U.S. Dollar Lower As Soft ADP Data Increases Odds Of Aggressive Rate Cut

05 Settembre 2024 - 1:23PM

RTTF2

The U.S. dollar fell against its most major counterparts in the

New York session on Thursday, as private sector employment

increased less than expected in August, increasing the chances of a

50 basis point rate cut by the Federal Reserve this month.

Data from payroll processor ADP showed that private sector

employment rose by 99,000 jobs in August after climbing by a

downwardly revised 111,000 jobs in July.

Economists had expected private sector employment to jump by

145,000 jobs compared to the addition of 122,000 jobs originally

reported for the previous month.

The data is likely to add to recent concerns about the economic

outlook but could also boost the chances of accelerated interest

rate cuts by the Federal Reserve.

Meanwhile, the Labor Department released a separate report

showing a modest decrease by first-time claims for U.S.

unemployment benefits in the week ended August 31st.

The report said initial jobless claims dipped to 227,000, a

decrease of 5,000 from the previous week's revised level of

232,000.

Economists had expected jobless claims to edge down to 230,000

from the 231,000 originally reported for the previous week.

The greenback declined to a 1-week low of 1.1119 against the

euro and a 6-day low of 1.3179 against the pound, off its early

highs of 1.1074 and 1.3136, respectively. The currency is likely to

challenge support around 1.12 against the euro and 1.33 against the

pound.

The greenback dropped to more than a 4-week low of 142.84

against the yen and a 2-day low of 0.6225 against the kiwi, from

its early highs of 143.90 and 0.6178, respectively. The currency is

seen finding support around 141.00 against the yen and 0.63 against

the kiwi.

The greenback was lower against the loonie and the aussie and

was trading at 1.3510 and 0.6730, respectively. Immediate support

for the currency is seen around 1.32 against the loonie and 0.69

against the aussie.

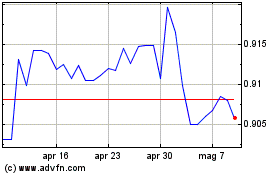

Meanwhile, the greenback recovered to 0.8485 against the franc,

from an early 1-week low of 0.8433. It is poised to challenge

resistance around the 0.92 level.

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Nov 2024 a Dic 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Dic 2023 a Dic 2024