U.S. Dollar Strengthens As Trump Leads In Polls

21 Ottobre 2024 - 3:24PM

RTTF2

The U.S. dollar firmed against its major counterparts in the New

York session on Monday, amid rising odds of former President Donald

Trump winning the November election.

Recent polls indicated Trump leading US Vice President and

Democratic candidate Kamala Harris in key battleground states.

Expectations that the Federal Reserve will deliver smaller rate

cuts also boosted the dollar.

Dallas Fed President Logan said that she supported gradual rate

cuts to help manage the risks and accomplish the goals.

On the economic front, flash PMI numbers on the U.S.

manufacturing and the services sectors, durable goods orders,

housing market data, the Federal Reserve's Beige Book on regional

economic activity and speeches by several Fed officials may

influence investor sentiment.

The greenback touched 1.2978 against the pound, setting a 4-day

high. If the greenback rises further, it is likely to test

resistance around the 1.26 region.

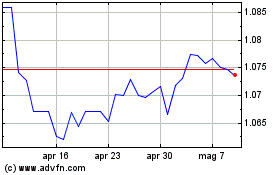

The greenback rose to a 4-day high of 1.0819 against the euro

and a 2-1/2-month high of 150.49 against the yen, from an early

4-day low of 1.0871 and a 5-day low of 149.08, respectively. The

currency is poised to challenge resistance around 1.06 against the

euro and 152.00 against the yen.

The greenback recovered to 0.8660 against the franc, from an

early 4-day low of 0.8633. The currency is likely to locate

resistance around the 0.90 level.

The greenback advanced to 1.3849 against the loonie, its highest

level since August 6. Immediate resistance for the currency is seen

around the 1.40 level.

The greenback firmed to near a 6-week high of 0.6654 against the

aussie and more than a 2-month high of 0.6028 against the kiwi,

from an early 6-day low of 0.6723 and a 5-day low of 0.6084,

respectively. The next possible resistance for the greenback is

seen around 0.64 against the aussie and 0.58 against the kiwi.

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Ott 2024 a Nov 2024

Grafico Cross Euro vs US Dollar (FX:EURUSD)

Da Nov 2023 a Nov 2024