Solana Dips Below $194 – A Continued Consolidation In Sight?

27 Dicembre 2024 - 2:30PM

NEWSBTC

Solana price action is at a critical juncture, with the

cryptocurrency testing market’s patience, it hovers just below the

pivotal $194 resistance level. This threshold has emerged as a

significant hurdle as bulls struggle to sustain enough momentum to

power a breakout despite recent attempts to push higher. The

current phase of consolidation raises important questions about

Solana’s next move. A successful breakout above this level could

signal the start of a fresh rally, propelling the price toward new

highs. However, failure to breach $194 might result in prolonged

sideways trading or a potential pullback. Technical Indicators

Signal Mixed Momentum Solana trading below the 100-day Simple

Moving Average (SMA) raises concerns about the possibility of

further downside movement. The 100-day SMA is a significant

technical indicator often used to assess an asset’s overall trend.

When the price consistently trades below this level, it typically

suggests that the market sentiment is leaning toward the bearish

side, with selling pressure outweighing buying activity. This

situation may signal that SOL is vulnerable to additional losses,

especially if the bears continue to dominate the market. A

sustained stay below the 100-day SMA might lead to a deeper

pullback, potentially testing lower support levels. However, for

the bulls to regain control, Solana would need to break above the

100-day SMA and turn it into a support level. Until then, the price

could struggle to mount a significant recovery as bearish forces

remain in play. Related Reading: Solana (SOL) Gearing Up: Is a New

Surge on the Horizon? Furthermore, the Relative Strength Index

(RSI) suggests that Solana’s price may be poised for an upward

move. After dipping to a low of 41%, the RSI line is now gradually

rising, indicating a possible shift in momentum. A level below 30%

typically signals oversold conditions, while levels above 70%

suggest overbought conditions. As the RSI recovers and climbs above

41%, this resurgence reflects a growing buying interest. A

continued upward movement in the RSI would support the case for an

increase in Solana’s price, with the possibility of breaking

through key resistance levels. Thus, the rising RSI could be a

positive indicator for traders, suggesting that Solana may undergo

a recovery in the near term. Market Sentiment: Solana Bulls And

Bears In Tug-of-War Solana’s price action below the $194 resistance

level reflects a classic battle between bullish optimism and

bearish caution. Bulls are fueled by the asset’s recent recovery

momentum and broader market support, aiming to push the price past

the critical resistance zone. A successful breakout above $194

could act as a strong bullish confirmation, attracting buying

interest and driving SOL to the next resistance level at $209.

Related Reading: Solana Holds Weekly Support At $180 – Analyst

Expects $330 Mid-Term Conversely, bears are equally resolute in

defending the $194 level, considering it a key pivot point to halt

the ongoing rally. If bears succeed in preventing the price from

surpassing this resistance, Solana could begin to decline again,

potentially heading toward the $164 support level and beyond.

Featured image from Adobe Stock, chart from Tradingview.com

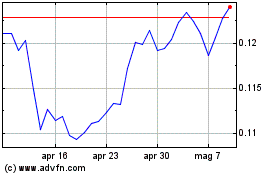

Grafico Azioni TRON (COIN:TRXUSD)

Storico

Da Nov 2024 a Dic 2024

Grafico Azioni TRON (COIN:TRXUSD)

Storico

Da Dic 2023 a Dic 2024