Atos publishes estimated 2024 year-end liquidity position well above business plan

20 Gennaio 2025 - 7:30PM

UK Regulatory

Atos publishes estimated 2024 year-end liquidity position well

above business plan

Press Release

Atos publishes

estimated 2024 year-end liquidity position well above business

plan

Paris, France

– January 20, 2025 – Atos SE (Euronext Paris : ATO) today

publishes an estimated 2024 year-end liquidity position well above

the level set out in the business plan presented as part of its

Accelerated Safeguard Plan. This publication is part of the regular

reporting requirements defined and agreed with the Group’s

financial creditors.

As at December 31,

2024, Atos liquidity is estimated at €2,191 million, more than one

billion euros above the €1,152 million expected cash position

presented in the Accelerated Safeguard Plan, and includes:

- Estimated €319 million of payments

received from customers, mostly public sector customers paying in

advance of invoice payment due dates;

- €240 million of net proceeds from

the sale of the Worldgrid business unit, which closed in December

2024;

- €440 million of undrawn Revolving

Credit Facility (“RCF”).

These three items are

not included in the definition of the year-end cash position

included in the business plan of the accelerated safeguard plan

that was approved by the specialized commercial Court of Nanterre

on October 24, 2024 (the “Accelerated Safeguard

Plan”).

Excluding these three

items, the 2024 year-end cash position would be estimated at €1,192

million, €40 million better than the 2024 year-end cash position of

€1,152 million presented in the Accelerated Safeguard Plan.

The liquidity report

is available on the company website

(https://atos.net/en/investors/financial-reports-for-creditors).

*

Atos SE confirms that information that could be

qualified as inside information within the meaning of Regulation

No. 596/2014 of 16 April 2014 on market abuse and that may have

been given on a confidential basis to its financial creditors has

been published to the market, either in the past or in the context

of this press release, with the aim of reestablishing equal access

to information relating to the Atos Group between the

investors.

*

***

Disclaimer

This document contains forward-looking statements that involve

risks and uncertainties, including references, concerning the

Group’s expected growth and profitability in the future which may

significantly impact the expected performance indicated in the

forward-looking statements. These risks and uncertainties are

linked to factors out of the control of the Company and not

precisely estimated, such as market conditions or competitors’

behaviors. Any forward-looking statements made in this document are

statements about Atos’s beliefs and expectations and should be

evaluated as such. Forward-looking statements include statements

that may relate to Atos’s plans, objectives, strategies, goals,

future events, future revenues or synergies, or performance, and

other information that is not historical information. Actual events

or results may differ from those described in this document due to

a number of risks and uncertainties that are described within the

2023 Universal Registration Document filed with the Autorité

des Marchés Financiers (AMF) on May 24, 2024 under the

registration number D.24-0429, as updated by chapter 2 “Risk

factors” of the first amendment to Atos' 2023 universal

registration document and by chapter 2 “Risk factors” of the second

amendment to Atos' 2023 universal registration document, and the

half-year report filed with the Autorité des Marchés Financiers

(AMF) on August 6, 2024. Atos does not undertake, and specifically

disclaims, any obligation or responsibility to update or amend any

of the information above except as otherwise required by law.

This document does not contain or constitute an offer of Atos’s

shares for sale or an invitation or inducement to invest in Atos’s

shares in France, the United States of America or any other

jurisdiction. This document includes information on specific

transactions that shall be considered as projects only. In

particular, any decision relating to the information or projects

mentioned in this document and their terms and conditions will only

be made after the ongoing in-depth analysis considering tax, legal,

operational, finance, HR and all other relevant aspects have been

completed and will be subject to general market conditions and

other customary conditions, including governance bodies and

shareholders’ approval as well as appropriate processes with the

relevant employee representative bodies in accordance with

applicable laws .

About

Atos

Atos is a global

leader in digital transformation with circa 82,000 employees and

annual revenue of circa €10 billion. European number one in

cybersecurity, cloud and high-performance computing, the Group

provides tailored end-to-end solutions for all industries in 69

countries. A pioneer in decarbonization services and products, Atos

is committed to a secure and decarbonized digital for its clients.

Atos is a SE (Societas Europaea) and listed on Euronext

Paris.

The purpose of

Atos is to help design the future of the information space.

Its expertise and services support the development of knowledge,

education and research in a multicultural approach and contribute

to the development of scientific and technological excellence.

Across the world, the Group enables its customers and employees,

and members of societies at large to live, work and develop

sustainably, in a safe and secure information space.

Contacts

Investor

relations:

David Pierre-Kahn | investors@atos.net | +33 6 28 51 45 96

Sofiane El Amri | investors@atos.net | +33 6 29 34 85 67

Individual

shareholders: 0805 65 00 75

Press contact: globalprteam@atos.net

- PR - Atos publishes December 31 2024 estimated liquidity

position - 20 January 2025

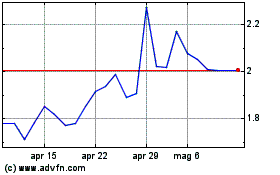

Grafico Azioni Atos (EU:ATO)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Atos (EU:ATO)

Storico

Da Gen 2024 a Gen 2025