Bitcoin Could Be Ready For ‘Phase 2’ Of This Historical Bull Pattern

09 Novembre 2024 - 10:30AM

NEWSBTC

On-chain data shows Bitcoin could currently be following a similar

pattern as in a previous cycle in terms of this indicator. Bitcoin

Could Now Be Entering Phase 2 Of The Bull Run In a CryptoQuant

Quicktake post, an analyst has pointed out how the recent trend in

the Bitcoin long-term holder supply has been reminiscent to what

was observed in the 2017 cycle. The long-term holders (LTHs) make

up for one of the two main divisions of the BTC userbase done on

the basis of holding time, with the other side being known as the

short-term holders (STHs). The cutoff between these two cohorts is

155 days, with investors who bought inside this window being part

of the STHs, while those holding since more than it falling in the

LTHs. Related Reading: Bitcoin Sentiment Enters Danger Zone:

Investors Now Extremely Greedy Statistically, the longer an

investor holds onto their coins, the less likely they become to

sell said coins at any point. Thus, the LTHs are considered to

include the more resolute market participants. Below is a chart

that shows the trend in the combined amount of supply held by the

participants of the respective Bitcoin groups. As is visible in the

graph, the Bitcoin LTH supply observed a sharp decline back during

the rally of the first quarter of the year, suggesting that even

these diamond hands couldn’t resist the temptation of

profit-taking. Alongside this decrease in the LTH supply, the STH

supply naturally went up, as whenever the LTHs transfer their

tokens on the blockchain, they become part of the STH cohort

instead. Recently, the LTH supply had reversed this drawdown from

earlier in the year, but with the latest rally to the new all-time

high (ATH), the metric has again switched directions. In the chart,

the quant has highlighted how a similar pattern was also witnessed

back during the 2017 cycle; a first phase of distribution from the

LTHs was followed by accumulation, which then led to a second phase

of distribution. Related Reading: Dogecoin Descending Triangle

Could Hint At Next Destination For DOGE It’s possible that the

latest turnaround in the LTH supply is the start of the phase 2

distribution for the current cycle, where fresh capital flows in to

take coins off the hands of the HODLers. The LTH supply isn’t the

only metric that’s showing a trend that matches that of the

previous cycle. As the chart shared by the analyst shows, the

Bitcoin Binary CDD is also forming an interesting pattern. The

Binary Coin Days Destroyed (CDD) basically tells us about whether

the HODLers are selling less or more than the historical average.

From the graph, it’s apparent that the 152-day moving average (MA)

of this metric may be showing a second breakout similar to the one

that led into the 2021 bull run. BTC Price Bitcoin continues to be

in ATH exploration mode as its price is trading around $75,900.

Featured image from Dall-E, CryptoQuant.com, chart from

TradingView.com

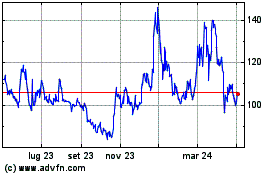

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

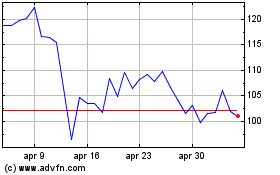

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025