Technip Energies Capital Markets Day 2024A strong

growth path to 2028 and beyond with value creation designed to

last

Paris, Thursday, November 21, 2024. Technip

Energies (PARIS:TE) (the “Company”), a Technology and Engineering

powerhouse leading in energy and decarbonization infrastructure

development, will host a Capital Markets Day (CMD) at 1pm GMT to

update on the Company’s strategy and business outlook. The CMD will

take place in-person for investors and financial analysts in

London, with the plenary presentations webcast here.

Arnaud Pieton, CEO of Technip Energies,

stated:

“Technip Energies (T.EN) is a company in motion.

We have delivered strong financial performance since creating the

company in 2021, and the strategic choices we have made position us

to play a more prominent role in our markets, leveraging our

leadership and differentiation to fuel more growth and capture more

value. Today, T.EN is part of the solution as we are key to

securing access to sustainable energy through our proven operating

model, our technologies and unparalleled scale-up capabilities. In

addition to a strong long-term growth outlook for our core

business, we are diversifying and broadening our portfolio of

solutions and customers, establishing our leadership in new

markets. As such, T.EN is set to thrive in any energy transition

scenario. With our substantial commercial pipeline of more than

€75bn, our complementary business segments are primed to transform

this expanding market opportunity into revenue growth with enhanced

profitability through 2028 and beyond. Moreover, our balance sheet

strength, with over €1 billion of available firepower, and highly

cash generative business model support future dividend growth and

enable us to deploy capital selectively to drive further value

creation. Through continuous innovation, smart engineering and

excellence in execution, T.EN is set to win the affordability

battle, bridging prosperity and sustainability for a world designed

to last.”

Financial guidance and medium-term

framework

Based on its current outlook, and assuming no

major changes to the macro-economic and geopolitical environment,

T.EN announces the following financial guidance and medium-term

framework:

Financial guidance by segment for

2025

- Project Delivery

revenue: €5.0 – 5.4bn, EBITDA margin: ~8%

- Technology,

Products & Services (TPS): revenue €2.0 – 2.2bn, EBITDA margin:

~13.5%

- Corporate costs:

€50 – 60m

Financial

framework for

2028

- Project Delivery

revenue: >€6.0bn, EBITDA margin: ~8.5%

- TPS revenue:

>€2.6bn, EBITDA margin: ~14.5%

- Corporate costs:

~€60m

Free cash flow*

outlook

- Free cash flow

conversion from EBITDA expected at 70% – 85%, excluding working

capital

- 2024 – 2028

cumulative free cash flow of €2.2 – 2.6bn

Key factors supporting T.EN’s financial

guidance, framework and outlook

Strong market growth and business

diversification

Energy (e.g. LNG) and energy derivatives (e.g.

ethylene) markets will continue to grow at long-term historical

rates (i.e. GDP+) through to 2040 supported by structural

megatrends – rising population, urbanization and economic growth –

and the need to bridge economic prosperity and sustainability. At

the same time, decarbonization (e.g. carbon capture, clean

hydrogen, sustainable fuels) and circularity markets will mature,

scale and accelerate with strong double digit compound annual

growth through to 2040. T.EN’s core competences in process

engineering, technology integration and scale-up, and project

execution are also attracting new customer profiles beyond the

traditional energy domain, notably in hard-to-abate sectors

including power, aviation, and cement. In aggregate, T.EN’s

addressable market is inexorably expanding in the near-to-medium

term and accelerating in the long-term.

Attractive commercial opportunity

set

T.EN’s commercial pipeline of more than

€75 billion through to the end of 2026 is well

balanced by market and geography and further supports business

expansion and diversification. About two thirds of the pipeline is

within established energy and energy derivatives markets, with

one-third dedicated to decarbonization markets. The opportunity set

for decarbonization has grown substantially since 2021, and while

these markets are maturing at different paces and in different

geographies, it is significant that T.EN now has a €20 billion-plus

pipeline across carbon capture, blue molecules, green molecules,

and sustainable aviation fuel – with each market representing

multi-billion-euro opportunities. As a decarbonization leader, T.EN

brings the flexibility and selectivity to capitalize on the

richness of this pipeline and thrive in these

markets.

Complementary growth engines power 2028

financial framework: uncapping Project Delivery, sustaining TPS

momentum

Project Delivery: this segment

provides an extremely robust baseload of activity and cash flows

derived from a de-risked and dynamic portfolio. Today, T.EN uncaps

the growth opportunity with a 2028 Project Delivery revenue target

of more than €6 billion, delivering controlled growth in an

expanding market while staying true to its selectivity principles

and discipline. The quality of T.EN’s backlog and opportunity set

combined with its strong execution and efficiency gains support

further expansion of its best-in-class EBITDA margin to

~8.5%.

TPS: for its short-cycle,

margin-accretive segment, T.EN is strengthening its capabilities,

upskilling and growing its workforce, and innovating to expand its

technology and product offerings. TPS revenue of more than €2.6bn

in 2028 will have an accretive mix drawing on higher Technology

& Product content, driving EBITDA margins to ~14.5%.

Capital allocation

The strength of the Company’s balance sheet,

with more than €1 billion of available firepower (adjusted for

project-associated cash), coupled with sustainable free cash flow

generation, underpins T.EN’s commitment to a disciplined and

effective capital allocation that prioritizes shareholder returns

and accretive investments while maintaining its investment grade

balance sheet.

The Company’s priorities are:

1) Dividends: to payout a

minimum range of 25% – 35% of free cash flow, excluding working

capital, with growth aligned to its earnings trajectory;

and

2) Value accretive investments:

to allocate free cash flow to enhance differentiation and capture

more value through TPS-focused M&A and investment in adjacent

business models. For example, Reju – a Technip Energies

company focused on materials regeneration – has the potential to

generate annual revenue of €2 billion-plus within 10

years.

Subject to investment opportunities and market

conditions, supplemental shareholder returns will be considered,

including share buybacks.

* Free cash flow is stated excluding working

capital and post IFRS 16 lease repayment.

About Technip Energies

Technip Energies is a global technology and

engineering powerhouse. With leadership positions in LNG, hydrogen,

ethylene, sustainable chemistry, and CO2 management, we are

contributing to the development of critical markets such as energy,

energy derivatives, decarbonization, and circularity. Our

complementary business segments, Technology, Products and Services

(TPS) and Project Delivery, turn innovation into scalable and

industrial reality.

Through collaboration and excellence in

execution, our 17,000+ employees across 34 countries are fully

committed to bridging prosperity with sustainability for a world

designed to last.

Technip Energies generated revenues of €6

billion in 2023 and is listed on Euronext Paris. The Company also

has American Depositary Receipts trading over the counter.

For further information: www.ten.com

Contacts

|

Investor RelationsPhillip LindsayVice-President

Investor RelationsTel: +44 207 585 5051Email: Phillip

Lindsay |

Media RelationsJason HyonnePress Relations &

Social Media ManagerTel: +33 1 47 78 22 89Email: Jason

Hyonne |

Important Information for Investors and

Security holders

Forward-Looking Statements

This Press Release contains forward-looking

statements that reflect Technip Energies’ (the “Company”)

intentions, beliefs or current expectations and projections about

the Company's future results of operations, anticipated revenues,

earnings, cashflows, financial condition, liquidity, performance,

prospects, anticipated growth, strategies and opportunities and the

markets in which the Company operates. Forward-looking statements

are often identified by the words “believe”, “expect”,

“anticipate”, “plan”, “intend”, “foresee”, “should”, “would”,

“could”, “may”, “estimate”, “outlook”, and similar expressions,

including the negative thereof. The absence of these words,

however, does not mean that the statements are not forward-looking.

These forward-looking statements are based on the Company’s current

expectations, beliefs and assumptions concerning future

developments and business conditions and their potential effect on

the Company. While the Company believes that these forward-looking

statements are reasonable as and when made, there can be no

assurance that future developments affecting the Company will be

those that the Company anticipates.

All of the Company’s forward-looking statements

involve risks and uncertainties, some of which are significant or

beyond the Company’s control, and assumptions that could cause

actual results to differ materially from the Company’s historical

experience and the Company’s present expectations or projections.

Should one or more of these risks or uncertainties materialize, or

should underlying assumptions prove incorrect, actual results may

vary materially from those set forth in the forward-looking

statements.

For information regarding known material factors

that could cause actual results to differ from projected results,

please see the Company’s risk factors set forth in the Company’s

2023 Annual Financial Report filed on March 8, 2024 and in the

Company’s 2024 Half-Year Report filed on August 1, 2024, with the

Dutch Autoriteit Financiële Markten (AFM) and the French Autorité

des Marchés Financiers (AMF) which include a discussion of factors

that could affect the Company's future performance and the markets

in which the Company operates.

Forward-looking statements involve inherent

risks and uncertainties and speak only as of the date they are

made. The Company undertakes no duty to and will not necessarily

update any of the forward-looking statements in light of new

information or future events, except to the extent required by

applicable law.

- T.EN_CMD_2024_Press Release_EN

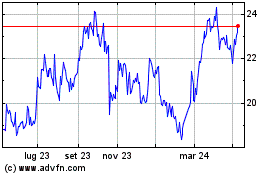

Grafico Azioni Technip Energies NV (EU:TE)

Storico

Da Dic 2024 a Gen 2025

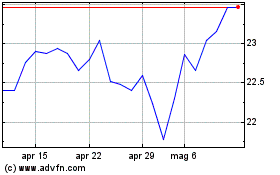

Grafico Azioni Technip Energies NV (EU:TE)

Storico

Da Gen 2024 a Gen 2025