Yen Falls Amid Risk Appetite

03 Dicembre 2024 - 3:50AM

RTTF2

The Japanese yen weakened against other major currencies in the

Asian session on Tuesday amid risk appetite, as traders remain

optimistic about an interest rate cut by the U.S. Fed in December

after remarks from Fed Governor Christopher Waller that he is

'leaning toward' a December rate cut.

Investors bet that the Bank of Japan (BoJ) will raise rates from

the current 0.25 percent as soon as its next meeting.

Traders are also cautious ahead of a slew of crucial U.S.

economic data later this week, including a closely watched monthly

jobs report and a reading on consumer sentiment.

Concerns over a broader trade war capped regional gains after

U.S. President-elect Donald Trump's threat of 100% tariff on BRICS

countries if they pursue new currency alternatives to the U.S.

dollar. He has threatened a 100 percent tariff on the bloc of nine

nations if they undercut the U.S. dollar.

"The idea that the BRICS Countries are trying to move away from

the dollar while we stand by and watch is OVER," Trump said in a

post on his Truth Social network on Saturday.

In the Asian trading today, the yen fell to 157.53 against the

euro, 189.94 against the pound and 169.06 against the Swiss franc,

from yesterday's closing quotes of 157.02, 189.31 and 168.65,

respectively. If the yen extends its downtrend, it is likely to

find support around 160.00 against the euro, 192.00 against the

pound and 175.00 against the franc.

Against the U.S., Australia, the New Zealand and the Canadian

dollars, the yen slipped to 150.24, 97.19, 88.29 and 106.92 from

yesterday's closing quotes of 149.59, 96.80, 88.05 and 106.46,

respectively. The yen may test support near 157.00 against the

greenback, 102.00 against the aussie, 92.00 against the kiwi and

111.00 against the loonie.

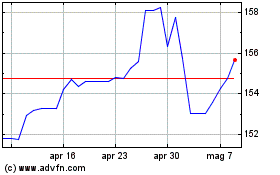

Grafico Cross US Dollar vs Yen (FX:USDJPY)

Da Nov 2024 a Dic 2024

Grafico Cross US Dollar vs Yen (FX:USDJPY)

Da Dic 2023 a Dic 2024