false

0001350102

0001350102

2024-05-23

2024-05-23

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d) of

The

Securities Exchange Act of 1934

Date of Report (Date of

earliest event reported): May 23,

2024

ASCENT SOLAR

TECHNOLOGIES, INC.

(Exact name of registrant

as specified in its charter)

| Delaware |

|

001-32919 |

|

20-3672603 |

| (State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(I.R.S. Employer Identification No.) |

| 12300 Grant Street |

|

| Thornton, CO |

80241 |

| (Address of principal executive offices) |

(Zip Code) |

| |

(720) 872-5000 |

|

| |

(Registrant’s telephone number, including area code) |

|

Not Applicable

(Former name, or former

address, if changed since last report.)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

| Common

Stock, par value $0.0001 per share |

|

ASTI |

|

Nasdaq Capital

Market |

Indicate by check mark whether

the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule

12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company,

indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

As previously disclosed,

on May 16, 2024, Ascent Solar Technologies, Inc., a Delaware corporation (“we,” “us,” the “Company”

or “Ascent”), entered into an At The Market Offering Agreement (the “ATM Agreement”) with H.C. Wainwright &

Co., LLC, as sales agent (“Wainwright”), to sell shares of its common stock, par value $0.0001 per share (the “Shares”),

with an aggregate sales price of initially up to $4,219,000, from time to time, through an “at the market offering” program.

The Company has determined

to increase the amount available for sale under the ATM Agreement, up to an additional aggregate offering price of $4,344,000.

The Shares will be

issued pursuant to our shelf registration statement on Form S-3 (File No. 333-267971) initially filed by the

Company with the U.S. Securities and Exchange Commission (the “SEC”) on October 21, 2022 and declared effective by the SEC

on November 7, 2022, and a related prospectus supplement (the “Prospectus Supplement”), dated May 23, 2024, and the accompanying

prospectus filed with the SEC on the date hereof in connection with the offer and sale of the Shares.

Because there is no

minimum offering amount required pursuant to the ATM Agreement, the total number of Shares to be sold under the ATM agreement, if any,

and proceeds to the Company, if any, are not determinable at this time. The Company expects to use any net proceeds primarily for general

and administrative expenses and other general corporate purposes. The Company’s management will have significant discretion and

flexibility in applying the net proceeds from the sale of these securities.

This Current Report

does not constitute an offer to sell or the solicitation of an offer to buy any security nor shall there be any sale of these securities

in any state in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws

of any such state.

Attached hereto as

Exhibit 5.1, and incorporated by reference to the Prospectus Supplement, is the opinion of Carroll Legal LLC relating to the legality

of the issuance and sale of the Shares.

Since May 16, 2024,

the Company has sold 24,332,693 shares of common stock under the ATM Agreement for gross proceeds of approximately $4,216,209. The Company’s

current outstanding shares of common stock are 65,394,126 as of May 23, 2024.

Item 9.01. Financial Statements and Exhibits.

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

| |

|

|

|

ASCENT SOLAR TECHNOLOGIES, INC. |

| |

|

|

|

| May 23, 2024 |

|

|

|

By: |

|

/s/ Jin Jo |

| |

|

|

|

|

|

|

|

Name: Jin Jo |

| |

|

|

|

|

|

|

|

Title: Chief Financial Officer |

Exhibit 5.1

CARROLL LEGAL LLC

1449 Wynkoop Street

Suite 507

Denver, CO 80202

May 23, 2024

Ascent Solar Technologies, Inc.

12300 Grant Street

Thornton, Colorado 80241

Re: At-The-Market Offering

pursuant to Registration Statement on Form S-3

Ladies and Gentlemen:

We have acted as counsel to Ascent

Solar Technologies, Inc., a Delaware corporation (the “Company”), in connection with the sale through H.C. Wainwright &

Co., LLC (the “Manager”), as the sales agent, from time to time by the Company of shares of the common stock of the Company,

par value $0.0001 per share (the “Common Stock”), having an aggregate offering price of up to $4,344,000 (the “Shares”),

to be issued pursuant to a registration statement on Form S-3 initially filed by the Company with the Securities and Exchange

Commission (the “Commission”) on October 21, 2022 (File No. 333-267971) (as amended, the “Registration Statement”),

the base prospectus, dated November 7, 2022, included in the Registration Statement (the “Base Prospectus”) and a prospectus

supplement, dated May 23, 2024, filed with the Commission pursuant to Rule 424(b) of the Securities Act of 1933, as amended (the “Act”)

(the “Prospectus Supplement” and together with the Base Prospectus, the “Prospectus”), and that certain At

The Market Offering Agreement, dated as of May 16, 2024, by and between the Company and the Manager (the “Offering Agreement”).

This opinion is being furnished

in connection with the requirements of Item 601(b)(5) of Regulation S-K under the Act, and no opinion is expressed herein as

to any matter pertaining to the contents of the Registration Statement or the Prospectus, other than as expressly stated herein with

respect to the issue of the Shares.

You have requested our opinion as to the matters set forth below in connection with the Registration

Statement and the Offering Agreement. For purposes of rendering the opinion set forth below, we have examined such documents and reviewed

such questions of law as we have considered necessary and appropriate for the purposes of our opinion including (i) the Registration

Statement, including the exhibits filed therewith, (ii) the Base Prospectus, (iii) the Prospectus Supplement, (iv) the Company’s

amended and restated certificate of incorporation, as amended (the “Certificate of Incorporation”), (v) the Company’s

second amended and restated bylaws, as amended, (vi) the Offering Agreement, and (vii) the corporate resolutions and other actions of

the Company that authorize and provide for the filing of the Prospectus Supplement and the issuance of the Shares pursuant thereto and

the Offering Agreement, and we have made such other investigation as we have deemed appropriate. We have not independently established

any of the facts so relied on.

For purposes of this opinion letter,

we have assumed the accuracy and completeness of each document submitted to us, the genuineness of all signatures on original documents,

the authenticity of all documents submitted to us as originals, the conformity to original documents of all documents submitted to us

as facsimile, electronic, certified, conformed or photostatic copies thereof, and the due execution and delivery of all documents where

due execution and delivery are prerequisites to the effectiveness thereof. We have further assumed the legal capacity of natural persons,

that persons identified to us as officers of the Company are actually serving in such capacity, that the representations of officers and

employees of the Company are correct as to questions of fact, that the board of directors will have taken all action necessary to set

the issuance price of the Shares to be offered and sold and that each party to the documents we have examined or relied on (other than

the Company) has the power, corporate or other, to enter into and perform all obligations thereunder and also have assumed the due authorization

by all requisite action, corporate or other, the execution and delivery by such parties of such documents, and the validity and binding

effect thereof on such parties. We have not independently verified any of these assumptions.

The opinions expressed in this

opinion letter are limited to the General Corporation Law of the State of Delaware (the “DGCL”) and the applicable statutory

provisions of the Delaware Constitution and the reported judicial decisions interpreting such statute and provisions and, solely in connection

with the opinion given below. We are not opining on, and we assume no responsibility for, the applicability to or effect on any of the

matters covered herein of (a) any other laws; (b) the laws of any other jurisdiction; or (c) the laws of any county, municipality or other

political subdivision or local governmental agency or authority.

Based on the foregoing and in

reliance thereon, and subject to the assumptions, qualifications, limitations and exceptions set forth below, we are of the opinion that:

| 1. | The Shares have been duly authorized by all requisite corporate action on

the part of the Company, and when the Shares are issued and paid for as described in the Prospectus in accordance with the terms of the

Offering Agreement, the Shares will be validly issued, fully paid and non-assessable. |

In rendering the foregoing opinion,

we have assumed that (i) the Company will comply with all applicable notice requirements regarding uncertificated shares provided in the

DGCL and (ii) upon the issue of any of the Shares, the total number of shares of Common Stock issued and outstanding will not exceed the

total number of shares of Common Stock that the Company is then authorized to issue under its Certificate of Incorporation.

We hereby consent to the filing

of this opinion with the Commission as Exhibit 5.1 to the Company’s Current Report on Form 8-K being filed on the date hereof and

incorporated by reference in the Prospectus. We also hereby consent to the reference to our firm under the heading “Legal Matters”

in the Prospectus and in each case in any amendment or supplement thereto. In giving this consent, we do not thereby admit that we are

within the category of persons whose consent is required under Section 7 and Section 11 of the Act, or the rules and regulations of the

Commission promulgated thereunder, nor do we admit that we are experts with respect to any part of the Prospectus within the meaning of

the term “expert” as used in the Act or the related rules and regulations of the Commission promulgated thereunder.

Yours truly,

CARROLL LEGAL LLC

By: /s/ James H. Carroll

Name: James H. Carroll

Title: Managing Member

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

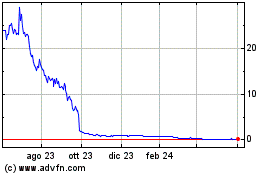

Grafico Azioni Ascent Solar Technologies (NASDAQ:ASTI)

Storico

Da Nov 2024 a Dic 2024

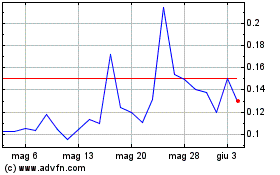

Grafico Azioni Ascent Solar Technologies (NASDAQ:ASTI)

Storico

Da Dic 2023 a Dic 2024