they were initially significantly lower on many Layer 2

solutions after the upgrade. Related Reading: Solana Primed For

Takeoff? Expert Analysis Points To Buying Opportunity Market

Uncertainty Remains The combined effect of the whale’s sale, the

wider accumulation trend, and the Dencun upgrade’s impact on

network activity make it difficult to predict the short-term

direction of the Ethereum market. While the whale’s sale could

trigger a price dip, the broader accumulation trend suggests

underlying bullish sentiment. The Dencun upgrade’s success in

reducing transaction fees and increasing network usage could

further bolster investor confidence. Featured image from Pexels,

chart from TradingView

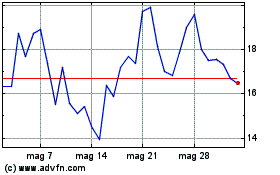

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Nov 2023 a Nov 2024