Brian Hamilton Joins Coastal Financial Corporation Board of Directors

04 Gennaio 2024 - 6:00PM

Coastal Financial Corporation (Nasdaq: CCB), the bank holding

company for Coastal Community Bank announced that Brian Hamilton

has joined its Board of Directors.

Mr. Hamilton is a seasoned financial technology executive and

business leader, with more than 25 years of experience in the

banking, lending, payments, and digital product development

industries. A serial entrepreneur, with deep expertise in domestic

and international settlement systems and digital platforms, Mr.

Hamilton has held senior leadership roles at Capital One, serving

as President of their Merchant Services division, Wells Fargo, and

Verifone, in addition to founding and operating multiple companies

in the fintech space.

Most recently Mr. Hamilton was co-founder and CEO of ONE (One

Finance Inc.), which was acquired by a Walmart-led joint venture in

2022. Prior to co-founding ONE, he was the founder of Azlo, a

digital bank for small businesses, and helped to build out the BBVA

Open Platform for sponsor banking services.

An honors graduate of Oregon State University, with technical

certifications from Wells Fargo’s commercial banking school and

various industry groups, Mr. Hamilton has extensive experience

across multiple aspects of the finance and technology industries,

thought leadership, public speaking, and mergers and

acquisitions.

“Brian will play a crucial role in guiding Coastal through the

evolving landscape of rapid technological advancements in the

financial services industry,” said Eric Sprink, CEO.

About Coastal Financial Corporation

Coastal Financial Corporation (Nasdaq: CCB), is an Everett,

Washington-based bank holding company with Coastal Community Bank

(the “Bank”) a full-service commercial bank, as its sole wholly

owned banking subsidiary. The Bank operates through its 14 branches

in Snohomish, Island, and King Counties, the Internet, and its

mobile banking application. The Bank, through its CCBX segment,

provides banking as a service (“BaaS”) that allows our

broker-dealer and digital financial service partners to offer their

customers banking services. As of September 30, 2023, we had total

assets of $3.68 billion, total gross loans of $2.97 billion, total

deposits of $3.29 billion, and total shareholders’ equity of $284.5

million. To learn more about Coastal Community Bank visit

www.coastalbank.com. Member FDIC.

Forward Looking Statements

This press release contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. These forward-looking statements reflect our current views

with respect to, among other things, future events and our

financial performance. Any statements about our management’s

expectations, beliefs, plans, predictions, forecasts, objectives,

assumptions or future events or performance are not historical

facts and may be forward-looking. Words or phrases such as

“anticipate,” “believes,” “can,” “could,” “may,” “predicts,”

“potential,” “should,” “will,” “estimate,” “plans,” “projects,”

“continuing,” “ongoing,” “expects,” “intends” and similar words or

phrases are intended to identify forward-looking statements but are

not the exclusive means of identifying such statements. The

inclusion of or reference to forward-looking information in this

press release should not be regarded as a representation by us or

any other person that the future plans, estimates or expectations

contemplated by us will be achieved. We have based these

forward-looking statements on our current expectations and

projections about future events and financial trends that we

believe may affect our financial condition, results of operations,

business strategy, and financial needs. Our actual results could

differ materially from those anticipated in such forward-looking

statements as a result of risks, uncertainties and assumptions that

are difficult to predict, an increase in unemployment levels and

slowdowns in economic growth; our expected future financial

results; the overall health of the local and national real estate

market; the credit risk associated with our loan portfolio, such as

possible additional loan losses and impairment of collectability of

loans as a result of the COVID-19 pandemic and policies and

programs implemented by the Coronavirus Aid, Relief, and Economic

Security Act (“CARES Act”), including its automatic loan

forbearance provisions and the effects on our loan portfolio from

our Paycheck Protection Program (“PPP”) lending activities,

specifically with our commercial real estate loans, and the success

of new hires in achieving anticipated objectives. For further

information with respect to factors that could cause actual results

to differ materially from those in the forward-looking statements

include, without limitation, the risks and uncertainties discussed

under “Risk Factors” in our Annual Report on Form 10-K for the most

recent period filed, our Quarterly Report on Form 10-Q for the most

recent quarter, and in any of our subsequent filings with the

Securities and Exchange Commission.

If one or more events related to these or other risks or

uncertainties materialize, or if our underlying assumptions prove

to be incorrect, actual results may differ materially from what we

anticipate. You are cautioned not to place undue reliance on

forward-looking statements. Further, any forward-looking statement

speaks only as of the date on which it is made and we undertake no

obligation to update or revise any forward-looking statement to

reflect events or circumstances after the date on which the

statement is made or to reflect the occurrence of unanticipated

events, except as required by law.

Contact:

Joel Edwards

Chief Financial Officer

425.357.3687

JEdwards@coastalbank.com

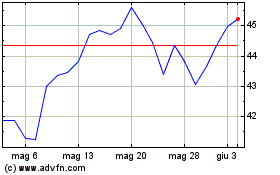

Grafico Azioni Coastal Financial (NASDAQ:CCB)

Storico

Da Dic 2024 a Gen 2025

Grafico Azioni Coastal Financial (NASDAQ:CCB)

Storico

Da Gen 2024 a Gen 2025