Chainlink (LINK) Forms Bullish Pattern That Led To 50% Rally On Average

19 Aprile 2024 - 3:00AM

NEWSBTC

On-chain data shows that a Chainlink indicator is currently forming

a pattern that has led to an average 50% increase for LINK in the

past. Chainlink 30-Day MVRV Ratio Has Plunged In a new post on X,

analyst Ali discussed the latest trend in Chainlink’s 30-day MVRV

ratio. The “Market Value to Realized Value (MVRV) ratio” is a

popular on-chain indicator that tracks the ratio between LINK’s

market cap and realized cap. The market cap naturally refers to the

total valuation of the asset’s circulating supply at the current

spot price. In contrast, the realized cap is a different type of

capitalization model that calculates the total value of the

cryptocurrency by instead taking the price at which each coin in

circulation last moved on the network as its “true” value. Related

Reading: 69% Of PEPE Holders Left In Profits After 26% Plunge Since

the last transaction of any coin was probably the last time it

changed hands, the price at its time would signify its current cost

basis. As such, the realized cap sums up the cost basis of every

coin in circulation. In this view, the realized cap would be

nothing but a measure of the total capital the investors have used

to purchase the asset. In contrast, the market cap represents the

value that they are holding right now. The MVRV ratio compares

these two models, and its value can provide hints about whether the

overall market holds more or less than it puts into Chainlink. In

the context of the current topic, the 30-day version of this

indicator is of focus, which restricts itself to only the investors

who bought within the past month. Here is the chart shared by the

analyst that shows the trend in this LINK indicator over the past

couple of years: The value of the metric seems to have registered a

steep decline in recent days | Source: @ali_charts on X As

displayed in the above graph, the Chainlink 30-day MVRV ratio has

recently taken a sharp plunge and dipped under the 0% mark. The 0%

mark is where the market cap and realized cap are exactly equal, so

below it, the latter would be greater than the former. When this is

the case, the investors are carrying losses. This recent plunge

into the negative has naturally come for the metric as the

cryptocurrency’s price has plummeted, putting the 30-day buyers

underwater. In the chart, Ali has highlighted a specific pattern

that Chainlink appears to have followed regarding this indicator,

plunging deep into the negative territory. “Each time Chainlink

MVRV 30-Day Ratio has dropped below -12.24% since August 2022, it’s

signaled a prime buying opportunity, averaging 50% returns!” notes

the analyst. Related Reading: Bitcoin Long-Term Holders Slow Down

After 700,000 BTC Selloff, Reversal Sign? Recently, the indicator

has declined towards 17.54%, meaning it’s below this level, which

has historically led to profitable buying windows for the coin. It

remains to be seen whether the pattern followed in the last two

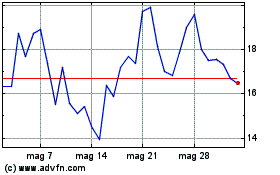

years will hold this time as well. LINK Price The past week has

been terrible for Chainlink investors. The asset’s price has

plunged by more than 23%, coming down to just $13.3 now. Looks like

the price of the coin has plunged recently | Source: LINKUSD on

TradingView Featured image from Shutterstock.com, Santiment.net,

chart from TradingView.com

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni Prime (COIN:PRIMEUSD)

Storico

Da Nov 2023 a Nov 2024