DBV Technologies Reports Third Quarter 2024 Financial Results

Châtillon, France, November 6, 2024

DBV Technologies Reports Third Quarter

2024 Financial Results

DBV closes Q3 2024 with a cash balance

of $46.4 million; cash runway into Q1

2025

DBV Technologies (Euronext: DBV – ISIN:

FR0010417345 – Nasdaq Stock Market: DBVT – CUSIP: 23306J200), a

clinical-stage biopharmaceutical company, today reported financial

results for the third quarter of 2024. The quarterly and nine

months financial statements were approved by the Board of Directors

on November 6, 2024.

Financial Highlights for the third

quarter Ended September 30,

2024

The Company’s interim condensed consolidated

financial statements for the nine months ended September 30, 2024,

are prepared in accordance with accounting principles generally

accepted in the United States (“U.S. GAAP”).

Cash and Cash Equivalents

Cash and cash equivalents amounted to $46.4 million as of September

30, 2024, compared to $141.4 million as of December 31, 2023, a net

decrease of $95.0 million. This decrease includes $92.2 million in

operating activities, mainly in external clinical trial related

expenses, notably progress on patient enrollment in VITESSE Phase 3

clinical trial, as well as Regulatory and Manufacturing activities

to support ongoing clinical trials.

The Company has incurred operating losses and

negative cash flows from operations since inception. As of the date

of the filling, DBV’s available cash and cash equivalents will not

be sufficient to support our operating plan for at least the next

12 months. As such, there is substantial doubt regarding its

ability to continue as a going concern.

Based on its current operations, plans and

assumptions, the Company expects that its balance of cash and cash

equivalents will be sufficient to fund its operations into Q1

2025.

The Company intends to seek additional capital

as it continues research and development efforts and prepares for

the launch of Viaskin Peanut, if approved.

The Company cannot guarantee that it will be able to obtain the

necessary financing to meet its needs or to obtain funds at

attractive terms and conditions, including as a result of

disruptions or fluctuations of the global financial markets due to

various factors outside the Company's control. A severe or

prolonged economic downturn could result in a variety of risks to

the Company, including reduced ability to raise additional capital

when needed or on acceptable terms, if at all.

If the Company is not successful in its

financing objectives, the Company could have to scale back its

operations, notably by delaying or reducing the scope of its

research and development efforts or obtain financing through

arrangements with collaborators or others that may require the

Company to relinquish rights to its product candidates that the

Company might otherwise seek to develop or commercialize

independently.

In millions of USD

(unaudited)

|

U.S. GAAP |

|

nine months ended September 30, |

|

2024 |

2023 |

|

Net cash & cash equivalents at the beginning

of the period |

141.4 |

209.2 |

|

Net cash flow used in operating activities |

(92.2) |

(66.0) |

|

Net cash flow provided by / (used in) investing activities |

(1.5) |

(0.6) |

|

Net cash flow provided by / (used in) financing activities |

(0.1) |

7.0 |

|

Effect of exchange rate changes on cash & cash equivalents |

(1.1) |

(0.4) |

|

Net cash & cash equivalents at the end of the period |

46.4 |

149.1 |

This interim condensed financial information

does not include any adjustments to the carrying amounts and

classification of assets, liabilities, and reported expenses that

may be necessary if the Company was unable to continue as a going

concern.

Operating Income

Until the end of 2023, our operating income was composed of both

the French Research Tax Credit scheme (Crédit d’Impôt Recherche, or

“CIR”) and the revenue recognized under the Collaboration Agreement

with NESTEC. Following the termination of the Collaboration

Agreement on October 30, 2023, our operating income is now

exclusively generated by the French Research Tax Credit.

Operating income amounted to $3.6 million

for the 9 months ended September 30, 2024, compared with

$6.9 million for the same period in 2023. This decrease by

$3.2 million is composed of (1) $1.9 million following the

termination of the Collaboration Agreement with NESTEC, and (2) a

lower Research Tax Credit entitlement as a greater proportion of

studies activities are carried out in North America by $1.3

million

In millions of USD

(unaudited)

|

U.S. GAAP |

U.S. GAAP |

|

nine months ended September 30, |

three months ended September 30, |

|

2024 |

2023 |

2024 |

2023 |

|

Research tax credits |

3.6 |

5.0 |

1.1 |

1.2 |

|

Other operating income |

— |

1.9 |

— |

1.1 |

|

Operating income |

3.6 |

6.9 |

1.1 |

2.4 |

|

|

|

|

|

|

Operating Expenses

Operating expenses amounted to $96.4 million for the nine months

ended September 30, 2024, compared with $71.4 million for the nine

months ended September 30, 2023, an increase by $25.0 million.

This increase is primarily driven by Research & Development for

$23.0 million resulting from (1) patient enrollment in VITESSE

Phase 3 clinical trial, (2) preparatory activities for the

COMFORT studies in anticipation of initiation after FDA alignment,

(3) Regulatory and Manufacturing activities to support ongoing

clinical trials.

General and Administrative expenses increased by

$1.4 million during the nine months ended September 30, 2024,

compared to the nine months ended September 30, 2023, mainly due to

one-time costs associated with (1) office moves in France and the

U.S., (2) financing activities and (3) trademark and patent

activities.

In millions of USD

(unaudited)

|

U.S. GAAP |

U.S. GAAP |

|

nine months ended September 30, |

three months ended September 30, |

|

2024 |

2023 |

2024 |

2023 |

|

Research & Development |

(70.4) |

(47.4) |

(23.7) |

(13.8) |

|

Sales & Marketing |

(2.3) |

(1.6) |

(0.5) |

(0.7) |

|

General & Administrative |

(23.7) |

(22.3) |

(7.2) |

(6.2) |

|

Operating expenses |

(96.4) |

(71.4) |

(31.4) |

(20.6) |

Net Loss and Net Loss Per

Share

The Company recorded a net loss for the nine months ended September

30, 2024, of $90.9 million, compared to a net loss of $61.5

million for the nine months ended September 30, 2023.

On a per share basis, net loss (based on the

weighted average number of shares outstanding over the period) was

$(0.95) for the nine months ended September 30, 2024.

| |

U.S. GAAP |

U.S. GAAP |

| |

nine months ended September 30, |

three months ended September 30, |

|

|

2024 |

2023 |

2024 |

2023 |

|

Net income / (loss) (in millions of USD) |

(90.9) |

(61.5) |

(30.4) |

(16.7) |

|

Basic / diluted net income / (loss) per share (USD/share) |

(0.95) |

(0.65) |

(0.32) |

(0.17) |

CONDENSED CONSOLIDATED STATEMENTS OF

FINANCIAL POSITION

(unaudited)

In millions of USD

|

U.S. GAAP |

|

September 30, 2024 |

December 31, 2023 |

|

Assets |

93.1 |

183.0 |

|

of which cash & cash equivalents |

46.4 |

141.4 |

|

Liabilities |

39.0 |

42.8 |

|

Shareholders’ equity |

54.0 |

140.2 |

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS(unaudited)

In millions of USD

|

U.S. GAAP |

U.S. GAAP |

|

nine months ended September 30, |

three months ended September 30, |

|

2024 |

2023 |

2024 |

2023 |

|

Operating income |

3.6 |

6.9 |

1.1 |

2.4 |

|

Research & Development |

(70.4) |

(47.4) |

(23.7) |

(13.8) |

|

Sales & Marketing |

(2.3) |

(1.6) |

(0.5) |

(0.7) |

|

General & Administrative |

(23.7) |

(22.3) |

(7.2) |

(6.2) |

|

Operating expenses |

(96.4) |

(71.4) |

(31.4) |

(20.6) |

|

Financial income/(expenses) |

1.9 |

3.0 |

(0.1) |

1.5 |

|

Income tax |

— |

— |

— |

— |

|

Net loss |

(90.9) |

(61.5) |

(30.4) |

(16.7) |

|

Basic/diluted net loss per share attributable

to shareholders |

(0.95) |

(0.65) |

(0.32) |

(0.17) |

CONDENSED CONSOLIDATED STATEMENTS OF

CASH FLOWS (unaudited)

In millions of USD

|

U.S. GAAP |

|

nine months ended September 30, |

|

2024 |

2023 |

|

Net cash flows provided / (used) in operating activities |

(92.2) |

(66.0) |

|

Net cash flows provided / (used) in investing activities |

(1.5) |

(0.6) |

|

Net cash flows provided / (used) in financing activities |

(0.1) |

7.0 |

|

Effect of exchange rate changes on cash & cash equivalents

(U.S. GAAP presentation) |

(1.1) |

(0.4) |

|

Net increase / (decrease) in cash & cash equivalents |

(94.9) |

(60.1) |

|

Net cash & cash equivalents at the beginning of the period |

141.4 |

209.2 |

|

Net cash & cash equivalents at the end of the period |

46.4 |

149.1 |

About DBV Technologies

DBV Technologies is a clinical-stage biopharmaceutical company

developing treatment options for food allergies and other

immunologic conditions with significant unmet medical need. DBV is

currently focused on investigating the use of its proprietary

technology platform, Viaskin, to address food allergies, which are

caused by a hypersensitive immune reaction and characterized by a

range of symptoms varying in severity from mild to life-threatening

anaphylaxis. Millions of people live with food allergies, including

young children. Through epicutaneous immunotherapy (EPIT™), the

Viaskin platform is designed to introduce microgram amounts of a

biologically active compound to the immune system through intact

skin. EPIT is a new class of non-invasive treatment that seeks to

modify an individual’s underlying allergy by re-educating the

immune system to become desensitized to allergen by leveraging the

skin’s immune tolerizing properties. DBV is committed to

transforming the care of food allergic people. The Company’s food

allergy programs include ongoing clinical trials of Viaskin Peanut

in peanut allergic toddlers (1 through 3 years of age) and children

(4 through 7 years of age).

DBV Technologies is headquartered in Châtillon,

France, with North American operations in Warren, NJ. The Company’s

ordinary shares are traded on segment B of Euronext Paris (Ticker:

DBV, ISIN code: FR0010417345) and the Company’s ADSs (each

representing one ordinary share) are traded on the Nasdaq Capital

Select Market (Ticker: DBVT – CUSIP: 23306J200).

For more information, please visit

www.dbv-technologies.com and engage with us on X (formerly Twitter)

and LinkedIn.

Forward Looking Statements

This press release may contain forward-looking statements and

estimates, including statements regarding DBV’s financial

condition, forecast of its cash runway, the therapeutic potential

of Viaskin® Peanut patch and EPIT™, designs of DBV’s anticipated

clinical trials, DBV’s planned regulatory and clinical efforts

including timing and results of communications with regulatory

agencies, the ability of any of DBV’s product candidates, if

approved, to improve the lives of patients with food allergies.

These forward-looking statements and estimates are not promises or

guarantees and involve substantial risks and uncertainties. At this

stage, DBV’s product candidates have not been authorized for sale

in any country. Among the factors that could cause actual results

to differ materially from those described or projected herein

include uncertainties associated generally with research and

development, clinical trials and related regulatory reviews and

approvals, and DBV’s ability to successfully execute on its budget

discipline measures. A further list and description of risks and

uncertainties that could cause actual results to differ materially

from those set forth in the forward-looking statements in this

press release can be found in DBV’s regulatory filings with the

French Autorité des Marchés Financiers (“AMF”), DBV’s filings and

reports with the U.S. Securities and Exchange Commission (“SEC”),

including in DBV’s Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC on March 7, 2024, and future

filings and reports made with the AMF and SEC by DBV. Existing and

prospective investors are cautioned not to place undue reliance on

these forward-looking statements and estimates, which speak only as

of the date hereof. Other than as required by applicable law, DBV

Technologies undertakes no obligation to update or revise the

information contained in this Press Release.

Viaskin is a registered trademark and EPIT is a

trademark of DBV Technologies.

Investor Contact

Katie Matthews

DBV Technologies

katie.matthews@dbv-technologies.com

Media Contact

Angela Marcucci

DBV Technologies

angela.marcucci@dbv-technologies.com

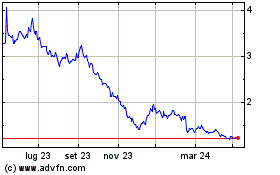

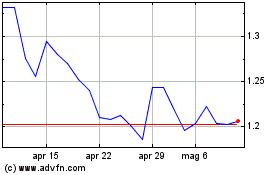

Grafico Azioni DBV Technologies (EU:DBV)

Storico

Da Ott 2024 a Nov 2024

Grafico Azioni DBV Technologies (EU:DBV)

Storico

Da Nov 2023 a Nov 2024