Yen Rebounds After Ishiba Wins LDP Presidential Election

27 Settembre 2024 - 10:02AM

RTTF2

The Japanese yen rebounded from early weakness against other

major currencies in the European session on Friday, after Shigeru

Ishiba has won the leadership race to become Japan's prime

minister.

Former defense minister Shigeru Ishiba won the Liberal

Democratic Party leadership contest, which positions him to become

Japan's next prime minister. Ishiba's victory paved the way for

more rate hikes and surprised markets that had anticipated a

Takaichi victory.

European stocks traded higher amid renewed optimism over China's

stimulus moves, and on expectations of more interest-rate cuts by

the Fed and other central banks.

Investors are also digesting the latest batch of economic data,

and await some key reports from the U.S.

In economic news, overall consumer prices in the Tokyo region of

Japan were up 2.2 percent on year in September, the Ministry of

Internal Affairs and Communications said on Friday. That was in

line with forecasts and was down from 2.6 percent in August. Core

CPI, which excludes the volatile costs of food, rose an annual 2.0

percent - again matching expectations and slowing from 2.4 percent

in the previous month.

Data from the Cabinet Office showed that Japan's leading index

increased less than initially estimated in July from a 7-month low

in June. The leading index, which measures future economic

activity, rose to 109.3 in July from 109.1 in the previous month.

In the flash report, the score was 109.5.

Meanwhile, the coincident index rose to 117.2 in July from 114.1

a month ago. The latest reading was revised up from 117.1. The

coincident index measures the current economic situation.

In the Asian trading today, the safe-haven yen fell against its

major counterparts as traders started speculating the Japan's New

Prime Minister to be decided by the Liberal Democratic Party's

presidential election.

Speculations of political pressure on monetary policy paved the

way for traders to bet on the election results.

In the European trading now, the yen rose to 1-week highs of

159.02 against the euro and 142.78 against the U.S. dollar, from an

early 1-1/2-month low of 163.50 and 146.49, respectively. If the

yen extends its uptrend, it is likely to find resistance around

155.00 against the euro and 140.00 against the greenback.

Against the pound and the Swiss franc, the yen advanced to 4-day

highs of 191.01 and 168.68 from an early near 2-month low of 195.96

and more than a 3-week low of 172.53, respectively. The yen is

likely to find resistance around 182.00 against the pound and

165.00 against the franc.

Against the Australia and the New Zealand dollars, the yen

climbed to 3-day highs of 98.28 and 90.06 from an early near

2-month low of 100.72and 92.29, respectively. The next possible

upside resistance levels for the yen are seen around 96.00 against

the aussie and 87.00 against the kiwi.

The yen jumped to a 4-day high of 105.87 against the Canadian

dollar, from more than a 3-week low of 108.56. On the upside,

102.00 is seen as the next resistance level for the yen.

Looking ahead, Canada GDP data for July, U.S. personal income

and spending data for August, goods trade balance for August, PCE

price index for August, retail an wholesale inventories for August,

U.S. University of Michigan's consumer sentiment for September,

Canada budget balance for July and U.S. Baker Hughes weekly oil rig

count data are slated for release in the New York session.

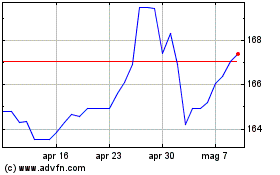

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Nov 2024 a Dic 2024

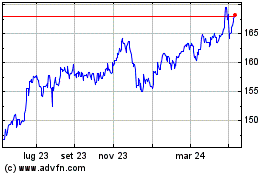

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Dic 2023 a Dic 2024