Technip Energies Financial Results for the First Nine Months of

2024

TECHNIP ENERGIES 9M 2024

FINANCIAL RESULTS

Strong 9M performance and substantial EPS

growth; upgrading full year guidance

| |

|

|

| |

- Strong

revenue growth of 13% Y/Y; upgrade 2024 revenue guidance to €6.5 -

6.8bn from €6.1 - 6.6bn

- Recurring EBIT

margin stable at 7.2%; diluted EPS up 35% Y/Y

- Successful

completion of €100m share buyback program

- Well positioned

for notable prospects that enable diversification by geography and

in new markets

|

|

| |

|

|

Paris, Thursday, October 31, 2024. Technip

Energies (the “Company”), a leading Engineering

& Technology company for the energy transition, today announces

its unaudited financial results for the first nine months of

2024.

Arnaud Pieton, Chief Executive Officer of Technip

Energies, commented:

“I am delighted to report a highly robust

performance by Technip Energies (T.EN) in the first nine months of

2024, evidenced by year-over-year revenue growth of 13%, sustained

profitability, and substantial growth in net income. These results

demonstrate the strength of our business model and execution, and

the impressive dedication of our teams across the globe. As a

result, we are raising full year revenue

guidance.”

“Our order intake year-to-date is in line

with revenue, and we are very confident that orders will exceed

revenue on a full-year basis. Our confidence is bolstered by our

recent selection for the delivery of large modules for a

major offshore project in the Americas. We have

also recently secured an important award for Rely, our

joint venture for green hydrogen and Power-to-X, to provide

services for one of the world's largest green ammonia plants

for AM Green in India, and, we celebrated a

technology first with an award for our proprietary low-emission

cracking ethylene furnace for CPChem in the US.”

“In addition, we secured our position on

notable projects that will reinforce and diversify our backlog in

2025 and beyond. This includes our selection by Lake Charles LNG

for a major export terminal in the US, as well a front-end

engineering design (FEED) award on Rovuma LNG in Mozambique - both

projects underscore our continued leadership in modularized LNG

trains.”

“Our strategic focus provides for sustained

growth and success in promising new industries including blue

molecules and carbon capture. In the third quarter, bp awarded T.EN

a FEED for its H2Teesside project, which is expected to be one of

the UK’s largest blue hydrogen production facilities. This

reinforces our position in the UK’s first decarbonized industrial

cluster, where we have also been selected for the NZT Power

carbon-capture project, pending final investment decision. These

awards are establishing T.EN’s early leadership in growth

markets.”

“With the completion of our share buyback

program and planned cancellation of treasury shares, T.EN will have

returned more than €170 million in cash to shareholders during 2024

through dividends and buybacks - roughly equivalent to

4.5% of our market capitalization - a clear and

tangible sign of our commitment to shareholder returns.”

“Finally, we are looking forward to engaging

with our investor community at our Capital Markets Day on November

21, 2024 and sharing more about our vision for T.EN’s bright

future.”

Key financials – adjusted IFRS

|

(In € millions, except EPS and %) |

9M 2024 |

9M 2023 |

|

Revenue |

4,970.8 |

4,407.4 |

|

Recurring EBIT |

356.7 |

318.6 |

|

Recurring EBIT margin % |

7.2% |

7.2% |

|

Net profit |

279.9 |

207.3 |

|

Diluted earnings per share(1) |

€1.55 |

€1.15 |

|

|

|

|

|

Order intake |

4,813.5 |

9,507.9 |

|

Backlog |

15,852.8 |

18,029.9 |

Financial information is presented under adjusted IFRS (see

Appendix 8.0 for complete definition). Reconciliation of IFRS to

non-IFRS financial measures are provided in appendices.

(1)9M 2024 and 9M 2023 diluted earnings per

share have been calculated using the weighted average number of

outstanding shares of 180,857,615 and 179,935,170

respectively. |

Key financials – IFRS

|

(In € millions, except EPS) |

9M 2024 |

9M 2023 |

|

Revenue |

4,778.5 |

4,367.5 |

|

Net profit |

276.5 |

210.5 |

|

Diluted earnings per share(1) |

€1.53 |

€1.17 |

|

(1)9M 2024 and 9M 2023 diluted earnings per

share have been calculated using the weighted average number of

outstanding shares of 180,857,615 and 179,935,170

respectively. |

Updating 2024 full company guidance – adjusted

IFRS

|

Revenue |

€6.5 – 6.8 billion (prior guidance: €6.1 – 6.6

billion) |

|

Recurring EBIT margin |

7.0% – 7.5% |

|

Effective tax rate |

29% – 33% (prior guidance: 26% – 30 %) |

|

Diluted earnings per

share(1) |

Double-digit growth |

Financial information is presented under adjusted IFRS (see

Appendix 8.0 for complete definition). Reconciliation of IFRS to

non-IFRS financial measures are provided in appendices.

(1) Diluted earnings per share growth

excludes potential enhancement from share buyback program

|

Capital Markets Day - November 21, 2024,

London

Technip Energies will update on its strategy and

business outlook during a Capital Markets Event in London on

November 21, 2024.

Conference call information

Technip Energies will host its 9M 2024 results

conference call and webcast on Thursday, October 31, 2024 at 13:00

CET. Dial-in details:

France: +33 1 70 91 87 04

United Kingdom: +44 1 212818004

United States: +1 718 7058796

Conference Code: 880901

The event will be webcast simultaneously and can

be accessed at: T.EN 9M 2024 Webcast

Contacts

Investor Relations

Phillip Lindsay

Vice President, Investor Relations

Tel: +44 20 7585 5051

Email: Phillip Lindsay

Media Relations

Jason Hyonne

Manager, Press Relations & Social Media

Tel: +33 1 47 78 22 89

Email: Jason Hyonne

About Technip Energies

Technip Energies is a leading Engineering & Technology company

for the energy transition, with leadership positions in LNG,

hydrogen and ethylene as well as growing market positions in blue

and green hydrogen, sustainable chemistry and CO2 management. The

Company benefits from its robust Project Delivery model supported

by an extensive Technology, Products and Services offering.

Operating in 34 countries, our 16,000 employees are fully committed

to bringing our clients’ innovative projects to life, breaking

boundaries to accelerate the energy transition for a better

tomorrow.

Technip Energies shares are listed on Euronext Paris. In addition,

Technip Energies has a Level 1 sponsored American Depositary

Receipts (“ADR”) program, with its ADRs trading

over-the-counter.

For further information: www.ten.com. |

Operational and financial review

Order intake, backlog and backlog

scheduling

Adjusted order intake for 9M 2024 amounted to

€4,814 million, equivalent to a book-to-bill of 1.0. Adjusted order

intake in the third quarter included a services contract award to

Rely, T.EN’s green hydrogen joint venture, from AM Green for

India’s largest green ammonia complex, a Front-End Engineering and

Design (FEED) contract by ExxonMobil for the Rovuma LNG project in

Mozambique, a FEED contract by bp for the low-carbon hydrogen

H2Teesside project in the UK, as well as other services contracts

and smaller projects. Also in the third quarter, T.EN was selected

for a major* Engineering, Procurement, Fabrication and

Construction (EPFC) project by Lake Charles LNG in the US (award

pending customer final investment decision) and announced the award

of an Engineering and Procurement contract by CPChem for the supply

of a proprietary low emission cracking furnace for an existing

olefins unit in the US.

H1 2024 commercial highlights are included here:

T.EN H1 2024 financial results.

* A “major” award for Technip Energies is a

contract award representing above €1 billion of revenue.

|

(In € millions) |

9M 2024 |

9M 2023 |

|

Adjusted order intake |

4,813.5 |

9,507.9 |

|

Project Delivery |

3,439.5 |

8,133.7 |

|

Technology, Products & Services |

1,374.1 |

1,374.2 |

|

Reconciliation of IFRS to non-IFRS financial measures are

provided in appendices. |

Adjusted backlog increased by 1% to €15.9

billion compared to December 31, 2023, equivalent to 2.6x FY 2023

revenue.

|

(In € millions) |

9M 2024 |

FY 2023 |

|

Adjusted backlog |

15,852.8 |

15,713.3 |

|

Project Delivery |

14,159.7 |

13,884.1 |

|

Technology, Products & Services |

1,693.1 |

1,829.2 |

Reconciliation of IFRS to non-IFRS financial measures are provided

in appendices.

Adjusted backlog at September 30, 2024, has been impacted

positively by foreign exchange of €0.6 million. |

The table below provides estimated backlog

scheduling as of September 30, 2024.

|

(In € millions) |

2024 (3M) |

FY 2025 |

FY 2026+ |

|

Adjusted backlog |

1,701.1 |

5,079.7 |

9,072.0 |

|

|

Company financial

performance

Adjusted statement of income

|

(In € millions, except %) |

9M 2024 |

9M 2023 |

% Change |

|

Adjusted revenue |

4,970.8 |

4,407.4 |

13% |

|

Adjusted EBITDA |

439.3 |

390.6 |

12% |

|

Adjusted recurring EBIT |

356.7 |

318.6 |

12% |

|

Non-recurring items |

(16.4) |

(42.0) |

(61)% |

|

EBIT |

340.3 |

276.6 |

23% |

|

Financial income (expense), net |

88.9 |

60.2 |

48% |

|

Profit (loss) before income tax |

429.2 |

336.8 |

27% |

|

Income tax (expense) profit |

(129.8) |

(101.3) |

28% |

|

Net profit (loss) |

299.4 |

235.5 |

27% |

|

Net profit (loss) attributable to Technip Energies Group |

279.9 |

207.3 |

35% |

|

Net profit (loss) attributable to non-controlling interests |

19.4 |

28.2 |

(31)% |

Business highlights

Project Delivery – adjusted IFRS

|

(In € millions, except % and bps) |

9M 2024 |

9M 2023 |

% Change |

|

Revenue |

3,495.5 |

2,977.8 |

17% |

|

Recurring EBITDA |

291.7 |

262.7 |

11% |

|

Recurring EBITDA margin % |

8.3% |

8.8% |

(50) bps |

|

Recurring EBIT |

258.3 |

231.7 |

11% |

|

Recurring EBIT margin % |

7.4% |

7.8% |

(40) bps |

|

Financial information is presented under adjusted IFRS (see

Appendix 8.0 for complete definition). |

9M 2024 Adjusted revenue

increased by 17% year-over-year to €3,495.5 million due to a

growing contribution from Qatar NFS and Qatar NFE, as well as

higher activity in offshore, partially offset by reduced activity

in downstream projects in completion phases.

9M 2024 Adjusted recurring

EBITDA increased by 11% to €291.7 million and 9M

2024 Adjusted recurring EBIT increased by 11%

year-over-year to €258.3 million.

9M 2024 Adjusted recurring EBITDA / EBIT

margin decreased year-over-year by 50 bps / 40 bps to 8.3%

/ 7.4%, reflecting a re-balancing of the portfolio and growing

contributions from earlier phase projects where less margin is

recognized. Project execution remains strong across the

portfolio.

Q3 2024 Key operational milestones

(Please refer to Q1 2024 and H1 2024 press releases

for first half milestones)

Qatar Energy North Field Expansion (Qatar)

- Mobilization at site has reached its peak and commissioning

activities for the desalination plant are ongoing.

Long Son Petrochemicals olefins plant

(Vietnam)

- Final performance acceptance test

passed.

Borouge IV Ethylene project (UAE)

- Cracking furnace

proprietary equipment delivered at site and heavy lifting campaign

started.

Bapco Refinery expansion (Bahrain)

- Start-up of first tail gas

treatment and sour water strippers units.

Assiut Hydrocracking Complex (Egypt)

- 20 million hours achieved without a

lost time incident (LTI).

Petronas Kasawari Offshore (Malaysia)

- Gas exported into the trunk line

for the first time.

Q3 2024 Key commercial and strategic

highlights

(Please refer to Q1 2024 and H1 2024 press releases for first

half highlights)

Technip Energies and KBR selected for a major LNG

project by Lake Charles LNG (USA)

- The KTJV joint

venture between Technip Energies and KBR has been selected for a

major* Engineering, Procurement, Fabrication and

Construction (EPFC) project by Lake Charles LNG. Subject to Lake

Charles LNG making a final investment decision to proceed with this

project, this project will convert the existing Lake Charles LNG

import and regasification terminal, located in Lake Charles,

Louisiana, on the United States Gulf Coast, into an LNG export

terminal. When the conversion is complete, the liquefaction

terminal will be among the largest LNG terminals in the United

States. The award covers a new 16.45 Mtpa LNG export facility,

including three 5.5 Mtpa modular LNG trains, brownfield

modification to LNG storage, along with procurement,

transportation, fabrication, installation, commissioning, and

startup of the terminal.

-

* A “major” award for Technip Energies is a

contract award representing above €1 billion of revenue. This

project is pending customer final investment decision and is not

included in 9M 2024 backlog.

Technip Energies and JGC Corporation awarded FEED

contract by ExxonMobil for the Rovuma LNG project in

Mozambique

- Technip Energies

and JGC Corporation have been awarded the Front-End Engineering

Design (FEED) contract by ExxonMobil – on behalf of Mozambique

Rovuma Venture (MRV), a joint venture of ExxonMobil, Eni, and CNPC

– for the Rovuma LNG project at Palma in the Afungi peninsula,

Northeast of Mozambique. The Rovuma LNG project will consist of an

LNG plant with a total production capacity of 18 Mtpa, comprising

12 fully modularized LNG trains of 1.5 Mtpa each. The plant design

will feature electric-driven LNG trains instead of gas turbines,

reducing greenhouse gases emissions compared to conventional LNG

projects. It will also include prefabricated and standardized

modules to be assembled at the project site in Mozambique, offering

cost competitiveness and certainty in delivery schedule.

Technology, Products & Services (TPS) – adjusted

IFRS

|

(In € millions, except % and bps) |

9M 2024 |

9M 2023 |

Change |

|

Revenue |

1,475.3 |

1,429.6 |

3% |

|

Recurring EBITDA |

188.2 |

179.9 |

5% |

|

Recurring EBITDA margin % |

12.8% |

12.6% |

20 bps |

|

Recurring EBIT |

139.2 |

138.1 |

1% |

|

Recurring EBIT margin % |

9.4% |

9.7% |

(30) bps |

|

Financial information is presented under adjusted IFRS (see

Appendix 8.0 for complete definition). |

9M 2024 Adjusted revenue

increased year-over-year by 3% to €1,475.3 million, resulting from

growth in renewable fuels work and decarbonization services, as

well as PMC activities, and other studies and services work across

energy and energy derivatives markets. Proprietary equipment

volumes, notably for ethylene projects, were broadly sustained at a

high level.

9M 2024 Adjusted recurring

EBITDA increased year-over-year by 5% to 188.2 million and

Adjusted recurring EBIT increased year-over-year

by 1% to €139.2 million.

9M 2024 Adjusted recurring EBITDA

margin increased by 20 bps to 12.8% benefiting from a

favorable mix. Conversely, Adjusted recurring EBIT

margin decreased year-over-year by 30 bps to 9.4% due to

increased depreciation and amortization expense associated with

higher capital investment and growth in services, including the

impact of IFRS 16, as well as the impact of higher sales and

tendering costs, strategic development costs, and higher spend on

research & development.

Q3 2024 Key operational milestones

(Please refer to Q1 2024 and H1 2024 press releases for first

half milestones)

Reju (Germany)

- Reju, a T.EN company, opens its first textile-to textile

Regeneration Hub Zero in Frankfurt.

ExxonMobil - LaBarge CCS (USA)

- Buildings for modularized power distribution center delivered

and installed on site.

Neste Renewable Products Refinery Expansion - Capacity

Growth Project, Rotterdam (Netherlands)

- Storage tank being erected, piping pre-fabrication and erection

progressing.

Arcadia eFUELS Endor (Denmark)

- FEED activities completed and delivered to client.

Q3 2024 Key commercial and strategic

highlights

(Please refer to Q1 2024 and H1 2024 press releases for first

half highlights)

Technip Energies awarded a proprietary equipment

contract by Chevron Phillips Chemical for the first complete

implementation of the low-CO2

cracking furnace technology (USA)

- Technip Energies

has been awarded an Engineering and Procurement contract by Chevron

Phillips Chemical (CPChem) for the supply of a proprietary Low

Emission Cracking Furnace in an existing olefins unit at its

facility in Sweeny, Texas. This low-emission design is

cost-effective and will reduce fuel consumption and CO₂ emissions

by approximately 30 %. Technip Energies’ patented design of the Low

Emission Cracking Furnace focuses on improving fuel efficiency

using a novel heat recovery scheme, which includes combustion air

preheat and a first-of-its-kind gas-to-gas primary feed effluent

exchanger. The project also electrifies a major compressor driver,

and because the low emission furnace will be capable of using

hydrogen as fuel, the project enables immediate and future

reductions to the existing unit’s carbon intensity.

Technip Energies to design groundbreaking low-carbon

hydrogen facility for bp (United Kingdom)

- Technip Energies

has been awarded the Front-End Engineering Design (FEED) contract

by bp for the H2Teesside project in the North East of the United

Kingdom. H2Teesside is expected to be one of the UK’s

largest low-carbon hydrogen production facilities - fully

integrated with carbon capture technology. The project is targeting

1.2 GW of low-carbon hydrogen production, which equates to more

than 10% of the UK’s 2030 hydrogen production target. As part of

the FEED study, Technip Energies will deliver a comprehensive

design utilizing their in-house expertise and global best practices

to design large scale project, integrating hydrogen and carbon

capture technologies. In the perspective of a 2025 final investment

decision, the next step for Technip Energies, if selected, will be

to provide the full Engineering Procurement, Construction and

Commissioning (EPCC) package for the project.

Rely awarded a contract by AM Green to engineer and

deliver India’s Largest*

Green Ammonia complex in Kakinada (India)

- Rely has been

awarded an EPsCm contract by AM Green India Pvt Ltd. for its 2 x

1500 tons per day (TPD) Green Ammonia Complex at Kakinada, Andhra

Pradesh, India. The project, which reached FID in August 2024,

includes 2 x 640MW Pressured Alkaline Electrolysers for the

production of green hydrogen, making it one of the world largest

green hydrogen facilities to move to execution phase. The

development has reached its final investment decision (FID) in

August 2024 and will deliver 1Mtpa of RED3 RFNBO compliant Green

Ammonia, most of which will be exported to the European market. It

will benefit from a round-the-clock carbon free power, thanks to a

combination of wind, solar power and pumped hydro storage system.

Rely will provide design, detailed engineering, procurement

services, construction management and commissioning services

(“EPsCm Services”) for the entire facility, consisting in

electrolyzers for Green Hydrogen Production, air separation units

for nitrogen, two trains of ammonia synthesis, ammonia storage,

ammonia loading facility at the port and offsite utilities. The

Pressured Alkaline Electrolysers will be provided by John Cockerill

Hydrogen.

- *Largest

Green Ammonia complex with FID approved.

Corporate and other items

Corporate costs, excluding

non-recurring items, were €40.8 million for the first nine months

of 2024.

Non-recurring expense amounted

to €16.4 million and includes costs incurred relating the set up of

new business ventures.

Net financial income of €88.9

million benefited from interest income generated from cash and cash

equivalents, partially offset by interest expenses associated with

the senior unsecured notes and the mark-to-market valuation impact

of investments in traded securities.

Effective tax rate on an

adjusted IFRS basis was 30.3% for the first nine months of 2024.

This is slightly above the prior 2024 guidance range of 26% - 30%.

This is due to the mix effect of reduced earnings from lower tax

rate jurisdictions and more earnings in higher tax rate

jurisdictions. As a result of this, and the potential impact of the

French surtax, FY 2024 tax rate guidance has increased to 29% - 33%

(previously 26% - 30%).

Depreciation and amortization

expense was €82.6 million, of which €52.7 million is

related to IFRS 16.

Adjusted net cash at September

30, 2024 was €2.7 billion, which compares to €2.8 billion at

December 31, 2023.

Adjusted free cash flow was

€191.6 million for the first nine months of 2024. Adjusted free

cash flow, excluding the working capital and provisions variance of

€168.7 million, was €360.3 million benefiting from strong

operational performance and consistently high conversion from

Adjusted recurring EBIT at 101%. Free cash flow is stated after

capital expenditures of €55.8 million. Adjusted operating

cash flow was €247.4 million.

Share buyback

Completion of the share buyback

program. On September 30, 2024, the Company announced the

completion of it €100 million share buyback program. Between March

5, 2024 and September 27, 2024 a total number of 4,580,640 shares

(representing 2.52% of the share capital of the Company) were

bought back.

The shares acquired under the share buyback

program will be used to 1) reduce the Company’s share capital by

cancelling treasury shares and 2) to meet the Company's obligations

under equity incentive plans.

Liquidity

Adjusted liquidity of €4.2

billion at September 30, 2024 comprised of €3.5 billion of cash and

€750 million of liquidity provided by the Company’s undrawn

revolving credit facility, offset by €80 million of outstanding

commercial paper. The Company’s revolving credit facility is

available for general use and serves as a backstop for the

Company’s commercial paper program.

Forward-looking statements

This Press Release contains forward-looking

statements that reflect Technip Energies’ (the

“Company”) intentions, beliefs or current

expectations and projections about the Company's future results of

operations, anticipated revenues, earnings, cashflows, financial

condition, liquidity, performance, prospects, anticipated growth,

strategies and opportunities and the markets in which the Company

operates. Forward-looking statements are often identified by the

words “believe”, “expect”, “anticipate”, “plan”, “intend”,

“foresee”, “should”, “would”, “could”, “may”, “estimate”,

“outlook”, and similar expressions, including the negative thereof.

The absence of these words, however, does not mean that the

statements are not forward-looking. These forward-looking

statements are based on the Company’s current expectations, beliefs

and assumptions concerning future developments and business

conditions and their potential effect on the Company. While the

Company believes that these forward-looking statements are

reasonable as and when made, there can be no assurance that future

developments affecting the Company will be those that the Company

anticipates.

All of the Company’s forward-looking statements

involve risks and uncertainties, some of which are significant or

beyond the Company’s control, and assumptions that could cause

actual results to differ materially from the Company’s historical

experience and the Company’s present expectations or projections.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those set forth in the forward-looking

statements.

For information regarding known material factors

that could cause actual results to differ from projected results,

please see the Company’s risk factors set forth in the Company’s

2023 Annual Financial Report filed on March 8, 2024, and in the

Company’s 2024 Half-Year Report filed on August 1, 2024, with the

Dutch Autoriteit Financiële Markten (AFM) and the French

Autorité des Marchés Financiers (AMF) which include a

discussion of factors that could affect the Company's future

performance and the markets in which the Company operates.

Forward-looking statements involve inherent

risks and uncertainties and speak only as of the date they are

made. The Company undertakes no duty to and will not

necessarily update any of the forward-looking statements in light

of new information or future events, except to the extent required

by applicable law.

APPENDIX

APPENDIX 1.0: ADJUSTED STATEMENT OF INCOME - FIRST NINE

MONTHS 2024

(In € millions)

|

Project

Delivery |

Technology, Products & Services |

Corporate/non allocable |

Total |

|

9M 24 |

9M 23 |

9M 24 |

9M 23 |

9M 24 |

9M 23 |

9M 24 |

9M 23 |

|

Adjusted revenue |

3,495.5 |

2,977.8 |

1,475.3 |

1,429.6 |

— |

— |

4,970.8 |

4,407.4 |

|

Adjusted recurring EBIT |

258.3 |

231.7 |

139.2 |

138.1 |

(40.8) |

(51.2) |

356.7 |

318.6 |

|

Non-recurring items (transaction & one-off costs) |

(6.2) |

(2.6) |

(5.3) |

(1.1) |

(4.9) |

(38.2) |

(16.4) |

(42.0) |

|

EBIT |

252.1 |

229.1 |

133.9 |

137.0 |

(45.7) |

(89.4) |

340.3 |

276.6 |

|

Financial income |

|

|

|

|

|

|

114.0 |

90.6 |

|

Financial expense |

|

|

|

|

|

|

(25.1) |

(30.4) |

|

Profit (loss) before income tax |

|

|

|

|

|

|

429.2 |

336.8 |

|

Income tax (expense) profit |

|

|

|

|

|

|

(129.8) |

(101.3) |

|

Net profit (loss) |

|

|

|

|

|

|

299.4 |

235.5 |

|

Net profit (loss) attributable to Technip Energies Group |

|

|

|

|

|

|

279.9 |

207.3 |

|

Net profit (loss) attributable to non-controlling interests |

|

|

|

|

|

|

19.4 |

28.2 |

APPENDIX 1.1: ADJUSTED STATEMENT OF INCOME - THIRD

QUARTER 2024

(In € millions)

|

Project

Delivery |

Technology, Products & Services |

Corporate/non allocable |

Total |

|

Q3 24 |

Q3 23 |

Q3 24 |

Q3 23 |

Q3 24 |

Q3 23 |

Q3 24 |

Q3 23 |

|

Adjusted revenue |

1,285.6 |

1,070.2 |

520.9 |

498.5 |

— |

— |

1,806.5 |

1,568.7 |

|

Adjusted recurring EBIT |

97.2 |

82.5 |

50.6 |

48.9 |

(18.4) |

(20.5) |

129.4 |

110.9 |

|

Non-recurring items (transaction & one-off costs) |

(4.6) |

0.1 |

(4.1) |

(0.8) |

(3.7) |

(7.3) |

(12.4) |

(8.0) |

|

EBIT |

92.6 |

82.6 |

46.5 |

48.1 |

(22.1) |

(27.9) |

117.0 |

102.9 |

|

Financial income |

|

|

|

|

|

|

39.4 |

35.1 |

|

Financial expense |

|

|

|

|

|

|

(8.0) |

(12.0) |

|

Profit (loss) before income tax |

|

|

|

|

|

|

148.4 |

126.0 |

|

Income tax (expense) profit |

|

|

|

|

|

|

(49.8) |

(32.4) |

|

Net profit (loss) |

|

|

|

|

|

|

98.6 |

93.6 |

|

Net profit (loss) attributable to Technip Energies Group |

|

|

|

|

|

|

91.8 |

82.2 |

|

Net profit (loss) attributable to non-controlling interests |

|

|

|

|

|

|

6.7 |

11.4 |

APPENDIX 1.2: STATEMENT OF INCOME - RECONCILIATION

BETWEEN IFRS AND ADJUSTED - FIRST NINE MONTHS 2024

|

(In € millions) |

9M 24

IFRS |

Adjustments |

9M 24

Adjusted |

|

Revenue |

4,778.5 |

192.3 |

4,970.8 |

|

Costs and expenses |

|

|

|

|

Cost of sales |

(4,103.8) |

(177.4) |

(4,281.2) |

|

Selling, general and administrative expense |

(291.8) |

(2.3) |

(294.1) |

|

Research and development expense |

(50.1) |

(0.6) |

(50.7) |

|

Impairment, restructuring and other expense |

(16.4) |

— |

(16.4) |

|

Other operating income (expense), net |

6.1 |

1.3 |

7.4 |

|

Operating profit (loss) |

322.5 |

13.3 |

335.8 |

|

Share of profit (loss) of equity-accounted investees |

18.1 |

(13.7) |

4.4 |

|

Profit (loss) before financial income (expense), net and

income tax |

340.5 |

(0.2) |

340.3 |

|

Financial income |

108.7 |

5.3 |

114.0 |

|

Financial expense |

(25.1) |

— |

(25.1) |

|

Profit (loss) before income tax |

424.1 |

5.1 |

429.2 |

|

Income tax (expense) profit |

(128.2) |

(1.6) |

(129.8) |

|

Net profit (loss) |

295.9 |

3.5 |

299.4 |

|

Net profit (loss) attributable to Technip Energies Group |

276.5 |

3.4 |

279.9 |

|

Net profit (loss) attributable to non-controlling interests |

19.4 |

— |

19.4 |

APPENDIX 1.3: STATEMENT OF INCOME - RECONCILIATION

BETWEEN IFRS AND ADJUSTED - FIRST NINE MONTHS 2023

|

(In € millions) |

9M 23

IFRS |

Adjustments |

9M 23

Adjusted |

|

Revenue |

4,367.5 |

39.9 |

4,407.4 |

|

Costs and expenses |

|

|

|

|

Cost of sales |

(3,745.1) |

(24.0) |

(3,769.1) |

|

Selling, general and administrative expense |

(280.1) |

— |

(280.1) |

|

Research and development expense |

(39.9) |

— |

(39.9) |

|

Impairment, restructuring and other expense |

(42.0) |

— |

(42.0) |

|

Other operating income (expense), net |

(0.3) |

0.1 |

(0.2) |

|

Operating profit (loss) |

260.1 |

16.0 |

276.1 |

|

Share of profit (loss) of equity-accounted investees |

38.1 |

(37.6) |

0.5 |

|

Profit (loss) before financial income (expense), net and

income tax |

298.2 |

(21.6) |

276.6 |

|

Financial income |

83.7 |

6.9 |

90.6 |

|

Financial expense |

(40.7) |

10.3 |

(30.4) |

|

Profit (loss) before income tax |

341.2 |

(4.4) |

336.8 |

|

Income tax (expense) profit |

(102.5) |

1.2 |

(101.3) |

|

Net profit (loss) |

238.7 |

(3.2) |

235.5 |

|

Net profit (loss) attributable to Technip Energies Group |

210.5 |

(3.2) |

207.3 |

|

Net profit (loss) attributable to non-controlling interests |

28.2 |

— |

28.2 |

APPENDIX 1.4: STATEMENT OF INCOME - RECONCILIATION

BETWEEN IFRS AND ADJUSTED - THIRD QUARTER 2024

|

(In € millions) |

Q3 24

IFRS |

Adjustments |

Q3 24

Adjusted |

|

Revenue |

1,739.3 |

67.2 |

1,806.5 |

|

Costs and expenses |

|

|

|

|

Cost of sales |

(1,498.9) |

(75.4) |

(1,574.3) |

|

Selling, general and administrative expense |

(91.5) |

(1.3) |

(92.8) |

|

Research and development expense |

(15.1) |

(1.4) |

(16.5) |

|

Impairment, restructuring and other expense |

(12.4) |

— |

(12.4) |

|

Other operating income (expense), net |

0.1 |

1.5 |

1.6 |

|

Operating profit (loss) |

121.5 |

(9.4) |

112.1 |

|

Share of profit (loss) of equity-accounted investees |

(5.7) |

10.6 |

4.9 |

|

Profit (loss) before financial income (expense), net and

income tax |

115.8 |

1.2 |

117.0 |

|

Financial income |

37.7 |

1.7 |

39.4 |

|

Financial expense |

(8.0) |

— |

(8.0) |

|

Profit (loss) before income tax |

145.5 |

2.9 |

148.4 |

|

Income tax (expense) profit |

(48.7) |

(1.1) |

(49.8) |

|

Net profit (loss) |

96.8 |

1.8 |

98.6 |

|

Net profit (loss) attributable to Technip Energies Group |

90.0 |

1.8 |

91.8 |

|

Net profit (loss) attributable to non-controlling interests |

6.7 |

— |

6.7 |

APPENDIX 1.5: STATEMENT OF INCOME - RECONCILIATION

BETWEEN IFRS AND ADJUSTED - THIRD QUARTER 2023

|

(In € millions) |

Q3 23

IFRS |

Adjustments |

Q3 23

Adjusted |

|

Revenue |

1,537.2 |

31.5 |

1,568.7 |

|

Costs and expenses |

|

|

|

|

Cost of sales |

(1,331.8) |

(15.2) |

(1,347.0) |

|

Selling, general and administrative expense |

(101.3) |

— |

(101.3) |

|

Research and development expense |

(16.2) |

— |

(16.2) |

|

Impairment, restructuring and other expense |

(8.0) |

— |

(8.0) |

|

Other operating income (expense), net |

6.7 |

(0.5) |

6.2 |

|

Operating profit (loss) |

86.6 |

15.8 |

102.4 |

|

Share of profit (loss) of equity-accounted investees |

22.3 |

(21.8) |

0.5 |

|

Profit (loss) before financial income (expense), net and

income tax |

108.9 |

(6.0) |

102.9 |

|

Financial income |

32.6 |

2.5 |

35.1 |

|

Financial expense |

(13.9) |

1.9 |

(12.0) |

|

Profit (loss) before income tax |

127.6 |

(1.6) |

126.0 |

|

Income tax (expense) profit |

(32.8) |

0.4 |

(32.4) |

|

Net profit (loss) |

94.8 |

(1.2) |

93.6 |

|

Net profit (loss) attributable to Technip Energies Group |

83.4 |

(1.2) |

82.2 |

|

Net profit (loss) attributable to non-controlling interests |

11.4 |

— |

11.4 |

APPENDIX 2.0: ADJUSTED STATEMENT OF FINANCIAL

POSITION

|

(In € millions) |

9M 24 |

FY 23 |

|

Goodwill |

2,090.9 |

2,093.3 |

|

Intangible assets, net |

127.1 |

120.5 |

|

Property, plant and equipment, net |

160.1 |

116.7 |

|

Right-of-use assets |

184.4 |

200.8 |

|

Equity accounted investees |

24.8 |

24.8 |

|

Other non-current assets |

341.7 |

305.7 |

|

Total non-current assets |

2,929.0 |

2,861.8 |

|

Trade receivables, net |

1,190.1 |

1,189.6 |

|

Contract assets |

565.6 |

399.8 |

|

Other current assets |

920.3 |

781.8 |

|

Cash and cash equivalents |

3,500.9 |

3,569.3 |

|

Total current assets |

6,176.9 |

5,940.5 |

|

Total assets |

9,105.9 |

8,802.3 |

|

Total equity |

2,033.4 |

1,956.3 |

|

Long-term debt, less current portion |

641.9 |

637.3 |

|

Lease liability – non-current |

153.7 |

160.4 |

|

Accrued pension and other post-retirement benefits, less current

portion |

120.0 |

115.8 |

|

Other non-current liabilities |

159.8 |

157.9 |

|

Total non-current liabilities |

1,075.4 |

1,071.4 |

|

Short-term debt |

129.9 |

123.9 |

|

Lease liability – current |

60.3 |

71.9 |

|

Accounts payable, trade |

1,652.3 |

1,572.8 |

|

Contract liabilities |

3,318.7 |

3,156.7 |

|

Other current liabilities |

835.9 |

849.3 |

|

Total current liabilities |

5,997.1 |

5,774.6 |

|

Total liabilities |

7,072.5 |

6,846.0 |

|

Total equity and liabilities |

9,105.9 |

8,802.3 |

APPENDIX 2.1: STATEMENT OF FINANCIAL POSITION -

RECONCILIATION BETWEEN IFRS AND ADJUSTED - FIRST NINE MONTHS

2024

| (In €

millions) |

9M 24

IFRS |

Adjustments |

9M 24

Adjusted |

|

Goodwill |

2,090.9 |

— |

2,090.9 |

|

Intangible assets, net |

127.0 |

0.1 |

127.1 |

|

Property, plant and equipment, net |

158.6 |

1.5 |

160.1 |

|

Right-of-use assets |

183.7 |

0.7 |

184.4 |

|

Equity accounted investees |

99.8 |

(75.0) |

24.8 |

|

Other non-current assets |

345.9 |

(4.2) |

341.7 |

|

Total non-current assets |

3,005.9 |

(76.9) |

2,929.0 |

|

Trade receivables, net |

1,214.1 |

(24.0) |

1,190.1 |

|

Contract assets |

562.5 |

3.1 |

565.6 |

|

Other current assets |

892.6 |

27.7 |

920.3 |

|

Cash and cash equivalents |

3,320.1 |

180.8 |

3,500.9 |

|

Total current assets |

5,989.3 |

187.6 |

6,176.9 |

|

Total assets |

8,995.2 |

110.7 |

9,105.9 |

|

Total equity |

2,029.6 |

3.8 |

2,033.4 |

|

Long-term debt, less current portion |

637.5 |

4.4 |

641.9 |

|

Lease liability – non-current |

153.7 |

— |

153.7 |

|

Accrued pension and other post-retirement benefits, less current

portion |

118.7 |

1.3 |

120.0 |

|

Other non-current liabilities |

247.9 |

(88.1) |

159.8 |

|

Total non-current liabilities |

1,157.8 |

(82.4) |

1,075.4 |

|

Short-term debt |

129.9 |

— |

129.9 |

|

Lease liability – current |

59.6 |

0.7 |

60.3 |

|

Accounts payable, trade |

1,570.7 |

81.6 |

1,652.3 |

|

Contract liabilities |

3,212.8 |

105.9 |

3,318.7 |

|

Other current liabilities |

834.8 |

1.1 |

835.9 |

|

Total current liabilities |

5,807.8 |

189.3 |

5,997.1 |

|

Total liabilities |

6,965.6 |

106.9 |

7,072.5 |

|

Total equity and liabilities |

8,995.2 |

110.7 |

9,105.9 |

APPENDIX 2.2: STATEMENT OF FINANCIAL POSITION -

RECONCILIATION BETWEEN IFRS AND ADJUSTED - FIRST NINE MONTHS

2023

| (In €

millions) |

9M 23

IFRS |

Adjustments |

9M 23

Adjusted |

|

Goodwill |

2,097.0 |

— |

2,097.0 |

|

Intangible assets, net |

117.5 |

— |

117.5 |

|

Property, plant and equipment, net |

101.9 |

0.2 |

102.1 |

|

Right-of-use assets |

211.8 |

— |

211.8 |

|

Equity accounted investees |

100.8 |

(69.1) |

31.7 |

|

Other non-current assets |

253.5 |

3.5 |

257.0 |

|

Total non-current assets |

2,882.5 |

(65.4) |

2,817.1 |

|

Trade receivables, net |

1,268.5 |

(36.6) |

1,231.9 |

|

Contract assets |

469.2 |

(0.7) |

468.5 |

|

Other current assets |

751.7 |

30.8 |

782.5 |

|

Cash and cash equivalents |

3,271.0 |

236.7 |

3,507.7 |

|

Total current assets |

5,760.4 |

230.2 |

5,990.6 |

|

Total assets |

8,642.9 |

164.8 |

8,807.7 |

|

Total equity |

1,904.5 |

(0.1) |

1,904.4 |

|

Long-term debt, less current portion |

595.9 |

— |

595.9 |

|

Lease liability – non-current |

172.5 |

— |

172.5 |

|

Accrued pension and other post-retirement benefits, less current

portion |

104.5 |

1.0 |

105.5 |

|

Other non-current liabilities |

121.0 |

(13.3) |

107.7 |

|

Total non-current liabilities |

993.9 |

(12.4) |

981.6 |

|

Short-term debt |

135.5 |

— |

135.5 |

|

Lease liability – current |

74.0 |

0.1 |

74.1 |

|

Accounts payable, trade |

1,439.5 |

100.6 |

1,540.1 |

|

Contract liabilities |

3,304.5 |

103.1 |

3,407.6 |

|

Other current liabilities |

791.0 |

(26.6) |

764.4 |

|

Total current liabilities |

5,744.5 |

177.2 |

5,921.7 |

|

Total liabilities |

6,738.4 |

164.8 |

6,903.3 |

|

Total equity and liabilities |

8,642.9 |

164.8 |

8,807.7 |

APPENDIX 3.0: ADJUSTED STATEMENT OF CASH

FLOWS

|

(In € millions) |

9M 24 |

9M 23 |

|

Net profit (loss) |

299.4 |

235.5 |

|

Change in working capital and provisions |

(168.7) |

(382.3) |

|

Non-cash items and other |

116.7 |

186.3 |

|

Cash provided (required) by operating

activities |

247.4 |

39.5 |

|

Acquisition of property, plant, equipment and intangible

assets |

(55.8) |

(33.0) |

|

Acquisition of financial assets |

(5.1) |

(31.6) |

|

Proceeds from disposal of assets |

— |

0.1 |

|

Proceeds from disposals of subsidiaries, net of cash disposed |

(1.3) |

(111.3) |

|

Other |

5.0 |

0.4 |

|

Cash provided (required) by investing

activities |

(57.2) |

(175.4) |

|

Capital increase |

(0.7) |

29.7 |

|

Net increase (repayment) in long-term, short-term debt

and commercial paper |

7.0 |

12.6 |

|

Purchase of treasury shares |

(89.0) |

— |

|

Dividends paid to Shareholders |

(101.5) |

(91.2) |

|

Payments for the principal portion of lease liabilities |

(52.0) |

(57.5) |

|

Other (of which dividends paid to non-controlling interests) |

(19.0) |

(26.6) |

|

Cash provided (required) by financing

activities |

(255.2) |

(133.0) |

|

Effect of changes in foreign exchange rates on cash

and cash equivalents |

(3.3) |

(14.6) |

|

(Decrease) Increase in cash and cash

equivalents |

(68.3) |

(283.5) |

|

Cash and cash equivalents, beginning of period |

3,569.2 |

3,791.2 |

|

Cash and cash equivalents, end of period |

3,500.9 |

3,507.7 |

APPENDIX 3.1: STATEMENT OF CASH FLOWS - RECONCILIATION

BETWEEN IFRS AND ADJUSTED - FIRST NINE MONTHS 2024

|

(In € millions) |

9M 24

IFRS |

Adjustments |

9M 24

Adjusted |

|

Net profit (loss) |

295.9 |

3.5 |

299.4 |

|

Change in working capital and provisions |

(146.1) |

(22.6) |

(168.7) |

|

Non-cash items and other |

140.4 |

(23.7) |

116.7 |

|

Cash provided (required) by operating

activities |

290.2 |

(42.8) |

247.4 |

|

Acquisition of property, plant, equipment and intangible

assets |

(55.0) |

(0.8) |

(55.8) |

|

Acquisition of financial assets |

(5.1) |

— |

(5.1) |

|

Proceeds from disposals of subsidiaries, net of cash disposed |

(1.3) |

— |

(1.3) |

|

Other |

(5.0) |

10.0 |

5.0 |

|

Cash provided (required) by investing

activities |

(66.4) |

9.2 |

(57.2) |

|

Capital increase |

(0.7) |

— |

(0.7) |

|

Net increase (repayment) in long-term, short-term debt

and commercial paper |

6.5 |

0.5 |

7.0 |

|

Purchase of treasury shares 1 |

(89.0) |

— |

(89.0) |

|

Dividends paid to Shareholders |

(101.5) |

— |

(101.5) |

|

Settlements of mandatorily redeemable financial liability |

(16.0) |

16.0 |

— |

|

Payments for the principal portion of lease liabilities |

(51.6) |

(0.4) |

(52.0) |

|

Other (of which dividends paid to non-controlling interests) |

(19.0) |

— |

(19.0) |

|

Cash provided (required) by financing

activities |

(271.3) |

16.1 |

(255.2) |

|

Effect of changes in foreign exchange rates on cash

and cash equivalents |

(3.4) |

0.1 |

(3.3) |

|

(Decrease) Increase in cash and cash

equivalents |

(50.9) |

(17.4) |

(68.3) |

|

Cash and cash equivalents, beginning of period |

3,371.0 |

198.2 |

3,569.2 |

|

Cash and cash equivalents, end of period |

3,320.1 |

180.8 |

3,500.9 |

|

1 The total cash outflow is exclusively

related to the Share Buy Back transactions, the remaining amount of

€11 million is paid on the 1st of October. |

APPENDIX 3.2: STATEMENT OF CASH FLOWS - RECONCILIATION

BETWEEN IFRS AND ADJUSTED - FIRST NINE MONTHS 2023

|

(In € millions) |

9M 23

IFRS |

Adjustments |

9M 23

Adjusted |

|

Net profit (loss) |

238.7 |

(3.2) |

235.5 |

|

Change in working capital and provisions |

(343.1) |

(39.2) |

(382.3) |

|

Non-cash items and other |

218.0 |

(31.7) |

186.3 |

|

Cash provided (required) by operating

activities |

113.6 |

(74.1) |

39.5 |

|

Acquisition of property, plant, equipment and intangible

assets |

(33.0) |

— |

(33.0) |

|

Acquisition of financial assets |

(31.6) |

— |

(31.6) |

|

Proceeds from disposal of assets |

0.1 |

— |

0.1 |

|

Proceeds from disposals of subsidiaries, net of cash disposed |

(30.5) |

(80.8) |

(111.3) |

|

Other |

0.4 |

— |

0.4 |

|

Cash provided (required) by investing

activities |

(94.6) |

(80.8) |

(175.4) |

|

Capital increase |

29.7 |

— |

29.7 |

|

Net increase (repayment) in long-term, short-term debt

and commercial paper |

12.7 |

(0.1) |

12.6 |

|

Dividends paid to Shareholders |

(91.2) |

— |

(91.2) |

|

Settlements of mandatorily redeemable financial liability |

(80.9) |

80.9 |

— |

|

Payments for the principal portion of lease liabilities |

(57.0) |

(0.5) |

(57.5) |

|

Other (of which dividends paid to non-controlling interests) |

(25.8) |

(0.8) |

(26.6) |

|

Cash provided (required) by financing

activities |

(212.5) |

79.5 |

(133.0) |

|

Effect of changes in foreign exchange rates on cash

and cash equivalents |

(12.9) |

(1.7) |

(14.6) |

|

(Decrease) Increase in cash and cash

equivalents |

(206.4) |

(77.1) |

(283.5) |

|

Cash and cash equivalents, beginning of period |

3,477.4 |

313.8 |

3,791.2 |

|

Cash and cash equivalents, end of period |

3,271.0 |

236.7 |

3,507.7 |

APPENDIX 4.0: ADJUSTED ALTERNATIVE PERFORMANCE MEASURES

- FIRST NINE MONTHS 2024

|

(In € millions, except %) |

9M 24 |

% of revenues |

9M 23 |

% of revenues |

|

Adjusted revenue |

4,970.8 |

|

4,407.4 |

|

|

Cost of sales |

(4,281.2) |

86.1% |

(3,769.1) |

85.5% |

|

Adjusted gross margin |

689.6 |

13.9% |

638.3 |

14.5% |

|

Adjusted recurring EBITDA |

439.3 |

8.8% |

390.6 |

8.9% |

|

Amortization, depreciation and impairment |

(82.6) |

|

(72.0) |

|

|

Adjusted recurring EBIT |

356.7 |

7.2% |

318.6 |

7.2% |

|

Non-recurring items |

(16.4) |

|

(42.0) |

|

|

Adjusted profit (loss) before financial income (expense),

net and income tax |

340.3 |

6.8% |

276.6 |

6.3% |

|

Financial income (expense), net |

88.9 |

|

60.2 |

|

|

Adjusted profit (loss) before tax |

429.2 |

8.6% |

336.8 |

7.6% |

|

Income tax (expense) profit |

(129.8) |

|

(101.3) |

|

|

Adjusted net profit (loss) |

299.4 |

6.0% |

235.5 |

5.3% |

APPENDIX 4.1: ADJUSTED ALTERNATIVE PERFORMANCE MEASURES

- THIRD QUARTER 2024

|

(In € millions, except %) |

Q3 24 |

% of revenues |

Q3 23 |

% of revenues |

|

Adjusted revenue |

1,806.5 |

|

1,568.7 |

|

|

Cost of sales |

(1,574.3) |

87.1% |

(1,347.0) |

85.9% |

|

Adjusted gross margin |

232.2 |

12.9% |

221.7 |

14.1% |

|

Adjusted recurring EBITDA |

157.9 |

8.7% |

135.2 |

8.6% |

|

Amortization, depreciation and impairment |

(28.5) |

|

(24.3) |

|

|

Adjusted recurring EBIT |

129.4 |

7.2% |

110.9 |

7.1% |

|

Non-recurring items |

(12.4) |

|

(8.0) |

|

|

Adjusted profit (loss) before financial income (expense),

net and income tax |

117.0 |

6.5% |

102.9 |

6.6% |

|

Financial income (expense), net |

31.4 |

|

23.1 |

|

|

Adjusted profit (loss) before tax |

148.4 |

8.2% |

126.0 |

8.0% |

|

Income tax (expense) profit |

(49.8) |

|

(32.4) |

|

|

Adjusted net profit (loss) |

98.6 |

5.5% |

93.6 |

6.0% |

APPENDIX 5.0: ADJUSTED RECURRING EBIT AND EBITDA

RECONCILIATION - FIRST NINE MONTHS 2024

(In € millions)

|

Project

Delivery |

Technology, Products & Services |

Corporate/non allocable |

Total |

|

9M 24 |

9M 23 |

9M 24 |

9M 23 |

9M 24 |

9M 23 |

9M 24 |

9M 23 |

|

Revenue |

3,495.5 |

2,977.8 |

1,475.3 |

1,429.6 |

— |

— |

4,970.8 |

4,407.4 |

|

Profit (loss) before financial income (expense), net and income

tax |

|

|

|

|

|

|

340.3 |

276.6 |

|

Non-recurring items: |

|

|

|

|

|

|

|

|

|

Other non-recurring income/(expense) |

|

|

|

|

|

|

16.4 |

42.0 |

|

Adjusted recurring EBIT |

258.3 |

231.7 |

139.2 |

138.1 |

(40.8) |

(51.2) |

356.7 |

318.6 |

|

Adjusted recurring EBIT margin % |

7.4% |

7.8% |

9.4% |

9.7% |

—% |

—% |

7.2% |

7.2% |

|

Adjusted amortization and depreciation |

(33.5) |

(31.0) |

(49.0) |

(41.8) |

(0.1) |

0.9 |

(82.6) |

(72.0) |

|

Adjusted recurring EBITDA |

291.7 |

262.7 |

188.2 |

179.91 |

(40.6) |

(52.1) |

439.3 |

390.6 |

|

Adjusted recurring EBITDA margin % |

8.3% |

8.8% |

12.8% |

12.6% |

—% |

—% |

8.8% |

8.9% |

APPENDIX 5.1: ADJUSTED RECURRING EBIT AND EBITDA

RECONCILIATION - THIRD QUARTER 2024

(In € millions, except %)

|

Project

Delivery |

Technology, Products & Services |

Corporate/non allocable |

Total |

|

Q3 24 |

Q3 23 |

Q3 24 |

Q3 23 |

Q3 24 |

Q3 23 |

Q3 24 |

Q3 23 |

|

Revenue |

1,285.6 |

1,070.2 |

520.9 |

498.5 |

— |

— |

1,806.5 |

1,568.7 |

|

Profit (loss) before financial income (expense), net and income

tax |

|

|

|

|

|

|

117.0 |

102.9 |

|

Non-recurring items: |

|

|

|

|

|

|

|

|

|

Other non-recurring income/(expense) |

|

|

|

|

|

|

12.4 |

8.0 |

|

Adjusted recurring EBIT |

97.2 |

82.5 |

50.6 |

48.9 |

(18.4) |

(20.5) |

129.4 |

110.9 |

|

Adjusted recurring EBIT margin % |

7.6% |

7.7% |

9.7% |

9.8% |

—% |

—% |

7.2% |

7.1% |

|

Adjusted amortization and depreciation |

(11.5) |

(9.9) |

(16.2) |

(12.9) |

(0.8) |

(1.5) |

(28.5) |

(24.3) |

|

Adjusted recurring EBITDA |

108.7 |

92.4 |

66.7 |

61.9 |

(17.6) |

(19.1) |

157.9 |

135.2 |

|

Adjusted recurring EBITDA margin % |

8.5% |

8.6% |

12.8% |

12.4% |

—% |

—% |

8.7% |

8.6% |

APPENDIX 6.0: BACKLOG - RECONCILIATION BETWEEN IFRS AND

ADJUSTED

|

(In € millions) |

9M 24

IFRS |

Adjustments |

9M 24

Adjusted |

|

Project Delivery |

14,150.1 |

9.6 |

14,159.7 |

|

Technology, Products & Services |

1,675.8 |

17.3 |

1,693.1 |

|

Total |

15,825.9 |

|

15,852.8 |

APPENDIX 7.0: ORDER INTAKE - RECONCILIATION BETWEEN IFRS

AND ADJUSTED

|

(In € millions) |

9M 24

IFRS |

Adjustments |

9M 24

Adjusted |

|

Project Delivery |

3,333.1 |

106.3 |

3,439.5 |

|

Technology, Products & Services |

1,334.7 |

39.3 |

1,374.1 |

|

Total |

4,667.9 |

|

4,813.5 |

APPENDIX 8.0: Definition of Alternative Performance

Measures (APMs)

Certain parts of this Press Release contain the

following non-IFRS financial measures: Adjusted Revenue, Adjusted

Recurring EBIT, Adjusted Recurring EBITDA, Adjusted net (debt)

cash, Adjusted Backlog, and Adjusted Order Intake, which are not

recognized as measures of financial performance or liquidity under

IFRS and which the Company considers to be APMs. APMs should not be

considered an alternative to, or more meaningful than, the

equivalent measures as determined in accordance with IFRS or as an

indicator of the Company’s operating performance or liquidity.

Each of the APMs is defined below:

- Adjusted

revenue: represents the revenue recognized under IFRS as

adjusted according to the method described below. For the periods

presented in this Press Release, the Company’s proportionate share

of joint venture revenue from the following projects was included:

the revenue from ENI CORAL FLNG and NFE is included at 50%, the

revenue from BAPCO Sitra Refinery is included at 36%. Starting

2024, revenue from TPIT & DAR Engineering Consulting is

included at 60% and revenue from Ruwais is included at 40%. The

Company believes that presenting the proportionate share of its

joint venture revenue in construction projects carried out in joint

arrangements enables management and investors to better evaluate

the performance of the Company’s core business period-over-period

by assisting them in more accurately understanding the activities

actually performed by the Company on these projects.

- Adjusted

recurring EBIT: represents profit before financial

expense, net, and income taxes recorded under IFRS as adjusted to

reflect line-by-line for their respective share incorporated

construction project entities that are not fully owned by the

Company (applying to the method described above under Adjusted

Revenue and including Ekwil at 50%) and adds or removes, as

appropriate, items that are considered as non-recurring from EBIT

(such as restructuring expenses, costs arising out of significant

litigation that have arisen outside of the ordinary course of

business and other non-recurring expenses). The Company believes

that the exclusion of such expenses or profits from these financial

measures enables investors and management to evaluate the Company’s

operations and consolidated results of operations

period-over-period, and to identify operating trends that could

otherwise be masked to both investors and management by the

excluded items.

- Adjusted

recurring EBITDA: corresponds to the adjusted recurring

EBIT as described above before depreciation and amortization

expenses.

- Adjusted

net (debt) cash: reflects cash and cash equivalents, net

of debt (including short-term debt), as adjusted according to the

method described above under adjusted revenue. Management uses this

APM to evaluate the Company’s capital structure and financial

leverage. The Company believes adjusted net (debt) cash, is a

meaningful financial measure that may assist investors in

understanding the Company’s financial condition and recognizing

underlying trends in its capital structure.

- Adjusted

backlog: backlog is calculated as the estimated sales

value of unfilled, confirmed customer orders at the relevant

reporting date. Adjusted backlog takes into account the Company’s

proportionate share of backlog related to equity affiliates (ENI

Coral FLNG, BAPCO Sitra Refinery, the joint-venture Rovuma, two

affiliates of the NFE joint-venture, TPIT & DAR Engineering

Consulting and Ruwais from 2024). The Company believes that the

adjusted backlog enables management and investors to evaluate the

level of the Company’s core business forthcoming activities by

including its proportionate share in the estimated sales coming

from construction projects in joint arrangements.

- Adjusted

order intake: order intake corresponds to signed contracts

which have come into force during the reporting period. Adjusted

order intake adds the proportionate share of orders signed related

to equity affiliates (ENI Coral FLNG, BAPCO Sitra Refinery, the

joint-venture Rovuma, two affiliates of the NFE joint-venture, TPIT

& DAR Engineering Consulting and Ruwais from 2024). This

financial measure is closely connected with the adjusted backlog in

the evaluation of the level of the Company’s forthcoming activities

by presenting its proportionate share of contracts which came into

force during the period and that will be performed by the

Company.

•

Contacts

Investor Relations

Phillip Lindsay

Vice President, Investor Relations

Tel: +44 20 7585 5051

Email: Phillip Lindsay

Media Relations

Jason Hyonne

Manager, Press Relations & Social Media

Tel: +33 1 47 78 22 89

Email: Jason Hyonne

- Technip Energies 9M 2024 Financial Results

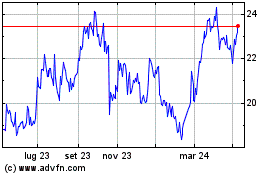

Grafico Azioni Technip Energies NV (EU:TE)

Storico

Da Dic 2024 a Gen 2025

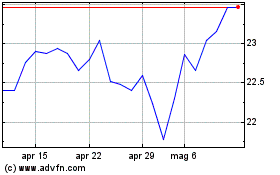

Grafico Azioni Technip Energies NV (EU:TE)

Storico

Da Gen 2024 a Gen 2025