Bitcoin To Smash $100,000? Rapid Stablecoin Exchange Inflows Continue

26 Novembre 2024 - 12:00AM

NEWSBTC

On-chain data shows exchanges have continued to receive stablecoin

deposits recently, a sign that could be bullish for Bitcoin and

other digital assets. Stablecoin Exchange Netflow Has Remained

Positive Recently As pointed out by an analyst in a CryptoQuant

Quicktake post, stablecoins have been flowing into exchanges

recently. The on-chain metric of relevance here is the “Exchange

Netflow,” which keeps track of the net amount of a given asset

that’s moving into or out of the wallets associated with

centralized platforms. When the value of this metric is positive,

it means the investors are making net deposits of the coin to

exchanges. Such a trend suggests the holders want to trade the

asset away. Related Reading: 54% Of Bitcoin Supply Inactive Since 2

Years Despite 500% Price Jump On the other hand, the indicator

being negative implies investors prefer to hold onto the

cryptocurrency, as they are taking their tokens off into

self-custody. The implication of these trends for the wider sector

and the asset itself can be different depending on the exact type

of coin that’s witnessing the outflows/inflows. In the case of

volatile assets like Bitcoin, a positive Netflow can be bearish for

the price, as it means the holders are looking to sell. BTC also

acts as one of the main transition points for capital in the sector

as a whole, so it being sold can be a bad sign for the rest of the

coins as well. Stablecoin deposits also imply traders want to sell

them, but since their price always remains stable around the $1

mark, the selling has no ‘bearish’ effect on them. Like Bitcoin,

the stablecoins act as a gateway for capital into the sector. More

particularly, investors invest their money into the stables

whenever they want to avoid the volatility associated with other

assets. Such holders usually eventually plan to delve into the

volatile coins, and once they are ready, they transfer these

fiat-tied tokens into exchanges to make the swap. This naturally

acts as buying pressure for whatever asset that they are shifting

to. As such, positive stablecoin Exchange Netflows are considered

bullish for Bitcoin. Now, here is the chart shared by the quant

that shows the recent trend in the Exchange Netflow for the

stablecoins: From the graph, it’s visible that the stablecoin

exchange netflow has mostly been sitting inside the positive

territory for the last few weeks. Alongside these inflows, Bitcoin

has been breaking record after record, so it’s likely that these

stablecoin deposits have been acting as fuel for the asset. Related

Reading: Bitcoin Officially In Overheated MVRV Zone, Rally End

Near? The indicator’s value has continued to show strength

recently, so it seems the investors aren’t done with their BTC

accumulation yet. If the earlier trend continues, the latest

stablecoin inflows can elongate the rally and perhaps help the

asset to finally break through the $100,000 dream target. Bitcoin

Price Bitcoin had seen a plunge under the $96,000 level yesterday,

but it appears the coin has already bounced back as its price is

now trading around $98,400. Featured image from Dall-E,

CryptoQuant.com, chart from TradingView.com

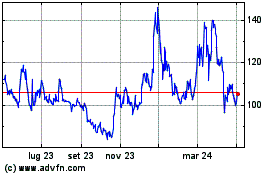

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Dic 2024 a Gen 2025

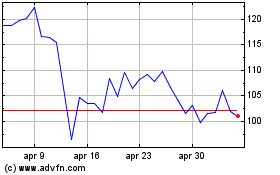

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Gen 2024 a Gen 2025