Maisons du Monde: FY2023 results and Medium-Term Transformation

Plan 2024-2026

PRESS RELEASENantes, 12 March

2024

FY2023 Results: Adjusted guidance fully

met across all criteria

- 3C plan produced tangible

results

- Customer focus

initiatives allowing for sales sequential improvement H2 vs

H1

- Cost reduction

resulting in circa €35 million in gross

savings on SG&A and logistics costs

- Strict Cash control

streamlining Capex by 50% and reducing inventory

by €43 million whilst improving product

availability

- Significant progress on our

ESG roadmap

- Reduction of our carbon

intensity1 by 18% vs

2018

- 36% of the Good is

beautiful selection in Maisons du Monde's offering in 2023

- Selected Climate Change “A

List” company by CDP (Carbon Disclosure Project)

- FY 2023 adjusted guidance

fully met across all criteria

- Group Sales: -9.3% yoy at

€1,125 million vs c. -10% adjusted guidance

- EBIT: €45.8

million vs adjusted guidance €40m-€50m

- FCF: €27.4 million

vs adjusted guidance €20m-€30m

- Payout ratio of 30% consistent

with range announced in October,amounting to €0.06

dividend per share, to be submitted at the General Meeting on 21

June

Inspire

everyday2024-2026 Transformation Plan

François-Melchior de Polignac, CEO of Maisons du Monde

commented:

"Maisons du Monde’s 2024-2026 transformation

plan, ‘Inspire everyday’ is backed by an enriched

and highly engaged Board, and is being undertaken by a renewed

executive team, and our committed associates. By focusing on

customer needs and operational excellence, we are laying the

groundwork for sustainable profitable growth. With a strong focus

on simplification and financial discipline, we are increasing cash

returns. Over this three-year journey, Maisons du Monde will

transition into a more asset-light operator and evolve further into

a lifestyle brand. This shift will improve returns on capital

employed and enhance shareholder value.”

- A pragmatic

transformation already under way, leveraging Maisons du Monde’s

unique assets, fixing customer centricity and execution challenges,

and resolutely focusing on cash returns with a shift towards an

asset-light approach

- Structurally

optimizing our commercial model to better meet customer

needs:Net reduction of assortment by 25%

- Simplifying

our operating model to unlock value creation:

Streamline supplier portfolio by 50%

- Challenging

100% of our costs to reinvest in our

development:€85 million gross cost

savings2 over 3

years

- Reducing

capital intensity with a more balanced and optimized

footprint: 40-50 store closures/transfers and circa 30% of

the network under affiliation/franchise by 2026

- 2024-2026

financial trajectory

- 2024: a

pivotal year to transform the commercial model and lay the

foundations for growth

- Progressive return to topline

growth in 2025-2026

- Cumulative FCF above €100

million over 3 years

VIDEO WEBCAST FOR

INVESTORS AND

ANALYSTS

Presentation in English. Questions by chat from the

webcast platform

Date: 12 March 2024 at 9:30 am CET

Speakers: François-Melchior de Polignac, CEO / Denis Lamoureux,

CFO / Gilles Lemaire, Deputy CFOConnection details: Webcast

link :

https://edge.media-server.com/mmc/p/tvsty332

***

FY 2023 RESULTS

FY 2023 SALES

FY 2023 Group sales reached

€1,125.4 million, reflecting a year-on-year decline of -9.3%,

amidst a low cycle in the Home & furniture market, intensified

by macro headwinds (geopolitical uncertainties, unprecedented

inflation, deteriorated consumer confidence).

|

|

FY 2023 |

FY 2022 |

%Change |

|

(in EUR million) |

|

Group GMV |

1 263.9 |

1 337.1 |

-5.5% |

|

Sales |

1 125.4 |

1 240.4 |

-9.3% |

|

Sales by product

category |

|

|

|

|

Decoration |

648.2 |

719.8 |

-9.9% |

|

% of sales |

57.6% |

58.0% |

|

|

Furniture |

477.2 |

520.6 |

-8.4% |

|

% of sales |

42.4% |

42.0% |

|

|

Sales by

channel |

|

|

|

|

Stores |

815.7 |

880.9 |

-7.4% |

|

% of sales |

72.5% |

71.0% |

|

|

Online |

309.6 |

359.6 |

-13.9% |

|

% of sales |

27.5% |

29.0% |

|

|

Sales by

geography |

|

|

|

|

France |

622.9 |

663.8 |

-6.2% |

|

% of sales |

55.3% |

53.5% |

|

|

International |

502.5 |

576.6 |

-12.9% |

|

% of sales |

44.7% |

46.5% |

|

The Group continued its proactive store

portfolio management. At the end of December 2023, the store

portfolio reached 340 own stores following 18 net closures o/w 5

transfers to affiliates, as anticipated.

FY 2023 FINANCIAL

PERFORMANCE

EBIT

|

In € million |

2023 |

2022 |

%Change |

|

Sales |

1,125.4 |

1,240.4 |

-9.3% |

|

Cost of goods sold |

(399.6) |

(437.9) |

-8.7% |

|

Gross margin |

725.8 |

802.5 |

-9.6% |

|

As a % of Sales |

64.5% |

64.7% |

|

|

Store operating and central costs |

(382.8) |

(415.9) |

-8.0% |

|

Logistics costs |

(135.5) |

(159.6) |

-15.1% |

|

Operating Costs |

(518.3) |

(575.5) |

-10.0% |

|

EBITDA |

207.6 |

227.0 |

-8.6% |

|

As a % of Sales |

18.4% |

18.3% |

|

Depreciation, amortization, and allowance for provisions |

(161.8) |

(158.5) |

2.1% |

|

As a % of Sales |

14.4% |

12.8% |

|

|

EBIT |

45.8 |

68.5 |

-33.1% |

|

As a % of Sales |

4.1% |

5.5% |

|

While EBIT was impacted by sales decline,

Gross margin rate remained relatively stable at

64.5%, thanks to savings from normalized freight costs and the

positive contribution from the Marketplace, which were reinvested

in promotional activities, improving price accessibility, and

clearing old inventories.

Store operating and central

costs decreased by 8.0%. 3C plan initiatives on costs have

more than compensated inflation with a €25 million gross savings on

SG&A. Additional savings were driven by lower volumes and

one-time items (e.g. expired gift cards write-off).

Logistics costs decreased by

15.1% as a result of €10 million 3C plan cost optimization

measures. Additional savings were driven notably by efficiently

leveraging lower volumes.

EBITDA margin remained stable

at 18.4% despite loss of volumes, notably as a result of cost

initiatives undertaken within the 3C plan.

Slight increase in Depreciation and

Amortization (D&A) mainly due to the start of

amortization of our second distribution center in Northern

France.

EBIT margin decreased from 5.5%

to 4.1%, impacted by D&A slight increase in a context of sales

decline.

Net income amounted to €8.8

million vs €34.2 million in 2022. EPS was €0.21, compared to €0.80

in 2022.It included:

-

Other operating income and expenses, at €(8.9) million, mainly

related to store closure costs.

-

Net financial result at €(22.3) million vs €(18.2) million in 2022,

mainly due to higher interests on lease debt (€13.5 million vs

€12.4 million in 2022), as well as €0.9 million losses on currency

transactions vs a gain of €1.9 million in 2022.

-

Income tax, representing €5.2 million vs €18.4 million in

2022.

Free Cash

Flow3: Streamlined Capex and

tight inventory management nearly offsetting volume

impact

|

In € million |

31 Dec. 2023 |

|

31 Dec. 2022 |

|

EBITDA |

|

207.6 |

227.0 |

|

Change in working capital |

0.2 |

(2.8) |

|

Change in other operating items |

(19.1) |

(12.2) |

|

Net cash

generated by operating

activities |

188.7 |

212.0 |

|

Capital expenditures (Capex) |

(33.0) |

(66.6) |

|

Change in debt on fixed assets |

(2.5) |

5.3 |

|

Proceeds from sale of non-current assets |

1.9 |

0.8 |

|

Decrease in lease debt |

(114.4) |

(107.3) |

|

Decrease in lease debt/Lease interest paid |

(13.3) |

(11.8) |

|

Free cash

flow |

27.4 |

32.3 |

In 2023, Capex reached €33 million representing

a 50% decrease from last year. The implementation of a rigorous

payback approach, coupled with reduced Capex on the second

distribution center, has enabled Maisons du Monde to align with

market standards. Capex on sales ratio decreased from 5.4% in 2022

to 2.9% in 2023.

In terms of working capital requirements,

Maisons du Monde improved its inventory levels, decreasing from

€245.7 million in December 2022 to €202.2 million. This reflects

tight monitoring and old inventory liquidation, with DIO4 lowered

by half a month compared to last year, whilst improving product

availability. Working capital effects were limited due to reduced

purchases.

Thanks to these actions, Free Cash

Flow demonstrated strong resilience, amounting to €27.4

million compared to €32.3 million in December 2022.

|

Effective management of net financial debt |

|

In € million |

|

31 Dec. 2023 |

|

31 Dec. 2022 |

|

Convertible bonds (“OCEANE”) |

- |

195.6 |

|

Term loan |

100.0 |

(0.5) |

|

Revolving Credit Facilities (RCFs) |

(1.0) |

(0.7) |

|

Share buyback |

- |

28.1 |

|

Other debt |

20.1 |

1.7 |

|

Gross debt |

119.1 |

224.2 |

|

Finance leases |

571.0 |

613.1 |

|

Cash & cash equivalents |

(29.9) |

(121.3) |

|

Net debt (IFRS

16) |

660.2 |

716.0 |

|

Less: Lease debt (IFRS 16) |

(571.0) |

(613.1) |

|

Plus: Lease debt (finance lease) |

1.2 |

2.2 |

|

Net debt |

90.4 |

105.1 |

|

LTM (Last twelve months) EBITDA5 |

81.3 |

109.5 |

|

Leverage |

1.11x |

0.96X |

Maisons du Monde reduced its net debt position

by €15 million compared to 2022. With cash and cash equivalent

totaling €29.9 million, Maisons du Monde’s net debt position as of

31 December 2023 amounted to €90.4 million.

As previously announced, Maisons du Monde repaid

the €200 million “OCEANE” convertible bonds on 6 December 2023.

This repayment was done through a combination of a €100 million

term loan, a €14 million loan from BPI and €86 million in cash.

The Group also increased its RCF credit line

from €150 million to nearly €200 million, with an extended maturity

to April 2028. This credit line is undrawn as of 31 December 2023

and the Group benefits from circa €200 million of liquidity.

GOVERNANCE

As announced on 29 February, 2024, Denis

Lamoureux was appointed Chief Financial Officer. He started his new

role on 4 March and is part of the Executive Committee.Gilles

Lemaire, Group Controlling Director, acting CFO since 1st September

2023, was appointed Deputy Chief Financial Officer.

PROPOSED DIVIDEND

General Meeting is scheduled to be held on 21 June 2024.

Shareholders will be asked to approve the payment of a dividend of

€0.06per share for the 2023 financial year, translating to a 30%

payout ratio. The ex-dividend date is 3 July 2024, with payment on

6 July 2024.

MEDIUM TERM TRANSFORMATION PLAN

Inspire everyday transformation

plan is designed to restore Maisons du Monde’s growth and enhance

FCF generation, leveraging the strong foundations laid by the 3C

Plan, focusing on Customer centricity, and prioritizing operational

excellence (Costs) and financial efficiency (Cash).

This transformation plan is based on two

fundamental pillars that will pave the way for Maison du Monde’s

journey from 2024 to 2026:

-

Driving the transformation of our commercial model to win: rethink

our offer, enhance in-store experience, strengthen growth levers,

notably the Marketplace, and enrich our model with services,

- While

streamlining our operational model: simplify the value chain,

develop “think global/act local” approach to store operations, and

reduce capital intensity.

Over the 2024–2026 period, the Group is

expected to generate a cumulative Free Cash Flow above €100

million.

The FCF generation should increase over the

duration of the plan. We expect positive FCF to continue in 2024,

despite a significant portion of our FCF being reinvested into the

transformation of the Group, and seizing opportunities to

accelerate this transformation.

To secure FCF generation, Maisons du Monde will notably focus

on:

-

Delivering €85 million gross cost savings over 3

years, building upon the €25 million and €35 million plans

of 2022 and 2023

- Reducing capital intensity

with:

- a more standardized Capex on

sales ratio of circa 3%, already achieved in 2023,

representing a notable reduction compared to 2019-2022 period

- further optimizing inventory,

with 1 month reduction of MoH6

- a more balanced and optimized

retail store network:40-50 store closures/transfers and

circa 30% of the network under affiliation/franchise by 2026

Over the three-year period, the Group will maintain its 30%-40%

dividend payout ratio.

Disclaimer:

Forward Looking

Statement

This press release contains certain statements

that constitute "forward-looking statements," including but not

limited to statements that are predictions of or indicate future

events, trends, plans or objectives, based on certain assumptions

or which do not directly relate to historical or current facts.

Such forward-looking statements are based on management's current

expectations and beliefs and are subject to a number of risks and

uncertainties that could cause actual results to differ materially

from the future results expressed, forecasted or implied by such

forward- looking statements. Accordingly, no representation is made

that any of these statements or forecasts will come to pass or that

any forecast results will be achieved. Any forward-looking

statements included in this press release speak only as of the date

hereof and will not give rise to updates or revision. For a more

complete list and description of such risks and uncertainties,

refer to Maisons du Monde’s filings with the French Autorité des

marchés financiers.

Financial calendar

15 May

2024 Q1

2024 Sales

21 June

2024 Annual

General Meeting

29 July

2024 Half-Year

2024 Results

23 October

2024 Q3

2024 Sales

About Maisons du Monde

Maisons du Monde is the leading player in

inspiring, accessible, and sustainable home and decoration. The

Brand offers a rich and constantly refreshed range of furniture and

decorative items in a multitude of styles. Leveraging a highly

efficient omnichannel model and direct access to consumers, the

Group generates over 50% of its sales through its online platform

and operates in 10 European countries.

corporate.maisonsdumonde.com

Contacts

|

Investor Relations |

Press Relations |

|

Carole Alexandre Tel: (+33) 6 30 85 12 78 |

Pierre Barbe Tel: (+33) 6 23 23 08 51 |

|

calexandre@maisonsdumonde.com |

pbarbe@maisonsdumonde.com |

1 In tCO2 by million euros sales2 €145 million gross cost

savings over a five-year span (2022-2026) 3 Free-Cash Flow defined

as Operational cash flow generation after Capex, consistent with

historical financial communication4 Days Inventory Outstanding – in

months of COGS5 EBITDA of €207.6 million is restated in accordance

with the senior credit facility agreement dated April 22, 2022

6 Months of Inventory on Hand

- 2024.03.12 MdM Presse Release_FY23 results and Mid-Term

transformation plan_FOR RELEASE

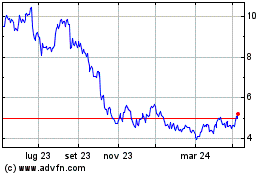

Grafico Azioni Maisons du Monde (EU:MDM)

Storico

Da Dic 2024 a Gen 2025

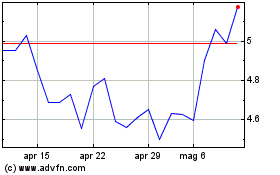

Grafico Azioni Maisons du Monde (EU:MDM)

Storico

Da Gen 2024 a Gen 2025