Will Whole Foods Beat in 1Q13? - Analyst Blog

12 Febbraio 2013 - 1:11PM

Zacks

We expect Whole Foods Market, Inc. (WFM), one

of the leading natural and organic foods supermarkets, to beat

expectations when it reports first-quarter fiscal 2013 results on

Feb 13, 2013.

Why a Likely Positive Surprise?

Our proven model shows that Whole Foods Market is likely to beat

earnings because it has the right combination of two key

components.

Positive Zacks ESP: Whole Foods Market

currently has an Earnings ESP (Read: Zacks Earnings ESP: A Better

Method) of +1.30%. This is because the Most Accurate Estimate

stands at 78 cents, while the Zacks Consensus Estimate is pegged at

77 cents.

Zacks Rank #3 (Hold): Note that stocks with

Zacks Ranks of #1, #2 and #3 have a significantly higher chance of

beating earnings estimates. The sell-rated stocks (Zacks Rank #4

and #5) should never be considered going into an earnings

announcement.

The combination of Whole Foods Market’s Zacks Rank #3 (Hold) and

+1.30% ESP makes us very confident regarding a positive earnings

beat on Feb 13.

What is Driving the Better than Expected

Earnings?

Whole Foods Market with a strong brand image, and marketing and

merchandising expertise, offers investors one of the strongest

growth profiles in the industry. The company is revamping its

pricing strategy and concentrating more on value offerings, while

maintaining healthy margins.

Cost containment efforts, effective inventory management, and

improved store level performance are driving earnings growth. The

positive trend is seen in the trailing four-quarter average

surprise of 6.7%.

Other Stocks to Consider

Here are some other companies you may want to consider as our

model shows they have the right combination of elements to post an

earnings beat:

Flowers Foods, Inc. (FLO), Earnings ESP of

+5.56% and Zacks Rank #1 (Strong Buy).

J&J Snack Foods Corp. (JJSF), Earnings ESP

of +5.00% and Zacks Rank #1 (Strong Buy).

The Hershey Company (HSY), Earnings ESP of

+0.96% and Zacks Rank #2 (Buy).

FLOWERS FOODS (FLO): Free Stock Analysis Report

HERSHEY CO/THE (HSY): Free Stock Analysis Report

J&J SNACK FOODS (JJSF): Free Stock Analysis Report

WHOLE FOODS MKT (WFM): Free Stock Analysis Report

To read this article on Zacks.com click here.

Zacks Investment Research

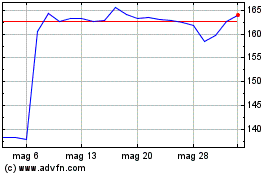

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Giu 2024 a Lug 2024

Grafico Azioni J and J Snack Foods (NASDAQ:JJSF)

Storico

Da Lug 2023 a Lug 2024