false

0001173313

0001173313

2025-01-06

2025-01-06

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange

Act of 1934

Date of Report (Date of earliest event reported): January 6, 2025

ABVC BIOPHARMA, INC.

(Exact name of registrant as specified in its charter)

| Nevada |

|

001-40700 |

|

26-0014658 |

(State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

44370 Old Warm Springs Blvd.

Fremont, CA |

|

94538 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number including area

code: (510) 668-0881

(Former name or former address, if changed since last

report)

Check the appropriate box below if the Form 8-K filing

is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.001 per share |

|

ABVC |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an

emerging growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark

if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards

provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

As previously reported, over the past year, ABVC BioPharma,

Inc. (the “Company”) has entered into three securities purchase agreements with Lind Global Fund II, LP (“Lind”),

pursuant to which the Company has issued to Lind: (i) 3,527,778 shares of the Company’s common stock, par value $0.001 per share

(the “Common Stock”) underlying a secured, convertible note pursuant to that certain securities purchase agreement

dated as of February 23, 2023 between the Company and Lind (the “Lind Transaction”); (ii) 5,291,667 shares of Common

Stock underlying a common stock purchase warrant pursuant to the Lind Transaction; (iii) 342,857 shares of Common Stock of the Company

underlying a secured, convertible note pursuant to that certain securities purchase agreement dated as of November 17, 2023 between the

Company and Lind (the “2nd Lind Transaction”); (iv) 1,000,000 shares of Common Stock underlying a common

stock purchase warrant pursuant to the 2nd Lind Transaction; (v) 285,714 shares of Common Stock of the Company underlying a

secured, convertible note pursuant to that certain securities purchase agreement dated as of January 17, 2024 between the Company and

Lind (the “3rd Lind Transaction,” together with the Lind Transaction and 2nd Lind Transaction,

the “Initial Lind Transactions”) and (vi) 1,000,000 shares of Common Stock underlying a common stock purchase warrant

pursuant to the 3rd Lind Transaction. On May 22, 2024, the Company and Lind entered into a letter agreement (the “May

Letter Agreement”), pursuant to which Lind exercised, for cash, 1,000,000 of the Existing Warrants to purchase shares of Common

Stock at a reduced exercise price of $0.75 per share. Lind also received a new warrant to purchase 1,000,000 shares Common Stock, exercisable

at any time on or after the date of its issuance and until the five-year anniversary thereof, for $1.00 per share (the “May Warrant”,

with all of the warrants issued to Lind hereinafter referred to as the “Existing Warrants”). On November 4, 2024, the

Company and Lind entered into another letter agreement (the “November Letter Agreement”), pursuant to which Lind agreed

to exercise, for cash, 500,000 of the Existing Warrants to purchase shares of Common Stock, with a current exercise price of $0.75 per

share, at a reduced exercise price of $0.42 per share.

On January 5, 2025, the Company and Lind entered

into a third letter agreement (the “December Letter Agreement”), pursuant to which Lind agreed to exercise for cash,

1,029,167 of the Existing Warrants (the number of warrants so exercised is herein referred to as the “Outstanding Exercised Warrants”)

to purchase shares of Common Stock, with a current exercise price of $0.75 per share, at a reduced exercise price of $0.40 per share.

Other than the Outstanding Exercised Warrants, the exercise price of the remaining warrants held by Lind remained unchanged. Pursuant

to the December Letter Agreement, the Company also agreed not to sell or issue any additional shares of common stock for a period of 15

days following the closing, with some noted exceptions.

The December Letter Agreement

also contains customary representation and warranties of the Company and Lind, indemnification obligations of the Company, termination

provisions, and other obligations and rights of the parties.

The foregoing description of the transaction documents

is qualified by reference to the full text of the forms of the documents, which are filed as Exhibits hereto and incorporated herein by

reference.

Neither this Current Report on Form 8-K, nor any exhibit

attached hereto, is an offer to sell or the solicitation of an offer to buy the Securities described herein. Such disclosure does not

constitute an offer to sell, or the solicitation of an offer to buy nor shall there be any sales of the Company’s securities in

any state in which such offer, solicitation or sale would be unlawful. The securities mentioned herein have not been registered under

the United States Securities Act of 1933, as amended, and may not be offered or sold in the United States absent registration or an applicable

exemption from the registration requirements under the Securities Act and applicable state securities laws.

Item 3.02 Unregistered Sales of Equity Securities.

The information contained above under Item 1.01, to

the extent applicable, is hereby incorporated by reference herein.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits.

Exhibit

Number |

|

Exhibit |

| 10.1 |

|

Letter Agreement |

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities and

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

ABVC BioPharma, Inc. |

| |

|

|

| January 6, 2025 |

By: |

/s/ Uttam Patil |

| |

|

Uttam Patil |

| |

|

Chief Executive Officer |

Exhibit 10.1

January 5, 2025

| Re: | Inducement Offer to Exercise Existing Warrants to Purchase

Common Stock |

Reference is made

to that certain (i) Common Stock Purchase Warrant issued by ABVC Biopharma, Inc., a Nevada corporation (the “Company”)

to Lind Global Fund II LP (the “Holder”), on February 23, 2023, to initially purchase 5,291,667 shares (529,167 shares

after the after the July 2023 1-for-10 reverse stock split) of the Company’s common stock, par value $0.001 per share (the “Common

Stock”) (the “First Warrant”), (ii) Common Stock Purchase Warrant issued by the Company to the Holder, on

November 17, 2023, to initially purchase 1,000,000 shares of Common Stock (the “Second Warrant”), and (iii) Common

Stock Purchase Warrant issued by the Company to the Holder, on January 17, 2024, to initially purchase 1,000,000 shares of Common Stock

(the “Third Warrant”). On May 22, 2024, the Company and the Holder entered into a letter agreement (the “First

Letter Agreement”), pursuant to which the Holder exercised, for cash, 1,000,000 of the Existing Warrants to purchase shares

of Common Stock at a reduced exercise price of $0.75 per share, and in respect of which Holder also received a new warrant to purchase

1,000,000 shares Common Stock, exercisable at any time on or after the date of its issuance and until the five-year anniversary thereof,

for $1.00 per share (the “Fourth Warrant”, and together with the First Warrant, the Second Warrant, and the Third Warrant,

the “Existing Warrants”).

We are pleased to offer to

the Holder the opportunity to receive a modification in the current exercise price (the “Exercise Price”) of the Existing

Warrants in consideration for you exercising for cash a portion of the Existing Warrants into 1,029,167 shares of Common Stock (the “Warrant

Purchase Amount”). The Company agrees to modify the Exercise Price of the Warrants representing the Warrant Purchase Amount

(the “Outstanding Exercised Warrants”) to $0.40 per share (the “New Exercise Price”) in consideration

for you exercising the Existing Warrants as provided herein (the “Warrant Exercise”). Other than the Outstanding Exercised

Warrants, the Exercise Price of any remaining unexercised Warrants shall remain unchanged at $1.00 per share. The Company also makes the

representations and warranties included on Annex A attached hereto, which is incorporated herein by reference.

The resale of the

Common Stock underlying the Existing Warrants (the “Warrant Shares”) has been registered for resale pursuant to the

registration statement on the Company’s Registration Statement (the “Registration Statement”) on Form S-1 (File

number 333-280411 under the Securities Act of 1933, as amended (“Securities Act”)). The Registration Statement is currently

effective and, upon your exercise of your Existing Warrants pursuant to this letter agreement, will be effective for the resale of the

Warrant Shares. Capitalized terms not otherwise defined herein shall have the meanings set forth in the New Warrants (as defined herein).

The Holder will exercise the

Existing Warrants up to the Warrant Purchase Amount upon or promptly following execution of this letter at the New Exercise Price. The

Holder shall first exercise all or a portion of the First Warrant, followed by all or a portion of the Second Warrant, and lastly all

or a portion of the Third Warrant up to the Warrant Purchase Amount.

Expressly subject to the paragraph

immediately following this paragraph below, you may accept this offer by executing the signature page of this letter, with such acceptance

constituting your exercise of the Existing Warrants for an aggregate exercise price set forth on your signature page hereto (the “Warrant

Exercise Price”) up to the Warrant Purchase Amount.

If this offer is accepted

and this letter agreement is executed by you and the Company, then as promptly as possible following the date of this letter agreement’s

execution, but in any event no later than 8:00 a.m., Eastern Time, on the Trading Day succeeding the date of this letter agreement’s

execution, the Company shall issue a press release disclosing all material terms of the transactions contemplated hereunder and/or file

a Current Report on Form 8-K with the Commission disclosing all material terms of the transactions contemplated hereunder, including this

letter agreement as an exhibit thereto with the Commission within the time required by the Exchange Act. From and after the issuance of

such press release or the filing of such Current Report on Form 8-K, as applicable, the Company represents to you that it shall have publicly

disclosed all material, non-public information delivered to you by the Company, or any of its respective officers, directors, employees,

or agents in connection with the transactions contemplated hereunder. In addition, effective upon the issuance of such press release and/or

the filing of such Current Report on Form 8-K, the Company acknowledges and agrees that any and all confidentiality or similar obligations

under any agreement, whether written or oral, between the Company, any of its Subsidiaries or any of their respective officers, directors,

agents, employees or Affiliates on the one hand, and you and your Affiliates on the other hand, shall terminate. The Company represents,

warrants, and covenants that, upon acceptance of this offer, the Warrant Shares issuable upon your exercise of the Existing Warrants shall

be issued free of any legends or restrictions on resale by Holder.

No later than the Trading

Day following the date of the public disclosure of the transactions hereunder (the “Closing Date”), the closing (“Closing”)

shall occur at such location as the parties shall mutually agree. Unless otherwise directed by the Company, settlement of the Warrant

Shares shall occur via “Delivery Versus Payment” (“DVP”) (i.e., on the Closing Date, the Company shall

issue the Warrant Shares registered in the Holder’s name and address provided to the Company in writing and released by the Transfer

Agent directly to the account(s) identified by the Holder; upon receipt of such Warrant Shares, the Holder therefor shall make a payment

by wire transfer to the Company). The date of the Closing of the exercise of the Existing Warrants shall be referred to as the “Closing

Date.”

*****

| |

Sincerely yours, |

| |

|

|

| |

ABVC Biopharma, Inc. |

| |

|

|

| |

By: |

|

| |

Name: |

|

| |

Title: |

|

[Holder Signature Page Follows]

Accepted and Agreed to:

| LIND GLOBAL FUND II LP |

|

| |

|

|

| By: |

|

|

| Name: |

|

|

| Title: |

|

|

Aggregate Reduced Exercise Price of Holder’s

Existing Warrants being exercised contemporaneously with signing this letter agreement: $411,666.80

DTC Instructions:

[Holder signature page to Inducement Offer]

Annex A

Representations, Warranties and

Covenants of the Company. The Company hereby makes the following representations and warranties to the Holder:

| a) | SEC Reports. The Company has filed all reports, schedules, forms, statements and other documents required to be filed by the

Company under the Exchange Act, including pursuant to Section 13(a) or 15(d) thereof, for the two years preceding the date hereof (or

such shorter period as the Company was required by law or regulation to file such material) (the foregoing materials, including the exhibits

thereto and documents incorporated by reference therein “SEC Reports”). As of their respective dates, the SEC Reports

complied in all material respects with the requirements of the Exchange Act and none of the SEC Reports, when filed, contained any untrue

statement of a material fact or omitted to state a material fact required to be stated therein or necessary in order to make the statements

therein, in the light of the circumstances under which they were made, not misleading. The Company has never been an issuer subject to

Rule 144(i) under the Securities Act. |

| b) | Authorization; Enforcement. The Company has the requisite corporate power and authority to enter into and to consummate the

transactions contemplated by this letter agreement and otherwise to carry out its obligations hereunder and thereunder. The execution

and delivery of this letter agreement by the Company and the consummation by the Company of the transactions contemplated hereby have

been duly authorized by all necessary action on the part of the Company and no further action is required by the Company, its board of

directors or its stockholders in connection therewith. This letter agreement has been duly executed by the Company and, when delivered

in accordance with the terms hereof, will constitute the valid and binding obligation of the Company enforceable against the Company in

accordance with its terms, except (i) as limited by general equitable principles and applicable bankruptcy, insolvency, reorganization,

moratorium and other laws of general application affecting enforcement of creditors’ rights generally, (ii) as limited by laws relating

to the availability of specific performance, injunctive relief or other equitable remedies and (iii) insofar as indemnification and contribution

provisions may be limited by applicable law. |

| c) | No Conflicts. The execution, delivery and performance of this letter agreement by the Company and the consummation by the Company

of the transactions contemplated hereby do not and will not: (i) conflict with or violate any provision of the Company’s certificate

or articles of incorporation, bylaws or other organizational or charter documents; or (ii) conflict with, or constitute a default (or

an event that with notice or lapse of time or both would become a default) under, result in the creation of any liens, claims, security

interests, other encumbrances or defects upon any of the properties or assets of the Company in connection with, or give to others any

rights of termination, amendment, acceleration or cancellation (with or without notice, lapse of time or both) of, any material agreement,

credit facility, debt or other material instrument (evidencing Company debt or otherwise) or other material understanding to which such

Company is a party or by which any property or asset of the Company is bound or affected; or (iii) conflict with or result in a violation

of any law, rule, regulation, order, judgment, injunction, decree or other restriction of any court or governmental authority to which

the Company is subject (including federal and state securities laws and regulations), or by which any property or asset of the Company

is bound or affected, except, in the case of each of clauses (ii) and (iii), such as could not have or reasonably be expected to result

in a material adverse effect upon the business, prospects, properties, operations, condition (financial or otherwise) or results of operations

of the Company, taken as a whole, or in its ability to perform its obligations under this letter agreement. |

| d) | Trading Market. To the Company’s knowledge, the transactions contemplated under this letter agreement comply with all

the rules and regulations of the Nasdaq Capital Market. |

| e) | Filings, Consents and Approvals. The Company is not required to obtain any consent, waiver, authorization or order of, give

any notice to, or make any filing or registration with, any court or other federal, state, local or other governmental authority or other

Person in connection with the execution, delivery and performance by the Company of this letter agreement, other than: (i) the filings

required pursuant to this letter agreement; (ii) the filing of Form D with the Commission and such filings as are required to be made

under applicable state securities laws. |

| f) | Listing of Common Stock. The Company hereby agrees to use best efforts to maintain the listing or quotation of the Common Stock

on the Trading Market on which it is currently listed and will then take all action reasonably necessary to continue the listing and trading

of its Common Stock on a Trading Market and will comply in all respects with the Company’s reporting, filing and other obligations

under the bylaws or rules of the Trading Market. The Company agrees to maintain the eligibility of the Common Stock for electronic transfer

through the Depository Trust Company or another established clearing corporation, including, without limitation, by timely payment of

fees to the Depository Trust Company or such other established clearing corporation in connection with such electronic transfer. |

| g) | Subsequent Equity Sales. |

| |

(i) | From the date of this letter agreement until fifteen (15) calendar

days after the Closing Date (the “Prohibition Period”), neither the Company nor any Subsidiary shall (A) issue, enter

into any agreement to issue or announce the issuance or proposed issuance of any Common Stock or Common Stock Equivalents or (B) file

any registration statement or any amendment or supplement to any existing registration statement (other than (x) the Resale Registration

Statement referred to herein, (y) prospectus supplement to the Resale Registration Statement to reflect the transactions contemplated

hereby or (z) supplements to an existing registration statement and the prospectus used in connection with an existing registration statement,

which prospectus is to be filed pursuant to Rule 424 promulgated under the Securities Act, as may be necessary to keep such registration

statement effective at all times during the respective registration period associated with such existing registration statement). Notwithstanding

the foregoing, this Section (g)(i) shall not apply in respect of an Exempt Issuance. “Exempt Issuance” means the issuance

of (a) Common Stock or options to employees, officers or directors of the Company pursuant to any stock or option plan duly adopted for

such purpose, by a majority of the non-employee members of the Board of Directors or a majority of the members of a committee of non-employee

directors established for such purpose for services rendered to the Company, (b) securities issued pursuant to acquisitions or strategic

transactions approved by a majority of the disinterested directors of the Company, provided that such securities are issued as “restricted

securities” (as defined in Rule 144) and carry no registration rights that require or permit the filing of any registration statement

in connection therewith during the Prohibition Period , and provided that any such issuance shall only be to a Person (or to the equity

holders of a Person) which is, itself or through its subsidiaries, an operating company or an owner of an asset in a business synergistic

with the business of the Company and shall provide to the Company additional benefits in addition to the investment of funds, but shall

not include a transaction in which the Company is issuing securities primarily for the purpose of raising capital or to an entity whose

primary business is investing in securities, and (c) securities upon the exercise or exchange of or conversion of any securities exercisable

or exchangeable for or convertible into shares of Common Stock issued and outstanding on the date of this letter agreement, provided

that such securities have not been amended since the date of this letter agreement to increase the number of such securities or to decrease

the exercise price, exchange price or conversion price of such securities (other than in connection with automatic price resets, stock

splits, adjustments or combinations as set forth in such securities) or to extend the term of such securities. “Person”

means an individual or corporation, partnership, trust, incorporated or unincorporated association, joint venture, limited liability

company, joint stock company, government (or an agency or subdivision thereof) or other entity of any kind, for purposes of this Section

(g)(i). |

| h) | Form D; Blue Sky Filings. If required, the Company agrees to timely file a Form D with respect to the New Warrants and New

Warrant Shares as required under Regulation D and to provide a copy thereof, promptly upon request of any Holder. The Company shall take

such action as the Company shall reasonably determine is necessary in order to obtain an exemption for, or to qualify the New Warrants

and New Warrant Shares for, sale to the Holder at Closing under applicable securities or “Blue Sky” laws of the states of

the United States and shall provide evidence of such actions promptly upon request of any Holder. |

| i) | Expenses of the Holder. The Company shall reimburse the Holder $3,000.00 for the expenses of Holder’s counsel in connection

with its review and negotiation of the letter agreement, which such amount will be withheld from the Warrant Exercise Price. |

v3.24.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

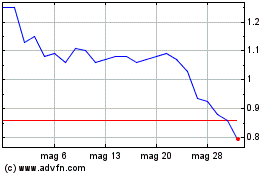

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Feb 2025 a Mar 2025

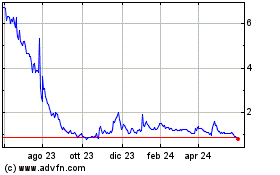

Grafico Azioni ABVC BioPharma (NASDAQ:ABVC)

Storico

Da Mar 2024 a Mar 2025