Bitcoin Consolidates After Recent Surge – Metrics Reveal Moderate Selling Pressure

13 Novembre 2024 - 7:30PM

NEWSBTC

Bitcoin has reached a new all-time high of $90,243 following a week

of relentless upward momentum. After days marked by euphoria and

rapid gains, the price is now entering a consolidation phase,

providing a much-needed pause for the market. Key data from

CryptoQuant indicates moderate selling pressure is emerging, which

may signal a brief pullback or stabilization below the $90,000

mark. Related Reading: Dogecoin Could Target $2.4 If Price Aligns

With Macro Pattern – Details This week will be pivotal in

determining Bitcoin’s next steps as traders and investors watch if

BTC will hold near the $90,000 supply level or retreat to test

support around $80,000. With strong market fundamentals and

continued interest from bullish investors, the potential for

another rally remains high. However, a short consolidation

period could offer healthier groundwork for BTC’s long-term ascent.

All eyes will be on whether Bitcoin can sustain its current levels

or if this cooling-off phase will allow buyers to re-enter lower

demand zones, setting the stage for the next major price move.

Bitcoin Selling Pressure Still Far From Peak Levels Bitcoin has

reached a local top after setting a fresh all-time high, signaling

a potential pause in its recent surge. Analysts and investors are

watching closely, as BTC has a history of making aggressive moves

once it starts trending upward. Despite this bullish momentum, many

are exercising caution, anticipating that Bitcoin might need time

to consolidate before pushing higher. According to key data from

CryptoQuant analyst Axel Adler, the market is now experiencing

moderate selling pressure. Adler’s analysis points to a possible

consolidation phase, as short-term holders take profits. He

specifically examines the short-term holder realized profit and

loss data, which reveals that the current selling pressure is

relatively mild compared to historical peak selling periods. In

Adler’s view, this moderate pressure suggests that BTC’s recent

rally might not end. He highlights clusters of intense selling seen

in previous peaks, marked as Clusters #1, #2, and #3 on his chart,

showing levels of selling pressure significantly higher than what

we see today. This data implies that while some profit-taking is

underway, it’s nowhere near the intense levels seen at past tops.

Related Reading: Bitcoin Weekly RSI Entering Power Zone – Last Time

BTC Soared 80% As Bitcoin approaches consolidation, this subdued

selling pressure could set the foundation for a more stable rally.

Investors are eyeing this moment to gauge whether BTC will gather

strength for the next leg up or continue cooling off, forming a

solid base around current levels before another potential breakout.

BTC Testing New Supply Levels (Again) Bitcoin has officially

entered a much-anticipated price discovery phase, recently marking

a new all-time high of $90,243. Currently trading around $87,500,

BTC has experienced days of intense buying pressure and

record-setting highs. However, the market may see a period of

consolidation below the $90,000 threshold as traders assess new

demand levels, potentially around $80,000. The coming days will be

critical in determining BTC’s short-term path. If Bitcoin holds

above the $85,000 mark, this would signal resilience and likely

encourage a push toward higher supply zones as bullish momentum

builds. However, if BTC loses this level, a retracement to lower

demand of nearly $82,000 could come into play, allowing for a more

stable foundation before the next rally attempt. Related Reading:

Ethereum Weekly Volume Hits $60 Billion As ETH Aims For Yearly

Highs Analysts view this consolidation phase as necessary after

BTC’s rapid ascent, as it allows the market to establish support.

Holding within the current range would signal strength, suggesting

that BTC is well-positioned for further gains. Investors are now

watching closely, gauging whether BTC will secure its recent gains

or find a brief reset before aiming for new heights. Featured image

from Dall-E, chart from TradingView

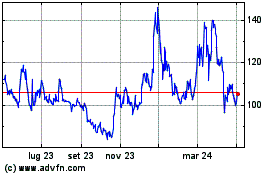

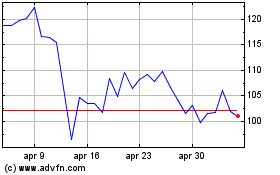

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025