Yen Falls Amid BoJ Rate Hike Uncertainty

10 Dicembre 2024 - 6:14AM

RTTF2

The Japanese yen weakened against other major currencies in the

European session on Tuesday, as traders speculate uncertainty about

the Bank of Japan's (BoJ) rate hike in December.

According to some reports, the BoJ is likely to skip raising

interest rates this month.

The BoJ board member Toyoaki Nakamura said that the central bank

must move cautiously in raising rates, adding a layer of

uncertainty and undermining the Japanese Yen.

Markets in the region react positively to China's announcement

of more proactive fiscal measures and a moderately looser monetary

policy that bodes well for the nations flattering economy. However,

the escalating conflict in the Middle East is weighing on market

sentiment.

Also, focus shifted to upcoming U.S. CPI data and the ECB policy

meeting.

The European Central Bank's (ECB) monetary policy decision is

due on Thursday, with the central bank expected to cut interest

rates by 25 bps for the third time in a row.

While the U.S. Fed is widely expected to lower rates by another

25 basis points next week, there is some uncertainty about whether

the central bank will continue cutting rates next year.

Traders currently price in an 87% chance of a 25-basis-point

interest rate cut at next week's Fed meeting, up from 61.6% last

week, according to the CME Group's FedWatch Tool.

In economic news, data from the Bank of Japan showed that the M2

money stock in Japan was up 1.2 percent on year in November,

standing at 1,255.0 trillion yen. That was in line with

expectations and unchanged from the previous two months.

Data from the Japan Machine Tool Builders Association, or JMTBA,

showed that the Japan's machine tool orders increased for the

second straight month in November. Machine tool orders climbed 3.0

percent year-on-year in November, though much slower than the 9.4

percent sharp recovery in the previous month.

On a monthly basis, machine tool orders declined 2.6 percent in

November, extending the 2.2 percent fall in the prior month.

The safe-haven yen traded slightly higher against its major

rivals in the Asian trading today.

In the European trading today, the yen fell to near 2-week lows

of 160.07 against the euro, 151.79 against the U.S. dollar and

172.64 against the Swiss franc, from early highs of 159.38, 150.90

and 171.99, respectively. If the yen extends its downtrend, it is

likely to find support around 163.00 against the euro, 155.00

against the greenback and 175.00 against the franc.

Against the pound, the yen edged down to 193.41 from an early

high of 192.46. The yen may test support near the 197.00

region.

Looking ahead, U.S. NFIB business optimism index for November

and U.S. Redbook report are due to be released in the New York

session.

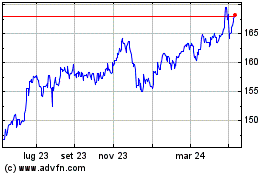

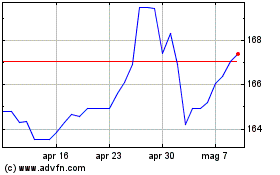

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Nov 2024 a Dic 2024

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Dic 2023 a Dic 2024