U.S. Dollar Drops After Soft PCE Inflation Data

20 Dicembre 2024 - 3:06PM

RTTF2

The U.S. dollar declined against its major counterparts in the

New York session on Friday, as a slowdown in PCE inflation for

November bolstered the prospect of slower pace of rate cuts by the

Federal Reserve next year.

Data from the Commerce Department showed that the personal

consumption expenditures (PCE) price index inched up by 0.1 percent

in November after rising by 0.2 percent in October. Economists had

expected prices to increase by another 0.2 percent.

The annual rate of growth by the PCE price index accelerated to

2.4 percent in November from 2.3 percent in October, slightly

slower than 2.5 percent jump economists had expected.

Excluding food and energy prices, the core PCE price index also

edged up by 0.1 percent in November after climbing by 0.3 percent

in October. Economists had expected core prices to rise by 0.2

percent.

The annual rate of growth by the core PCE price index in

November came in at 2.8 percent, unchanged from October, while

economists had expected an acceleration to 2.9 percent.

The inflation readings, which are preferred by the Federal

Reserve, were included in a report on personal income and

spending.

The data bolstered expectations of two rate reductions in

2025.

The greenback fell to 2-day lows of 0.8922 against the franc and

1.0435 against the euro, from an early high of 0.8992 and a 4-week

high of 1.0342, respectively. The currency is seen finding support

around 0.88 against the franc and 1.06 against the euro.

The greenback declined to 2-day lows of 1.4342 against the

loonie, 0.6269 against the aussie and 0.5668 against the kiwi, off

its early highs of 1.4435, 0.6214 and 0.5613, respectively. The

next possible support for the greenback is seen around 1.38 against

the loonie, 0.66 against the aussie and 0.60 against the kiwi.

The greenback dropped to 1.2591 against the pound and 156.09

against the yen, from an early 7-1/2-month high of 1.2474 and more

than a 5-month high of 157.92, respectively. The currency is likely

to locate support around 1.28 against the pound and 149.5 against

the yen.

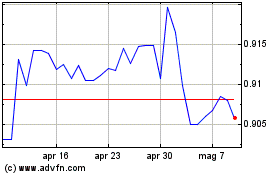

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Nov 2024 a Dic 2024

Grafico Cross US Dollar vs CHF (FX:USDCHF)

Da Dic 2023 a Dic 2024