Bitcoin panic selling costs new investors $100M in 6 weeks — Research

14 Marzo 2025 - 10:29AM

Cointelegraph

Bitcoin (BTC) speculators have

secured losses of over $100 million in just six weeks thanks to

panic selling, new research calculates.

Data from onchain analytics platform CryptoQuant

reveals the true extent of recent capitulation by short-term

holders (STHs).

Bitcoin speculators run to the exit “in the red”

Bitcoin entities hodling coins between one and three months bore

the brunt of a brutal bull market drawdown — and many did not stay

the course.

CryptoQuant suggests that this section of the overall STH

investor cohort, defined as those buying up to six months ago, is

around $100 million out of pocket.

“This represents a significant reduction in the value of Bitcoin

held by this cohort, who are now underwater as many bought at

higher prices and are exiting with losses,” contributor Onchained

wrote in one of its “Quicktake” blog posts on March 13.

Onchained referenced the market cap and realized cap of the

relevant entities, corresponding to the current value of the BTC

they own versus the price at which they last moved onchain.

“The market capitalization (MC) of their holdings is now lower

than the realized capitalization (RC), signaling that these holders

are locking in realized losses,” the post continues.

“This behavior is contributing to increased selling

pressure and could lead to further downward price action in the

short term.”

Bitcoin 1-3 month investor market cap, realized cap

(screenshot). Source: CryptoQuant

An accompanying chart shows a dramatic negative weekly change in

the realized cap on a scale not seen in many months.

The cohort’s net unrealized profit/loss

(NUPL) score,

currently at -0.19, likewise suggests more coins being held

“underwater” than at any time over the past year.

Bitcoin 1-3 month investor NUPL. Source:

CryptoQuant

BTC price drawdown belies “broader bearish phase”

February marks just the latest trial for recent Bitcoin buyers,

with BTC/USD losing up to 30% versus its latest all-time highs seen

in mid-January.

Related:

Bitcoin price drops 2% as falling inflation boosts US

trade war fears

As Cointelegraph

reported, sudden corrections have tended to cost speculative

investors heavily, with loss-making sales commonplace as fear and

panic set in.

Large-volume entities, meanwhile, are increasingly

ignoring short-term BTC price fluctuations to add exposure at

levels around $80,000.

In its latest weekly report seen by Cointelegraph on March 12,

CryptoQuant warned that the current correction may be more

tenacious than it appears on the surface.

“Historically, bull market corrections tend to be short-lived

and followed by strong recoveries, but current on-chain indicators

point to a potential structural shift that could preclude a broader

bearish phase,” it summarized.

Bitcoin price drawdowns by year. Source:

CryptoQuant

This article does not

contain investment advice or recommendations. Every investment and

trading move involves risk, and readers should conduct their own

research when making a decision.

...

Continue reading Bitcoin panic selling costs new

investors $100M in 6 weeks — Research

The post

Bitcoin panic selling costs new investors $100M in 6

weeks — Research appeared first on

CoinTelegraph.

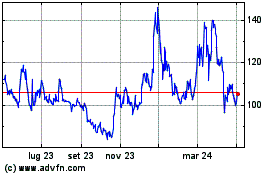

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Feb 2025 a Mar 2025

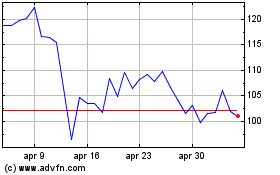

Grafico Azioni Quant (COIN:QNTUSD)

Storico

Da Mar 2024 a Mar 2025