Commodity Currencies Fall Amid Risk Aversion

30 Maggio 2024 - 6:16AM

RTTF2

The commodity currencies such as Australia, the New Zealand and

the Canadian dollars weakened against their major currencies in the

Asian session on Thursday amid risk aversion, following the broadly

negative cues from global markets overnight, as bond yields

continued to spike amid uncertainty about the U.S. Fed's

interest-rate moves ahead of key inflation data later in the

week.

The report on U.S. personal income and spending in the month of

April, due on Friday, includes readings on inflation said to be

preferred by the U.S. Fed. There are concerns the Fed might keep

interest rates higher for longer at the next monetary policy

meeting on June 11-12 in the event of U.S. inflation readings

coming in hotter than expected.

Weakness across most sectors led by mining, energy and

technology stocks, also weighed on the investor sentiment.

Crude oil prices fell on concerns about the outlook for interest

rates, and the likely adverse impact high borrowing costs will have

on energy demand. West Texas Intermediate Crude oil futures for

July sank $0.60 at $79.23 a barrel.

In the Asian trading today, the Australian dollar fell to 6-day

lows of 0.6600 against the U.S. dollar and 103.81 against the yen,

from yesterday's closing quotes of 0.6611 and 104.18, respectively.

If the aussie extends its downtrend, it is likely to find support

around 0.64 against the greenback and 101.00 against the yen.

Against the euro and the Canadian dollar, the aussie edged down

to 1.6354 and 0.9060 from Wednesday's closing quotes of 1.6334 and

0.9066, respectively. On the downside, 1.65 against the euro and

0.89 against the loonie is seen as the support levels for the

aussie.

The NZ dollar fell to 6-day lows of 0.6100 against the U.S.

dollar and 95.87 against the yen, from yesterday's closing quotes

of 0.6107 and 96.40, respectively. If the kiwi extends its

downtrend, it is likely to find support around 0.59 against the

greenback and 92.00 against the yen.

Against the euro and the Australian dollar, the kiwi edged down

to 1.7698 and 1.0832 from Wednesday's closing quotes of 1.7659 and

1.0806, respectively. The next possible downside target for the

kiwi is seen around 1.79 against the euro and 1.10 against the

aussie.

The Canadian dollar fell to 6-day low of 1.3728 against the U.S.

dollar and 114.41 against the yen, from yesterday's closing quotes

of 1.3714 and 114.91. respectively. If the loonie extends its

downtrend, it is likely to find support around 1.38 against the

greenback and 112.00 against the yen.

Against the euro, the looie edges down to 1.4821 from

Wednesday's closing value of 1.4815. The loonie may test support

near the 1.50 region.

Meanwhile, the safe-haven currencies such as the Japanese yen

and the U.S. dollar fell against their major currencies in the

Asian session today amid risk aversion.

The yen rose to a 1-week high of 169.47 against the euro and a

6-day high of 199.31 against the pound, from yesterday's closing

quotes of 170.25 and 200.19, respectively. If the yen extends its

uptrend, it is likely to find resistance around against the 166.00

against the euro and 197.00 against the pound.

Against the U.S. dollar and the Swiss franc, the yen edged up to

157.05 and 172.09 from Wednesday's closing quotes of 157.60 and

172.59, respectively. The yen is likely to find resistance around

154.00 against the greenback and 171.00 against the franc.

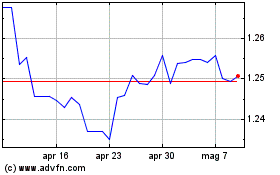

The U.S. dollar rose to more than a 2-week high of 1.0789

against the euro and a 6-day high of 1.2689 against the pound, from

yesterday's closing quotes of 1.0800 and 1.2707, respectively. If

the greenback extends its uptrend, it is likely to find resistance

around 1.06 against the euro and 1.25 against the pound.

Looking ahead, Eurozone economic sentiment for May and

unemployment data for April are due to be released in the European

session at 5:00 am ET.

In the New York session, Canada average weekly earnings for

March and current account for the first quarter, U.S. GDP data for

the first quarter, weekly jobless claims data, trade balance data

for April, pending home sales data for April and U.S. EIA crude oil

data are slated for release.

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Mag 2024 a Giu 2024

Grafico Cross Sterling vs US Dollar (FX:GBPUSD)

Da Giu 2023 a Giu 2024