Euro Falls On Weak Eurozone PMI Data

23 Settembre 2024 - 10:16AM

RTTF2

The euro weakened against other major currencies in the European

session on Monday, after data showed that the Eurozone business

activity contracted more than expected in September.

Data from S&P Global showed that Eurozone business activity

contracted more than expected in September, with the corresponding

PMI falling to 48.9 from 51.0 as both services and manufacturing

sectors weakened.

Also, data from S&P Global showed that German private sector

activity fell deeper into contraction in September with accelerated

reduction in manufacturing output. At 47.2, the headline HCOB

composite output index fell to a seven-month low in September from

48.4 in August. The score was forecast to fall moderately to

48.2.

Morever, the indications of further weakness would increase

market anticipation for a third interest rate cut by the European

Central Bank (ECB) in October.

European stocks were traded lower as investors reacted to weak

business activity data and the latest political developments in the

region.

Similarly, growth softened across U.K. businesses in

September.

In political news, German Chancellor Olaf Scholz's Social

Democratic Party (SPD) has narrowly beaten the far-right

Alternative for Germany (AfD) in an election in the east German

state of Brandenburg, according to official results released this

morning.

In France, Prime Minister Michel Barnier said his new government

could increase taxes for big business and the wealthiest to help

tackle the budget deficit.

Elsewhere in the U.K., Finance Minister Rachel Reeves said there

would be no return to austerity or widespread cuts despite

financial challenges.

In the European trading today, the euro fell to more than a

2-year low of 0.8356 against the pound, from an early high of

0.8387. The EUR/GBP pair may test support near the 0.81 region.

On economic news, data published by S&P Global showed that

U.K. private sector activity logged a further sustained growth in

September despite easing since August. The flash composite output

index dropped to 52.9 in September from 53.8 in August. The

services business activity index stood at 52.8 in September, down

from 53.7 in August. The expected score was 53.5.

The manufacturing Purchasing Managers' Index declined to a

3-month low of 51.5 from 52.5 in August. Economists expected a

reading of 52.3.

Against the Swiss franc and the U.S. dollar, the euro dropped to

4-day lows of 0.9435 and 1.1083 from early highs of 0.9503 and

1.1168, respectively. If the euro extends its downtrend, it is

likely to find support around 0.92 against the franc and 1.09

against the greenback.

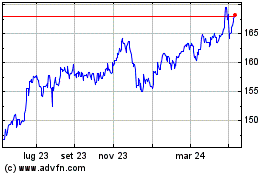

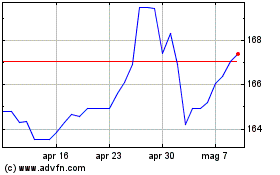

The euro edged down to 159.05 against the yen, from an early

near 3-week high of 161.19. The EUR/JPY pair is likely to find

support near the 155.00 region.

Against the Australia, the New Zealand and the Canadian dollars,

the euro slipped to a 3-week low of 1.6278, nearly a 3-week low of

1.7766 and a 1-week low of 1.5049 from early highs of 1.6391,

1.7912 and 1.5140, respectively. On the downside, 1.60 against the

aussie, 1.76 against the kiwi and 1.48 against the loonie are seen

as the next support levels for the euro.

Looking ahead, Canada new housing price index for August, U.S.

Chicago Fed national activity index for August and U.S. S&P

Global flash PMI data for September are slated for release in the

New York session.

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Nov 2024 a Dic 2024

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Dic 2023 a Dic 2024