Yen Slides Against Majors

25 Dicembre 2024 - 4:43AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Wednesday.

Speaking at the councilors meeting of Keidanren Japan Business

Federation in Tokyo, the Bank of Japan Governor Kazuo Ueda said

that he expects the economy to move closer to sustainably achieving

the central bank's 2 percent inflation target next year, signaling

the timing of its next rate hike was nearing.

"If economic activity and prices continue to improve, the Bank

will accordingly need to raise the policy interest rate and adjust

the degree of monetary accommodation," he added.

"There are high uncertainties surrounding future developments in

the U.S. and other overseas economies, particularly with regard to

the economic policies of the incoming U.S. administration," the BoJ

Ueda said.

In the Asian trading today, the yen fell to more than a 1-month

low of 163.96 against the euro, from an early high of 163.35. The

yen is likely to find support around the 166.00 region.

Against the Canada and the U.S. dollars, the yen slid to a 6-day

high of 109.71 and a 5-day low of 157.51 from early highs of 109.20

and 156.99, respectively. On the downside, 112.00 against the

loonie and 159.00 against the greenback are seen as the next

support levels for the yen.

The yen edged down to 197.77 against the pound and 175.07

against the Swiss franc, from early highs of 196.87 and 174.43,

respectively. If the yen extends its downtrend, it is likely to

find support around 200.00 against the pound and 178.00 against the

franc.

Against the Australia and the New Zealand dollars, the yen

dropped to 98.26 and 88.96 from early highs of 97.83 and 88.53,

respectively. The next possible downside target for the yen is seen

around 101.00 against the aussie and 92.00 against the kiwi.

Most of the markets are off for the Christmas Day holiday.

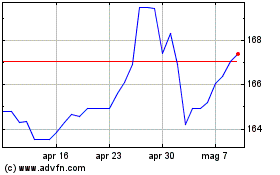

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Nov 2024 a Dic 2024

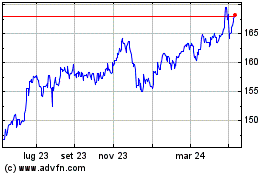

Grafico Cross Euro vs Yen (FX:EURJPY)

Da Dic 2023 a Dic 2024