UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16

UNDER THE SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number: 001-41834

GLOBAL

MOFY AI LIMITED

No. 102, 1st Floor, No.

A12, Xidian Memory Cultural and Creative Town

Gaobeidian Township, Chaoyang

District, Beijing

People’s Republic of China, 100000

+86-10-64376636

(Address of Principal Executive Offices)

Indicate by check mark whether the registrant files or will file annual

reports under cover Form 20-F or Form 40-F.

Form 20-F ☒ Form 40-F ☐

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

GLOBAL MOFY AI LIMITED |

| |

|

|

| Date: January 3, 2025 |

By: |

/s/ Haogang Yang |

| |

Name: |

Haogang Yang |

| |

Title: |

Chief Executive Officer, and a director |

2

Exhibit 99.1

Global Mofy Announces Fiscal Year 2024 Financial

Results; Conference Call Scheduled for Friday, January 3rd, at 9:00 AM Eastern Time

- Total Revenue of $41.4 million, up 53.8%

from the previous year, reflecting record high annual revenue in the Company’s history.

- Gross Profit of $20.8 million and net

income of $12.1 million, both reaching historical high, with a robust 50.3% gross margin.

BEIJING, January 3, 2025 — Global Mofy AI

Limited (the “Company” or “Global Mofy”) (Nasdaq: GMM), a generative AI-driven technology solutions provider engaged

in virtual content production and the development of 3D digital assets for use in the broader digital content industry, today reported

financial results for the fiscal year ended September 30, 2024, with revenue, gross profit, and net income achieving significant year-over-year

growth..

The growth trajectory was driven by the continued

demand for high-quality digital assets and AI-driven solutions in industries such as film, gaming, advertising, and digital tourism. Additionally,

the Company’s investments in technology, innovation, and global expansion have rendered us well-positioned to capitalize on the

significant opportunities ahead.

“We are proud to report exceptional financial

performance for fiscal year 2024, a year in which we achieved significant milestones that strengthen our position in the global digital

content industry,” said Haogang Yang, Founder and CEO of Global Mofy. “Our strategic shift towards generative AI driven solutions

and the continuous development of high-precision 3D digital assets has allowed us to meet the growing demand for digital content, while

driving profitability and positioning the Company for long-term growth. As we look ahead, we are confident in our ability to sustain this

momentum and deliver more value to our shareholders.”

Financial Results for Fiscal Year Ended September

30, 2024

Total Assets: As of September 30, 2024,

Global Mofy’s total assets reached $59.2 million, an increase of 118.3% compared to $27.1 million as of September 30, 2023. This

growth reflects the Company’s strong capital utilization, strategic investments in technology and infrastructure, and the successful

expansion of its asset base.

Revenue: Revenue for the fiscal year 2024

totaled $41.4 million, an increase of 53.8% from $26.9 million in fiscal year 2023. The revenue growth was primarily driven by the

prosperity of the movie and TV industries boomed in China in recently two years and sustained demand for high-quality virtual

content, 3D digital assets, and AI-driven solutions across multiple sectors, including entertainment, on-line game industry, and digital

tourism.

Gross Profit: Gross profit for the fiscal

year 2024 increased by 43.2% to $20.8 million, up from $14.5 million in fiscal year 2023. Gross margin remained strong at 50.3%, reflecting

effective cost control measures and a shift toward higher-margin digital asset development services.

Net Income: Net income for fiscal year

2024 was $12.1 million, resulting in a net margin of 29.4%, compared to $6.6 million in fiscal year 2023, also representing an increase

by 89%. The increase in net income was driven by higher revenues, improved operational efficiency, and effective cost control.

Earnings Per Share (EPS): Basic and diluted

earnings per share for fiscal year 2024 were $6.37, reflecting a significant 61.2% year-over-year increase from $3.93 in fiscal year 2023.

This figure has been adjusted for the effect of the reverse stock split on November 26, 2024.

Research and Development (R&D) Expenses:

R&D expenditures for fiscal year 2024 totaled $7.5 million, reflecting a 109.8% increase from $3.6 million in fiscal year 2023.

These investments primarily focused on expanding the Company’s 3D digital asset library, which encompassed over 100,000 assets by

the end of fiscal year 2024, as well as advancing its generative AI solutions. Notably, the development of the Gausspeed platform has

made significant progress, positioning the Company to further enhance its capabilities in AI-driven content creation. These technological

advancements are crucial for sustaining long-term growth, driving innovation, and maintaining a competitive edge in the rapidly evolving

digital content sector.

Recent Developments

Expansion of 3D Digital Asset Library: By

the end of fiscal year 2024, Global Mofy’s 3D digital asset library encompassed over 100,000 assets. These assets, characterized

by high precision and reusability, are now supporting a diverse range of applications in industries such as film, television, advertising,

on-line game industry, and digital tourism.

Generative AI Advancements: On April 30,

2024, Global Mofy announced the development of Gausspeed, a generative AI platform for film production and digital content creation. In

collaboration with Heartdub and powered by NVIDIA Omniverse and NVIDIA RTX GPUs, Gausspeed integrates with the NVIDIA Omniverse Cloud

API, enhancing collaboration, improving production efficiency, and enabling real-time scene generation. This platform allows creators

to visualize and adjust scenes early in the production process, streamlining workflows and reducing complexity, positioning Global Mofy

at the forefront of innovation in the digital entertainment industry.

North American Expansion: On May 22, 2024,

Global Mofy expanded its global footprint with the establishment of GMM DISCOVERY LLC in North America. This move strengthens the Company’s

presence in one of the world’s largest markets for AI-driven content and 3D asset development and positions the Company to better

serve a growing client base in the U.S., while capitalizing on new business opportunities across North America.

Launch of $69 Million Fund with Strategic Partners:

On July 2, 2024, Global Mofy announced the launch of a US$69 million investment fund aimed at fostering growth in the AI, digital economy,

and entertainment sectors. The fund is being launched in partnership with Yi Zheng Yangzi Culture and Tourism Holding Group Co., Ltd.

(“Yangzi”) and Beijing Hengyun International Private Equity Fund Management Co., Ltd. (“Beijing Hengyun”). The

fund will focus on acquisitions and investments in high-quality projects aligned with Global Mofy’s business strategy. This strategic

initiative will strengthen the Company’s position in rapidly expanding sectors, create value for shareholders, and drive long-term

growth.

Establishment of Vocational Education Institute:

On July 9, 2024, Global Mofy announced the setup of the Century Mofy Vocational Education Institute in Zhejiang, China, to address

the growing demand for skilled talents in AI and digital content creation industry. The Institute will offer specialized training in AIGC

technology development and the creation of various digital content formats such as images, videos, text, and music.

Private Placement Financing of $2.5 Million:

On October 15, 2024, Global Mofy announced it has entered into a Securities Purchase Agreement (SPA) with certain institutional and

accredited investors for a private placement financing of approximately $2.5 million.

Strategic Cooperation with Lianyungang:

On October 23, 2024, Global Mofy signed a strategic agreement with Lianyungang’s Haizhou High-Tech District to collaborate on generative

AI, digital tourism, and cultural projects. The partnership aims to enhance Lianyungang’s cultural heritage through digital platforms

and AI-driven solutions.

MIIT Membership Awarded: On November 12,

2024, Global Mofy was awarded membership in the Industrial Brand Promotion Organization by the Ministry of Industry and Information Technology

(MIIT). This membership highlights the Company’s leadership in generative AI technology and its commitment to advancing brand competitiveness

in the digital content industry.

Conference Call and Webcast Information

Global Mofy will host a conference call and webcast

to discuss its financial results for fiscal year 2024 and provide a business outlook on January 3, 2025, at 9:00 AM EST. Participants

can register for the live audio call using the following link:

[https://register.vevent.com/register/BI4123b2278fe8413caec3c544c97a6528]

Upon successful registration, participants will

receive a conference PIN and dial-in number. A live webcast of the conference call will be available at:

[https://edge.media-server.com/mmc/p/3vzc68vn]

A full recording of the call will be available

on the Company’s investor relations website immediately after the event:

[http://ir.globalmofy.cn]

Forward-Looking Statement

This press release contains forward-looking statements.

Forward-looking statements include statements concerning plans, objectives, goals, strategies, future events or performance, and underlying

assumptions and other statements that are other than statements of historical facts. When the Company uses words such as “may,”

“will,” “intend,” “should,” “believe,” “expect,” “anticipate,” “project,”

“estimate” or similar expressions that do not relate solely to historical matters, it is making forward-looking statements.

These forward-looking statements include, without limitation, the Company’s statements regarding the expected trading of its Ordinary

Shares on the Nasdaq Capital Market and the closing of the Offering. Forward-looking statements are not guarantees of future performance

and involve risks and uncertainties that may cause the actual results to differ materially from the Company’s expectations discussed in

the forward-looking statements. These statements are subject to uncertainties and risks including, but not limited to, the uncertainties

related to market conditions and the completion of the initial public offering on the anticipated terms or at all, and other factors discussed

in the “Risk Factors” section of the registration statement filed with the SEC. For these reasons, among others, investors are

cautioned not to place undue reliance upon any forward-looking statements in this press release. Additional factors are discussed in the

Company’s filings with the SEC, which are available for review at www.sec.gov. The Company undertakes no obligation to publicly revise

these forward-looking statements to reflect events or circumstances that arise after the date hereof.

For more information, please contact:

Global Mofy AI Ltd.

Investor Relations Department

ir@mof-vfx.com

GLOBAL MOFY AI LIMITED

CONSOLIDATED BALANCE SHEETS

(Expressed in U.S. Dollars, except for the number of shares)

| | |

As of September 30, |

| | |

2024 | |

2023 |

| | |

US$ | |

US$ |

| ASSETS | |

| |

|

| Current assets | |

| |

|

| Cash | |

$ | 8,068,560 | | |

$ | 10,437,580 | |

| Restricted cash | |

| 3,000,000 | | |

| — | |

| Short-term investments | |

| — | | |

| 780,000 | |

| Accounts receivable, net | |

| 1,254,613 | | |

| 3,286,330 | |

| Advances to vendors | |

| 5,736,093 | | |

| 2,593,887 | |

| Due from related parties | |

| 19,665 | | |

| — | |

| Loans receivable – current | |

| — | | |

| 287,829 | |

| Prepaid expenses and other current assets, net | |

| 967,613 | | |

| 507,336 | |

| Total current assets | |

$ | 19,046,544 | | |

| 17,892,962 | |

| | |

| | | |

| | |

| Non-current assets | |

| | | |

| | |

| Long-term investments | |

| 284,998 | | |

| — | |

| Property and equipment, net | |

| 13,420 | | |

| 34,431 | |

| Intangible assets, net | |

| 38,796,262 | | |

| 6,505,792 | |

| Operating lease right-of-use assets | |

| 660,946 | | |

| 954,771 | |

| Loans receivable – non-current | |

| — | | |

| 447,505 | |

| Advances to vendors – non-current | |

| 261,956 | | |

| 1,020,874 | |

| Prepaid expenses and other non-current assets, net | |

| 127,732 | | |

| 262,986 | |

| Total non-current assets | |

| 40,145,314 | | |

| 9,226,359 | |

| Total assets | |

$ | 59,191,858 | | |

$ | 27,119,321 | |

| | |

| | | |

| | |

| LIABILITIES AND EQUITY | |

| | | |

| | |

| Current liabilities | |

| | | |

| | |

| Short-term bank loans | |

$ | 5,397,521 | | |

$ | 2,442,609 | |

| Loans from third parties | |

| 23,512 | | |

| 22,615 | |

| Accounts payable | |

| 1,213,114 | | |

| 531,091 | |

| Advances from customers | |

| 3,837,621 | | |

| 345,838 | |

| Due to a related party | |

| 50,380 | | |

| — | |

| Tax payable | |

| 2,035,653 | | |

| 1,555,059 | |

| Accrued expenses and other liabilities | |

| 553,696 | | |

| 555,440 | |

| Operating lease liabilities – current | |

| 270,183 | | |

| 293,040 | |

| Total current liabilities | |

$ | 13,381,680 | | |

| 5,745,692 | |

| | |

| | | |

| | |

| Non-current liabilities | |

| | | |

| | |

| Operating lease liabilities – non-current | |

| 308,575 | | |

| 556,674 | |

| Total non-current liabilities | |

| 308,575 | | |

| 556,674 | |

| Total liabilities | |

$ | 13,690,255 | | |

| 6,302,366 | |

| | |

| | | |

| | |

| Equity: | |

| | | |

| | |

| Class A ordinary shares ($0.00003 par value, 30,000,000,000 shares authorized, 1,410,001 and 1,728,410 shares issued and outstanding as of September 30, 2024 and 2023, respectively)* | |

| 42 | | |

| 52 | |

| Class B Ordinary Shares ($0.00003 par value, 4,000,000,000 shares authorized, 848,203 and 0 shares issued and outstanding as of September 30, 2024 and 2023, respectively) | |

| 26 | | |

| - | |

| Additional paid-in capital | |

| 27,796,887 | | |

| 16,035,229 | |

| Statutory reserves | |

| 1,926,547 | | |

| 368,271 | |

| Accumulated earnings | |

| 15,737,191 | | |

| 5,158,115 | |

| Accumulated other comprehensive income (loss) | |

| 187,118 | | |

| (604,182 | ) |

| Total Global Mofy AI Limited shareholders’ equity | |

| 45,647,811 | | |

| 20,957,485 | |

| Non-controlling interests | |

| (146,208 | ) | |

| (140,530 | ) |

| Total equity | |

| 45,501,603 | | |

| 20,816,955 | |

| Total liabilities and equity | |

$ | 59,191,858 | | |

$ | 27,119,321 | |

| * | Retrospectively

restated for effect of reverse stock split on November 26, 2024. |

GLOBAL MOFY AI LIMITED

CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (LOSS)

(Expressed in U.S. Dollars, except for the number of shares)

| | |

For the years ended

September 30, |

| | |

2024 | |

2023 | |

2022 |

| | |

US$ | |

US$ | |

US$ |

| Revenue | |

| |

| |

|

| Revenue from third parties | |

$ | 41,360,953 | | |

$ | 26,889,911 | | |

$ | 14,540,300 | |

| Revenue from related parties | |

| — | | |

| — | | |

| 2,647,993 | |

| Revenue | |

| 41,360,953 | | |

| 26,889,911 | | |

| 17,188,293 | |

| Cost of revenue | |

| (20,556,763 | ) | |

| (12,357,934 | ) | |

| (13,072,732 | ) |

| Gross profit | |

| 20,804,190 | | |

| 14,531,977 | | |

| 4,115,561 | |

| | |

| | | |

| | | |

| | |

| Operating expenses: | |

| | | |

| | | |

| | |

| Selling expenses | |

| (1,107,215 | ) | |

| (294,587 | ) | |

| (153,822 | ) |

| General and administrative expenses | |

| (5,425,015 | ) | |

| (3,046,037 | ) | |

| (1,041,330 | ) |

| Research and development expenses | |

| (7,448,583 | ) | |

| (3,546,155 | ) | |

| (3,207,759 | ) |

| Total operating expenses | |

| (13,980,813 | ) | |

| (6,886,779 | ) | |

| (4,402,911 | ) |

| | |

| | | |

| | | |

| | |

| Income (loss) from operations | |

| 6,823,377 | | |

| 7,645,198 | | |

| (287,350 | ) |

| | |

| | | |

| | | |

| | |

| Other (expenses) income: | |

| | | |

| | | |

| | |

| Interest income | |

| 208,647 | | |

| 41,230 | | |

| 42,948 | |

| Interest expenses | |

| (195,331 | ) | |

| (126,206 | ) | |

| (74,888 | ) |

| Issuance costs allocated to warrant liability | |

| (823,846 | ) | |

| — | | |

| — | |

| Change in fair value of warrant liability | |

| 6,827,034 | | |

| — | | |

| — | |

| Other income, net | |

| 144,819 | | |

| 89,124 | | |

| 54,049 | |

| Total other income, net | |

| 6,161,323 | | |

| 4,148 | | |

| 22,109 | |

| | |

| | | |

| | | |

| | |

| Income (loss) before income taxes | |

| 12,984,700 | | |

| 7,649,346 | | |

| (265,241 | ) |

| Income tax expense | |

| (847,448 | ) | |

| (1,098,087 | ) | |

| — | |

| Net income (loss) | |

| 12,137,252 | | |

| 6,551,259 | | |

| (265,241 | ) |

| Net (loss) income attributable to non-controlling interest | |

| (100 | ) | |

| (579 | ) | |

| 1,981 | |

| Net income (loss) attributable to Global Mofy AI Limited | |

$ | 12,137,352 | | |

$ | 6,551,838 | | |

$ | (267,222 | ) |

| | |

| | | |

| | | |

| | |

| Comprehensive income (loss) | |

| | | |

| | | |

| | |

| Net income (loss) | |

$ | 12,137,252 | | |

$ | 6,551,259 | | |

$ | (265,241 | ) |

| Foreign currency translation Gain (loss) | |

| 785,722 | | |

| (407,248 | ) | |

| (198,124 | ) |

| Total comprehensive income (loss) | |

| 12,922,974 | | |

| 6,144,011 | | |

| (463,365 | ) |

| Comprehensive income attributable to non-controlling interests | |

| (5,678 | ) | |

| 3,031 | | |

| 2,304 | |

| Comprehensive income (loss) attributable to Global Mofy AI Limited | |

$ | 12,928,652 | | |

$ | 6,140,980 | | |

$ | (465,669 | ) |

| | |

| | | |

| | | |

| | |

| | |

| | | |

| | | |

| | |

| Earnings (loss) per Class A ordinary share | |

| | | |

| | | |

| | |

| – Basic and diluted* | |

$ | 6.37 | | |

$ | 3.93 | | |

$ | (0.17 | ) |

| | |

| | | |

| | | |

| | |

| Weighted average number of Class A ordinary shares outstanding | |

| | | |

| | | |

| | |

| – Basic and diluted* | |

| 1,798,850 | | |

| 1,668,083 | | |

| 1,562,766 | |

| Earnings per Class B ordinary share | |

| | | |

| | | |

| | |

| – Basic and diluted* | |

$ | 6.37 | | |

$ | - | | |

$ | - | |

| | |

| | | |

| | | |

| | |

| Weighted average Class B ordinary shares outstanding | |

| | | |

| | | |

| | |

| – Basic and diluted* | |

| 106,605 | | |

| - | | |

| - | |

| * | Retrospectively

restated for effect of reverse stock split on November 26, 2024. |

5

Exhibit

99.2

COPYRIGHT©GLOBAL MOFY, All RIGHTS RESERVED. Beijing, China · Zhejiang, China · California, USA

Certain statements contained in this document constitute forward - looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. For these purposes, forward - looking statements are statements that address activities, events, conditions or developments that the Company expects or anticipates may occur in the future. In some cases forward - looking statements can be identified because they contain words such as “anticipate,” “believe,” “continue,” “could,” “estimate,” “expect,” “intend,” “likely,” “may,” “might,” “plan,” “potential,” “predict,” “project,” “seek,” “should,” “target,” “will,” “would,” or similar expressions and the negatives of those terms. Such forward - looking statements involve risks and uncertainties that may cause actual events, results or performance to differ materially from those indicated by such statements. These risks and uncertainties include, but are not limited to, domestic and international economic conditions, including exchange rates, inflation or deflation, the effects of competition and regulation, uncertainties in the financial markets, consumer and small business spending patterns and debt levels, breaches of security or privacy of member or business information, conditions affecting the acquisition, development, ownership or use of real estate, capital spending, actions of vendors, rising costs associated with employees (generally including health - care costs and wages), energy and certain commodities, geopolitical conditions (including tariffs), the ability to maintain effective internal control over financial reporting, regulatory and other impacts related to climate change, public - health related factors, and other risks identified from time to time in the Company’s public statements and reports filed with the Securities and Exchange Commission. Forward - looking statements speak only as of the date they are made, and the Company does not undertake to update these statements, except as required by law. Comparable sales and comparable sales excluding impacts from changes in gasoline prices and foreign exchange are intended as supplemental information and are not a substitute for net sales presented in accordance with U.S. GAAP. GMM

• Record Revenues of $41.4 million , up 53.8% from year ago. • Gross profit and net income reached $20.8 million and $12.1 million , respectively; with a 50.3% gross margin. • Successfully completed our follow - on offering of $10 million in January 2024. And another private placement financing of $2.5 million in October 2024. • 3D digital assets has increased from more than 30,000 in fiscal 2023 to more than 100,000 as of September 30, 2024. GMM

COMPANY OVERVIEW CORE ADVANTAGES INDUSTRY OVERVIEW MAIN BUSINESS MAJOR EVENTS & MANAGEMENT TEAM FINANCIAL DATA

COMPANY OVERVIEW ·Company Introduction ·Company Roadmap ·Awards and Honors

Launched "Gausspeed" generative AI platform in collaboration with NVIDIA Omniverse. Secured strategic financing of $10 million, bringing in two renowned American funds. Established U.S. subsidiary: GMM Discovery LLC GMM

We are an AI - driven technology solutions provider engaged in virtual content production and 3D digital asset development for upstream and downstream partners in the digital content industry. Utilizing advanced artificial intelligence and 3D reconstruction technologies, we efficiently create high - precision digital versions of characters, scenes, and props from the physical world, implementing them across various application scenarios. With offices in Beijing, Zhejiang, and California, we are dedicated to driving the growth and development of the global digital content and entertainment sectors. On October 10 2023, Global Mofy Metaverse Limited was officially listed on the Nasdaq Stock Exchange with the ticker symbol: GMM. According to a Frost & Sullivan report, Global Mofy is among China’s leading digital asset bank, with over 100,000 digital assets. GMM

GMM

• • GMM

·Generative AI Platform: Gausspeed ·Digital Asset Bank ·Mofy Lab ·Proprietory Registered IP Since 2024, we have entered the AIGC (Artificial Intelligence Generated Content) field through a strategic partnership with Heartdub, a leading company in the physics engine domain from Seattle, USA, further driving technological innovation and business expansion. CORE ADVANTAGES

Gausspeed, our Generative AI video generation platform developed in collaboration with NVIDIA Omniverse, debuted in 2024 as a flagship R&D product. Designed to revolutionize the filmmaking process, Gausspeed serves as a robust tool for industrial - grade film production and content creation. GMM

Prompt: The main shot starts with a closeup of a flower [POI#11], then slowly moves through the forest towards the lakeside, transitioning to a horizon level view. The camera stops at the lakeside [POI#185], capturing orcas swimming in the lake. File Input: screenplay.docx ǃ scenemap.jpeg Gausspeed creates stunning, realistic visuals with advanced AI technology, ensuring top - quality results for virtual projects. Gausspeed provides intuitive tools for detailed storyboard and shot design, allowing creators to visualize and plan each scene precisely, reducing the need for costly revisions. Gausspeed offers advanced previs capabilities for accurate pre - production planning, helping clients define service needs, minimizing trial costs. GMM

We possess a vast and diverse collection of high - precision 3D digital assets, covering categories such as characters, scenes, and props, and spanning various domains including nature, science fiction, historical eras, and architecture. Additionally, our 3D digital assets are continuously updated and expanded to include the latest trends and technologies in digital content creation. High Precision (4K) 3D Digital Assets China’s Largest Digital Asset Bank GMM

High - precision 3D Model Conversion: Utilizing advanced 3D reconstruction technology, this process converts any object from the physical world, such as people, objects, and scenes, into universally usable 3D models in the virtual world on a 1:1 basis. Industry Services: Provides high - precision 3D digital assets to enterprises across various industry sectors, supporting the generation of 3D digital assets on the application side to meet diverse industry needs. Optimized Front - end Technology: Integrates and optimizes mainstream front - end technologies to provide a powerful digital content editable middleware tool. Integration of Multiple Tools: Combines multiple underlying tools to achieve efficient content editing and generation. One - stop Content Generation: The digital content editable middleware tool supports the one - stop generation of digital content, providing a one - stop digital content generation solution for application ends. GMM

Global Mofy integrates multiple independently developed software copyrights within MOFY LAB, covering various fields such as digital content creation, visual effects processing, project management, and AI technology applications. These software systems together demonstrate our leading position in technological innovation and development, further enhancing our core competitiveness. "Our R&D team has over 10 years of industry experience." "45 independent intellectual properties." "Our continued effort to invest in R&D, expecting to add at least 10 new independent IPs each year." GMM

·E&M Market ·3D Modeling Market ·Generative AI Market INDUSTRY OVERVIEW

China is the second - largest Entertainment & Media (E&M) market globally, with substantial growth expected over the next few years . China's E&M market is expected to grow from approximately US$275 billion to US$362 billion in 2028, representing a CAGR of 7.1%. The global 3D models market is experiencing significant growth, driven by the increasing demand across various industries. This market was valued at USD 1.16 billion in 2024 and is projected to reach USD 2.72 billion by 2032, growing at a compound annual growth rate (CAGR) of 11.2% during the forecast period. GMM

Generative AI develops systems to create new content like images, videos, music, and text by learning from large datasets. This technology can enhance creativity, enable data synthesis, and revolutionize industries such as art, entertainment, and content creation. The North America market size in the Generative AI market is projected to reach US $ 23 . 03 billion in 2025 . The market is expected to show an annual growth rate (CAGR 2025 - 2030 ) of 41 . 51 % , resulting in a market volume of US $ 130 . 70 billion by 2030 . The China market size in the Generative AI market is projected to reach US$5.48 billion in 2025. The market is expected to show an annual growth rate (CAGR 2025 - 2030) of 41.53%, resulting in a market volume of US$31.12 billion by 2030. 0 50 100 150 2024 2025 2026 2027 2028 2029 2030 Market Size (in billion USD) 0 10 20 30 40 2024 2025 2026 2027 2028 2029 2030 Market Size (in billion USD) GMM

·Virtual Technology Services ·3D Digital Assets Development and Others ·Strategic Partners BUSINESS MODEL

We leverage AI to offer high - quality, efficient, and cost - effective content production through streamlined, scalable, and systematic virtual technology process services. Our strong synergy with MOFY LAB ensures comprehensive support, providing customers with full - process management from production output to quality control. Project Evaluation Customized Solutions Module Production Quality Delivery Digital Content GMM

Our 3D Digital Assets Development and related services focus on creating high - precision 3D models for various applications, including film, gaming, and virtual reality. Our extensive library and advanced technologies allow for efficient and cost - effective production. 3D Digital Assets More Application Scenarios GMM

In 2024, Global Mofy was selected as a partner in iQIYI's second Leap Program, showcasing our strength in technological innovation and business expansion. Additionally, we developed and launched the generative AI platform Gausspeed in collaboration with NVIDIA Omniverse and Heartdub Technology. GMM

MAJOR EVENTS & MANAGEMENT TEAM GMM

Global Mofy Officially Completed Major Strategic Transformation GMM

Global Mofy Launches: $69 Million Fund Global Mofy Signed Strategic Cooperation Agreement with Lianyungang’s Haizhou High - Tech District GMM Global Mofy Awarded Membership in MIIT’s Industrial Brand Promotion Organization

Our core team consists of professionals with extensive experience in their respective fields, ensuring the company's steady growth and innovative capabilities. The team members possess strong expertise and rich practical experience in technological innovation, financial management, market expansion, and operational optimization. Together, they drive Global Mofy's continuous advancement in technological innovation and business expansion. GMM

·Financial Reports ·Income Structure ·Financial Forecasts FINANCIAL DATA GMM

Global Mofy achieved record high gross profit margin and net profit margin for fiscal year 2024, reaching 50.3% and29.4%, respectively, showing significant growth compared to fiscal year 2023.. 26.9 41.4 45 40 35 30 25 20 15 10 5 0 2023 2024 Million (US Dollars) 14.5 20.8 0 5 10 15 20 25 2023 2024 Million (US Dollars) FY ended Sep 30 FY ended Sep 30 6.6 12.1 14 12 10 8 6 4 2 0 2024 Million (US Dollars) Global Mofy achieved a total revenue of $41.4 million for fiscal year 2024, representing a YoY 53.8% increase compared to fiscal year 2023. Similarly, gross profit and net income reached new heights, amounting to $20.8 million and $12.1 million, respectively, reflecting substantial year - over - year growth of 43.2% and 89%. REVENUE GROSS PROFIT NET PROFIT 2023 FY ended Sep 30 GMM

For fiscal year ended Sep 30, 2024, R&D expenses totaled $7.5 Million, compared to $3.6 million in fiscal year 2023, with capitalization of certain R&D investments into intangible assets. Meanwhile, the high - profit - margin 3D digital asset development and others business accounted for 49.4% of the total revenue, showing a steady increase compared to 42.8% for fiscal year 2023. 3.6 7.5 0 1 2 3 4 7 6 5 8 2023 2024 Million (US Dollars) 51% 49% 3D Digital Assets Development and others 0 20 40 60 80 Total 3D Digital Assets Development and Others Virtual Technology Services Virtual Technology Services GMM

Our company is experiencing rapid growth by leveraging advanced AI technologies, expanding our 3D digital assets, and strategically focusing on the booming digital entertainment market. GMM

Q&A with our Management Team Wenjun Jiang Chief Technology Officer Chen Chen Chief Financial Officer GMM

GLOBALMOFY.CN COPYRIGHT©GLOBAL MOFY, All RIGHTS RESERVED. CHINA HEADQUARTER ˖ Building A12, Xidian Memory Creative and Cultural Township, Chaoyang District, Beijing

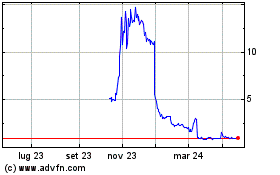

Grafico Azioni Globa Mofy AI (NASDAQ:GMM)

Storico

Da Dic 2024 a Gen 2025

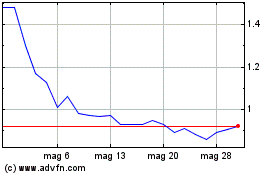

Grafico Azioni Globa Mofy AI (NASDAQ:GMM)

Storico

Da Gen 2024 a Gen 2025