Global Mofy AI Limited (the “Company” or “Global Mofy”) (Nasdaq:

GMM), a generative AI-driven technology solutions provider engaged

in virtual content production and the development of 3D digital

assets for use in the broader digital content industry, today

reported financial results for the fiscal year ended September 30,

2024, with revenue, gross profit, and net income achieving

significant year-over-year growth.

The growth trajectory was driven by the

continued demand for high-quality digital assets and AI-driven

solutions in industries such as film, gaming, advertising, and

digital tourism. Additionally, the Company’s investments in

technology, innovation, and global expansion have rendered us

well-positioned to capitalize on the significant opportunities

ahead.

“We are proud to report exceptional financial

performance for fiscal year 2024, a year in which we achieved

significant milestones that strengthen our position in the global

digital content industry,” said Haogang Yang, Founder and CEO of

Global Mofy. “Our strategic shift towards generative AI driven

solutions and the continuous development of high-precision 3D

digital assets has allowed us to meet the growing demand for

digital content, while driving profitability and positioning the

Company for long-term growth. As we look ahead, we are confident in

our ability to sustain this momentum and deliver more value to our

shareholders.”

Financial Results for Fiscal Year Ended

September 30, 2024

Total Assets: As of September

30, 2024, Global Mofy’s total assets reached $59.2 million, an

increase of 118.3% compared to $27.1 million as of September 30,

2023. This growth reflects the Company’s strong capital

utilization, strategic investments in technology and

infrastructure, and the successful expansion of its asset base.

Revenue: Revenue for the fiscal

year 2024 totaled $41.4 million, an increase of 53.8% from $26.9

million in fiscal year 2023. The revenue growth was primarily

driven by the prosperity of the movie and TV industries boomed in

China in recent two years and sustained demand for

high-quality virtual content, 3D digital assets, and AI-driven

solutions across multiple sectors, including entertainment, on-line

game industry, and digital tourism.

Gross Profit: Gross profit for

the fiscal year 2024 increased by 43.2% to $20.8 million, up from

$14.5 million in fiscal year 2023. Gross margin remained strong at

50.3%, reflecting effective cost control measures and a shift

toward higher-margin digital asset development services.

Net Income: Net income for

fiscal year 2024 was $12.1 million, resulting in a net margin of

29.4%, compared to $6.6 million in fiscal year 2023, also

representing an increase by 89%. The increase in net income was

driven by higher revenues, improved operational efficiency, and

effective cost control.

Earnings Per Share (EPS): Basic

and diluted earnings per share for fiscal year 2024 were $6.37,

reflecting a significant 61.2% year-over-year increase from $3.93

in fiscal year 2023. This figure has been adjusted for the effect

of the reverse stock split on November 26, 2024.

Research and Development (R&D)

Expenses: R&D expenditures for fiscal year 2024

totaled $7.5 million, reflecting a 109.8% increase from $3.6

million in fiscal year 2023. These investments primarily focused on

expanding the Company’s 3D digital asset library, which encompassed

over 100,000 assets by the end of fiscal year 2024, as well as

advancing its generative AI solutions. Notably, the development of

the Gausspeed platform has made significant progress, positioning

the Company to further enhance its capabilities in AI-driven

content creation. These technological advancements are crucial for

sustaining long-term growth, driving innovation, and maintaining a

competitive edge in the rapidly evolving digital content

sector.

Recent Developments

Expansion of 3D Digital Asset

Library: By the end of fiscal year 2024, Global Mofy’s 3D

digital asset library encompassed over 100,000 assets. These

assets, characterized by high precision and reusability, are now

supporting a diverse range of applications in industries such as

film, television, advertising, on-line game industry, and digital

tourism.

Generative AI Advancements: On

April 30, 2024, Global Mofy announced the development of Gausspeed,

a generative AI platform for film production and digital content

creation. In collaboration with Heartdub and powered by NVIDIA

Omniverse and NVIDIA RTX GPUs, Gausspeed integrates with the NVIDIA

Omniverse Cloud API, enhancing collaboration, improving production

efficiency, and enabling real-time scene generation. This platform

allows creators to visualize and adjust scenes early in the

production process, streamlining workflows and reducing complexity,

positioning Global Mofy at the forefront of innovation in the

digital entertainment industry.

North American Expansion: On

May 22, 2024, Global Mofy expanded its global footprint with the

establishment of GMM DISCOVERY LLC in North America. This move

strengthens the Company’s presence in one of the world’s largest

markets for AI-driven content and 3D asset development and

positions the Company to better serve a growing client base in the

U.S., while capitalizing on new business opportunities across North

America.

Launch of $69 Million Fund with

Strategic Partners: On July 2, 2024, Global Mofy announced

the launch of a US$69 million investment fund aimed at fostering

growth in the AI, digital economy, and entertainment sectors. The

fund is being launched in partnership with Yi Zheng Yangzi Culture

and Tourism Holding Group Co., Ltd. (“Yangzi”) and Beijing Hengyun

International Private Equity Fund Management Co., Ltd. (“Beijing

Hengyun”). The fund will focus on acquisitions and investments in

high-quality projects aligned with Global Mofy’s business strategy.

This strategic initiative will strengthen the Company’s position in

rapidly expanding sectors, create value for shareholders, and drive

long-term growth.

Establishment of Vocational Education

Institute: On July 9, 2024, Global Mofy announced the

setup of the Century Mofy Vocational Education Institute in

Zhejiang, China, to address the growing demand for skilled talents

in AI and digital content creation industry. The Institute will

offer specialized training in AIGC technology development and the

creation of various digital content formats such as images, videos,

text, and music.

Private Placement Financing of $2.5

Million: On October 15, 2024, Global Mofy announced it has

entered into a Securities Purchase Agreement (SPA) with certain

institutional and accredited investors for a private placement

financing of approximately $2.5 million.

Strategic Cooperation with

Lianyungang: On October 23, 2024, Global Mofy signed a

strategic agreement with Lianyungang’s Haizhou High-Tech District

to collaborate on generative AI, digital tourism, and cultural

projects. The partnership aims to enhance Lianyungang’s cultural

heritage through digital platforms and AI-driven solutions.

MIIT Membership Awarded: On

November 12, 2024, Global Mofy was awarded membership in the

Industrial Brand Promotion Organization by the Ministry of Industry

and Information Technology (MIIT). This membership highlights the

Company’s leadership in generative AI technology and its commitment

to advancing brand competitiveness in the digital content

industry.

Conference Call and Webcast

Information

Global Mofy will host a conference call and

webcast to discuss its financial results for fiscal year 2024 and

provide a business outlook on January 3, 2025, at 9:00 AM

EST. Participants can register for the live audio call

using the following link:

[https://register.vevent.com/register/BI4123b2278fe8413caec3c544c97a6528]Upon

successful registration, participants will receive a conference PIN

and dial-in number. A live webcast of the conference call will be

available at:[https://edge.media-server.com/mmc/p/3vzc68vn]A full

recording of the call will be available on the Company’s investor

relations website immediately after the event:

[http://ir.globalmofy.cn]

Forward-Looking StatementThis

press release contains forward-looking statements. Forward-looking

statements include statements concerning plans, objectives, goals,

strategies, future events or performance, and underlying

assumptions and other statements that are other than statements of

historical facts. When the Company uses words such as "may,"

"will," "intend," "should," "believe," "expect," "anticipate,"

"project," "estimate" or similar expressions that do not relate

solely to historical matters, it is making forward-looking

statements. These forward-looking statements include, without

limitation, the Company's statements regarding the expected trading

of its Ordinary Shares on the Nasdaq Capital Market and the closing

of the Offering. Forward-looking statements are not guarantees of

future performance and involve risks and uncertainties that may

cause the actual results to differ materially from the Company's

expectations discussed in the forward-looking statements. These

statements are subject to uncertainties and risks including, but

not limited to, the uncertainties related to market conditions and

the completion of the initial public offering on the anticipated

terms or at all, and other factors discussed in the "Risk Factors"

section of the registration statement filed with the SEC. For these

reasons, among others, investors are cautioned not to place undue

reliance upon any forward-looking statements in this press release.

Additional factors are discussed in the Company's filings with the

SEC, which are available for review at www.sec.gov. The Company

undertakes no obligation to publicly revise these forward-looking

statements to reflect events or circumstances that arise after the

date hereof.

For more information, please

contact:Global Mofy AI Ltd.Investor Relations

Departmentir@mof-vfx.com

|

GLOBAL MOFY AI LIMITED |

|

CONSOLIDATED BALANCE SHEETS |

|

(Expressed in U.S. Dollars, except for the number of

shares) |

|

|

|

|

|

As of September 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

|

|

US$ |

|

|

US$ |

|

|

ASSETS |

|

|

|

|

|

|

|

Current assets |

|

|

|

|

|

|

|

Cash |

|

$ |

8,068,560 |

|

|

$ |

10,437,580 |

|

|

Restricted cash |

|

|

3,000,000 |

|

|

|

— |

|

|

Short-term investments |

|

|

— |

|

|

|

780,000 |

|

|

Accounts receivable, net |

|

|

1,254,613 |

|

|

|

3,286,330 |

|

|

Advances to vendors |

|

|

5,736,093 |

|

|

|

2,593,887 |

|

|

Due from related parties |

|

|

19,665 |

|

|

|

— |

|

|

Loans receivable – current |

|

|

— |

|

|

|

287,829 |

|

|

Prepaid expenses and other current assets, net |

|

|

967,613 |

|

|

|

507,336 |

|

|

Total current assets |

|

$ |

19,046,544 |

|

|

|

17,892,962 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current assets |

|

|

|

|

|

|

|

|

|

Long-term investments |

|

|

284,998 |

|

|

|

— |

|

|

Property and equipment, net |

|

|

13,420 |

|

|

|

34,431 |

|

|

Intangible assets, net |

|

|

38,796,262 |

|

|

|

6,505,792 |

|

|

Operating lease right-of-use assets |

|

|

660,946 |

|

|

|

954,771 |

|

|

Loans receivable – non-current |

|

|

— |

|

|

|

447,505 |

|

|

Advances to vendors – non-current |

|

|

261,956 |

|

|

|

1,020,874 |

|

|

Prepaid expenses and other non-current assets, net |

|

|

127,732 |

|

|

|

262,986 |

|

|

Total non-current assets |

|

|

40,145,314 |

|

|

|

9,226,359 |

|

|

Total assets |

|

$ |

59,191,858 |

|

|

$ |

27,119,321 |

|

|

|

|

|

|

|

|

|

|

|

|

LIABILITIES AND EQUITY |

|

|

|

|

|

|

|

|

|

Current liabilities |

|

|

|

|

|

|

|

|

|

Short-term bank loans |

|

$ |

5,397,521 |

|

|

$ |

2,442,609 |

|

|

Loans from third parties |

|

|

23,512 |

|

|

|

22,615 |

|

|

Accounts payable |

|

|

1,213,114 |

|

|

|

531,091 |

|

|

Advances from customers |

|

|

3,837,621 |

|

|

|

345,838 |

|

|

Due to a related party |

|

|

50,380 |

|

|

|

— |

|

|

Tax payable |

|

|

2,035,653 |

|

|

|

1,555,059 |

|

|

Accrued expenses and other liabilities |

|

|

553,696 |

|

|

|

555,440 |

|

|

Operating lease liabilities – current |

|

|

270,183 |

|

|

|

293,040 |

|

|

Total current liabilities |

|

$ |

13,381,680 |

|

|

|

5,745,692 |

|

|

|

|

|

|

|

|

|

|

|

|

Non-current liabilities |

|

|

|

|

|

|

|

|

|

Operating lease liabilities – non-current |

|

|

308,575 |

|

|

|

556,674 |

|

|

Total non-current liabilities |

|

|

308,575 |

|

|

|

556,674 |

|

|

Total liabilities |

|

$ |

13,690,255 |

|

|

|

6,302,366 |

|

|

|

|

|

|

|

|

|

|

|

|

Equity: |

|

|

|

|

|

|

|

|

|

Class A ordinary shares ($0.00003 par value, 30,000,000,000 shares

authorized, 1,410,001 and 1,728,410 shares issued and outstanding

as of September 30, 2024 and 2023, respectively)* |

|

|

42 |

|

|

|

52 |

|

|

Class B Ordinary Shares ($0.00003 par value, 4,000,000,000 shares

authorized, 848,203 and 0 shares issued and outstanding as of

September 30, 2024 and 2023, respectively) |

|

|

26 |

|

|

|

- |

|

|

Additional paid-in capital |

|

|

27,796,887 |

|

|

|

16,035,229 |

|

|

Statutory reserves |

|

|

1,926,547 |

|

|

|

368,271 |

|

|

Accumulated earnings |

|

|

15,737,191 |

|

|

|

5,158,115 |

|

|

Accumulated other comprehensive income (loss) |

|

|

187,118 |

|

|

|

(604,182 |

) |

|

Total Global Mofy AI Limited shareholders’

equity |

|

|

45,647,811 |

|

|

|

20,957,485 |

|

|

Non-controlling interests |

|

|

(146,208 |

) |

|

|

(140,530 |

) |

|

Total equity |

|

|

45,501,603 |

|

|

|

20,816,955 |

|

|

Total liabilities and equity |

|

$ |

59,191,858 |

|

|

$ |

27,119,321 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

* Retrospectively restated for effect of reverse

stock split on November 26, 2024. |

|

GLOBAL MOFY AI LIMITED |

|

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME

(LOSS) |

|

(Expressed in U.S. Dollars, except for the number of

shares) |

|

|

|

|

|

For the years

endedSeptember 30, |

|

|

|

|

2024 |

|

|

2023 |

|

|

2022 |

|

|

|

|

US$ |

|

|

US$ |

|

|

US$ |

|

|

Revenue |

|

|

|

|

|

|

|

|

|

|

Revenue from third parties |

|

$ |

41,360,953 |

|

|

$ |

26,889,911 |

|

|

$ |

14,540,300 |

|

|

Revenue from related parties |

|

|

— |

|

|

|

— |

|

|

|

2,647,993 |

|

|

Revenue |

|

|

41,360,953 |

|

|

|

26,889,911 |

|

|

|

17,188,293 |

|

|

Cost of revenue |

|

|

(20,556,763 |

) |

|

|

(12,357,934 |

) |

|

|

(13,072,732 |

) |

|

Gross profit |

|

|

20,804,190 |

|

|

|

14,531,977 |

|

|

|

4,115,561 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Selling expenses |

|

|

(1,107,215 |

) |

|

|

(294,587 |

) |

|

|

(153,822 |

) |

|

General and administrative expenses |

|

|

(5,425,015 |

) |

|

|

(3,046,037 |

) |

|

|

(1,041,330 |

) |

|

Research and development expenses |

|

|

(7,448,583 |

) |

|

|

(3,546,155 |

) |

|

|

(3,207,759 |

) |

|

Total operating expenses |

|

|

(13,980,813 |

) |

|

|

(6,886,779 |

) |

|

|

(4,402,911 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) from operations |

|

|

6,823,377 |

|

|

|

7,645,198 |

|

|

|

(287,350 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Other (expenses) income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

208,647 |

|

|

|

41,230 |

|

|

|

42,948 |

|

|

Interest expenses |

|

|

(195,331 |

) |

|

|

(126,206 |

) |

|

|

(74,888 |

) |

|

Issuance costs allocated to warrant liability |

|

|

(823,846 |

) |

|

|

— |

|

|

|

— |

|

|

Change in fair value of warrant liability |

|

|

6,827,034 |

|

|

|

— |

|

|

|

— |

|

|

Other income, net |

|

|

144,819 |

|

|

|

89,124 |

|

|

|

54,049 |

|

|

Total other income, net |

|

|

6,161,323 |

|

|

|

4,148 |

|

|

|

22,109 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Income (loss) before income taxes |

|

|

12,984,700 |

|

|

|

7,649,346 |

|

|

|

(265,241 |

) |

|

Income tax expense |

|

|

(847,448 |

) |

|

|

(1,098,087 |

) |

|

|

— |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

|

12,137,252 |

|

|

|

6,551,259 |

|

|

|

(265,241 |

) |

|

Net (loss) income attributable to non-controlling interest |

|

|

(100 |

) |

|

|

(579 |

) |

|

|

1,981 |

|

|

Net income (loss) attributable to Global Mofy AI Limited |

|

$ |

12,137,352 |

|

|

$ |

6,551,838 |

|

|

$ |

(267,222 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Comprehensive income (loss) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Net income (loss) |

|

$ |

12,137,252 |

|

|

$ |

6,551,259 |

|

|

$ |

(265,241 |

) |

|

Foreign currency translation Gain (loss) |

|

|

785,722 |

|

|

|

(407,248 |

) |

|

|

(198,124 |

) |

|

Total comprehensive income (loss) |

|

|

12,922,974 |

|

|

|

6,144,011 |

|

|

|

(463,365 |

) |

|

Comprehensive income attributable to non-controlling interests |

|

|

(5,678 |

) |

|

|

3,031 |

|

|

|

2,304 |

|

|

Comprehensive income (loss) attributable to Global Mofy AI

Limited |

|

$ |

12,928,652 |

|

|

$ |

6,140,980 |

|

|

$ |

(465,669 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings (loss) per Class A ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

– Basic and diluted* |

|

$ |

6.37 |

|

|

$ |

3.93 |

|

|

$ |

(0.17 |

) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average number of Class A ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

– Basic and diluted* |

|

|

1,798,850 |

|

|

|

1,668,083 |

|

|

|

1,562,766 |

|

|

Earnings per Class B ordinary share |

|

|

|

|

|

|

|

|

|

|

|

|

|

– Basic and diluted* |

|

$ |

6.37 |

|

|

$ |

- |

|

|

$ |

- |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Weighted average Class B ordinary shares outstanding |

|

|

|

|

|

|

|

|

|

|

|

|

|

– Basic and diluted* |

|

|

106,605 |

|

|

|

- |

|

|

|

- |

|

|

* |

Retrospectively restated for effect of reverse stock split on

November 26, 2024. |

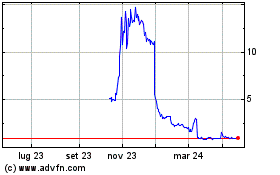

Grafico Azioni Globa Mofy AI (NASDAQ:GMM)

Storico

Da Dic 2024 a Gen 2025

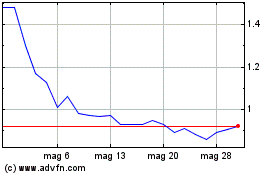

Grafico Azioni Globa Mofy AI (NASDAQ:GMM)

Storico

Da Gen 2024 a Gen 2025